1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D X-Ray Inspection System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

3D X-Ray Inspection System

3D X-Ray Inspection System3D X-Ray Inspection System by Type (Digital Radiography (DR) Type, Computed Tomography (CT) Type, World 3D X-Ray Inspection System Production ), by Application (Pharmacy, Food, Medical, Others, World 3D X-Ray Inspection System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

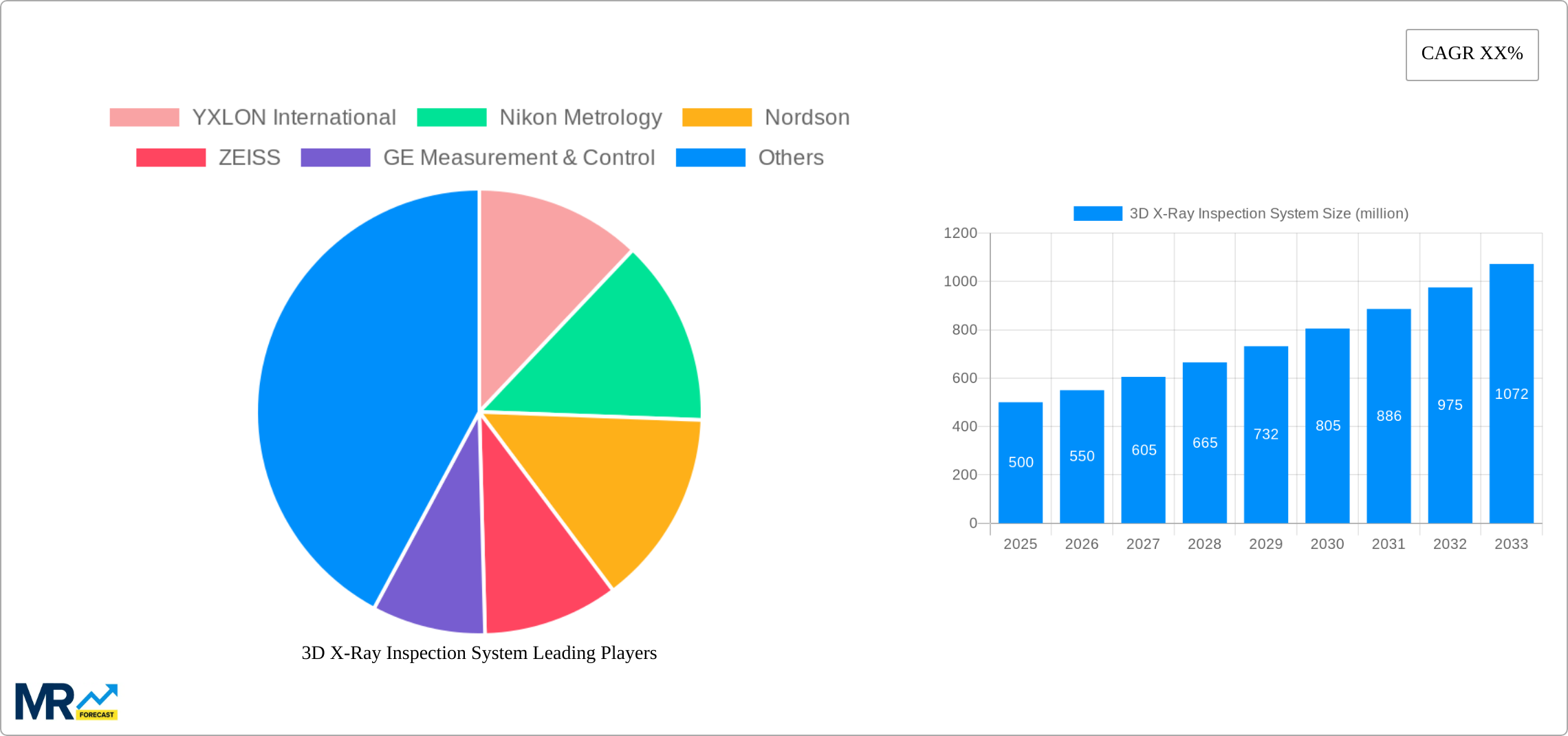

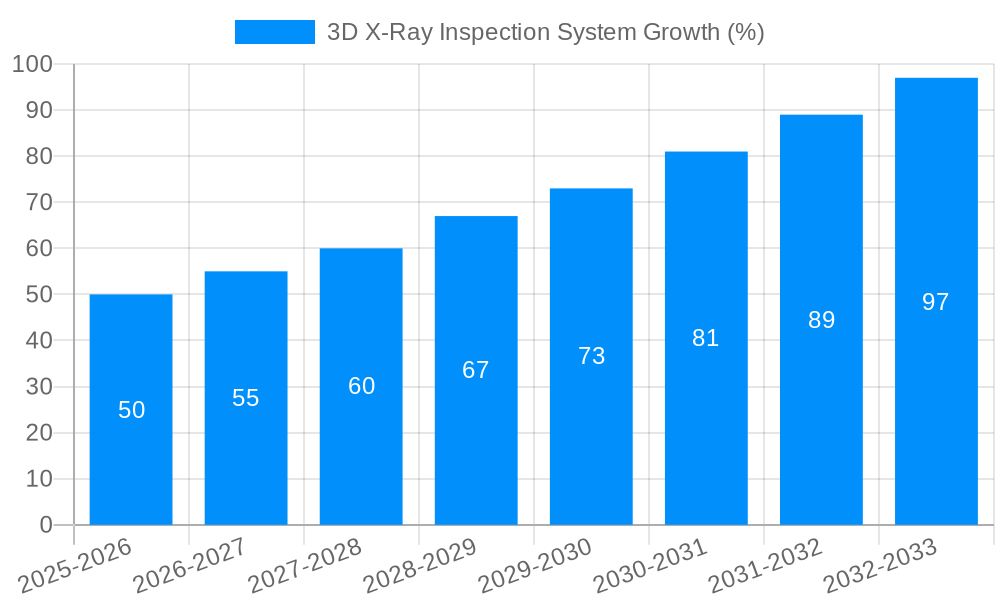

The global 3D X-Ray Inspection System market is poised for significant expansion, projected to reach an estimated USD 1.5 billion by 2025 and then grow at a robust Compound Annual Growth Rate (CAGR) of approximately 10% through 2033. This substantial growth is primarily fueled by the escalating demand for sophisticated inspection solutions across a diverse range of industries, notably pharmaceuticals and food processing, where stringent quality control and safety regulations are paramount. The increasing adoption of advanced manufacturing techniques, coupled with the growing complexity of product designs, necessitates precise, non-destructive testing methods, positioning 3D X-ray inspection systems as indispensable tools. Furthermore, advancements in imaging technology, including higher resolution detectors and AI-powered image analysis, are enhancing the capabilities of these systems, driving their appeal and market penetration. The inherent ability of 3D X-ray inspection to provide detailed volumetric data, revealing internal defects and inconsistencies that are invisible to traditional methods, underpins its widespread adoption in ensuring product integrity and compliance.

Key market drivers include the relentless pursuit of enhanced product quality and safety, particularly in sensitive sectors like medical device manufacturing and electronics, where even minor flaws can have severe consequences. The pharmaceutical industry, for instance, relies heavily on these systems to detect counterfeit drugs, verify fill levels, and inspect packaging integrity. Similarly, the food industry leverages them for contaminant detection, weight verification, and quality assurance of packaged goods. Despite this strong growth trajectory, certain restraints, such as the high initial investment cost of advanced 3D X-ray systems and the requirement for specialized operator training, could temper growth in some segments or regions. However, the long-term benefits of reduced recalls, improved efficiency, and enhanced brand reputation are expected to outweigh these initial hurdles, particularly as technological innovations lead to more accessible and user-friendly solutions. The market is also witnessing a growing trend towards miniaturization and integration of these systems into existing production lines, further streamlining inspection processes.

The global 3D X-Ray Inspection System market is experiencing a dynamic evolution, driven by an insatiable demand for enhanced quality control and non-destructive testing across a myriad of industries. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, encapsulates a significant transformation. During the historical period of 2019-2024, the market witnessed steady growth as industries began to recognize the unparalleled benefits of volumetric imaging over traditional 2D radiography. Projections for the forecast period of 2025-2033 indicate an accelerated expansion, with market revenues expected to climb into the multi-million dollar range. This surge is attributed to advancements in detector technology, leading to higher resolution and faster scan times, making 3D X-ray systems more accessible and efficient. The increasing complexity of manufactured components, particularly in sectors like aerospace, automotive, and electronics, necessitates sophisticated inspection methods that can identify internal defects, measure tolerances with extreme precision, and perform reverse engineering tasks. Consequently, Computed Tomography (CT) systems, offering unparalleled detail and reconstructive capabilities, are projected to be a dominant force. Digital Radiography (DR) systems, while still crucial for certain applications due to their speed and cost-effectiveness, are increasingly being complemented by or integrated with CT capabilities for more comprehensive analysis. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into 3D X-ray inspection software is another significant trend, enabling automated defect detection, faster data interpretation, and predictive maintenance insights. This intelligent automation not only boosts throughput but also reduces the reliance on highly specialized human operators, further contributing to market expansion. The growing emphasis on product safety and regulatory compliance across industries like food and pharmaceuticals is also a key driver, as 3D X-ray systems provide a robust solution for detecting contaminants, verifying packaging integrity, and ensuring the efficacy of products.

The remarkable growth trajectory of the 3D X-ray Inspection System market is underpinned by a confluence of powerful driving forces. Paramount among these is the escalating complexity and miniaturization of components across high-tech industries. As products become more intricate, with smaller features and hidden internal structures, traditional 2D inspection methods fall short. 3D X-ray systems, particularly Computed Tomography (CT), provide the essential volumetric data needed to thoroughly analyze these complex geometries, identify micro-defects, and ensure dimensional accuracy. Furthermore, stringent quality control mandates and evolving regulatory frameworks worldwide are pushing industries to adopt more advanced inspection technologies. For instance, in the pharmaceutical sector, the need to detect microscopic impurities or verify the precise dosage within pills necessitates the high-resolution capabilities offered by 3D X-ray. Similarly, in the automotive and aerospace industries, the imperative for safety and reliability demands the detection of even the slightest internal flaws in critical components, which can be reliably achieved through 3D X-ray inspection. The increasing focus on supply chain integrity and the prevention of counterfeit products also plays a significant role. 3D X-ray systems enable manufacturers and customs officials to verify the authenticity and internal composition of goods non-destructively, adding a critical layer of security. The continuous technological advancements in X-ray sources, detectors, and reconstruction algorithms are also making these systems more affordable, faster, and more user-friendly, broadening their accessibility to a wider range of businesses.

Despite its promising growth, the 3D X-ray Inspection System market is not without its inherent challenges and restraints. A primary hurdle is the significant initial investment required for sophisticated 3D X-ray systems, particularly high-resolution Computed Tomography (CT) scanners. This capital expenditure can be prohibitive for small and medium-sized enterprises (SMEs) or industries with tighter budgets, thereby limiting market penetration in certain segments. The complexity of operating and maintaining these advanced systems also presents a challenge. While technological advancements are improving user interfaces, a certain level of technical expertise is still required for effective operation and data interpretation, leading to a need for specialized training and skilled personnel. Furthermore, the processing of large volumes of 3D data generated by CT scans can be computationally intensive and time-consuming, requiring powerful hardware and sophisticated software solutions. This can impact the overall inspection throughput, especially in high-volume production environments. Concerns regarding radiation safety and the associated regulatory compliance add another layer of complexity. While modern 3D X-ray systems employ advanced shielding and safety protocols, stringent regulations and the need for specialized facilities can increase operational costs and logistical considerations for end-users. Finally, the availability of alternative non-destructive testing (NDT) methods, such as ultrasonic testing or eddy current testing, which may be more cost-effective for certain specific defect types or materials, can pose a competitive restraint for 3D X-ray systems in some niche applications.

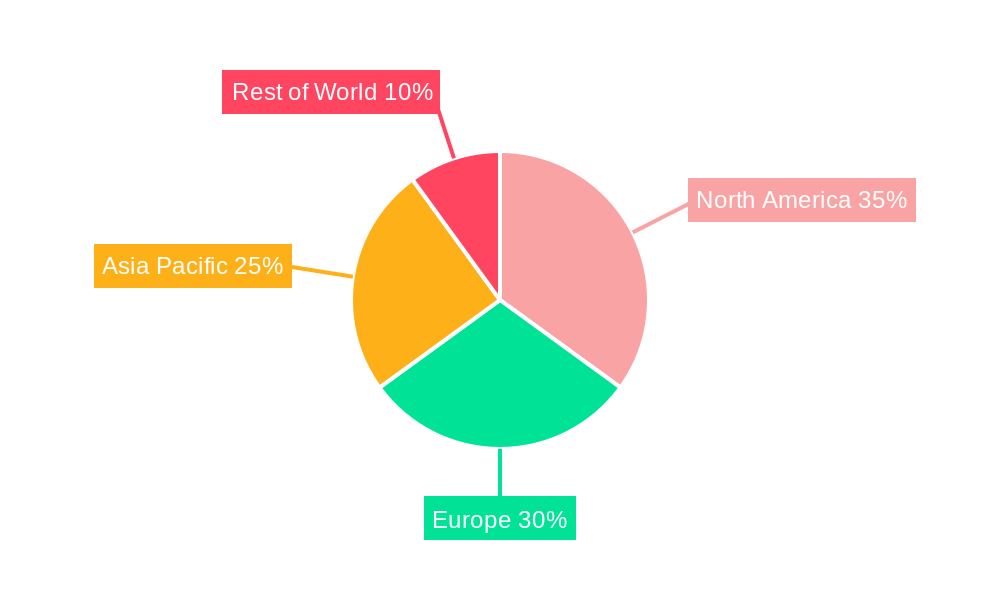

The global 3D X-ray Inspection System market is poised for substantial growth, with a distinct dominance expected from both geographical regions and specific technological segments.

Key Dominating Segment: Computed Tomography (CT) Type

Key Dominating Region: North America

Other Influential Regions:

The 3D X-ray Inspection System industry is experiencing robust growth, propelled by several key catalysts. The increasing demand for higher product quality and reliability across sectors like automotive, aerospace, and electronics is paramount. As components become more complex and miniaturized, traditional inspection methods are no longer sufficient, driving the adoption of 3D X-ray's volumetric capabilities. Furthermore, stringent regulatory compliance and evolving safety standards, especially in the pharmaceutical and food industries, necessitate advanced detection methods for contaminants and defects. Continuous technological advancements, including higher resolution detectors, faster scanning speeds, and sophisticated reconstruction algorithms, are making 3D X-ray systems more efficient and cost-effective. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated defect detection and data analysis further enhances the value proposition of these systems, reducing inspection time and human error.

This comprehensive report delves deep into the global 3D X-ray Inspection System market, offering an in-depth analysis of its growth trajectory and future potential. It meticulously examines market dynamics, including key trends, driving forces, and prevailing challenges, providing a holistic view of the landscape. The report segments the market by type, such as Digital Radiography (DR) and Computed Tomography (CT), and by application, including pharmacy, food, medical, and others, highlighting the dominant segments and their growth drivers. Furthermore, it forecasts market expansion across key regions and countries, identifying geographical areas poised for significant adoption and revenue generation. The report also identifies the leading industry players, detailing their market presence and strategic initiatives, and outlines significant technological developments and their impact on the market. With a study period spanning from 2019-2033 and a base year of 2025, this report provides actionable insights for stakeholders seeking to understand and capitalize on the evolving opportunities within the multi-million dollar 3D X-ray inspection system market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include YXLON International, Nikon Metrology, Nordson, ZEISS, GE Measurement & Control, Anritsu Industrial Solutions, North Star Imaging, Ishida, Mettler-Toledo International, VJ Technologies, Sesotec GmbH, Aolong Group, Loma, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "3D X-Ray Inspection System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 3D X-Ray Inspection System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.