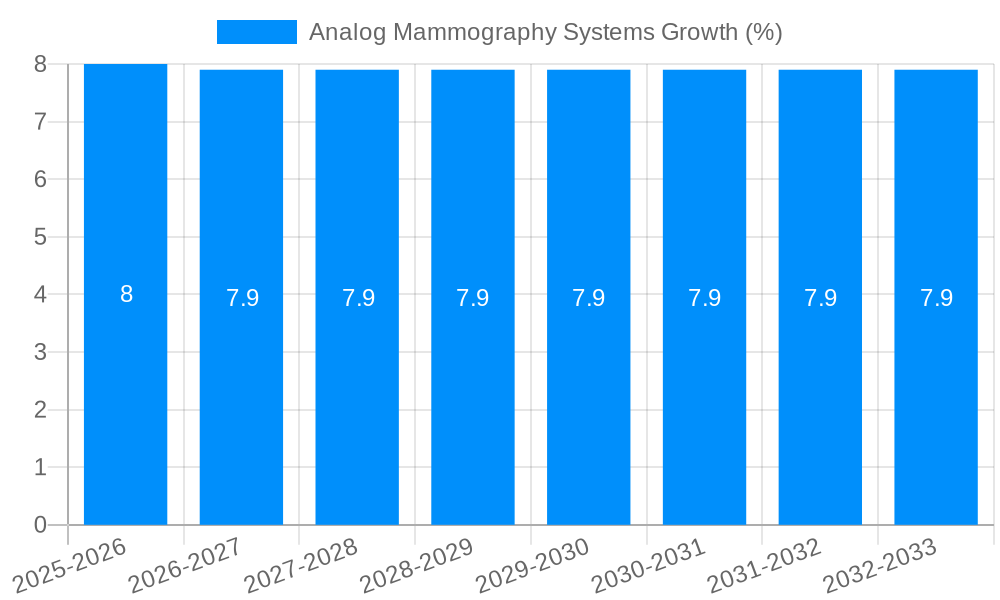

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog Mammography Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Analog Mammography Systems

Analog Mammography SystemsAnalog Mammography Systems by Type (Portable Mammography Systems, Non-Portable Mammography Systems, World Analog Mammography Systems Production ), by Application (Ambulatory Surgical Centers, Hospitals, Diagnostic Centers, World Analog Mammography Systems Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

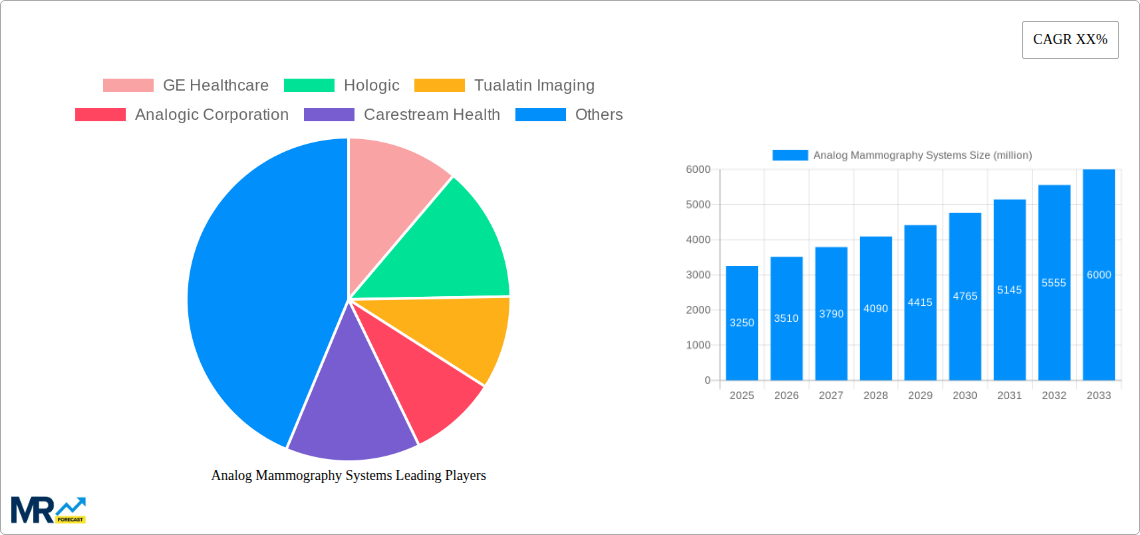

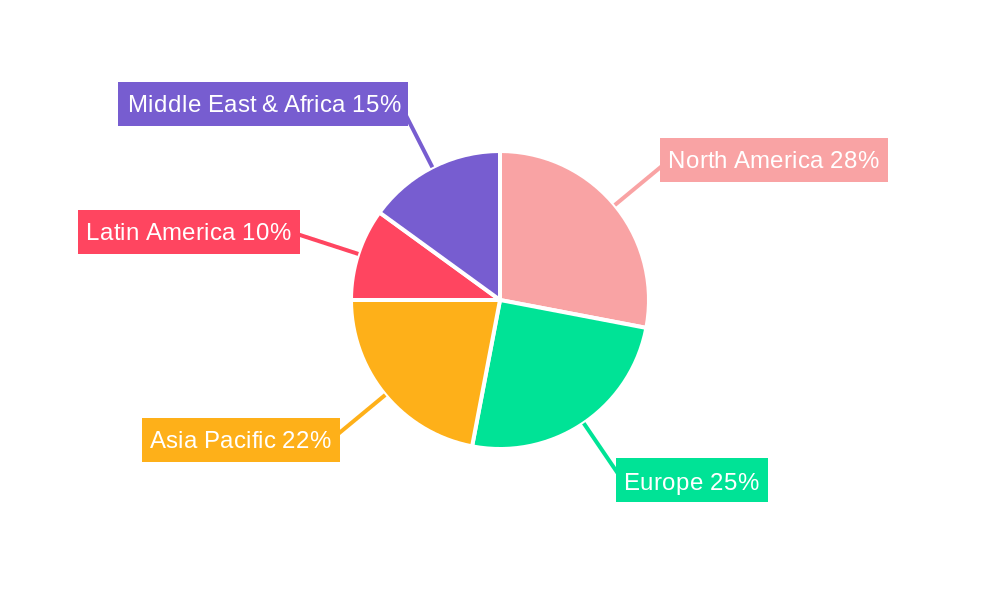

The global analog mammography systems market is experiencing moderate growth, driven primarily by the increasing prevalence of breast cancer and the rising demand for early detection and diagnosis. While digital mammography is rapidly gaining traction, analog systems continue to hold a niche market, particularly in regions with limited resources or where the cost of digital systems presents a significant barrier. The market is segmented by system type (portable and non-portable) and application (ambulatory surgical centers, hospitals, and diagnostic centers). Portable systems are experiencing relatively higher growth due to their flexibility and suitability for outreach programs in underserved areas. Key players like GE Healthcare, Hologic, and Fujifilm, along with several smaller manufacturers, contribute to a competitive landscape. The market is geographically diverse, with North America and Europe currently holding the largest market shares. However, regions like Asia Pacific are projected to witness significant growth in the coming years due to increasing healthcare infrastructure development and rising awareness of breast cancer. While the overall market size is expected to grow steadily, the penetration of digital mammography presents a significant restraint to the growth of analog systems.

The forecast period (2025-2033) suggests a continued, albeit moderate, expansion of the analog mammography systems market. This growth is tempered by the factors discussed previously. Maintaining market share will heavily rely on cost-effectiveness strategies and focusing on regions with limited access to advanced digital imaging technologies. Manufacturers are likely to focus on improving the efficiency and image quality of analog systems to retain a competitive edge. Technological advancements in analog systems, while less frequent than in digital systems, will likely concentrate on improved image clarity and reduced radiation exposure. The strategic partnerships and expansions into developing markets will be crucial for manufacturers seeking sustained growth in this evolving market segment.

The global analog mammography systems market, while facing the steady rise of digital mammography, continues to maintain a niche presence, particularly in resource-constrained settings where the lower initial cost remains a significant factor. The historical period (2019-2024) saw a relatively stable market size, fluctuating around the low millions, primarily driven by replacement cycles in existing analog systems within established healthcare facilities. However, the estimated market size for 2025 reflects a slight contraction compared to previous years, influenced by the accelerating adoption of digital mammography. The forecast period (2025-2033) projects a continued, albeit modest, decline in the analog market share as digital technologies become more cost-effective and widely accessible. This trend is particularly evident in developed nations where government initiatives and healthcare investments strongly favor the transition to digital. Nevertheless, a persistent demand is anticipated in developing economies, and specific regions with limited infrastructure or budgetary constraints will likely sustain a longer lifespan for analog mammography systems, preventing a complete market collapse. The overall market value, while not experiencing significant growth, is expected to remain in the low millions throughout the forecast period, mainly supported by ongoing replacement needs and continued demand within specific market segments. This makes strategic market positioning crucial for manufacturers to focus on the unique needs of these niche markets rather than pursuing broad market penetration. The study period (2019-2033) reveals a transition from a static to a shrinking yet resilient market, largely dependent on factors beyond technological advancements.

The continued existence of the analog mammography systems market, despite the clear advantages of digital technology, is primarily driven by cost considerations. The lower initial investment required for analog systems makes them an attractive option for smaller clinics, hospitals in developing countries, and facilities with limited budgets. This factor is particularly influential in regions where healthcare infrastructure is less developed or funding is scarce. Furthermore, the simplicity and relative ease of maintenance of analog systems contribute to their appeal, as specialized training and costly service contracts are often less demanding than those for digital systems. In certain contexts, the familiarity of medical staff with existing analog equipment also plays a role in maintaining demand. The preference for analog systems may arise from a perceived ease of use and established workflow integration. While technological obsolescence is a significant factor, the replacement market for these systems ensures a consistent, albeit diminishing, demand. The relative ease of repair and the lower costs associated with service also extend the lifespan of analog machines in certain settings, delaying the inevitable shift to digital.

The primary challenge facing the analog mammography systems market is the overwhelming shift towards digital mammography. Digital systems offer superior image quality, enhanced diagnostic capabilities, improved workflow efficiency, and better storage and retrieval options. These advantages are increasingly recognized and prioritized by healthcare providers, driving a significant decline in the demand for analog systems. Furthermore, the rising availability of government grants and funding programs specifically supporting the adoption of digital mammography technologies in many countries accelerates this transition. Another significant restraint is the limited availability of parts and servicing for aging analog systems, increasing maintenance costs and downtime. This issue is compounded by the dwindling expertise in analog system repair as trained technicians transition to digital systems. Finally, regulatory pressures and guidelines pushing for the adoption of advanced technologies, emphasizing superior image quality and diagnostic accuracy, further marginalize the analog systems market. These factors combine to create a significant headwind for the analog market, leading to its continued decline.

While the overall market for analog mammography systems is shrinking, specific segments and regions will continue to see some level of demand throughout the forecast period (2025-2033).

Developing Countries: Regions with limited healthcare infrastructure and budgetary constraints will likely sustain a longer reliance on analog systems due to lower initial costs and simpler maintenance requirements. The demand will be especially notable in certain regions of Africa, South America, and parts of Asia. These markets will represent a crucial, albeit slowly diminishing, segment.

Non-Portable Mammography Systems: While portable systems hold some appeal due to their flexibility, the higher initial cost of portable digital units relative to non-portable ones will likely extend the lifespan of existing analog non-portable systems, slowing down the rate of conversion. This segment will experience a gradual decline but will hold a larger market share than portable analog systems within the limited market.

Hospitals and Diagnostic Centers: While larger, more well-funded institutions are steadily adopting digital mammography, many smaller hospitals and diagnostic centers may delay upgrades due to budgetary pressures. This segment will contribute to the residual market demand for analog systems, but its contribution will steadily decrease.

The above analysis indicates that while the overall market shrinks, a sustained, though smaller, demand for analog mammography systems will exist primarily within specific developing regions and within certain segments (predominantly non-portable systems in smaller hospitals and diagnostic facilities) This niche demand will prevent the complete extinction of this technology, however, the ongoing trend is clearly towards its gradual replacement.

The market value, even within these segments, remains in the low millions throughout the forecast period.

The only real growth catalyst for analog mammography systems is the continued replacement of existing aging units within underserved healthcare facilities, mainly those located in developing countries. While not representing actual growth in overall market size, it sustains a small but consistent demand for these systems. This factor, however, is slowly being undermined by the decreasing cost of entry-level digital systems and increased funding opportunities for these areas.

Specific development information on analog mammography systems is difficult to find, as most industry news focuses on advancements in digital technology. The market is largely characterized by replacement rather than significant innovation.

This report provides a comprehensive overview of the analog mammography systems market, analyzing its current state, future projections, and key factors influencing its trajectory. The report details market trends, drivers, restraints, and dominant segments, providing valuable insights into the slowly shrinking but persistent niche occupied by this technology within the broader medical imaging landscape. The analysis considers factors like cost, accessibility, and regional variations in healthcare infrastructure, offering a nuanced perspective on this sector's future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GE Healthcare, Hologic, Tualatin Imaging, Analogic Corporation, Carestream Health, Fujifilm Global, Konica Minolta, Philips Healthcare, Allengers Medical Systems Limited, Delphinus Medical Technologies, Micrima Limited, Planmed, Siemens Healthineers Global, Aurora Imaging Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Analog Mammography Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Analog Mammography Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.