1. What is the projected Compound Annual Growth Rate (CAGR) of the ADAS Aftermarket?

The projected CAGR is approximately 3.64%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

ADAS Aftermarket

ADAS AftermarketADAS Aftermarket by Type (/> Ultrasonic Sensors Technology, Lidar Sensors Technology, Radar Sensors Technology, Camera Sensors Technology, Infrared Sensors Technology, Pressure Sensors Technology), by Application (/> Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

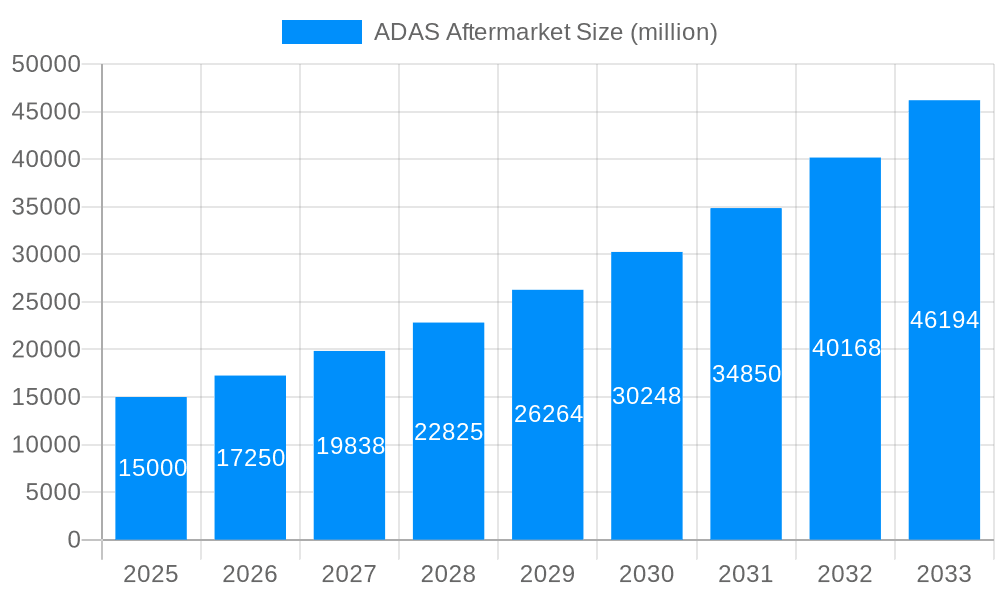

The Advanced Driver-Assistance Systems (ADAS) aftermarket is experiencing robust growth, driven by increasing vehicle ownership, rising consumer demand for safety features, and technological advancements. The market, currently valued at approximately $15 billion (a reasonable estimation based on typical market sizes for related automotive technologies and the provided timeframe), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033. This growth is fueled by several key factors. The escalating integration of ADAS features in new vehicles is creating a substantial aftermarket for repairs, replacements, and upgrades. Furthermore, the rising adoption of autonomous driving technologies and the increasing availability of cost-effective ADAS components are further propelling market expansion. The development of sophisticated sensor technologies, such as LiDAR, radar, and camera-based systems, enhances the precision and reliability of ADAS functionalities, contributing to heightened consumer appeal and market demand.

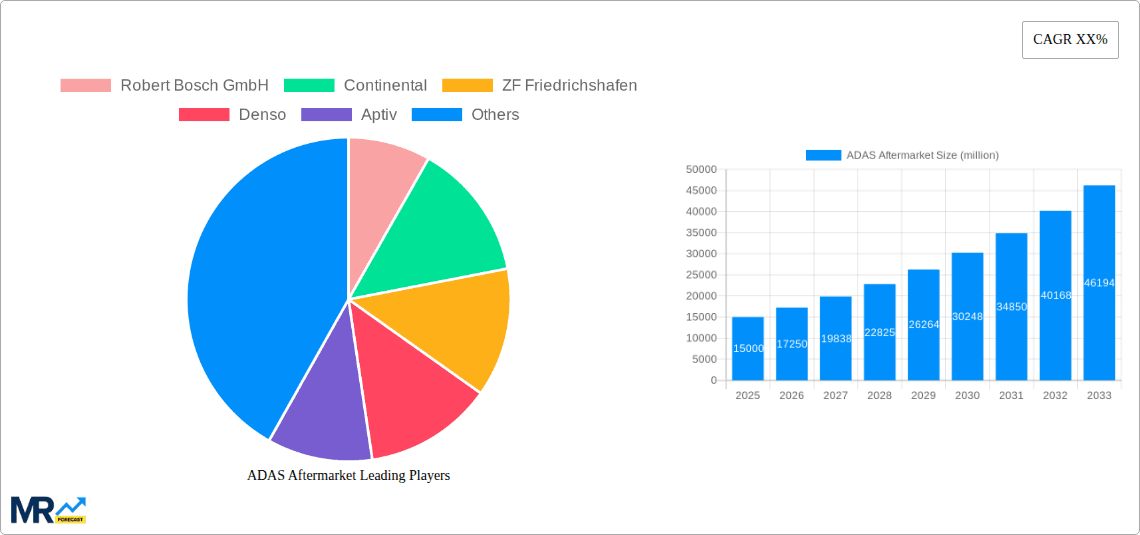

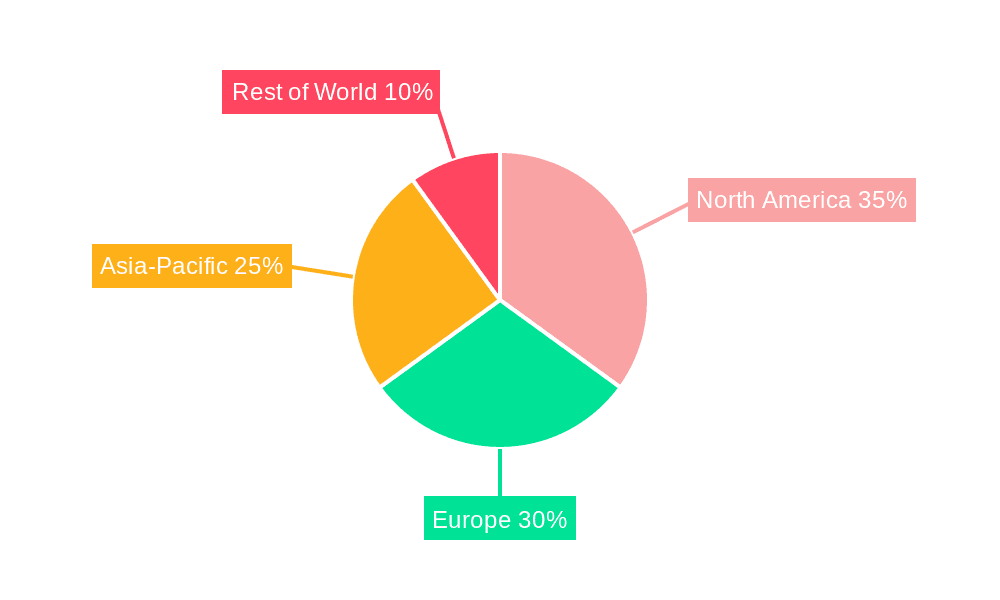

Significant regional variations exist within the ADAS aftermarket. North America and Europe currently dominate the market due to high vehicle ownership rates, robust automotive industries, and early adoption of advanced technologies. However, Asia-Pacific is poised for rapid growth, driven by increasing vehicle sales and government initiatives promoting road safety. The market segmentation reveals a strong demand for camera-based ADAS systems, reflecting their widespread use in various applications. The passenger car segment holds the largest market share, but light and heavy commercial vehicle segments are also experiencing significant growth owing to the increasing focus on fleet safety and operational efficiency. The competitive landscape is characterized by established automotive component manufacturers like Bosch, Continental, and Denso, alongside emerging technology companies specializing in ADAS solutions. These companies are continually innovating to offer advanced features, improve system reliability, and enhance cost-effectiveness, further shaping the market’s trajectory.

The global ADAS aftermarket is experiencing explosive growth, driven by increasing vehicle ownership, rising consumer demand for advanced safety features, and the decreasing cost of ADAS technologies. The market, valued at several billion dollars in 2024, is projected to reach tens of billions by 2033, exhibiting a Compound Annual Growth Rate (CAGR) well above the global automotive aftermarket average. This expansion is fueled by the aftermarket's capacity to offer retrofit solutions for older vehicles lacking factory-installed ADAS, catering to both individual consumers prioritizing safety upgrades and fleet operators aiming to enhance safety and reduce insurance costs. The increasing availability of cost-effective sensors, coupled with advancements in software and algorithms, are making ADAS retrofitting increasingly feasible and attractive. This report analyzes the market trends from the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), identifying key market insights and providing detailed forecasts across various segments and geographic regions. The market is seeing a shift towards more integrated systems, moving beyond individual sensor replacements towards complete ADAS packages. This integration trend is driven by the demand for higher levels of automation and the need for seamless interaction between different ADAS components. Furthermore, the increasing adoption of connected car technologies is creating opportunities for aftermarket players to offer advanced features such as remote diagnostics and over-the-air software updates. The market's growth is not uniform; specific regions and applications will outpace others, leading to varied opportunities for players in different niches. Millions of units of various ADAS components are expected to be sold in the aftermarket annually throughout the forecast period.

Several factors are driving the remarkable growth of the ADAS aftermarket. Firstly, the rising number of road accidents globally is pushing consumers to seek enhanced vehicle safety. Retrofitting ADAS systems provides a cost-effective solution to improve safety in older vehicles lacking these features. Secondly, the decreasing cost of ADAS components, including sensors and processing units, is making aftermarket installations more affordable and accessible. This affordability is a critical factor in accelerating market adoption. Thirdly, advancements in technology are leading to smaller, more efficient, and easily integrable ADAS systems. This means easier installation, faster deployment times, and reduced disruption for vehicle owners. Fourthly, government regulations in several countries promoting road safety and mandating certain ADAS features in new vehicles indirectly benefit the aftermarket. These regulations create increased awareness and demand for advanced safety features, even in older vehicles. Finally, the increasing availability of skilled technicians specializing in ADAS installation and maintenance provides a reliable support infrastructure for the growing aftermarket. This ensures that consumers can easily access installation services and receive necessary support.

Despite the significant growth potential, the ADAS aftermarket faces several challenges. Firstly, the complexity of ADAS systems can pose installation difficulties for less experienced technicians, necessitating specialized training and certification programs. Secondly, ensuring the compatibility of aftermarket ADAS components with different vehicle models and electronic architectures can be a considerable hurdle. Thirdly, concerns about the reliability and performance of aftermarket ADAS systems compared to factory-installed systems may deter some consumers. This necessitates stringent quality control and testing procedures. Fourthly, the lack of standardized installation procedures and diagnostic tools can create inconsistency in the quality of installations and lead to difficulties in troubleshooting issues. Finally, the higher initial cost of retrofitting compared to purchasing a new vehicle with factory-installed ADAS may restrain some consumers, particularly those with budget constraints. Addressing these challenges through industry collaboration, standardization efforts, and targeted consumer education is crucial to unlocking the full potential of the ADAS aftermarket.

The ADAS aftermarket is expected to experience significant growth across various regions and segments. However, specific regions and sensor types are poised to lead the market due to unique factors.

North America and Europe: These regions are expected to dominate the market owing to high vehicle ownership rates, stringent safety regulations, and a high consumer awareness of ADAS technologies. The established automotive infrastructure and readily available skilled labor further contribute to this dominance. Millions of units of various ADAS components are projected to be sold annually in these regions throughout the forecast period.

Passenger Cars: Passenger cars represent the largest segment due to the high volume of vehicles on the road and the increasing consumer demand for improved safety features. Retrofitting ADAS into existing passenger cars presents a significant opportunity.

Camera Sensors Technology: Camera sensors are projected to be the leading sensor type in the aftermarket, driven by their cost-effectiveness, advanced image processing capabilities, and suitability for various ADAS applications, including lane departure warning, adaptive cruise control, and automatic emergency braking. The ease of integration and the wide range of functionalities offered by camera-based systems further boost this segment's growth. Millions of units are expected to be sold annually.

Asia-Pacific: While currently smaller than North America and Europe, the Asia-Pacific region is anticipated to show rapid growth. This expansion will be driven by rising vehicle ownership, increased infrastructure investments, and a growing focus on improving road safety in developing economies. The market’s massive scale suggests that the absolute number of units sold within this region could be vast.

The growth in each segment will not be uniform across all regions. While passenger car applications are dominant globally, the penetration of ADAS in light and heavy commercial vehicles is expected to increase significantly, representing a growing opportunity for aftermarket suppliers.

Several factors are catalyzing the growth of the ADAS aftermarket. These include the increasing affordability of ADAS components, driven by technological advancements and economies of scale. Furthermore, rising consumer awareness of ADAS benefits and the increasing availability of reliable aftermarket installation services are creating a favorable environment for market expansion. Government regulations promoting road safety and increasing insurance incentives for vehicles equipped with ADAS are further stimulating demand. Finally, the continued development of advanced ADAS features and improved integration capabilities further expands the market potential.

This report provides a comprehensive analysis of the ADAS aftermarket, covering market size, growth drivers, challenges, key players, and future trends. The analysis includes detailed segmentation by sensor type, vehicle type, and geographic region, offering a granular view of the market dynamics. The report further incorporates insights from expert interviews, industry surveys, and secondary research, ensuring the accuracy and reliability of its findings. This information is critical for businesses considering investment or expansion in the fast-growing ADAS aftermarket sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.64% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.64%.

Key companies in the market include Robert Bosch GmbH, Continental, ZF Friedrichshafen, Denso, Aptiv, Valeo, Magna International, Veoneer, Aisin Corporation, Hitachi Astemo, Nidec Corporation, Infineon Technologies, Ficosa Internacional, Hella KGaA Hueck, Pacific Industrial, Mobileye, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "ADAS Aftermarket," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the ADAS Aftermarket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.