1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace & Defense Connectors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Aerospace & Defense Connectors

Aerospace & Defense ConnectorsAerospace & Defense Connectors by Type (Ethylene Propylene Diene Monomer (EPDM), Silicone Elastomers, Fluoroelastomers), by Application (O-Rings & Gaskets, Seals, Profiles, Hoses), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

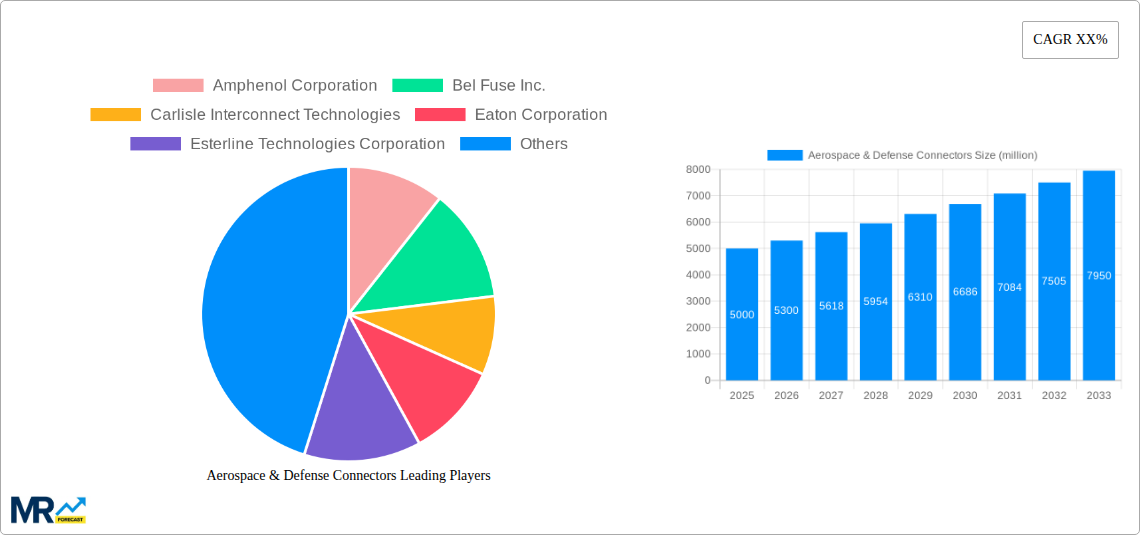

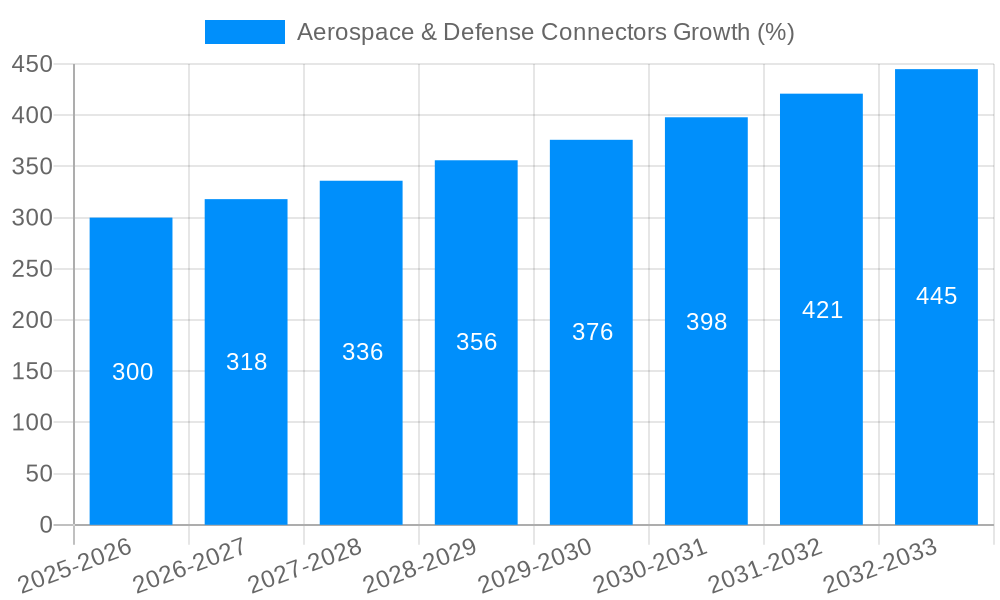

The Aerospace & Defense Connectors market is experiencing robust growth, driven by increasing demand for advanced aircraft and defense systems globally. The market's size in 2025 is estimated at $5 billion, reflecting a Compound Annual Growth Rate (CAGR) of approximately 6% between 2019 and 2025. This growth is fueled by several key factors, including the rising adoption of advanced technologies like UAVs (Unmanned Aerial Vehicles) and the modernization of existing military fleets. Furthermore, the increasing need for reliable and high-performance connectors in harsh environments contributes significantly to market expansion. Technological advancements in connector miniaturization, increased data transmission rates, and improved durability are also key drivers. While supply chain disruptions and fluctuating raw material prices pose some challenges, the long-term outlook remains positive, driven by sustained government spending on defense and aerospace programs worldwide.

The market is segmented by connector type (circular, rectangular, fiber optic, etc.), application (aircraft, missiles, satellites, etc.), and region. Major players, including Amphenol Corporation, TE Connectivity, and Eaton Corporation, are leveraging technological innovations and strategic partnerships to gain market share. Competition is intense, with companies focusing on product differentiation, cost optimization, and expanding their global presence. The North American market currently holds a significant share, owing to a large defense budget and a strong aerospace manufacturing base. However, regions like Asia-Pacific are witnessing rapid growth, driven by increasing military spending and investments in aerospace infrastructure. The forecast period (2025-2033) anticipates continued growth, driven by factors mentioned above and further technological innovation within the sector. The market is expected to reach approximately $8 billion by 2033.

The global aerospace & defense connectors market is experiencing robust growth, projected to reach several billion units by 2033. This expansion is fueled by a confluence of factors, including increasing military spending globally, a surge in demand for advanced aircraft and defense systems, and the ongoing trend towards miniaturization and increased connectivity within aerospace and defense platforms. The market witnessed significant growth during the historical period (2019-2024), with particularly strong performance in the years leading up to the base year (2025). This growth is not uniform across all segments, however. While traditional connectors remain vital, there's a clear shift towards high-speed, high-reliability connectors capable of handling the massive data transmission requirements of modern systems. This includes the integration of advanced materials and technologies to improve performance in harsh environments. The estimated market size for 2025 reflects a substantial increase over previous years, indicating a continued upward trajectory. Furthermore, the forecast period (2025-2033) suggests sustained growth driven by ongoing technological advancements and geopolitical factors that are spurring increased investment in aerospace and defense capabilities. The market is also witnessing a trend toward greater adoption of modular and customizable connector solutions to enhance system flexibility and reduce lifecycle costs. This trend, combined with stringent regulatory requirements for safety and performance, is reshaping the competitive landscape and driving innovation. The increasing complexity of aerospace and defense systems is pushing the industry towards more sophisticated connector technologies, fostering ongoing research and development efforts.

Several key factors are propelling the growth of the aerospace & defense connectors market. Firstly, significant increases in global military spending, particularly in regions experiencing geopolitical instability, are driving demand for advanced defense systems, which in turn require a substantial number of specialized connectors. Secondly, the ongoing modernization and upgrade of existing military fleets and infrastructure necessitate the replacement of older connectors with more advanced, reliable options. This modernization extends to both airborne and ground-based systems. Thirdly, the development of advanced aircraft, such as unmanned aerial vehicles (UAVs) and next-generation fighter jets, demands robust and lightweight connectors capable of withstanding extreme conditions and high data throughput. Furthermore, the growing integration of sophisticated electronics within aerospace and defense platforms, including advanced sensors, communication systems, and onboard computers, necessitates an increased number and diversity of connectors. Finally, the ongoing shift towards autonomous systems and increased reliance on data transmission for real-time situational awareness is fueling the demand for high-speed, high-bandwidth connectors capable of handling large volumes of data reliably and securely.

Despite the significant growth potential, the aerospace & defense connectors market faces several challenges. The stringent regulatory environment and stringent quality standards imposed on aerospace and defense components present significant hurdles for manufacturers, increasing production costs and lead times. The need for rigorous testing and certification processes further complicates the manufacturing and supply chain. Another significant restraint is the increasing complexity of aerospace and defense systems. This complexity necessitates the use of highly specialized and customized connectors, which can increase manufacturing costs and lead times. Furthermore, the long procurement cycles associated with defense contracts and the inherent uncertainty within the defense budget landscape pose challenges to market predictability. Competition from low-cost manufacturers, particularly from emerging economies, can also put downward pressure on pricing. Finally, the risk of obsolescence, particularly with rapidly evolving technologies, is a constant concern for both manufacturers and end-users, requiring careful planning and strategic product development.

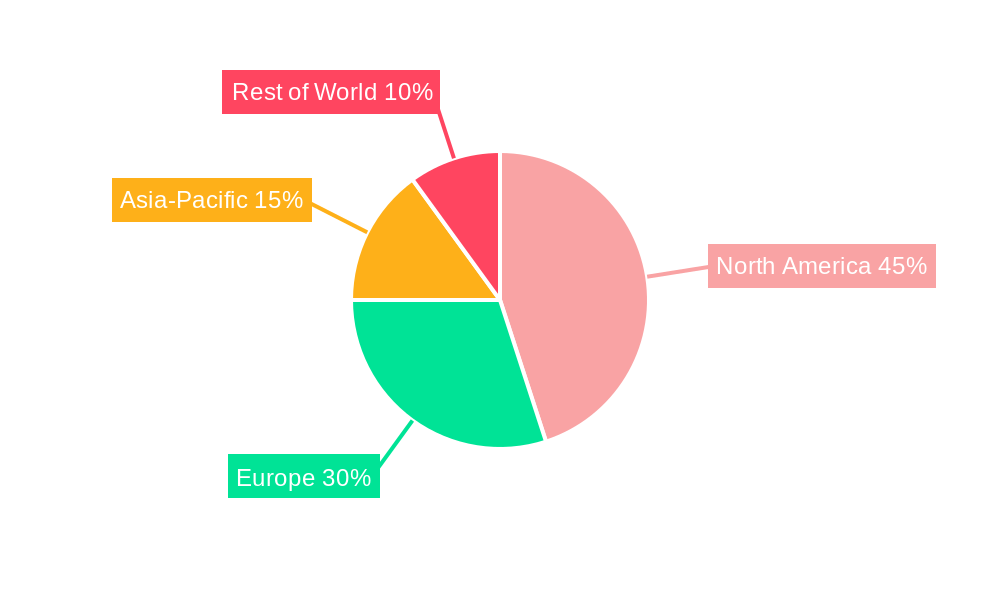

North America: This region is expected to dominate the market due to significant military spending, a strong aerospace industry, and ongoing technological advancements. The presence of major players and extensive research and development activities further solidify its leading position.

Europe: Significant investments in defense modernization and the presence of established aerospace and defense manufacturers contribute to Europe's substantial market share.

Asia-Pacific: Rapid economic growth and increasing military expenditure in countries like China and India are fueling growth in the Asia-Pacific region. However, technological advancements might lag behind North America and Europe in some segments.

High-Reliability Connectors: This segment is expected to exhibit high growth due to their critical role in ensuring safe and reliable operation of aerospace and defense systems. The increased demand for advanced communication, navigation, and surveillance systems further drives growth in this segment.

Fiber Optic Connectors: The increasing use of fiber optic technology for high-speed data transmission and its ability to withstand harsh electromagnetic interference (EMI) contribute to the growth of this segment.

Circular Connectors: Their robust design and ability to handle high power and data transmission make them particularly suitable for applications requiring high reliability and durability, driving segment growth.

In summary, the North American region, along with the high-reliability, fiber optic, and circular connector segments, are projected to be the dominant players in this market owing to several factors such as high military spending, stringent quality standards and the need for high-performance components.

The aerospace & defense connectors market is witnessing significant growth fueled by several key catalysts. These include the continuous modernization of existing military fleets, increasing demand for advanced unmanned aerial vehicles (UAVs), and the rising adoption of advanced technologies like fiber optics and high-speed data transmission within aerospace and defense systems. Government initiatives focused on enhancing national defense capabilities and technological advancements contributing to improved connector performance and reliability also contribute to the market's expansion.

This report provides a comprehensive analysis of the aerospace & defense connectors market, covering historical data, current market trends, and future growth projections. It offers detailed insights into key market drivers, restraints, and opportunities, along with an in-depth assessment of leading players and their market share. The report segments the market by region, type of connector, and application, providing a granular understanding of the market dynamics. The report also examines technological advancements, regulatory frameworks, and competitive landscape, providing valuable insights for stakeholders involved in this dynamic sector. Finally, the report projects the market's future growth trajectory based on a comprehensive analysis of current and emerging trends.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amphenol Corporation, Bel Fuse Inc., Carlisle Interconnect Technologies, Eaton Corporation, Esterline Technologies Corporation, Glenair, ITT Corporation, Radiall Inc., Rosenberger Hochfrequenztechnik, Smiths Group PLC, TE Connectivity, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Aerospace & Defense Connectors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Aerospace & Defense Connectors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.