1. What is the projected Compound Annual Growth Rate (CAGR) of the 3C Electronic Collaborative Robots?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

3C Electronic Collaborative Robots

3C Electronic Collaborative Robots3C Electronic Collaborative Robots by Type (Assembly Robots, Handling Robots, Test Robots, Other Robots), by Application (Production Line Assembly), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

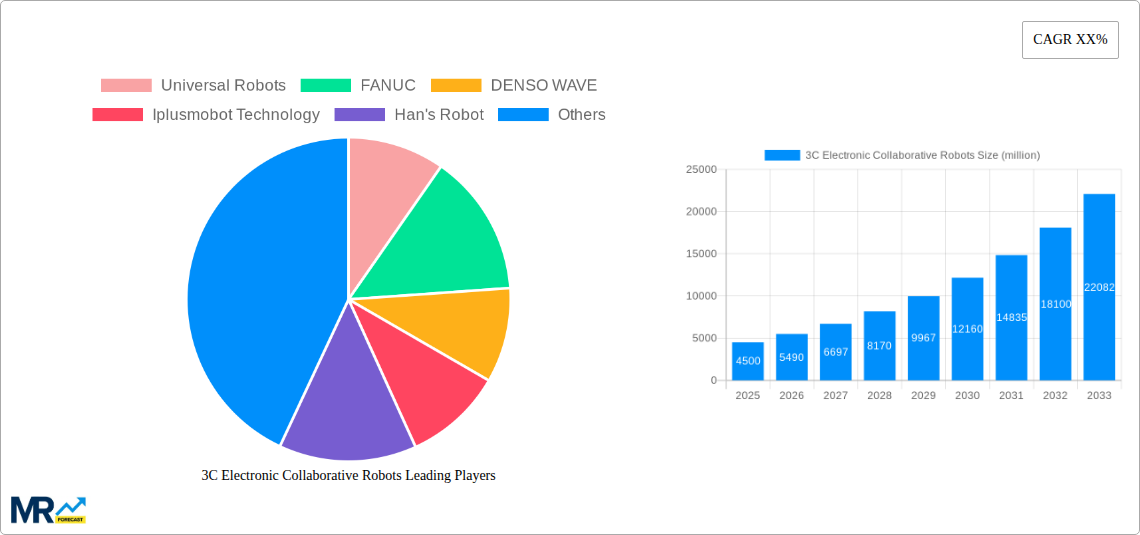

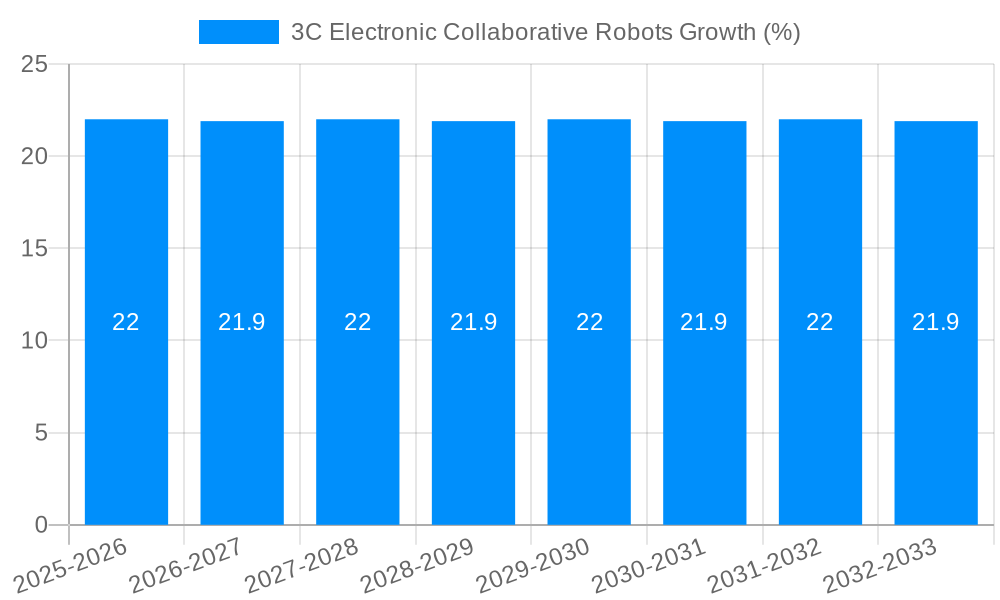

The 3C electronic collaborative robots market is poised for significant expansion, with an estimated market size of approximately \$4,500 million in 2025, and projected to grow at a compound annual growth rate (CAGR) of around 22% through 2033. This robust growth is primarily fueled by the escalating demand for automation in the consumer electronics, computer, and communication (3C) sectors. Key drivers include the increasing complexity of electronic device manufacturing, the need for enhanced precision and quality control, and the inherent benefits of collaborative robots – such as flexibility, ease of integration, and cost-effectiveness – which are particularly attractive to small and medium-sized enterprises (SMEs) within this industry. Furthermore, the continuous miniaturization of electronic components and the drive towards Industry 4.0 principles are creating new opportunities for cobots to perform intricate assembly, handling, and testing tasks with unprecedented efficiency. Leading companies like Universal Robots, FANUC, and DENSO WAVE are at the forefront, innovating to meet these evolving demands.

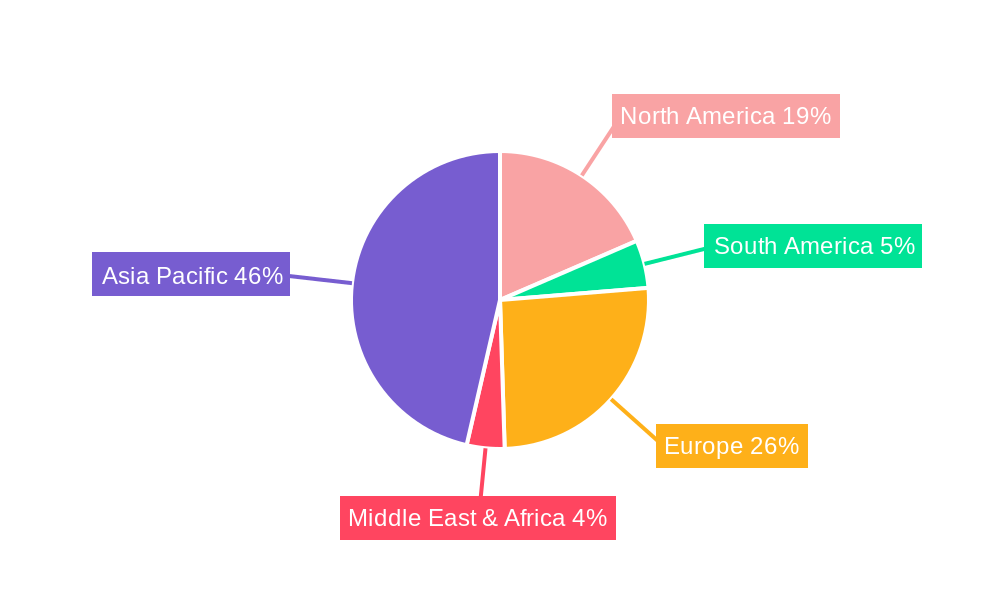

The market's trajectory is also shaped by emerging trends such as the integration of AI and machine learning into cobots, enabling them to adapt to dynamic production environments and learn from their operations. This advancement allows for more sophisticated applications in testing and quality assurance, where precise defect detection is paramount. However, the market faces certain restraints, including the initial investment costs, though these are diminishing with technological advancements and increased competition, and the need for skilled personnel to program and maintain these advanced systems. Despite these challenges, the inherent advantages of collaborative robots in improving worker safety by taking over repetitive and hazardous tasks, coupled with their contribution to increased production output and reduced error rates, are expected to sustain a strong upward momentum. The Asia Pacific region, driven by manufacturing hubs like China and Japan, is anticipated to dominate the market due to its substantial electronics production base.

Here is a report description for "3C Electronic Collaborative Robots," incorporating your specified details, word counts, and formatting.

This report provides a comprehensive analysis of the global 3C Electronic Collaborative Robots market, delving into its intricate dynamics and future trajectory. The study encompasses a detailed examination of trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments within the sector. Utilizing a robust methodology, the report projects market performance from the base year of 2025 through the forecast period of 2033, with a retrospective analysis covering the historical period from 2019 to 2024. The estimated year for market valuation is 2025, providing a snapshot of the current landscape. The report quantifies market size in millions of units, offering a tangible understanding of the scale and growth potential of this rapidly evolving industry.

The 3C Electronic Collaborative Robots market is experiencing a profound transformation, characterized by an accelerating adoption rate driven by the inherent advantages of collaborative robotics in electronic manufacturing. XXX **The demand for cobots in the electronics industry is being fueled by their ability to work alongside human operators, enhancing productivity, precision, and safety without requiring extensive safety guarding. This inherent flexibility is particularly crucial in the fast-paced and highly specialized world of electronics, where production lines often need to be reconfigured quickly to accommodate new product introductions or fluctuating demand. The increasing complexity of electronic components and the ever-present pressure to reduce manufacturing costs are pushing manufacturers to invest in automation solutions that can improve efficiency and minimize errors. Cobots, with their intuitive programming interfaces and smaller footprints compared to traditional industrial robots, are proving to be an ideal solution for small and medium-sized enterprises (SMEs) that may not have the resources or space for fully automated, caged production lines. The report highlights a significant upward trend in the deployment of cobots for repetitive tasks such as component placement, assembly, and quality inspection, where human fatigue can lead to inconsistencies. Furthermore, the integration of advanced sensing technologies, including vision systems and force/torque sensors, is empowering cobots to perform more sophisticated tasks with greater accuracy, further solidifying their role in critical electronic manufacturing processes. The projected growth indicates a shift towards a more human-robot collaborative environment, fostering a synergistic relationship that drives operational excellence and innovation in the electronics sector. The market is witnessing a diversification of cobot applications, moving beyond basic pick-and-place operations to encompass more intricate assembly procedures, intricate testing protocols, and even specialized material handling within cleanroom environments. This expanding application scope is directly correlated with the continuous advancements in cobot hardware and software, making them more adaptable and capable of addressing a wider array of manufacturing challenges. The insights within this report underscore the strategic importance of embracing cobot technology for electronics manufacturers seeking to maintain a competitive edge in a globalized and technologically driven marketplace.

The surge in the adoption of 3C Electronic Collaborative Robots is primarily propelled by a confluence of critical market drivers, each playing a pivotal role in shaping the industry's trajectory. At the forefront is the relentless pursuit of enhanced operational efficiency and cost reduction within the electronics manufacturing sector. Companies are increasingly recognizing that cobots offer a compelling solution to optimize production processes, reduce cycle times, and minimize human error, all of which directly translate into lower manufacturing costs. The inherent safety features and ease of deployment of collaborative robots are also significant drivers. Unlike traditional industrial robots that necessitate extensive safety fencing and complex programming, cobots are designed to operate safely in close proximity to human workers, requiring minimal modifications to existing factory layouts. This reduced implementation complexity and lower upfront investment make them an attractive option for a broader range of businesses, particularly small and medium-sized enterprises. Furthermore, the growing demand for flexible manufacturing solutions, especially in response to the rapid product development cycles characteristic of the electronics industry, is a key catalyst. Cobots can be easily reprogrammed and redeployed for different tasks, allowing manufacturers to quickly adapt to changing production needs and introduce new product variations with greater agility. The shortage of skilled labor in many manufacturing regions also contributes significantly to the adoption of cobots. By automating repetitive and labor-intensive tasks, cobots help alleviate the strain on the human workforce, allowing skilled workers to focus on more complex and value-added activities. The continuous technological advancements in areas such as artificial intelligence, machine learning, and advanced sensing capabilities are further enhancing the performance and versatility of cobots, making them capable of handling more intricate and precise tasks within the electronics assembly process. This ongoing innovation ensures that cobots remain at the cutting edge of automation technology, consistently offering new solutions to emerging manufacturing challenges and reinforcing their position as a critical component of modern electronic production.

Despite the promising growth trajectory, the 3C Electronic Collaborative Robots market faces several significant challenges and restraints that could temper its expansion. A primary hurdle remains the initial cost of investment. While cobots are generally more affordable than their traditional industrial counterparts, the upfront capital expenditure can still be a barrier for some smaller manufacturers, especially when considering the integration and peripheral costs. The complexity of integration with existing legacy systems can also present a challenge. Seamlessly incorporating cobots into established production lines often requires specialized expertise and potentially significant modifications to existing infrastructure, which can lead to extended implementation timelines and increased costs. Furthermore, the perceived complexity of programming and operation, although significantly reduced compared to traditional robots, can still be a concern for some end-users, particularly those with limited technical expertise. While many cobots offer user-friendly interfaces, the need for specialized training and ongoing technical support can be a deterrent. The evolving regulatory landscape and standardization efforts for collaborative robot safety can also introduce an element of uncertainty for businesses. Ensuring compliance with the latest safety standards and certifications requires ongoing vigilance and can necessitate additional investment in safety audits and modifications. Cybersecurity concerns are also becoming increasingly prominent. As cobots become more interconnected and data-driven, safeguarding them against cyber threats and ensuring the integrity of sensitive production data is paramount, requiring robust security protocols and ongoing monitoring. Lastly, the ongoing need for human oversight and intervention in certain complex tasks, even with advanced cobots, means that complete human displacement is not always feasible or desirable, requiring careful consideration of the optimal human-robot collaboration model.

The global 3C Electronic Collaborative Robots market is poised for substantial growth, with Asia Pacific, particularly China, and the Assembly Robots segment expected to emerge as dominant forces in the coming years.

Asia Pacific (with a focus on China):

Assembly Robots Segment:

Several factors are acting as powerful growth catalysts for the 3C Electronic Collaborative Robots industry. The escalating need for enhanced manufacturing agility and flexibility, driven by the rapid pace of product innovation in electronics, is a primary catalyst. Cobots' ease of reprogramming and redeployment allows manufacturers to quickly adapt to new product lines and fluctuating market demands. Furthermore, the persistent global shortage of skilled labor in manufacturing sectors is compelling companies to invest in cobots as a means to automate repetitive tasks and optimize their existing workforce. Continuous advancements in AI and machine learning are also enhancing cobot capabilities, enabling them to perform more complex and intelligent operations, thereby expanding their application scope. The decreasing cost of cobot technology, coupled with favorable government initiatives and incentives promoting automation, is making these solutions more accessible to a wider range of businesses, particularly SMEs.

This report offers an exhaustive examination of the 3C Electronic Collaborative Robots market, providing granular insights into market segmentation by type, application, and region. It meticulously analyzes historical data from 2019-2024 and projects future trends from 2025-2033, with 2025 serving as the key valuation year. The report delves into the competitive landscape, profiling leading players and their strategic initiatives. Furthermore, it explores the technological advancements, regulatory frameworks, and economic factors influencing market dynamics. The comprehensive coverage ensures that stakeholders gain a holistic understanding of the market's present state and future potential, enabling informed strategic decision-making. The inclusion of market size estimations in millions of units offers a clear quantitative perspective on the growth and scale of this crucial industry sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Universal Robots, FANUC, DENSO WAVE, Iplusmobot Technology, Han's Robot, Omron, KUKA, JAKA, Elite Robots, Elephant Robotics, EVS Robotics, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "3C Electronic Collaborative Robots," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 3C Electronic Collaborative Robots, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.