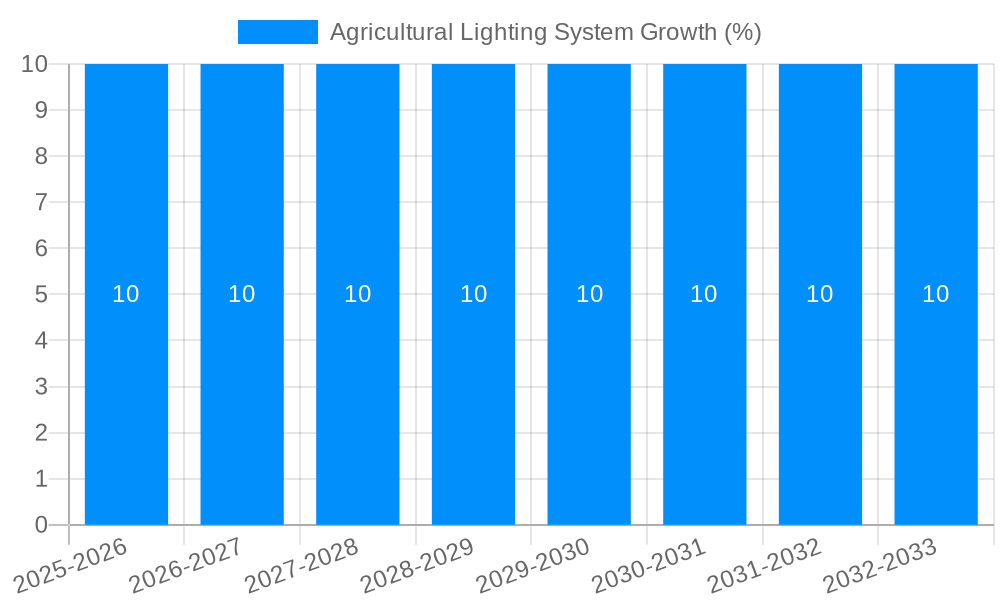

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Lighting System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agricultural Lighting System

Agricultural Lighting SystemAgricultural Lighting System by Type (LED Smart Light, Linear Fluorescent Lamp, Others), by Application (Vertical Farming, Animal Husbandry, Aquaculture, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

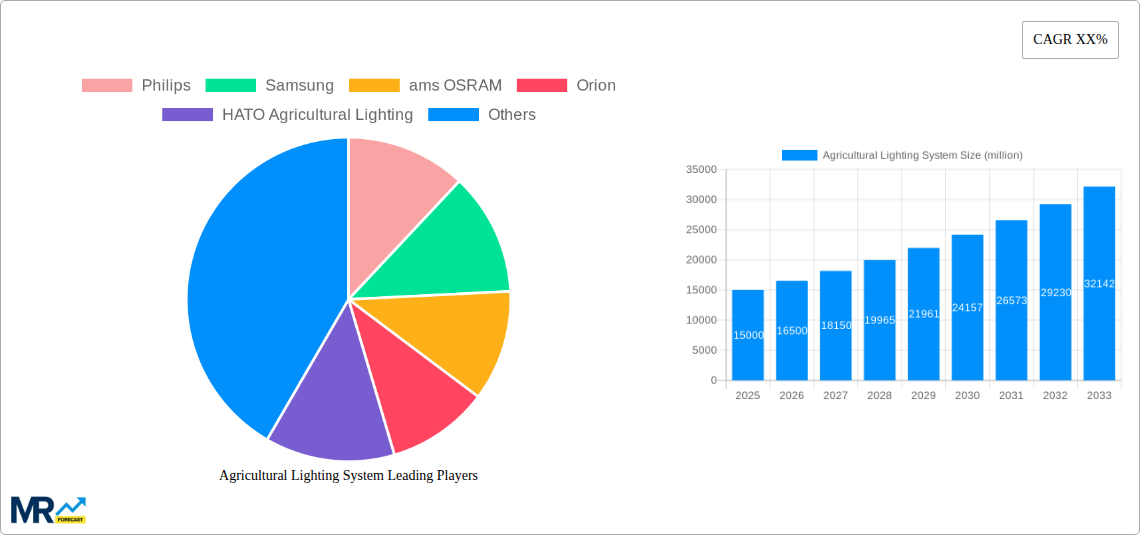

The agricultural lighting system market is experiencing robust growth, driven by the increasing demand for higher crop yields, year-round production, and improved crop quality. Technological advancements in LED lighting, offering energy efficiency and precise spectral control, are significantly contributing to market expansion. The rising adoption of vertical farming and controlled environment agriculture (CEA) further fuels this growth, as these methods heavily rely on optimized lighting solutions. While initial investment costs can be a barrier for some farmers, the long-term benefits in terms of increased productivity and reduced operational expenses are proving compelling. This market is segmented by lighting type (LED, HID, fluorescent), application (greenhouses, vertical farms, indoor farms), and geography. Major players like Philips, Signify, and Osram are leading the innovation and market penetration efforts, constantly enhancing product offerings to cater to the evolving needs of the agricultural sector. Competition is intensifying with the emergence of specialized agricultural lighting companies, particularly those focusing on customized spectral solutions for specific crops. Future growth will be influenced by factors such as advancements in sensor technology for precise light control, government initiatives promoting sustainable agriculture, and increased awareness of the environmental benefits of controlled environment agriculture.

The market's substantial growth is projected to continue throughout the forecast period (2025-2033), propelled by several key factors. The adoption of precision agriculture techniques and data-driven farming practices is driving the need for sophisticated lighting systems that can be precisely controlled and monitored. Furthermore, the global population's increasing demand for food and the limitations of arable land are forcing farmers to seek innovative solutions like vertical farming and greenhouses. These solutions require efficient and effective lighting systems, further stimulating market growth. While challenges remain, such as the high upfront costs and the need for specialized expertise in managing these systems, the long-term economic and environmental benefits will continue to drive adoption, making the agricultural lighting system market a highly attractive sector for investment and innovation. We anticipate steady growth across all major segments, with LED lighting solutions gaining significant traction due to their superior energy efficiency and customizable spectral output.

The global agricultural lighting system market is experiencing robust growth, projected to reach multi-million unit sales within the forecast period (2025-2033). Driven by increasing demand for higher crop yields, improved quality, and year-round production, the market witnessed significant expansion during the historical period (2019-2024). The estimated market size in 2025 is poised for substantial growth, exceeding previous years. This expansion is fueled by advancements in LED technology, offering energy efficiency and spectral control unmatched by traditional lighting solutions. Farmers are increasingly adopting LED-based systems to optimize plant growth, leading to a higher return on investment. The integration of smart technologies, such as sensors and data analytics, further enhances the efficiency and precision of agricultural lighting systems. This allows for real-time monitoring and adjustment of light parameters, optimizing crop production based on specific needs. Moreover, government initiatives promoting sustainable agriculture practices and increasing investments in research and development are also contributing to the market's growth. The market is segmented by light source (LED, HID, fluorescent), application (greenhouses, vertical farms, indoor farming), and spectrum (red, blue, white, full-spectrum). The LED segment holds a dominant position, owing to its energy efficiency and customizable spectral output. Greenhouses currently represent a significant market share, although vertical farms and indoor farming are witnessing exponential growth, reflecting the increasing trend towards controlled-environment agriculture. The market is characterized by intense competition among established players and emerging companies, each striving to innovate and offer superior solutions. This competition fosters continuous improvement in terms of energy efficiency, cost-effectiveness, and operational simplicity. The integration of artificial intelligence (AI) and the Internet of Things (IoT) is further revolutionizing the sector, promising even greater precision and automation in the future, ultimately increasing agricultural output globally. The future trends suggest a continued shift towards more sophisticated and integrated systems, fostering sustainable and efficient agricultural practices on a larger scale.

The agricultural lighting system market's rapid expansion is driven by several key factors. Firstly, the growing global population demands increased food production, putting pressure on existing agricultural land and resources. Agricultural lighting provides a solution by enabling year-round crop production regardless of geographical location or seasonal variations. This increases yield and reduces reliance on unpredictable weather patterns. Secondly, advancements in LED technology have significantly reduced the energy consumption and operational costs associated with agricultural lighting. LEDs offer superior energy efficiency compared to traditional lighting technologies like high-intensity discharge (HID) lamps, making them a more economically viable option for farmers. Thirdly, the rising demand for high-quality produce is driving the adoption of specialized lighting systems that can optimize plant growth and enhance the nutritional value of crops. Precision control over light spectrum and intensity allows farmers to tailor lighting conditions to specific plant needs, leading to improved quality and yield. Furthermore, the increasing adoption of controlled-environment agriculture (CEA), including vertical farming and indoor farming, requires advanced lighting solutions to ensure optimal plant growth in controlled environments. CEA is increasingly attractive due to its ability to minimize land usage, reduce water consumption, and enable local food production. Finally, government initiatives promoting sustainable agriculture and increasing investments in agricultural research and development are providing further impetus to market growth. Support for technological innovation and adoption of environmentally friendly practices is bolstering the adoption of energy-efficient agricultural lighting systems.

Despite the significant growth potential, the agricultural lighting system market faces several challenges. High initial investment costs associated with installing and maintaining advanced lighting systems can be a significant barrier for small-scale farmers and developing countries. This can limit adoption despite the long-term benefits. The complexity of controlling and managing sophisticated lighting systems requires specialized knowledge and training, which can hinder wider adoption among farmers. Furthermore, energy costs, while reduced compared to traditional lighting, can still represent a considerable expense, particularly in regions with high electricity prices. The need for reliable power supplies is critical; power outages can significantly impact crop production, emphasizing the need for backup power solutions. The durability and lifespan of lighting systems are also important factors; premature failures can lead to significant financial losses and disruptions to production. Finally, competition among different lighting technologies and suppliers can make it challenging for farmers to choose the optimal solution for their specific needs. Careful evaluation of various options is needed, requiring technical expertise or consultation. Addressing these challenges through technological advancements, financial incentives, and educational programs will be crucial for realizing the full potential of agricultural lighting systems.

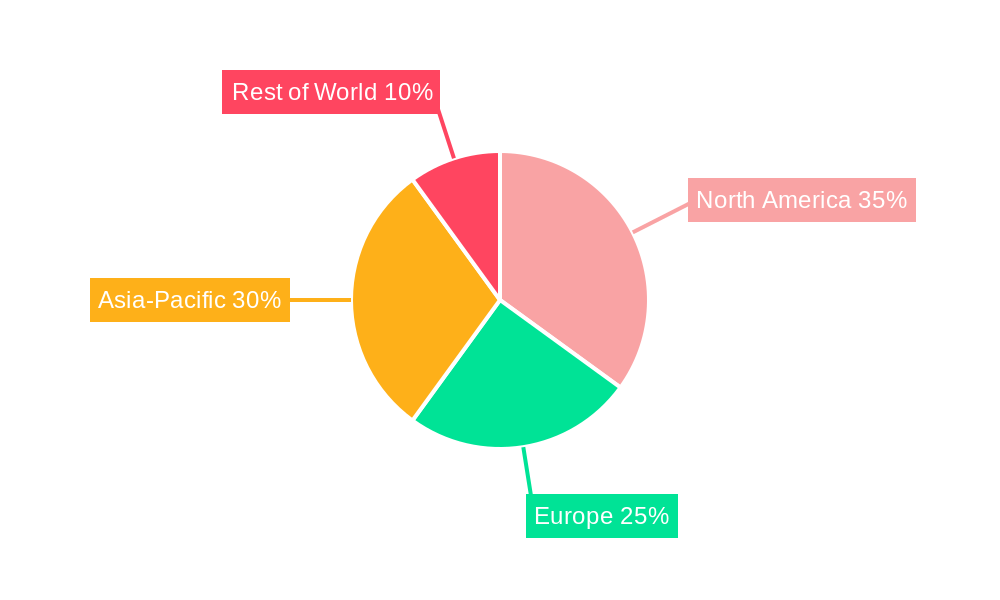

North America: The region is anticipated to dominate the market due to high adoption rates of advanced agricultural technologies, a strong focus on sustainable agriculture, and the presence of major players in the agricultural lighting industry. The US, in particular, is a significant market driver.

Europe: Significant growth is expected in Europe, driven by government initiatives promoting sustainable farming practices and the high prevalence of greenhouse cultivation. Countries like the Netherlands and Germany are expected to be key contributors.

Asia-Pacific: The Asia-Pacific region is predicted to witness rapid growth, fueled by rising demand for food, increasing investments in agriculture, and the expansion of controlled-environment agriculture in rapidly developing economies. China and India are expected to be particularly important.

LED Lighting Segment: The LED segment dominates the market due to its superior energy efficiency, longer lifespan, customizable spectral output, and cost-effectiveness in the long run. The ability to tailor light spectra to specific plant needs for optimal growth provides a significant advantage.

Greenhouse Application: Greenhouses currently represent the largest application segment owing to their established use in commercial agriculture, ease of integration of lighting systems, and the established infrastructure for climate control and automation.

The high initial investment cost of advanced systems remains a key challenge, especially for smaller farms in developing countries. However, the increasing awareness of the benefits of improved yield and quality, coupled with government support and financing options, are slowly addressing this hurdle. Continued innovation in LED technology, reductions in manufacturing costs, and the development of more user-friendly systems are further contributing to wider market adoption. The convergence of lighting technologies with data analytics and IoT-enabled controls allows for precision agriculture, significantly enhancing productivity.

The agricultural lighting system industry is propelled by several key growth catalysts: the rising global population demanding increased food production, advancements in LED technology reducing costs and enhancing efficiency, the burgeoning controlled-environment agriculture (CEA) sector, increasing government support for sustainable agriculture, and the integration of smart technologies and data analytics enabling precise control and monitoring of light conditions for optimal crop yields. These factors combine to create a favorable environment for continued expansion of the market.

This report provides a comprehensive analysis of the agricultural lighting system market, covering market trends, driving forces, challenges, key players, and future growth prospects. The analysis encompasses historical data (2019-2024), estimated figures for 2025, and forecasts extending to 2033, offering a complete overview of the market's evolution. The report's detailed segmentation and regional analysis provide valuable insights for stakeholders involved in the agricultural lighting sector, enabling them to make informed decisions. The insights provided are instrumental for both established players and new entrants looking to thrive in this dynamic and rapidly growing market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Philips, Samsung, ams OSRAM, Orion, HATO Agricultural Lighting, Leitech, Intellias, California LightWorks, Current, Gavita International, DeLaval, Sunbird, Signify, Heliospectra, Lely, Hubbell, Luminus, Valoya, Efficiency Vermont, Hortilux, Munnon, Anhui Zhinong Agricultural Equipment Technology, Guangdong Queendom Group Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Agricultural Lighting System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agricultural Lighting System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.