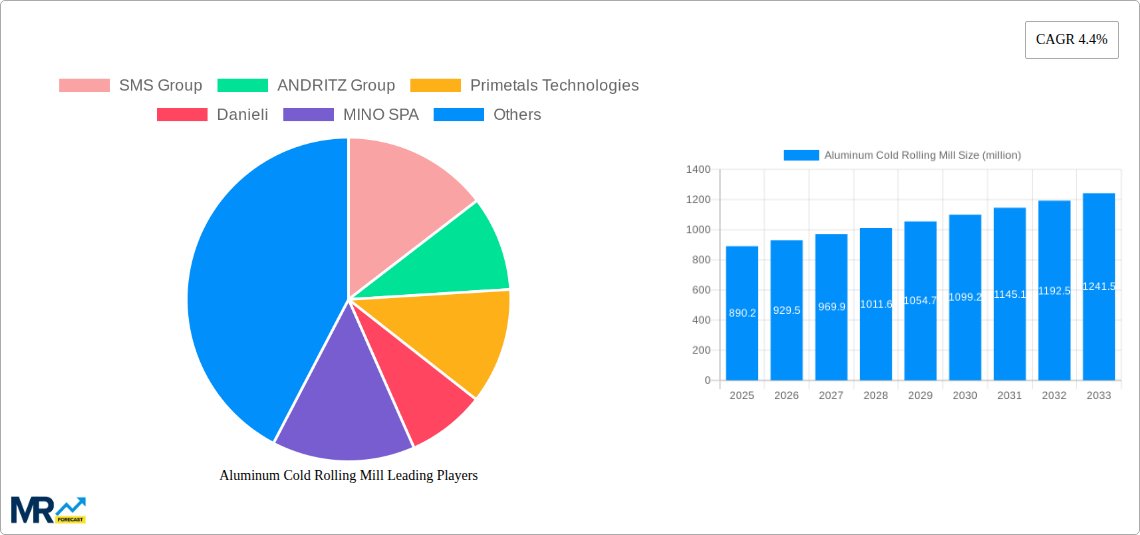

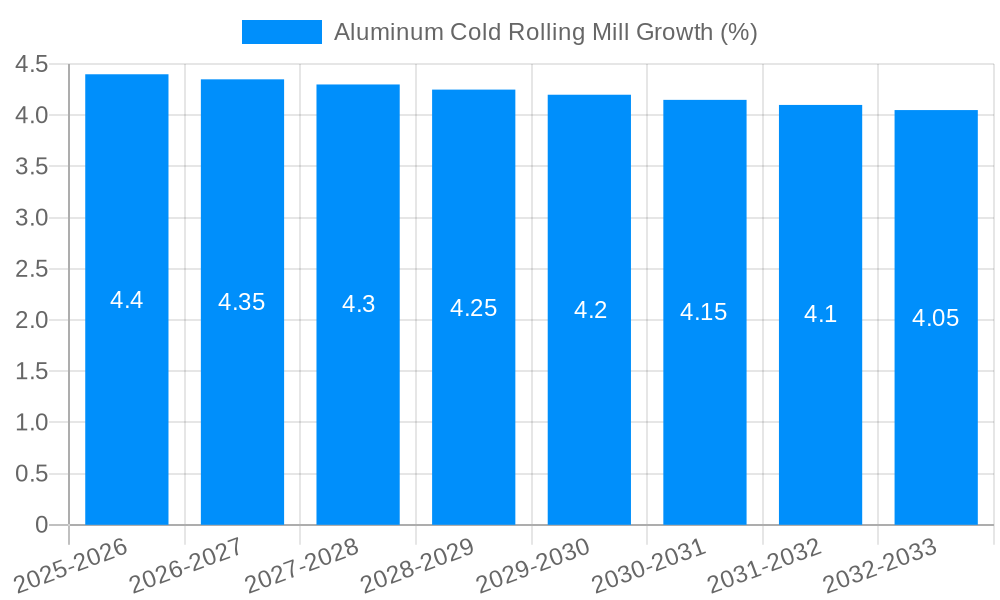

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aluminum Cold Rolling Mill?

The projected CAGR is approximately 4.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Aluminum Cold Rolling Mill

Aluminum Cold Rolling MillAluminum Cold Rolling Mill by Type (Tandem Cold Rolling Mill, Reversing Cold Rolling Mill, Others), by Application (Sheet Material, Strip Material, Bar Material, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Aluminum Cold Rolling Mill market is poised for robust growth, projected to reach approximately $890.2 million by 2025, with a compound annual growth rate (CAGR) of 4.4% anticipated from 2019 to 2033. This expansion is primarily driven by the increasing demand for lightweight and high-strength aluminum products across a multitude of industries, including automotive, aerospace, packaging, and construction. The automotive sector, in particular, is a significant contributor, with manufacturers increasingly adopting aluminum components to meet stringent fuel efficiency standards and reduce vehicle weight. This trend is further amplified by the growing adoption of electric vehicles, which often utilize more aluminum than their internal combustion engine counterparts. The versatility of aluminum, its recyclability, and its inherent corrosion resistance further solidify its position as a material of choice, underpinning the sustained demand for advanced cold rolling mill technologies.

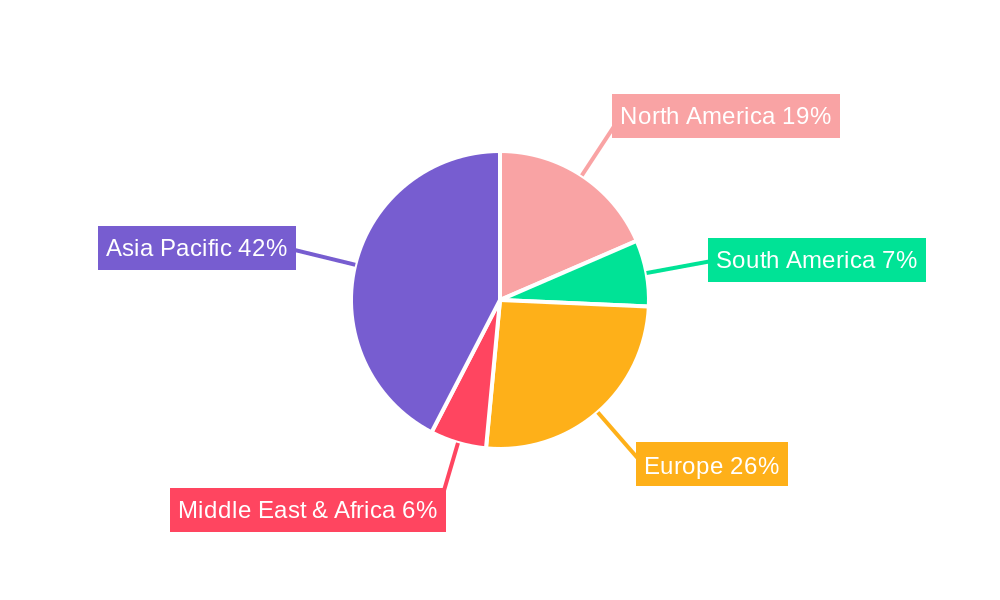

Further analysis reveals that the market is characterized by ongoing technological advancements aimed at improving efficiency, precision, and the ability to process thinner and more complex aluminum alloys. Key segments like Tandem Cold Rolling Mills and Reversing Cold Rolling Mills are expected to witness substantial demand, catering to the production of sheet and strip materials vital for diverse applications. While the market benefits from strong growth drivers, potential restraints such as fluctuating raw material prices and the initial capital investment required for advanced rolling mill technology may present challenges. However, strategic investments in research and development, coupled with a focus on sustainable manufacturing practices, are likely to mitigate these concerns, ensuring the continued upward trajectory of the Aluminum Cold Rolling Mill market. Asia Pacific, led by China and India, is anticipated to be a dominant region in terms of both market size and growth, owing to its burgeoning industrial base and increasing adoption of advanced manufacturing processes.

This report provides an in-depth analysis of the global Aluminum Cold Rolling Mill market, offering strategic insights and market forecasts from 2019 to 2033. It encompasses the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), presenting a holistic view of market dynamics, key drivers, challenges, and growth opportunities. The report leverages extensive research and market intelligence to deliver actionable information for stakeholders.

The Aluminum Cold Rolling Mill market is experiencing a significant transformation, driven by evolving end-use industry demands and technological advancements. XXX indicates that the market is witnessing a substantial growth trajectory, projected to reach a valuation of several million units in the coming years. This expansion is primarily fueled by the increasing consumption of aluminum in sectors such as automotive, aerospace, packaging, and construction. The automotive industry, in particular, is a major contributor, with manufacturers increasingly adopting lightweight aluminum components to improve fuel efficiency and reduce emissions. This trend necessitates a higher volume of precisely rolled aluminum sheets and strips, thereby boosting the demand for advanced cold rolling mills. Similarly, the aerospace sector's continuous pursuit of high-performance, lightweight materials is creating substantial opportunities for specialized aluminum alloys produced via cold rolling. The packaging industry's shift towards sustainable and recyclable materials further amplifies the demand for aluminum, especially for beverage cans and flexible packaging.

Furthermore, technological innovation is playing a pivotal role in shaping market trends. The development of more efficient, automated, and intelligent cold rolling mills is crucial for meeting the stringent quality requirements and production volumes of these industries. Innovations in roll surface technology, lubrication systems, and process control are enhancing the precision and surface finish of rolled aluminum products. The integration of Industry 4.0 principles, including AI-powered process optimization and predictive maintenance, is also gaining traction, promising to improve operational efficiency and reduce downtime. The increasing focus on sustainability is also influencing market trends, with a growing emphasis on energy-efficient rolling processes and the use of recycled aluminum. As a result, companies are investing in developing and deploying cold rolling mills that minimize environmental impact and maximize resource utilization. The global market for aluminum cold rolling mills is characterized by a dynamic interplay between technological progress, shifting end-user needs, and a growing commitment to sustainable manufacturing practices, all contributing to a robust and evolving market landscape.

Several powerful forces are driving the growth of the Aluminum Cold Rolling Mill market. Foremost among these is the insatiable demand from the automotive sector for lightweight materials. As global regulations tighten on emissions and fuel efficiency, manufacturers are increasingly turning to aluminum to replace heavier steel components. This translates directly into a heightened need for precisely rolled aluminum sheets and strips, requiring sophisticated cold rolling mill technology capable of delivering consistent quality and tight tolerances. The aerospace industry also represents a significant driver, with its unwavering requirement for high-strength, low-weight aluminum alloys for aircraft structures and components. The continuous innovation in aircraft design and the expansion of air travel necessitate a steady supply of premium aluminum materials, thereby bolstering the demand for advanced cold rolling capabilities.

The growing awareness and adoption of sustainable practices across industries are also acting as a major catalyst. Aluminum is a highly recyclable material, and its use in cold-rolled forms contributes to a circular economy. As companies strive to reduce their carbon footprint, the demand for aluminum products manufactured through efficient and environmentally conscious processes is on the rise. This includes investing in cold rolling mills that optimize energy consumption and minimize waste. Moreover, the expanding use of aluminum in consumer electronics, construction, and packaging for its aesthetic appeal, durability, and recyclability further amplifies the market's momentum. The continuous pursuit of improved product performance, enhanced surface finish, and greater material strength in these diverse applications directly translates into a sustained demand for high-quality, cold-rolled aluminum. The synergistic effect of these drivers, from regulatory pressures to consumer preferences for sustainable and high-performance materials, is creating a fertile ground for the expansion of the aluminum cold rolling mill industry.

Despite the robust growth prospects, the Aluminum Cold Rolling Mill market faces several inherent challenges and restraints that can temper its expansion. A primary concern is the significant capital investment required for establishing and upgrading cold rolling facilities. Advanced cold rolling mills, particularly those incorporating cutting-edge automation and precision control systems, represent substantial expenditures running into millions of dollars. This high upfront cost can be a deterrent for smaller players or companies in regions with less developed financial markets, potentially limiting market accessibility and competitive intensity. Furthermore, the aluminum industry is susceptible to fluctuations in raw material prices, specifically bauxite and alumina. Volatility in these commodity markets can directly impact the cost of aluminum production, influencing the profitability of rolling operations and potentially affecting investment decisions for new equipment.

Another significant challenge is the stringent quality control and precision demanded by end-use industries like aerospace and automotive. Achieving ultra-tight tolerances, specific surface finishes, and consistent material properties requires highly sophisticated equipment and meticulous operational management. Any deviation can lead to product rejection, incurring substantial financial losses and reputational damage. The technical expertise and skilled workforce required to operate and maintain these advanced rolling mills also pose a challenge. A shortage of qualified personnel capable of managing complex machinery and sophisticated process control systems can hinder operational efficiency and limit production capacity. Moreover, environmental regulations, while driving sustainability, can also add to the operational costs. Compliance with increasingly strict emission standards and waste management protocols necessitates continuous investment in pollution control technologies and sustainable practices, adding another layer of complexity and cost to the manufacturing process. These interwoven challenges, from financial barriers to technical complexities and market volatility, require careful navigation by industry participants.

The global Aluminum Cold Rolling Mill market is poised for significant dominance by specific regions and segments, driven by distinct industrial ecosystems and consumer demands. In terms of regional dominance, Asia Pacific is projected to emerge as the frontrunner. This supremacy is underpinned by the region's robust manufacturing base, burgeoning automotive industry, and rapidly expanding construction sector. Countries like China, India, and South Korea are witnessing substantial investments in aluminum production and processing capabilities. China, in particular, with its massive domestic consumption and significant export market for aluminum products, plays a pivotal role. Its vast industrial infrastructure, coupled with government initiatives promoting advanced manufacturing, positions it as a key demand and supply hub for cold-rolled aluminum. India's growing automotive sector and infrastructure development projects are also contributing to an increased demand for aluminum sheets and strips.

Within the segments, Sheet Material is anticipated to dominate the market. This is directly attributable to the extensive application of aluminum sheets in the automotive industry for body panels, structural components, and interior trims, where weight reduction is paramount. The packaging industry, especially for beverage cans and flexible packaging, also represents a substantial and growing consumer of aluminum sheets, driving consistent demand. The Tandem Cold Rolling Mill type is expected to see significant adoption and market share. Tandem mills, characterized by multiple rolling stands in a sequence, are highly efficient for continuous production of thin and wide aluminum sheets and strips with excellent dimensional accuracy and surface quality. Their ability to handle high-volume production makes them ideal for meeting the demands of large-scale industrial applications. The growing need for consistent quality and high throughput in sectors like automotive and packaging directly favors the deployment of these advanced tandem mill configurations.

Furthermore, the Application: Sheet Material segment, combined with the dominance of the Asia Pacific region, creates a powerful synergy. The burgeoning automotive manufacturing hubs in countries like China and its growing electric vehicle (EV) sector demand vast quantities of lightweight aluminum sheets. Similarly, the increasing urbanization and infrastructure development in the region necessitate aluminum sheets for construction purposes. The packaging sector, with its rapid growth in consumer goods and processed foods, also heavily relies on aluminum sheets for their barrier properties and recyclability. The technological advancements and economies of scale achieved in the Asia Pacific region, particularly in China, allow for the production of high-quality aluminum sheets at competitive prices, further solidifying this segment's and region's market leadership. The continuous innovation in rolling technologies, leading to improved efficiency and product capabilities in tandem mills, ensures their sustained relevance and dominance in catering to the ever-increasing demand for aluminum sheet material.

The Aluminum Cold Rolling Mill industry is fueled by several potent growth catalysts. The relentless pursuit of lightweighting in the automotive sector, driven by fuel efficiency and emission regulations, is a primary catalyst. The growing adoption of electric vehicles (EVs) further amplifies this trend, as battery weight necessitates significant reductions in other vehicle components. The aerospace industry's continuous demand for high-performance, lightweight materials for aircraft construction also provides a strong impetus for growth. Furthermore, the increasing global focus on sustainability and the circular economy strongly favors aluminum due to its high recyclability, prompting greater demand for its cold-rolled forms. Technological advancements, including automation and digitalization, are enhancing mill efficiency and product quality, making cold-rolled aluminum more attractive.

This report offers a granular and comprehensive view of the Aluminum Cold Rolling Mill market, extending beyond basic market sizing. It delves into the intricate dynamics of technological advancements, analyzing how innovations in mill design, automation, and control systems are shaping production capabilities and product quality. The report critically examines the evolving end-use industry landscape, highlighting the growing influence of sectors like electric vehicles and sustainable packaging on the demand for specific aluminum grades and processing techniques. Furthermore, it provides an in-depth assessment of regional market nuances, identifying key growth pockets and the factors driving their expansion, alongside a detailed breakdown of segment-specific trends and their projected market share. The strategic insights provided are designed to empower stakeholders with the knowledge needed to navigate this complex market landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.4%.

Key companies in the market include SMS Group, ANDRITZ Group, Primetals Technologies, Danieli, MINO SPA, Tenova (Techint Group), John Cockerill Group, IHI Corporation, Fagor Arrasate S.Coop., Shanghai Jingxiang, AT&M Environmental, MAS RollPro, .

The market segments include Type, Application.

The market size is estimated to be USD 890.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Aluminum Cold Rolling Mill," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Aluminum Cold Rolling Mill, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.