1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal-Free Recombinant Proteins?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Animal-Free Recombinant Proteins

Animal-Free Recombinant ProteinsAnimal-Free Recombinant Proteins by Type (Preclinical Proteins, GMP Proteins, World Animal-Free Recombinant Proteins Production ), by Application (Cell Therapy Manufacturing, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

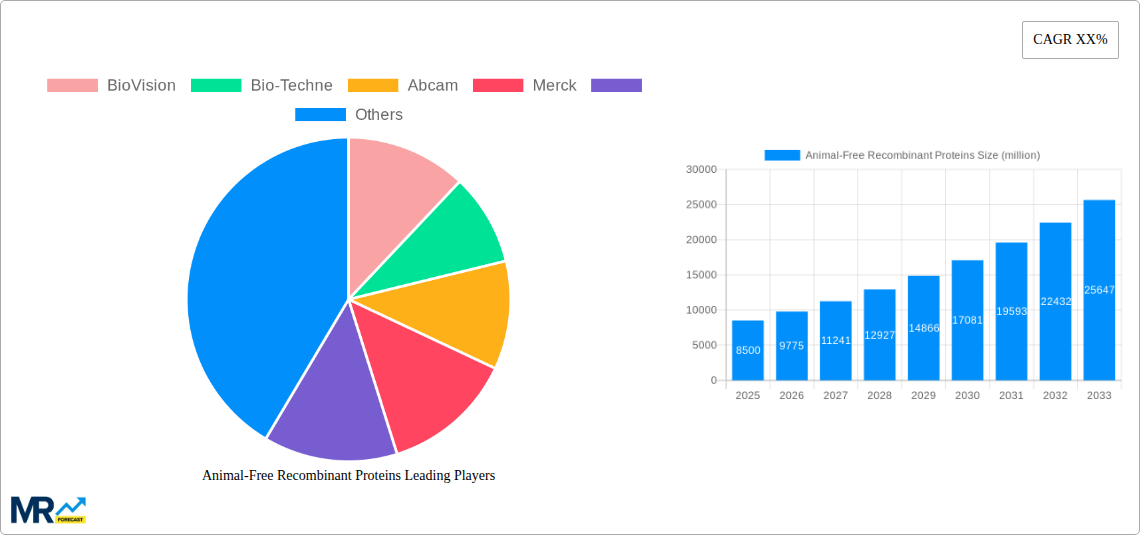

The global market for Animal-Free Recombinant Proteins is experiencing robust growth, projected to reach a substantial market size of approximately USD 8,500 million by 2025. This surge is driven by increasing demand across various high-impact applications, most notably in cell therapy manufacturing. The inherent advantages of animal-free recombinant proteins, including enhanced safety, purity, and batch-to-batch consistency, are making them the preferred choice over traditional cell-based protein production methods. This shift is amplified by stringent regulatory landscapes and a growing ethical consciousness within the life sciences industry. Key market drivers include the escalating investment in biopharmaceutical research and development, the expanding pipeline of biologic drugs, and the critical need for reliable protein reagents in advanced therapeutic modalities. The market is also benefiting from ongoing technological advancements that are improving production efficiency and cost-effectiveness.

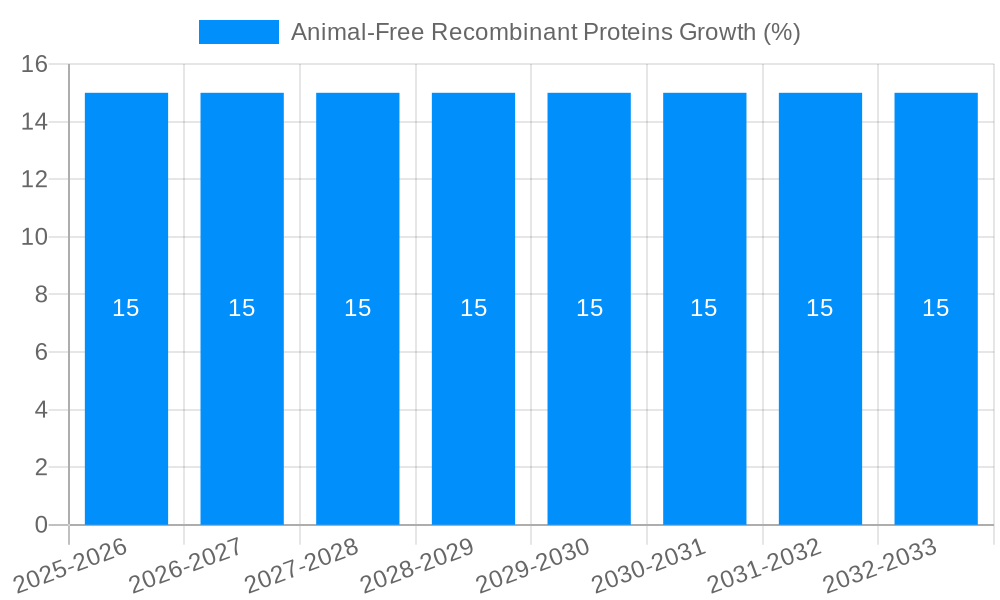

The market is characterized by significant growth potential, with an estimated Compound Annual Growth Rate (CAGR) of around 15% projected for the forecast period of 2025-2033. This sustained expansion is anticipated to be fueled by several key trends. The increasing adoption of GMP (Good Manufacturing Practice) proteins is a prominent trend, especially for clinical and commercial applications, ensuring the highest standards of quality and safety. Furthermore, the development and commercialization of World Animal-Free Recombinant Proteins Production technologies are revolutionizing protein manufacturing by eliminating the risks associated with animal-derived components. While the market presents immense opportunities, potential restraints such as the initial high cost of specialized production facilities and the need for continuous innovation to stay ahead of evolving scientific requirements need to be addressed. The market segmentation highlights the dominance of Preclinical Proteins and GMP Proteins, with Cell Therapy Manufacturing emerging as a dominant application segment, underscoring the sector's strategic importance. Leading companies like BioVision, Bio-Techne, Abcam, and Merck are actively shaping the market through strategic investments and product innovations.

Here's a unique report description on Animal-Free Recombinant Proteins, incorporating your specified elements:

The global Animal-Free Recombinant Proteins market is poised for significant expansion, driven by a confluence of scientific advancements and evolving regulatory landscapes. In the Base Year of 2025, the market is estimated to be valued in the hundreds of million units, a figure projected to surge dramatically throughout the Forecast Period of 2025-2033. This robust growth trajectory is underpinned by an increasing demand for biologics and a growing awareness of the ethical and safety concerns associated with traditional animal-derived proteins. The Study Period of 2019-2033 showcases a clear and accelerating shift towards sustainable and reliable protein production methods. Key market insights highlight a rising preference for recombinant proteins that offer enhanced purity, consistency, and a reduced risk of zoonotic contamination. The Historical Period of 2019-2024 laid the groundwork for this transformation, with early adopters recognizing the long-term benefits. Looking ahead, the Estimated Year of 2025 marks a critical juncture where animal-free options are becoming mainstream, moving beyond niche applications. The increasing investment in research and development, coupled with breakthroughs in cell culture and fermentation technologies, are enabling higher yields and more cost-effective production of complex recombinant proteins. Furthermore, the growing complexity of therapeutic modalities, particularly in areas like gene therapy and cell therapy, necessitates the use of highly defined and controlled raw materials, a niche perfectly filled by animal-free recombinant proteins. The market's dynamism is also reflected in its segmentation, with specific protein types and applications demonstrating particularly strong growth potential, indicating a maturing and diversifying industry landscape.

The escalating demand for animal-free recombinant proteins is primarily propelled by a global commitment to enhanced biopharmaceutical safety and efficacy. As regulatory bodies and industry stakeholders increasingly prioritize the reduction of potential contaminants, such as prions and viruses, that can be associated with animal-derived biologics, the appeal of recombinant alternatives intensifies. This heightened safety consciousness directly impacts the production of critical components for cell and gene therapies, where the purity and defined nature of every ingredient are paramount. Moreover, the pursuit of more sustainable and ethically responsible manufacturing practices is a significant driver. The environmental footprint associated with large-scale animal husbandry for protein extraction is a growing concern, pushing companies towards greener, more resource-efficient recombinant production methods. This shift is not just about environmental stewardship; it also translates to greater supply chain predictability and resilience, as recombinant protein production is less susceptible to the variability and disruptions inherent in agricultural supply chains. Consequently, the market is witnessing a significant influx of investment and innovation aimed at optimizing recombinant protein manufacturing processes, making them more scalable, cost-effective, and accessible for a wider range of therapeutic applications.

Despite the burgeoning growth, the animal-free recombinant protein sector faces notable challenges and restraints that could temper its rapid ascent. A primary hurdle remains the cost of production, particularly for highly complex recombinant proteins or those requiring extensive downstream purification. While advancements are continuously being made, the initial capital investment for setting up robust animal-free production platforms can be substantial, creating a barrier to entry for smaller players. Furthermore, scalability and yield optimization can still be areas requiring significant research and development. Achieving the high volumes and consistent quality demanded by large-scale biopharmaceutical manufacturing, especially for therapeutic applications, can be intricate. The regulatory landscape, while generally supportive of animal-free alternatives, can also present complexities. Companies need to navigate varying regulatory expectations for characterizing and validating animal-free components, which may differ from established protocols for animal-derived materials. Finally, market inertia and established supply chains built around traditional animal-derived proteins can create resistance. Convincing established manufacturers to transition to new production methodologies requires demonstrating clear cost-effectiveness, reliability, and a demonstrable improvement in product quality, which can take time and extensive validation.

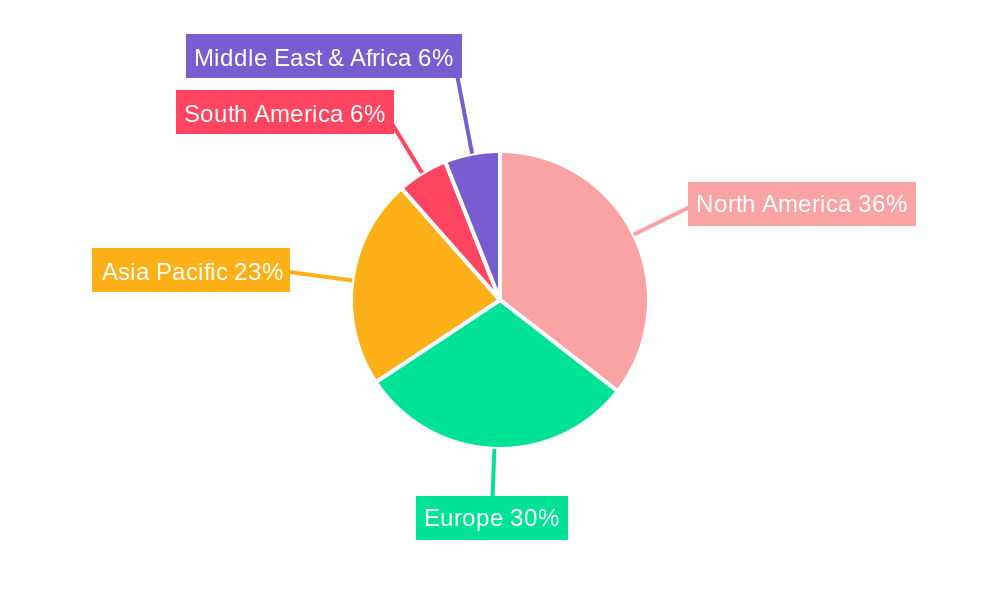

The global Animal-Free Recombinant Proteins market is characterized by dynamic regional contributions and segment dominance.

Dominant Regions:

Dominant Segments:

The dominance of GMP Proteins and the Cell Therapy Manufacturing application segment is intrinsically linked. The critical nature of cell therapies necessitates the highest standards of protein purity and safety, making animal-free GMP proteins the cornerstone of this rapidly evolving field. The increasing investments in manufacturing infrastructure for animal-free recombinant proteins further solidify their position as a dominant force in the market.

Several potent growth catalysts are fueling the expansion of the animal-free recombinant proteins industry. The relentless advancements in biotechnology, particularly in protein expression systems and downstream purification technologies, are making production more efficient and cost-effective. Furthermore, the escalating global emphasis on biosafety and the reduction of supply chain risks associated with animal-derived materials are creating a strong market pull. The booming cell and gene therapy sector, with its stringent requirements for highly pure and defined biological components, represents a significant demand driver, solidifying the necessity for animal-free alternatives.

This comprehensive report delves into the intricate dynamics of the animal-free recombinant proteins market, offering unparalleled insights for stakeholders. It meticulously analyzes the market size and projected growth from the Historical Period of 2019-2024 through the Forecast Period of 2025-2033, with a keen focus on the Base Year of 2025. The report highlights key trends, including the shift towards sustainable production and the increasing demand for biosafety. It unpacks the driving forces, such as advancements in biotechnology and the burgeoning cell therapy sector, and critically examines the challenges and restraints, including production costs and scalability. Furthermore, it identifies dominant regions and segments, such as North America and the GMP Proteins segment, and elaborates on crucial growth catalysts. A detailed overview of leading players and significant developments, incorporating year-specific milestones, provides a holistic understanding of the market's evolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BioVision, Bio-Techne, Abcam, Merck, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Animal-Free Recombinant Proteins," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Animal-Free Recombinant Proteins, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.