1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Flight Instrument?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Aircraft Flight Instrument

Aircraft Flight InstrumentAircraft Flight Instrument by Type (Flight Instruments, Engine Instruments, Navigation Instruments, World Aircraft Flight Instrument Production ), by Application (Civil Aircraft, Military Aircraft, World Aircraft Flight Instrument Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

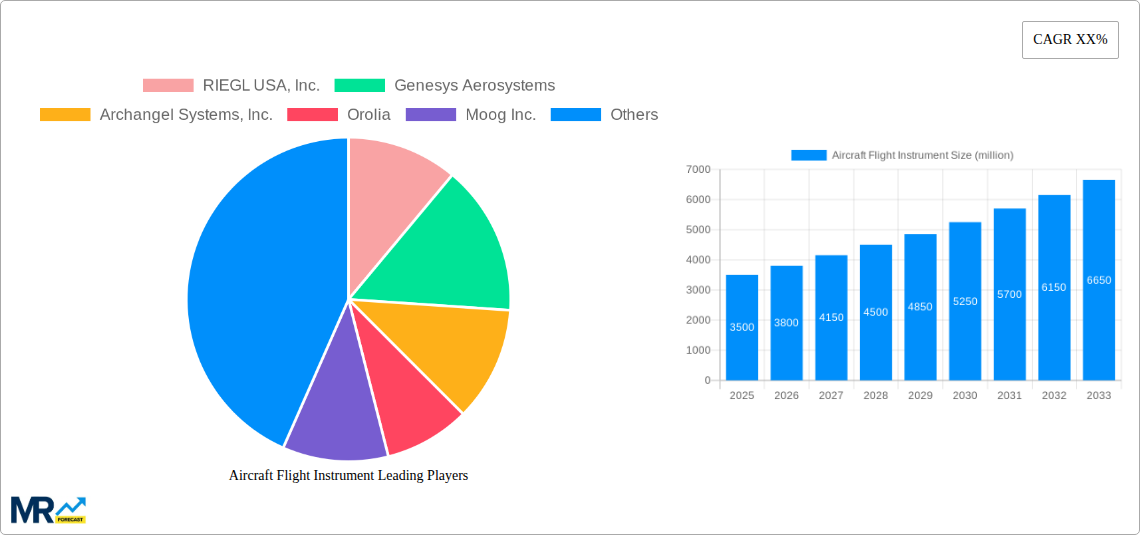

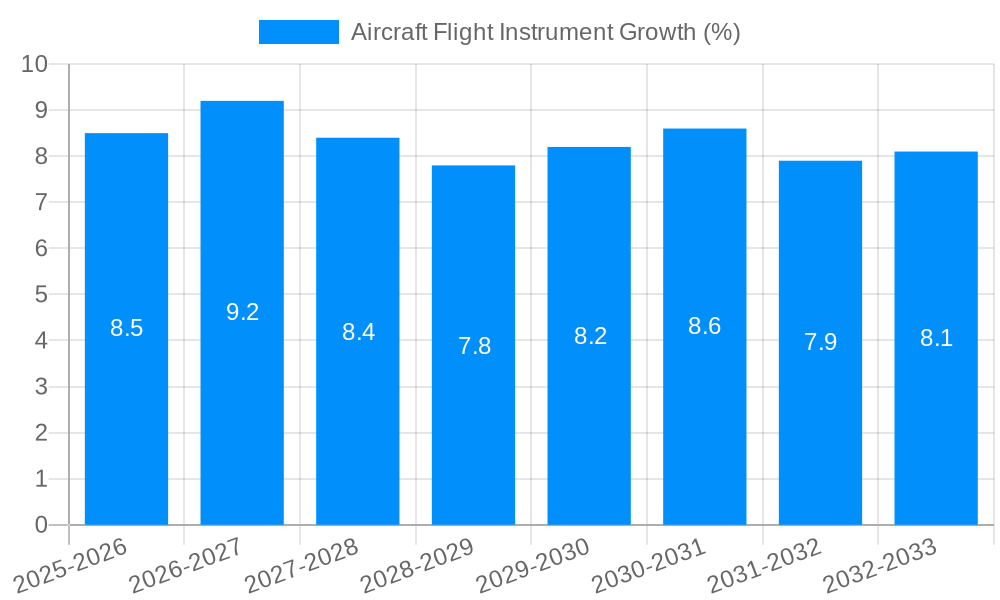

The global Aircraft Flight Instrument market is poised for substantial growth, projected to reach an estimated USD 3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% expected to drive it through 2033. This expansion is primarily fueled by the escalating demand for advanced avionics systems in both commercial and military aircraft, driven by stringent safety regulations and the need for enhanced situational awareness. The increasing global air traffic, coupled with the continuous modernization of existing fleets, presents significant opportunities for market players. Furthermore, the growing emphasis on fuel efficiency and reduced emissions is spurring innovation in flight instrument technologies, leading to the integration of more sophisticated digital systems and artificial intelligence-driven solutions. Emerging markets, particularly in the Asia Pacific region, are anticipated to contribute significantly to this growth due to burgeoning aviation infrastructure and increasing defense budgets.

Key segments shaping the market landscape include Flight Instruments and Navigation Instruments, with each experiencing distinct growth trajectories. The Civil Aircraft application segment is expected to dominate due to the burgeoning airline industry and the persistent need for upgraded, more reliable, and feature-rich instrumentation. Conversely, the Military Aircraft segment, though smaller, is characterized by high-value, technologically advanced systems driven by defense modernization programs. While the market benefits from strong drivers, potential restraints such as high research and development costs, complex certification processes for new technologies, and cybersecurity threats associated with connected avionics systems need to be carefully managed. However, the overarching trend towards greater automation and connectivity in aviation, supported by leading companies like RIEGL USA, Inc., Genesys Aerosystems, and Moog Inc., is expected to propel the market forward.

Here's a report description for Aircraft Flight Instruments, incorporating your specified elements:

The global Aircraft Flight Instrument market is poised for significant expansion, projected to reach an estimated $12,640.5 million by 2025, and further escalating to $19,876.2 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.8% during the 2025-2033 forecast period. This impressive trajectory is underpinned by a confluence of factors, primarily the relentless demand for enhanced aviation safety and operational efficiency. Throughout the 2019-2024 historical period, the market witnessed steady growth, driven by ongoing aircraft modernization programs and an increasing emphasis on advanced avionics. Key market insights reveal a discernible shift towards integrated cockpit solutions, where sophisticated flight instruments are seamlessly communicating with navigation and engine management systems. The rise of digital flight displays, augmented reality overlays, and advanced sensor technologies is fundamentally reshaping pilot situational awareness, offering unprecedented levels of data visualization and decision support. Furthermore, the burgeoning aviation industry, particularly in emerging economies, is creating a sustained demand for both new aircraft installations and retrofitting of existing fleets, thereby fueling market growth. The inherent complexity of modern aviation necessitates instruments that are not only reliable but also offer predictive capabilities, reducing downtime and enhancing overall fleet performance. As the aviation landscape evolves with the introduction of new aircraft designs and advancements in air traffic management, the role of intelligent and interconnected flight instruments will become even more critical. The market is characterized by a strong emphasis on research and development, with companies continuously investing in innovations that push the boundaries of what is possible in aircraft instrumentation. This includes the integration of artificial intelligence and machine learning to proactively identify potential issues and optimize flight parameters. The ongoing efforts to enhance fuel efficiency and reduce emissions also indirectly contribute to the demand for more precise and responsive engine instruments and overall flight management systems.

Several potent forces are actively propelling the aircraft flight instrument market forward. Foremost among these is the unwavering commitment to aviation safety. Regulatory bodies worldwide consistently mandate and encourage the adoption of advanced instrumentation that demonstrably improves pilot situational awareness and reduces the risk of human error. This inherent drive for safety translates directly into a demand for sophisticated Flight Instruments that provide real-time, accurate, and intuitive data. Concurrently, the burgeoning global aviation sector, encompassing both civil and military applications, is a significant catalyst. As more aircraft are manufactured and existing fleets undergo upgrades, the need for new and advanced flight instruments is amplified. The increasing complexity of air traffic management and the pursuit of greater airspace efficiency necessitate highly capable Navigation Instruments that can integrate seamlessly with global positioning systems (GPS), inertial navigation systems (INS), and other advanced navigation aids. Furthermore, the relentless pursuit of operational efficiency and cost reduction within the aviation industry is a major driver. Modern Engine Instruments provide pilots and maintenance crews with granular data on engine performance, enabling proactive maintenance, optimized fuel consumption, and extended engine lifespan, all of which contribute to significant cost savings. The continuous technological advancements in sensor technology, digital processing, and display technologies are also crucial in pushing the market forward, enabling the development of lighter, more powerful, and more integrated flight instrument systems.

Despite the robust growth prospects, the aircraft flight instrument market encounters several challenges and restraints that temper its expansion. A primary concern revolves around the high cost of research and development (R&D) and the subsequent price of advanced instrumentation. The stringent certification processes required for avionics, particularly for critical flight systems, are lengthy and expensive, adding to the overall cost of development and implementation. This can make cutting-edge technology less accessible for budget-conscious operators, especially in the general aviation sector. The rapid pace of technological evolution also presents a challenge. While innovation drives demand, it simultaneously creates a risk of rapid obsolescence for existing systems. This necessitates continuous investment in upgrades and replacements, which can be a significant financial burden for some operators. Moreover, the integration of complex digital systems requires highly skilled personnel for installation, maintenance, and operation. A shortage of qualified technicians and pilots trained in the use of advanced avionics can hinder the widespread adoption of new technologies. Cybersecurity threats are another growing concern. As flight instruments become more interconnected and reliant on digital data, they become potential targets for cyberattacks, which could have catastrophic consequences. Ensuring the security and integrity of these systems requires ongoing vigilance and investment in robust cybersecurity measures. Finally, geopolitical instability and economic downturns can impact global aircraft production and airline profitability, indirectly affecting the demand for new flight instruments.

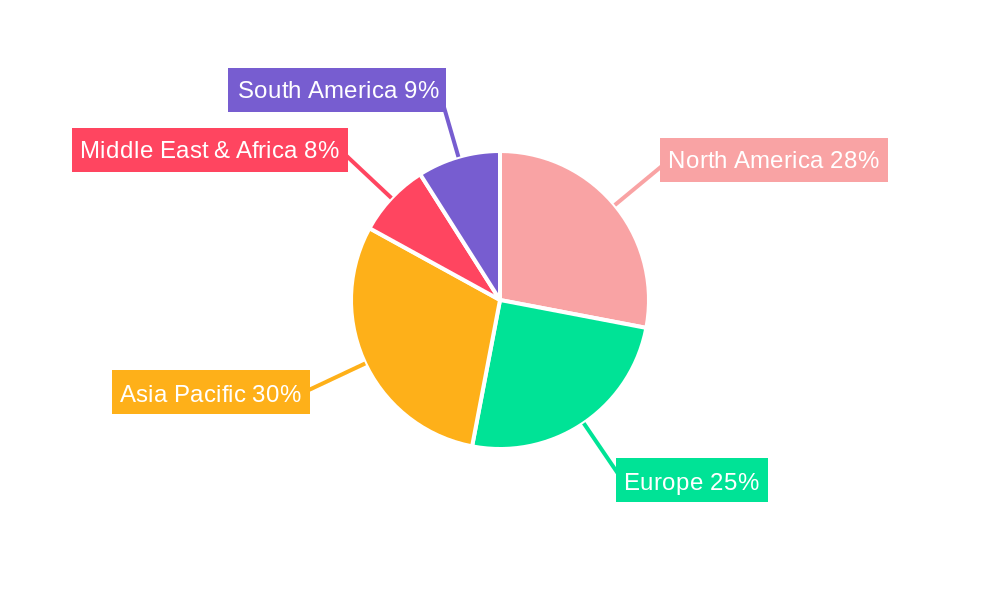

The global Aircraft Flight Instrument market is characterized by distinct regional dominance and segment leadership, with a significant portion of the market value driven by North America and the Civil Aircraft application segment.

North America (USA and Canada): This region is a perennial powerhouse in the aviation industry, boasting a highly developed civil aviation sector, a substantial military presence, and leading aircraft manufacturers. The United States, in particular, is home to a significant portion of global aircraft production and a large installed base of commercial and general aviation aircraft. This translates into a consistently high demand for both new installations and retrofitting of flight instruments. The presence of major aerospace companies like RIEGL USA, Inc., Genesys Aerosystems, Archangel Systems, Inc., Orolia, Moog Inc., Aviation Instrument Technologies, Inc., Firstmark Aerospace, National Hybrids, J.P. Instruments, Inc., Chelton Flight Systems, Airfield Technology, Inc., and Oxley, Inc., significantly contributes to R&D, production, and market innovation within this region. The robust regulatory framework, coupled with a proactive approach to adopting new safety and efficiency technologies, further solidifies North America's leading position. The extensive network of airports, flight schools, and maintenance facilities also fuels a continuous demand for flight instrument upgrades and replacements.

Civil Aircraft Application Segment: This segment is projected to be the largest and most influential within the Aircraft Flight Instrument market. The sheer volume of commercial aircraft operating globally, coupled with ongoing fleet expansion and modernization efforts by airlines, creates a sustained demand for advanced flight instruments. The increasing emphasis on fuel efficiency, passenger comfort, and operational reliability drives airlines to invest in state-of-the-art avionics. This includes sophisticated Flight Instruments, highly accurate Navigation Instruments, and precise Engine Instruments that contribute to optimized flight paths, reduced fuel burn, and enhanced passenger experience. The growth in air travel, particularly in emerging economies, further amplifies the demand for civil aircraft, thereby boosting the market for associated flight instruments. The development of new commercial aircraft models by major manufacturers consistently incorporates the latest advancements in flight instrument technology, setting new benchmarks for the industry.

While North America and the Civil Aircraft segment are expected to dominate, it's important to note the growing significance of other regions such as Europe, driven by its established aerospace industry and stringent safety regulations, and Asia-Pacific, witnessing rapid aviation growth. Similarly, the Military Aircraft segment, while smaller in volume, represents a high-value market due to the sophisticated and customized nature of military avionics. However, the sheer scale of commercial aviation operations and the continuous need for upgrades and new builds firmly position Civil Aircraft as the primary driver of global Aircraft Flight Instrument production and consumption.

The growth of the aircraft flight instrument industry is significantly catalyzed by the escalating global demand for air travel, which necessitates the expansion of commercial fleets and the production of new aircraft. Advancements in sensor technology and digital processing are enabling the creation of more sophisticated, lightweight, and integrated instruments, enhancing pilot situational awareness and operational efficiency. The stringent focus on aviation safety by regulatory bodies worldwide mandates the adoption of advanced avionics, driving innovation and market penetration. Furthermore, the increasing implementation of Next-Generation Air Traffic Management (ATM) systems requires highly precise and interconnected flight instruments for seamless integration and optimized airspace utilization.

This comprehensive report delves into the intricate dynamics of the global aircraft flight instrument market from 2019-2033, utilizing 2025 as the base and estimated year. It provides in-depth analysis of market trends, driving forces, challenges, and key growth catalysts. The report meticulously forecasts market valuation to reach $12,640.5 million in 2025 and project it to $19,876.2 million by 2033, with a CAGR of 5.8% during the 2025-2033 forecast period. It examines the historical performance during 2019-2024 and offers strategic insights into dominating regions and segments, particularly highlighting the prominence of North America and the Civil Aircraft application. The report also identifies leading industry players and significant developments, offering a holistic view of the evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include RIEGL USA, Inc., Genesys Aerosystems, Archangel Systems, Inc., Orolia, Moog Inc., Aviation Instrument Technologies, Inc., Firstmark Aerospace, National Hybrids, J.P. Instruments, Inc., Chelton Flight Systems, Airfield Technology, Inc., Oxley, Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Aircraft Flight Instrument," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Aircraft Flight Instrument, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.