1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-counterfeit Pharmaceuticals and Cosmetics Packaging?

The projected CAGR is approximately 8.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-counterfeit Pharmaceuticals and Cosmetics Packaging

Anti-counterfeit Pharmaceuticals and Cosmetics PackagingAnti-counterfeit Pharmaceuticals and Cosmetics Packaging by Type (Authentication Technology, Trace Technology), by Application (Pharmaceuticals, Cosmetics and Personal Care), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

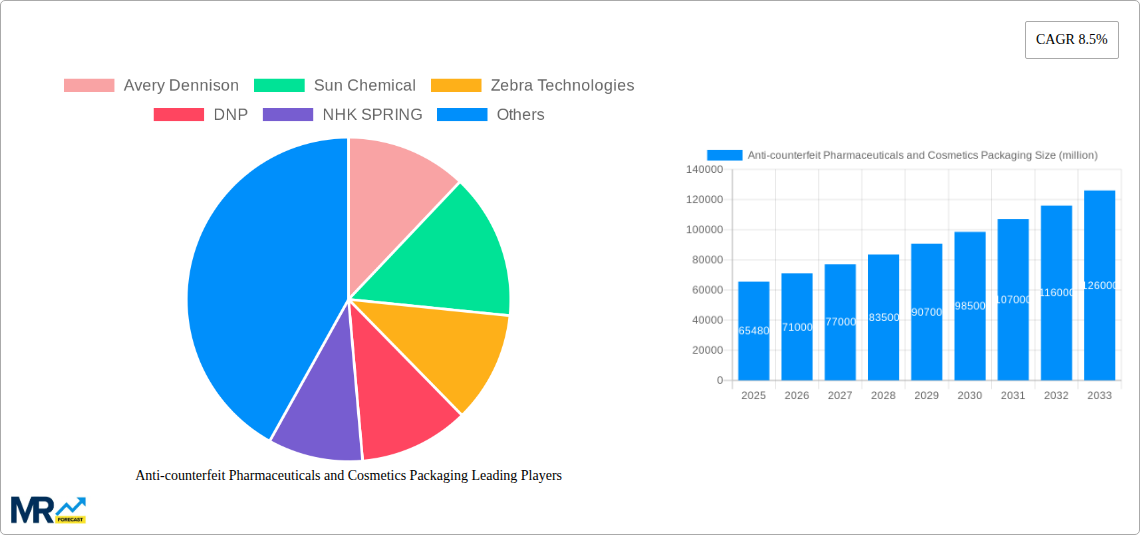

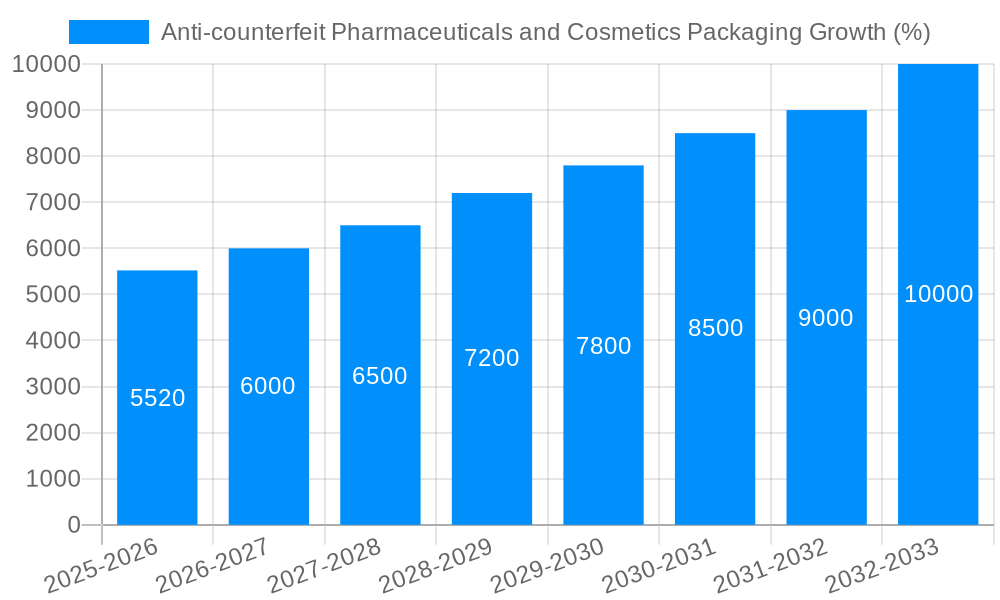

The anti-counterfeit pharmaceuticals and cosmetics packaging market, valued at $65.48 billion in 2025, is projected to experience robust growth, driven by escalating concerns over counterfeit products and increasing consumer demand for authentic goods. The market's compound annual growth rate (CAGR) of 8.5% from 2019 to 2033 reflects the significant investments by both pharmaceutical and cosmetic companies in advanced security features. This growth is fueled by several key factors: the rising prevalence of sophisticated counterfeiting techniques, stringent government regulations aimed at curbing counterfeiting, and the increasing adoption of innovative technologies such as blockchain, RFID tags, and track and trace solutions. The pharmaceutical sector, facing higher regulatory scrutiny and potential health risks associated with fake medications, is driving significant adoption of these technologies. Similarly, the cosmetics industry, plagued by concerns around product quality and brand reputation, is investing heavily in anti-counterfeiting measures to maintain consumer trust. Major players like Avery Dennison, 3M, and Zebra Technologies are at the forefront of innovation, developing and supplying a range of solutions, from security labels and inks to sophisticated serialization and authentication systems.

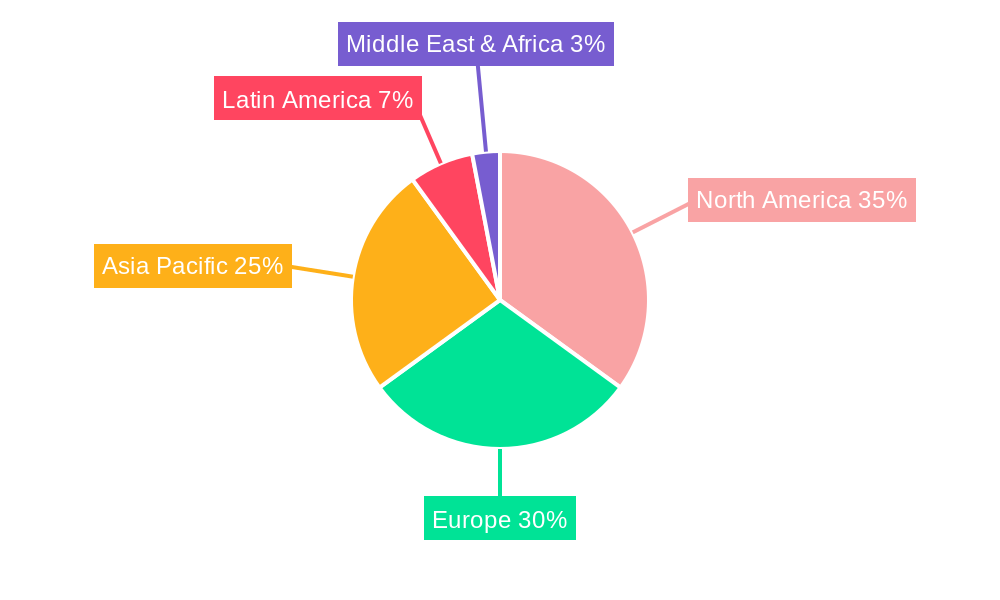

The market segmentation, while not explicitly provided, likely includes various packaging types (e.g., cartons, bottles, blister packs), technologies employed (e.g., holographic labels, RFID, digital watermarking), and regions. The regional breakdown would show variations based on regulatory stringency, economic development, and consumer awareness. Regions with higher levels of disposable income and stricter regulations, like North America and Europe, are likely to show higher market penetration. However, emerging economies in Asia and Latin America are expected to witness substantial growth due to increasing adoption of anti-counterfeit measures and rising consumer demand. Continued research and development in advanced anti-counterfeiting technologies, combined with the collaborative efforts of regulatory bodies and industry players, are crucial for ensuring the market's continued expansion and its crucial role in protecting consumer health and brand integrity.

The global anti-counterfeit pharmaceuticals and cosmetics packaging market is experiencing robust growth, driven by escalating concerns over counterfeit products and increasing consumer demand for authenticity verification. The market, valued at several billion units in 2024, is projected to reach tens of billions of units by 2033. This significant expansion reflects a rising awareness among consumers and regulatory bodies regarding the health risks associated with counterfeit medications and the economic impact of fraudulent cosmetics. Key market insights reveal a shift towards sophisticated, multi-layered security features integrated into packaging. These features go beyond traditional methods like holograms and tamper-evident seals, incorporating advanced technologies such as RFID tags, blockchain technology, and digital watermarks. The pharmaceutical sector is leading the adoption of these advanced technologies due to the high stakes involved in drug authenticity. However, the cosmetics industry is rapidly catching up, driven by the increasing prevalence of counterfeit luxury brands. The market is witnessing a consolidation trend, with larger packaging companies acquiring smaller specialized firms to expand their portfolios of anti-counterfeit solutions. Furthermore, collaborative partnerships between packaging manufacturers, technology providers, and brand owners are accelerating innovation and the development of comprehensive track-and-trace systems. This collaborative approach ensures a robust and reliable system to combat counterfeiting across the entire supply chain. Finally, the regulatory landscape is evolving, with governments worldwide implementing stricter regulations and enforcement mechanisms to combat the proliferation of counterfeit products. This regulatory push is a major catalyst for market growth, compelling manufacturers to adopt advanced anti-counterfeit technologies to meet compliance requirements.

Several factors are fueling the growth of the anti-counterfeit pharmaceuticals and cosmetics packaging market. Firstly, the alarming rise in counterfeit products poses significant health risks, particularly in the pharmaceutical sector, where fake medications can be ineffective or even harmful. This necessitates robust packaging solutions that provide undeniable proof of authenticity. Secondly, the growing consumer awareness of counterfeit goods and their impact is driving demand for products with verifiable authenticity. Consumers are increasingly willing to pay a premium for brands that offer robust anti-counterfeit measures, creating a strong incentive for manufacturers to invest in advanced packaging technologies. Thirdly, increasing regulatory scrutiny and stricter enforcement worldwide are forcing manufacturers to adopt sophisticated anti-counterfeit solutions to ensure compliance. Governments are implementing stricter regulations and imposing penalties for non-compliance, creating a substantial market opportunity for companies offering advanced packaging solutions. Finally, technological advancements are continuously expanding the range of available anti-counterfeit techniques. The development of innovative technologies, such as blockchain and digital watermarking, allows for improved traceability and verification, making it even harder for counterfeiters to replicate authentic products. This constant innovation keeps the market dynamic and attractive for both manufacturers and consumers.

Despite the substantial growth potential, the anti-counterfeit pharmaceuticals and cosmetics packaging market faces several challenges. The high cost of implementing advanced anti-counterfeit technologies can be a significant barrier for smaller manufacturers, particularly in developing countries. This cost barrier can limit adoption, especially for products with lower profit margins. Secondly, the sophistication of counterfeiting techniques is constantly evolving, requiring continuous innovation and adaptation from packaging manufacturers. Counterfeiters are becoming increasingly adept at replicating security features, making it a constant arms race between manufacturers and counterfeiters. Another challenge is the complexity of integrating different anti-counterfeit technologies into a cohesive and user-friendly system. Effective implementation requires seamless integration across the entire supply chain, which can be challenging to achieve. Finally, concerns about data privacy and security related to the use of advanced tracking technologies such as RFID and blockchain are also emerging. Balancing the need for robust security with consumer privacy concerns is a key challenge for the industry.

The North American and European markets are currently leading the adoption of advanced anti-counterfeit packaging solutions due to stringent regulations and high consumer awareness. However, the Asia-Pacific region is expected to witness significant growth in the coming years driven by rising disposable incomes, increasing consumer awareness, and the increasing prevalence of counterfeit products in the region.

Within segments, the pharmaceutical industry is currently dominating, due to the higher stakes and stringent regulatory requirements. However, the cosmetics sector is rapidly gaining traction as consumers become more discerning and luxury brands face increasing counterfeiting challenges.

The report further breaks down market segments by packaging type (e.g., bottles, cartons, labels) and technology type (e.g., RFID, holograms, digital watermarks), offering a granular view of market dynamics.

The increasing prevalence of sophisticated counterfeiting techniques and rising consumer awareness are driving the need for more robust and advanced anti-counterfeit packaging solutions. Simultaneously, supportive government regulations and initiatives are pushing manufacturers to adopt advanced technologies, creating a positive feedback loop that accelerates market growth. Technological advancements in track-and-trace systems and data analytics further enhance the effectiveness of anti-counterfeit measures, fostering greater confidence in the authenticity of products for both consumers and regulatory bodies.

This report offers a comprehensive analysis of the anti-counterfeit pharmaceuticals and cosmetics packaging market, providing valuable insights into market trends, driving forces, challenges, and key players. It serves as a critical resource for companies operating in this dynamic sector, enabling informed strategic decision-making and identifying growth opportunities. The detailed analysis of market segments and regional dynamics offers a nuanced understanding of the market landscape. Furthermore, the report's inclusion of significant developments and profiles of key players provides up-to-date information for accurate market forecasting.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.5%.

Key companies in the market include Avery Dennison, Sun Chemical, Zebra Technologies, DNP, NHK SPRING, Flint Group, Toppan, 3M, Essentra, DuPont, Leonhard Kurz, OpSec Security, Shiner International, Taibao Group, Invengo, De La Rue, Schreiner ProSecure, YPB Group, UPM Raflatac, Techsun, Impinj, .

The market segments include Type, Application.

The market size is estimated to be USD 65480 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-counterfeit Pharmaceuticals and Cosmetics Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-counterfeit Pharmaceuticals and Cosmetics Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.