1. What is the projected Compound Annual Growth Rate (CAGR) of the Ambient Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ambient Packaging

Ambient PackagingAmbient Packaging by Type (Glass Material, Metal Material, Plastic Material, Paperboard Material, World Ambient Packaging Production ), by Application (Meat & Seafood, Dairy, Fruits & Vegetables, Ready-to-go Foods, Others, World Ambient Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

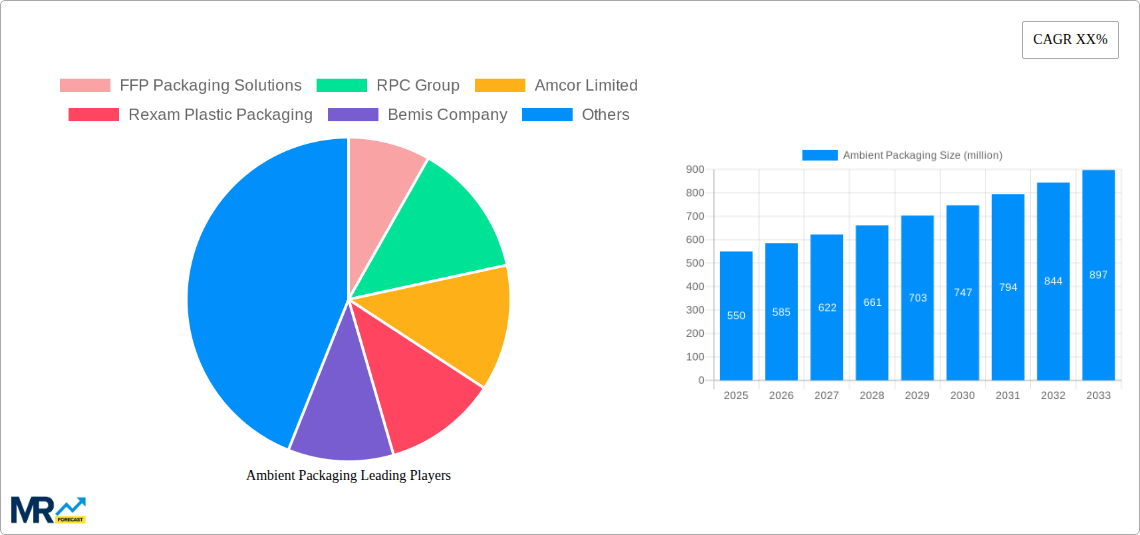

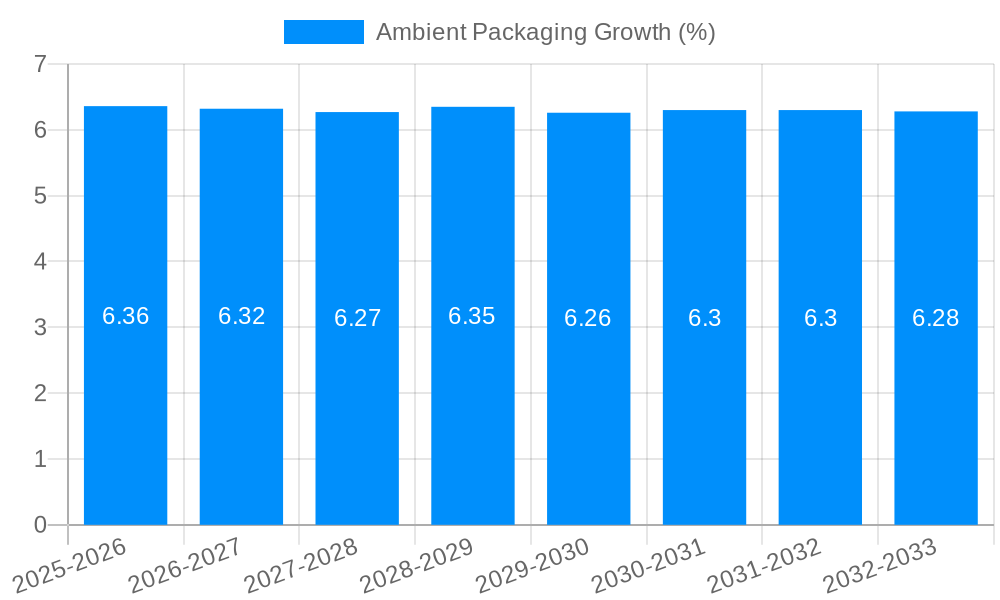

The global ambient packaging market is poised for significant expansion, projected to reach a substantial market size of approximately $550 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust growth is primarily fueled by an increasing consumer preference for convenience and longer shelf-life products, particularly in the meat & seafood, dairy, and ready-to-go food segments. The demand for innovative packaging solutions that can maintain product integrity without refrigeration is a key driver, allowing for wider distribution networks and reduced food waste. Advancements in material science, leading to more sustainable and high-performance packaging options such as advanced barrier films and retortable plastics, are further bolstering market penetration. The market is also seeing a surge in demand for recyclable and biodegradable materials, aligning with global sustainability initiatives and regulatory pressures.

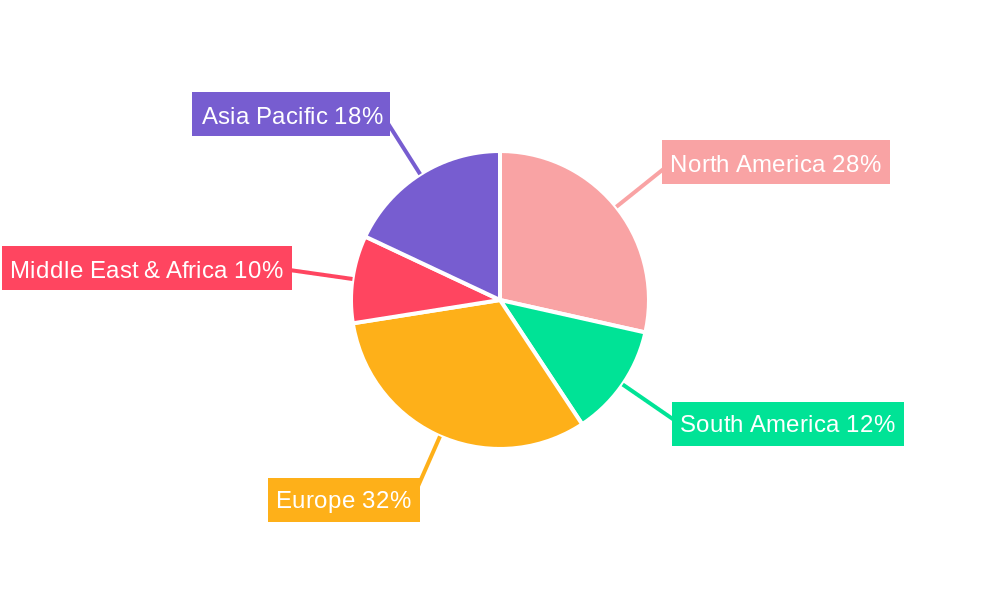

The ambient packaging landscape is characterized by a diverse range of materials, with glass, metal, plastic, and paperboard all playing crucial roles. Plastic materials are expected to lead in market share due to their versatility, cost-effectiveness, and excellent barrier properties, especially for food applications. However, the growing environmental consciousness is driving innovation towards more eco-friendly alternatives, creating opportunities for advanced paperboard-based solutions and metal packaging with improved recyclability. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the fastest-growing market, driven by a burgeoning middle class and rapid urbanization, which in turn increases the demand for packaged food products. North America and Europe are mature markets that continue to exhibit steady growth, focusing on premiumization and sustainable packaging solutions. Key players like Amcor Limited, Mondi Group Plc, and Tetra Pak are at the forefront of this evolution, investing in research and development to offer cutting-edge ambient packaging solutions.

This comprehensive report delves into the dynamic world of ambient packaging, offering a granular analysis of its production, consumption, and evolutionary landscape. Spanning a study period from 2019 to 2033, with a base year of 2025 and an estimated year also in 2025, this report meticulously examines the historical period of 2019-2024 and forecasts trends through the forecast period of 2025-2033. We will explore the intricate interplay of material types, end-use applications, and geographical influences that shape this critical sector of the packaging industry. The report leverages invaluable data points, with production figures often expressed in the millions of units, providing a concrete understanding of market scale.

The ambient packaging market is currently experiencing a significant transformation, driven by a confluence of consumer demands, technological advancements, and evolving regulatory landscapes. A key overarching trend is the escalating demand for shelf-stable products that do not require refrigeration, a direct response to the growing need for convenience and reduced food waste. This has propelled innovations in materials science and processing technologies, enabling a broader range of food and beverage items to be safely packaged and distributed at room temperature. Consumers are increasingly prioritizing packaging that offers extended shelf life, thereby minimizing spoilage and contributing to a more sustainable food supply chain. This trend is particularly pronounced in emerging economies where cold chain infrastructure may be less developed, making ambient packaging a vital solution. Furthermore, the rise of e-commerce and the associated logistics challenges have further amplified the importance of robust and resilient ambient packaging solutions capable of withstanding the rigors of long-distance transportation. Brands are actively seeking packaging that not only preserves product integrity but also enhances its visual appeal on digital platforms and during transit.

Another prominent trend is the burgeoning demand for sustainable and eco-friendly packaging options. This encompasses a move away from traditional single-use plastics towards recyclable, biodegradable, and compostable alternatives. Manufacturers are investing heavily in research and development to create innovative materials that offer comparable barrier properties and shelf life to conventional plastics, while significantly reducing their environmental footprint. This includes the exploration of advanced paperboard solutions, bio-based polymers, and novel composite materials. The aesthetic appeal and functionality of ambient packaging are also evolving, with an increasing emphasis on minimalist designs, clear labeling, and user-friendly opening mechanisms. Brands are recognizing the packaging as a crucial touchpoint for consumer engagement, using it to communicate product benefits, provenance, and sustainability credentials. The integration of smart packaging technologies, such as QR codes for enhanced traceability and interactive elements, is also gaining traction, offering consumers more information and control over their purchases. The global ambient packaging production is projected to witness substantial growth, driven by these multifaceted trends and the increasing adoption of advanced packaging technologies across various segments.

The market is also witnessing a shift towards specialized packaging solutions tailored to specific product needs. This includes advancements in barrier technologies to protect sensitive products from oxygen, moisture, and light, thereby extending their shelf life without the need for preservatives. For instance, advancements in plastic material formulations are enabling lighter, stronger, and more adaptable packaging for a diverse range of applications. Similarly, innovations in metal material packaging are focusing on enhanced recyclability and improved barrier properties for products requiring extreme protection. The "ready-to-go" food segment, in particular, is a significant driver, demanding packaging that not only preserves freshness but also offers microwavability and ease of consumption. The continued exploration of novel paperboard material solutions, often enhanced with sustainable barrier coatings, is also a key trend, offering a more environmentally conscious alternative for a growing number of products. The overarching goal is to achieve a balance between product protection, consumer convenience, and environmental responsibility, a complex but crucial endeavor shaping the future of ambient packaging. The world ambient packaging production figures are expected to reflect this expanding market reach and product diversification.

Several powerful forces are actively propelling the ambient packaging market forward, creating a fertile ground for innovation and growth. A primary driver is the ever-increasing global demand for convenience and ease of use. Consumers, particularly in urbanized and fast-paced societies, are seeking food and beverage options that are readily available, require minimal preparation, and offer extended shelf life without the need for refrigeration. This directly translates into a higher demand for ambient packaging solutions that can maintain product integrity and quality from the point of production to the consumer's table. Secondly, the expansion of the global food and beverage industry, coupled with the growing accessibility of retail channels, especially in emerging economies, is a significant catalyst. As more consumers gain access to a wider array of packaged goods, the need for reliable and cost-effective packaging solutions like ambient packaging becomes paramount. The ability of ambient packaging to facilitate efficient logistics and distribution, especially in regions with underdeveloped cold chains, further amplifies its importance and drives market expansion.

Furthermore, advancements in material science and packaging technology are consistently creating new possibilities and improving the performance of ambient packaging. Innovations in barrier materials, sterilization techniques, and sealing technologies are enabling a broader range of products, including sensitive items like meat & seafood and dairy products, to be effectively preserved at ambient temperatures. This continuous technological evolution ensures that ambient packaging can meet increasingly stringent product protection requirements. The growing consumer and regulatory pressure for sustainability and reduced environmental impact is also a powerful, albeit complex, driving force. While traditional plastics have faced scrutiny, the industry is actively developing and adopting more sustainable alternatives, such as recyclable plastics, biodegradable materials, and innovative paperboard-based solutions. This push for greener packaging is compelling manufacturers to invest in and adopt ambient packaging solutions that align with environmental goals. The increasing popularity of ready-to-go foods and the growth of the e-commerce sector, which necessitates robust packaging for long-distance transit, are also contributing significantly to the sustained growth of the ambient packaging market.

Despite its robust growth trajectory, the ambient packaging market is not without its challenges and restraints, which can influence its pace of expansion and strategic direction. A significant hurdle is the inherent perception of reduced freshness and quality compared to refrigerated or frozen alternatives for certain product categories. For some consumers, ambient packaging for items like fresh produce or certain dairy products might raise concerns about nutrient loss or taste degradation, leading to a preference for chilled options where available. Overcoming this perception requires continuous innovation in barrier technologies and clear communication of product quality preservation. Another critical challenge lies in the ongoing pressure to develop truly sustainable and cost-effective alternative materials. While there is a strong push towards eco-friendly solutions, finding materials that can match the barrier properties, durability, and affordability of conventional plastics remains a complex endeavor. The investment in new manufacturing processes and infrastructure for these novel materials can also be substantial, posing a barrier for some manufacturers.

Furthermore, stringent regulatory requirements and evolving standards for food safety and packaging materials can create complexities and necessitate significant investment in compliance. Keeping pace with these regulations across different geographical markets can be a demanding task, requiring constant vigilance and adaptation. The cost-competitiveness of traditional packaging materials also presents a restraint. While the long-term benefits of sustainable packaging are recognized, the initial cost of some eco-friendly alternatives can be higher, making it challenging for price-sensitive markets or products to adopt them immediately. Additionally, the reliance on specific raw material supply chains can expose the market to price volatility and availability issues, impacting production costs and lead times. For example, fluctuations in the price of petrochemicals can directly affect the cost of plastic packaging, and shifts in paper pulp availability can impact paperboard packaging. The technical limitations of certain ambient packaging formats for highly sensitive or perishable goods can also act as a restraint, requiring ongoing research and development to expand the scope of products suitable for ambient storage and distribution.

The ambient packaging market is poised for significant growth, with distinct regions and segments expected to lead this expansion. The Asia-Pacific region is anticipated to dominate the market, driven by a confluence of factors including a rapidly growing population, increasing disposable incomes, and a burgeoning middle class with a growing demand for packaged consumer goods. Countries like China, India, and Southeast Asian nations are witnessing a significant rise in urbanization, leading to a greater adoption of convenient, shelf-stable food and beverage options. The underdeveloped cold chain infrastructure in many parts of this region further amplifies the importance and demand for ambient packaging solutions for a wide array of products, from ready-to-go foods to staples like dairy and fruits & vegetables. The increasing penetration of modern retail formats, including supermarkets and hypermarkets, alongside the booming e-commerce sector, facilitates wider distribution of ambiently packaged goods. Moreover, a growing awareness and demand for sustainable packaging within the region, coupled with government initiatives promoting circular economy principles, will also influence the types of ambient packaging solutions that gain traction. The sheer scale of consumption in Asia-Pacific, coupled with increasing manufacturing capabilities, positions it as the undisputed leader in global ambient packaging production and consumption.

Within the broader market, the Plastic Material segment is expected to maintain its dominance, primarily due to its inherent versatility, cost-effectiveness, and excellent barrier properties. Plastic packaging, including various forms like flexible pouches, rigid containers, and bottles, offers a wide range of customization options to meet the specific needs of different food and beverage products. For applications such as meat & seafood, dairy, fruits & vegetables, and ready-to-go foods, advanced plastic materials provide crucial protection against oxygen, moisture, and contamination, thereby extending shelf life. The continuous innovation in plastic formulations, including the development of thinner yet stronger films and the incorporation of recycled content, further strengthens its market position. The recyclability of many plastic packaging types, coupled with ongoing efforts to improve collection and recycling infrastructure globally, is addressing some of the environmental concerns associated with plastic. The world ambient packaging production figures will heavily reflect the widespread adoption of plastic solutions across numerous applications.

Other segments are also contributing to the market's growth, though perhaps at a different pace. Paperboard Material is experiencing a significant upswing, driven by the strong consumer preference for eco-friendly and sustainable packaging. Innovative paperboard solutions, often combined with advanced barrier coatings, are increasingly being used for products like juices, cereals, and dry goods, offering a viable alternative to plastic. The Metal Material segment remains crucial for products requiring exceptional barrier protection and durability, such as canned foods and beverages, where its inert nature and excellent shelf-life preservation capabilities are highly valued. While Glass Material offers premium appeal and inertness, its heavier weight and fragility can limit its application in high-volume ambient packaging scenarios, especially for distribution-intensive products. However, for certain niche applications and premium segments, glass continues to hold its ground. The interplay between these material types, driven by evolving consumer preferences, regulatory landscapes, and technological advancements, will continue to shape the competitive dynamics of the ambient packaging market in the coming years. The overall world ambient packaging production will be a testament to the diverse material landscape and application breadth.

The ambient packaging industry is fueled by several potent growth catalysts. The ever-increasing global demand for convenience and ready-to-eat meals stands as a primary driver, aligning perfectly with ambient packaging's ability to offer shelf-stable, easily accessible food options. Furthermore, advancements in material science and processing technologies are continuously expanding the range of products that can be safely and effectively packaged for ambient distribution, overcoming previous limitations. The growing emphasis on reducing food waste by extending product shelf life through robust ambient packaging solutions is another significant catalyst. Finally, the surge in e-commerce and online grocery shopping necessitates packaging that can withstand transit, a strength of well-designed ambient packaging.

This report offers an exhaustive analysis of the ambient packaging market, providing a 360-degree view of its landscape. It meticulously details World Ambient Packaging Production figures, segmenting them by Type (Glass Material, Metal Material, Plastic Material, Paperboard Material) and Application (Meat & Seafood, Dairy, Fruits & Vegetables, Ready-to-go Foods, Others). The report encompasses a detailed historical analysis from 2019-2024 and provides robust forecasts for the 2025-2033 period, with 2025 serving as both the base and estimated year. We delve into the driving forces, challenges, growth catalysts, and significant industry developments, offering actionable insights for stakeholders. The report also profiles key leading players in the industry, providing a comprehensive resource for strategic decision-making and market understanding.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include FFP Packaging Solutions, RPC Group, Amcor Limited, Rexam Plastic Packaging, Bemis Company, Mondi Group Plc, Ampac Holdings, Dupont Packaging, KM Packaging, Tetra Pak, Leepack Industrial, Excelsior Technologies, Signature Pac, Packman Industries, Avonflex.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ambient Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ambient Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.