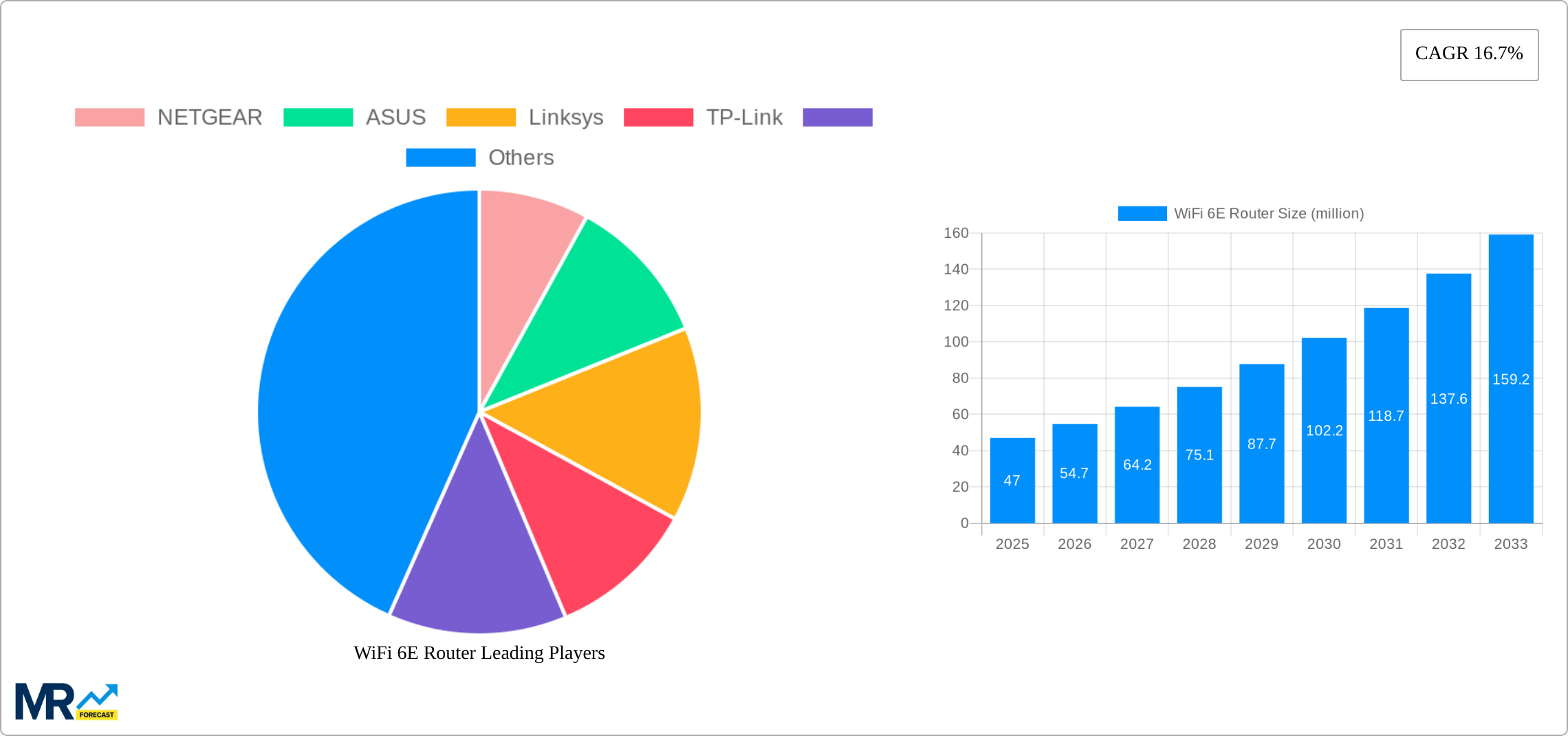

1. What is the projected Compound Annual Growth Rate (CAGR) of the WiFi 6E Router?

The projected CAGR is approximately 16.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

WiFi 6E Router

WiFi 6E RouterWiFi 6E Router by Type (WiFi Speed AXE6600, WiFi Speed AXE11000, Other), by Application (Household, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

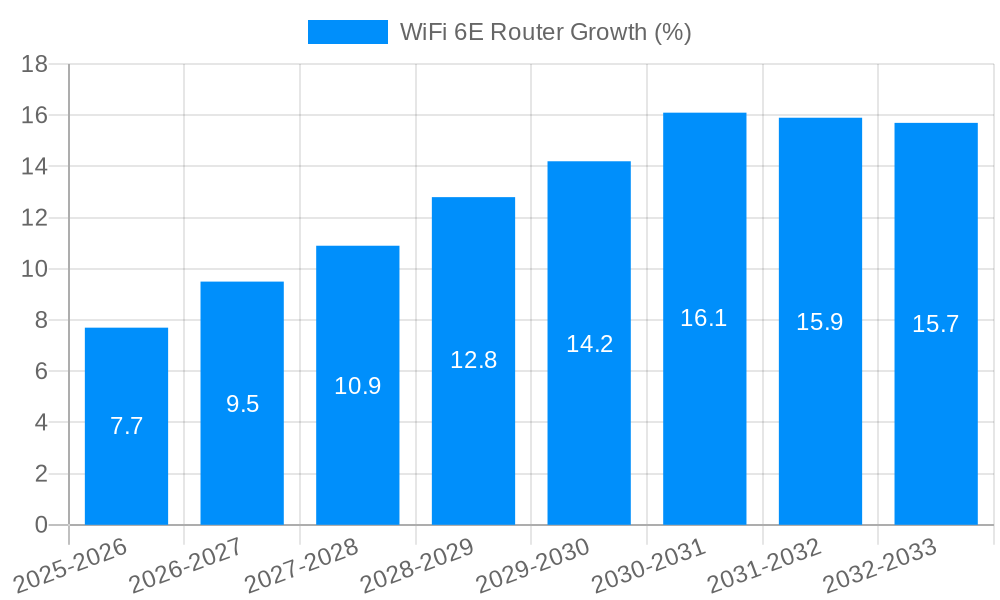

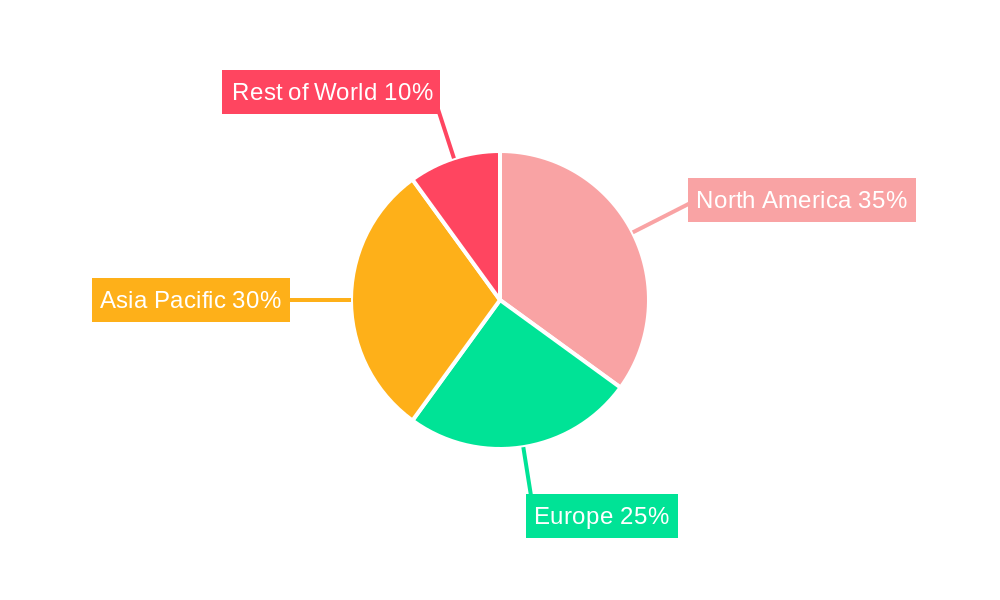

The WiFi 6E router market is experiencing robust growth, projected to reach a market size of $47 million in 2025 and expanding significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 16.7% indicates a consistently strong demand driven by several key factors. The increasing adoption of smart home devices and the need for higher bandwidth to support multiple devices simultaneously are major contributors. Furthermore, the expansion of 6 GHz frequency band availability, offering wider channels and less interference compared to previous WiFi generations, is fueling this growth. The market segmentation reveals a significant demand for higher-speed routers, with AXE6600 and AXE11000 models leading the way. The commercial sector, including offices and businesses, is also showing a marked increase in WiFi 6E adoption, mirroring the trend seen in the household sector. Key players like NETGEAR, ASUS, Linksys, and TP-Link are actively competing to capture market share through technological innovation and strategic partnerships. Geographic analysis suggests North America and Asia Pacific will be key regions driving market expansion, given their advanced technological infrastructure and high consumer spending power.

The sustained growth of the WiFi 6E router market will likely be influenced by ongoing technological advancements, such as enhanced security protocols and improved power efficiency. However, factors such as the initial higher cost of WiFi 6E routers compared to previous generations and the need for compatible devices could pose challenges to widespread adoption. Despite these potential restraints, the long-term outlook for the market remains highly positive, fueled by the increasing demand for faster and more reliable wireless connectivity in both residential and commercial environments. This growth is expected to continue as more devices support the WiFi 6E standard and as the technology further matures. The competition among leading manufacturers will further drive innovation and affordability, contributing to wider market penetration in the coming years.

The WiFi 6E router market is experiencing explosive growth, projected to reach multi-million unit shipments by 2033. The historical period (2019-2024) saw a gradual adoption of WiFi 6 technology, laying the groundwork for the rapid expansion witnessed in the estimated year (2025) and forecast period (2025-2033). This surge is fueled by several factors, primarily the increasing demand for higher bandwidth and lower latency in both residential and commercial settings. The availability of the 6 GHz band, a largely untapped spectrum, has unlocked significantly higher speeds and capacity compared to previous WiFi generations. This has made WiFi 6E a compelling upgrade for consumers and businesses alike, driving substantial market expansion. The key players, including NETGEAR, ASUS, Linksys, and TP-Link, are actively innovating to cater to this burgeoning demand, launching a wide range of routers with varying specifications to suit diverse needs and budgets. Market segmentation based on WiFi speed (AXE6600, AXE11000, and others) and application (household, commercial) reveals a strong preference for higher-speed solutions, particularly in commercial environments. This trend is likely to continue in the forecast period, creating significant opportunities for market players to capitalize on the rising demand for improved network performance and capacity. The market is also seeing a shift towards mesh WiFi systems, offering improved coverage and performance across larger areas, further boosting market growth. The overall trend reflects a clear and accelerating shift towards higher-performance wireless connectivity, a crucial element in the increasingly interconnected world. Millions of units are anticipated to be shipped annually by the end of the forecast period.

Several key factors are driving the phenomenal growth of the WiFi 6E router market. The expansion of the 6 GHz band has been instrumental, providing significantly more bandwidth and eliminating much of the congestion that plagues the 2.4 GHz and 5 GHz bands. This translates directly into faster speeds, lower latency, and more stable connections – crucial for bandwidth-intensive applications like streaming 4K video, online gaming, and video conferencing. The increasing penetration of smart home devices also plays a pivotal role. As homes become increasingly interconnected with smart appliances, security systems, and entertainment devices, the need for a robust and high-capacity WiFi network becomes paramount. Businesses are also rapidly adopting WiFi 6E to support their growing bandwidth needs, from supporting large numbers of connected devices in offices to facilitating high-bandwidth applications like cloud computing and data analytics. The ongoing advancements in router technology, leading to more efficient and powerful chips and antennas, are further fueling market expansion. Furthermore, the rising affordability of WiFi 6E routers is making them accessible to a wider range of consumers, accelerating market penetration. The combined effect of these factors is creating a perfect storm for the WiFi 6E router market, driving millions of units in sales.

Despite the remarkable growth, the WiFi 6E router market faces some challenges. One significant hurdle is the relatively high initial cost of WiFi 6E routers compared to their predecessors. This price point can limit adoption, particularly among budget-conscious consumers. Furthermore, the lack of widespread awareness about the benefits of WiFi 6E technology remains a significant barrier to entry for many potential customers. Educating consumers and businesses about the advantages of this technology is crucial for driving wider adoption. The compatibility issue with older devices is another challenge. While WiFi 6E routers are backward compatible with older WiFi standards, not all devices support the 6 GHz band, potentially limiting the full benefits for users with a mixed set of devices. Finally, the regulatory landscape surrounding the 6 GHz band varies across different regions, creating complexities for manufacturers and potentially delaying market penetration in certain areas. Overcoming these challenges requires a multi-pronged approach, including efforts to reduce manufacturing costs, enhance consumer education, and navigate the regulatory environment effectively.

The WiFi 6E router market is expected to witness robust growth across several regions and segments. North America and Europe are predicted to lead the market due to early adoption of advanced technologies and higher disposable incomes. The Asia-Pacific region is anticipated to show significant growth in the coming years, driven by expanding economies and rising demand for high-speed internet connectivity.

The overall dominance will be shared across various regions and segments, with the Household and Commercial applications and the higher-speed AXE11000 segment showing particularly strong growth potential. Millions of units from these segments are expected to ship annually throughout the forecast period.

Several factors are catalyzing the growth of the WiFi 6E router industry. The expanding availability of 6 GHz spectrum, coupled with technological advancements leading to more powerful and efficient chips, is creating routers with unparalleled performance capabilities. Simultaneously, the increasing affordability of these routers makes them accessible to a broader consumer base. This combination fuels rapid adoption, driving millions of units of sales annually and making it a very lucrative market sector. The trend towards smart homes and the ever-growing demand for high-bandwidth applications further accelerate this growth trajectory.

The WiFi 6E router market is poised for sustained and substantial growth throughout the forecast period (2025-2033), driven by the demand for higher speeds, better performance, and increased capacity in both residential and commercial environments. The availability of the 6 GHz band, the increasing affordability of routers, and the proliferation of smart devices have created a perfect storm for market expansion. The major players are constantly innovating, driving both technological advancement and increased accessibility, ultimately contributing to the projected multi-million unit sales figures for the coming years.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.7%.

Key companies in the market include NETGEAR, ASUS, Linksys, TP-Link, .

The market segments include Type, Application.

The market size is estimated to be USD 47 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "WiFi 6E Router," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the WiFi 6E Router, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.