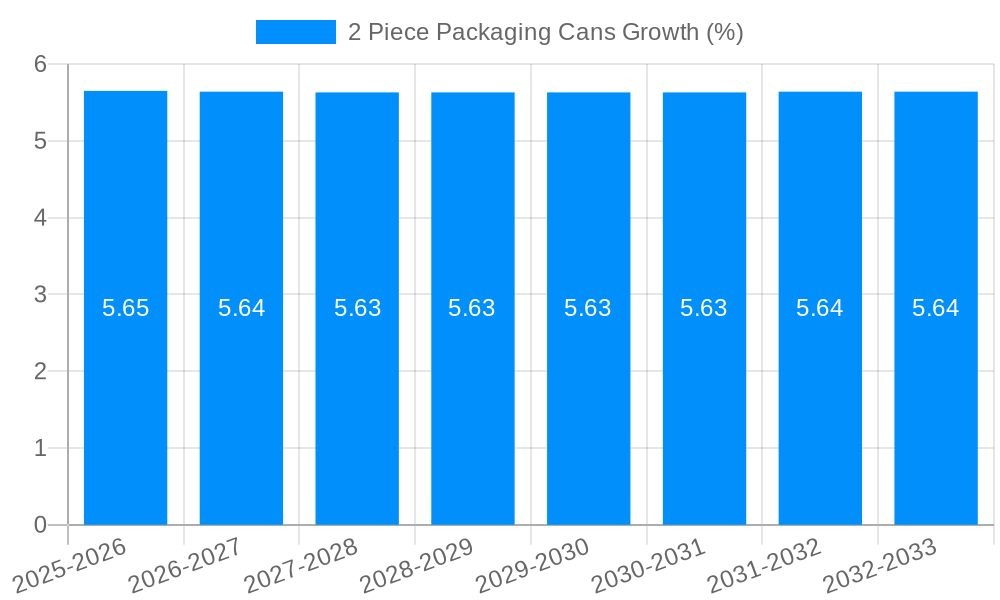

1. What is the projected Compound Annual Growth Rate (CAGR) of the 2 Piece Packaging Cans?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

2 Piece Packaging Cans

2 Piece Packaging Cans2 Piece Packaging Cans by Type (Aluminum 2 Piece Cans, Steel 2 Piece Cans, Others, World 2 Piece Packaging Cans Production ), by Application (Food & Beverages, Spices, Paints, Others, World 2 Piece Packaging Cans Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global market for 2-piece packaging cans is poised for significant growth, projected to reach an estimated USD 43,180 million by 2025. This expansion is driven by a confluence of factors, including the increasing demand for convenient and sustainable packaging solutions across various industries, particularly in the food and beverage sector. The inherent benefits of 2-piece cans, such as their light weight, durability, and recyclability, make them a preferred choice for consumers and manufacturers alike. Advancements in manufacturing technologies and the development of innovative can designs are further fueling market momentum. The market is segmented by type, with Aluminum 2-Piece Cans and Steel 2-Piece Cans dominating the landscape, catering to a diverse range of applications from beverages and food preservation to paints and other consumer goods. The growing emphasis on eco-friendly packaging alternatives is a key trend, pushing for higher adoption rates of these recyclable metal containers.

Looking ahead, the market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, underscoring a robust growth trajectory. This expansion will be propelled by emerging economies in the Asia Pacific and Rest of Europe regions, which are experiencing rising disposable incomes and a burgeoning consumer base. However, the market faces certain restraints, including volatile raw material prices, particularly for aluminum and steel, and the competitive threat from alternative packaging materials like flexible pouches and cartons. Nevertheless, the established infrastructure, widespread consumer acceptance, and the continuous drive for innovation within the 2-piece can segment are expected to outweigh these challenges, ensuring sustained market development and reinforcing its position as a cornerstone of modern packaging.

This comprehensive report delves into the intricate world of 2-piece packaging cans, offering a detailed analysis of its global market dynamics from the historical period of 2019-2024 to an extensive forecast extending to 2033, with a specific focus on the estimated base year of 2025. The report meticulously examines production volumes, market trends, driving forces, challenges, and key regional and segmental dominance. Utilizing a data-driven approach, the analysis incorporates millions of units to quantify production and consumption patterns across various applications and material types.

The global 2-piece packaging cans market is poised for robust growth and significant evolution throughout the study period (2019-2033), with the base and estimated year of 2025 serving as a crucial inflection point. A key trend shaping this sector is the persistent and accelerating shift towards sustainable packaging solutions. Consumers and regulatory bodies alike are increasingly demanding environmentally friendly alternatives, pushing manufacturers to innovate in areas such as increased recycled content, lightweighting of cans, and the development of more easily recyclable materials. Aluminum 2-piece cans, in particular, are benefiting from this trend due to their high recyclability rates and established recycling infrastructure. The demand for convenience and portability also continues to fuel the market, with single-serving and multi-pack formats of beverages and foods driving the need for efficient and aesthetically pleasing packaging. Furthermore, the diversification of applications beyond traditional food and beverage sectors, such as the expanding use in specialty food items, paints, and even personal care products, presents new avenues for growth. Technological advancements in can manufacturing, including improved decoration techniques and barrier properties, are also contributing to the market's dynamism, enabling brands to enhance product appeal and shelf life. The market is witnessing a gradual increase in production volumes, projected to reach significant figures in the millions, as global consumption patterns adapt to evolving lifestyles and environmental consciousness. This trend indicates a market that is not only expanding in size but also maturing in its approach to innovation and sustainability.

The report will meticulously analyze key market insights, including:

The growth trajectory of the 2-piece packaging cans market is underpinned by several potent driving forces that are reshaping its landscape. Foremost among these is the unparalleled convenience and portability offered by this packaging format. The modern consumer's lifestyle, characterized by on-the-go consumption and a desire for easy-to-handle products, makes 2-piece cans an ideal choice for a vast array of food and beverage items, from refreshing sodas and beers to ready-to-eat meals and snacks. This inherent user-friendliness ensures their continued relevance and widespread adoption. Furthermore, the exceptional barrier properties of metal cans are a critical advantage, effectively protecting sensitive contents from light, oxygen, and moisture. This preserves product quality, extends shelf life, and minimizes spoilage, thereby reducing waste and providing significant economic benefits. As manufacturers strive to deliver high-quality products with optimal freshness, the protective attributes of 2-piece cans become increasingly valuable. Coupled with this is the growing consumer consciousness regarding sustainability. The high recyclability of aluminum and steel, coupled with advancements in lightweighting technologies, positions 2-piece cans as a sustainable packaging option, aligning with global environmental goals and appealing to a growing segment of eco-aware consumers. The efficiency of production processes, which allows for high-speed filling and packaging, also contributes to the cost-effectiveness of 2-piece cans, making them an attractive choice for high-volume consumer goods.

Despite the positive growth outlook, the 2-piece packaging cans market is not without its challenges and restraints that necessitate strategic navigation. One of the most significant hurdles is the inherent price volatility of raw materials, particularly aluminum and steel. Fluctuations in global commodity markets can directly impact manufacturing costs, potentially affecting profit margins and the overall competitiveness of 2-piece cans against alternative packaging materials. This requires manufacturers to implement robust procurement strategies and explore hedging mechanisms to mitigate such risks. Another notable restraint is the increasing competition from alternative packaging solutions. Flexible packaging, PET bottles, and cartons are continually evolving, offering their own unique advantages in terms of cost, weight, and consumer perception. The market must consistently innovate and highlight the distinct benefits of 2-piece cans, such as their superior barrier properties and premium feel, to maintain market share. Furthermore, the environmental impact associated with the production of primary metals, including energy consumption and emissions, remains a concern. While recycling offers a significant advantage, the initial production footprint necessitates ongoing efforts to improve manufacturing processes and explore greener energy sources. Regulatory landscapes, although often supportive of recycling, can also introduce complexities through evolving packaging waste directives and extended producer responsibility schemes, requiring manufacturers to adapt their operations and investments accordingly. The logistics and transportation costs associated with shipping the relatively heavier metal cans, especially over long distances, also present a constant consideration for market players.

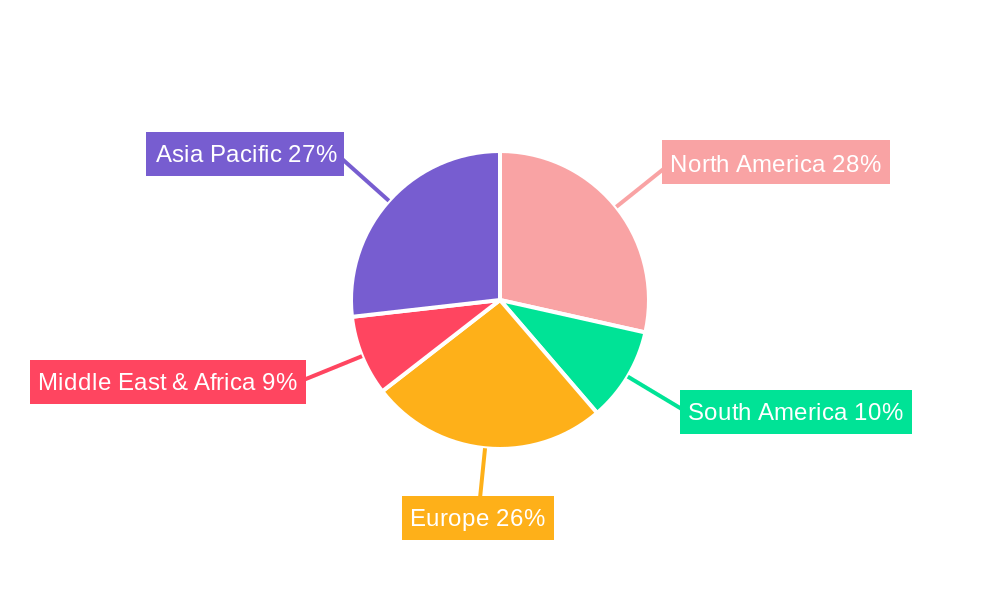

The global 2-piece packaging cans market is characterized by a dynamic interplay of regional dominance and segment leadership, with North America and the Food & Beverages segment poised to exert significant influence throughout the study period (2019-2033), with particular emphasis on the base and estimated year of 2025.

North America:

North America's dominance is largely attributed to its well-established market maturity, significant purchasing power, and a strong emphasis on convenience and brand loyalty. The region's proactive approach to sustainability, coupled with the presence of key industry players investing in advanced manufacturing technologies, provides a fertile ground for the growth and innovation within the 2-piece packaging cans sector. The robust demand from the extensive food and beverage industry, encompassing both alcoholic and non-alcoholic drinks as well as a wide range of processed foods, directly translates into substantial production volumes, estimated in the hundreds of millions of units annually.

Food & Beverages Segment:

The Food & Beverages segment is the undeniable backbone of the 2-piece packaging cans market. Its vast scope, encompassing nearly every type of consumable product that benefits from metal protection and convenient delivery, ensures a consistent and ever-growing demand. The segment's ability to leverage the protective, aesthetic, and convenient attributes of 2-piece cans, coupled with its alignment with consumer trends like RTD beverages, solidifies its position as the dominant force driving global production, which is projected to reach billions of units annually.

Several key catalysts are igniting growth within the 2-piece packaging cans industry. The escalating global demand for convenient and portable packaging solutions, driven by evolving consumer lifestyles, is a primary propellant. Furthermore, the increasing environmental consciousness among consumers and regulators is fueling a shift towards sustainable packaging, with aluminum and steel cans, renowned for their high recyclability, benefiting significantly. Technological advancements in manufacturing, including lightweighting initiatives and enhanced decoration capabilities, are also contributing to improved cost-efficiency and product appeal, further driving adoption. The diversification of applications into areas beyond traditional food and beverages, such as paints and specialty foods, opens up new market avenues, while the burgeoning market for ready-to-drink beverages presents a substantial growth opportunity.

This report offers an exhaustive exploration of the 2-piece packaging cans market, covering all critical facets from historical performance to future projections. It meticulously analyzes production volumes, estimated in the millions of units, across various material types and applications, with a special emphasis on the pivotal base year of 2025. The report delves into the intricate trends and driving forces shaping the market, alongside a thorough examination of the challenges and restraints that players must navigate. It identifies key regions and segments poised for dominance and outlines the significant growth catalysts that will propel the industry forward. Furthermore, it provides a comprehensive list of leading industry players and chronicles significant developments with specific year/month references, offering readers an unparalleled understanding of this vital packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ardagh Group, Ball Corporation, Silgan Containers LLC, Crown Holdings Inc., Pacific Can China Holdings Limited, Helvetia Packaging, Nampak, Bway Corporation, DS Containers, ITW Sexton, Metal Packaging Europe, Anheuser-Busch Inc., .

The market segments include Type, Application.

The market size is estimated to be USD 43180 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "2 Piece Packaging Cans," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 2 Piece Packaging Cans, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.