1. What is the projected Compound Annual Growth Rate (CAGR) of the Warehouse Supermarket and Warehouse Club?

The projected CAGR is approximately 0.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Warehouse Supermarket and Warehouse Club

Warehouse Supermarket and Warehouse ClubWarehouse Supermarket and Warehouse Club by Application (Individual and Family, Commercial), by Type (Food and Beverages, Medicines, Minerals and Supplements, Household Goods, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

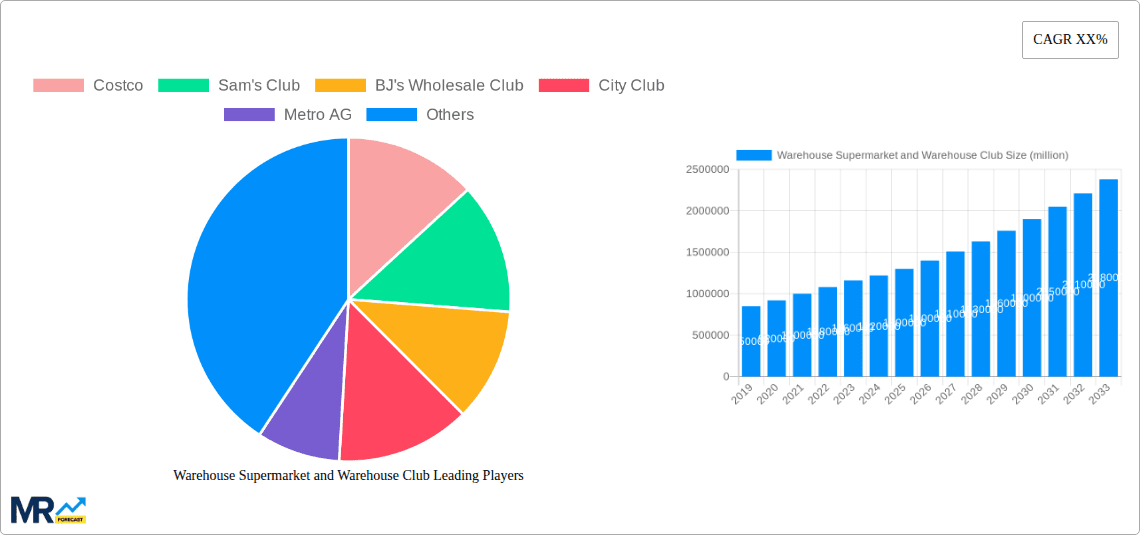

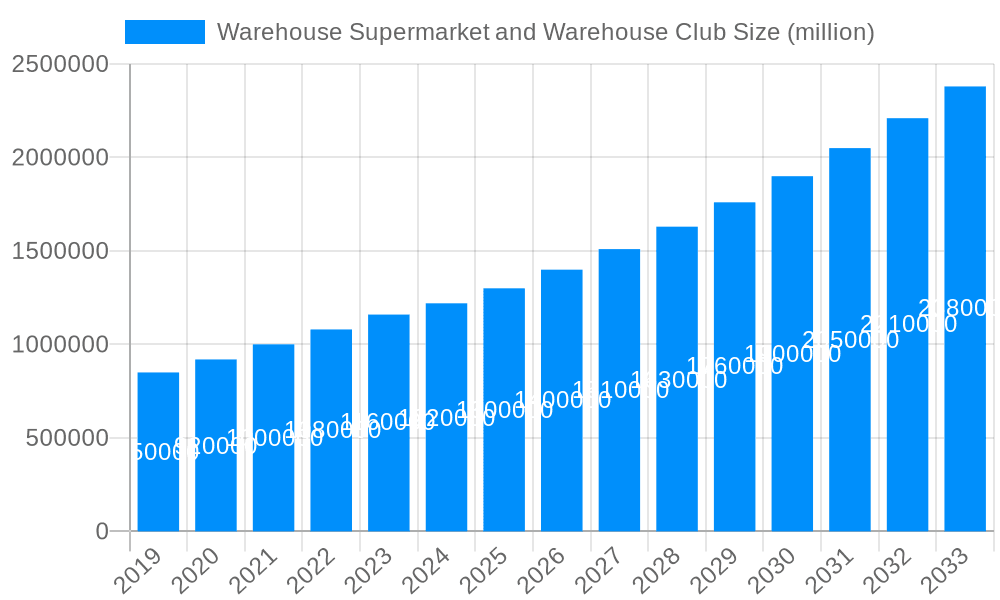

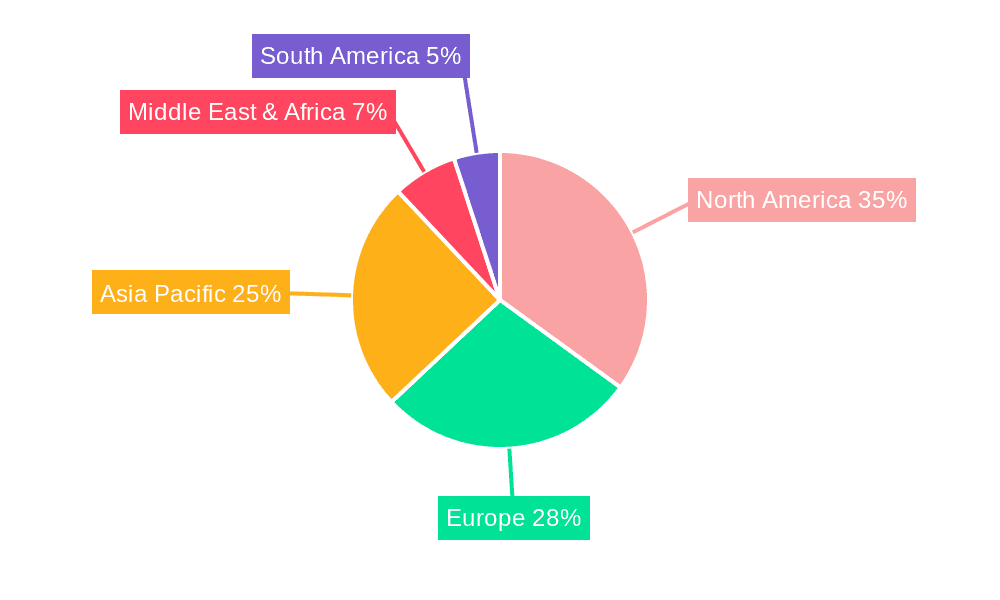

The warehouse supermarket and warehouse club market, valued at $1417.9 million in 2025, exhibits a slow but steady growth trajectory, reflected in its 0.5% CAGR. This relatively low growth rate suggests a mature market, potentially indicating saturation in certain regions and among established players like Costco, Sam's Club, and BJ's Wholesale Club. However, the market's segmentation offers avenues for future expansion. The "food and beverages" segment likely dominates, given consumer staples' consistent demand. Growth opportunities lie in leveraging the increasing popularity of online grocery shopping and integrating e-commerce into the warehouse club model, catering to the growing preference for convenient home delivery. Expanding into emerging markets within Asia-Pacific and strategically targeting the "medicines, minerals, and supplements" segment – driven by health-conscious consumers – could further stimulate market growth. Competition is fierce, especially amongst larger players, necessitating a focus on customer loyalty programs, value-added services, and private label brands to maintain a competitive edge. Regional variations are expected, with North America likely maintaining a significant market share due to the established presence of major players, while Asia-Pacific holds substantial growth potential due to increasing disposable incomes and a rising middle class.

The restraints on market growth may include the high initial membership fees deterring some consumers, the need for bulk purchases, and the geographical limitations of warehouse club locations. Successfully navigating these challenges requires a strategic balance of online and offline presence, attractive membership benefits, and innovative retail formats to appeal to a broader customer base. Expansion into smaller format warehouse stores, or the development of hybrid models incorporating smaller-scale retail offerings alongside wholesale options, could counteract the restraints associated with traditional warehouse club formats. Further diversification of product offerings beyond traditional staples, such as incorporating experiential retail elements, might attract younger demographics and increase customer engagement. A focus on sustainability initiatives and ethical sourcing, increasingly important consumer values, would also contribute positively to long-term market viability.

The warehouse supermarket and warehouse club industry, encompassing giants like Costco, Sam's Club, and Metro AG, experienced significant growth between 2019 and 2024, driven by evolving consumer preferences and strategic industry developments. The market, valued at XXX million units in 2025, is projected to reach XXX million units by 2033, showcasing robust expansion. This growth is fueled by several factors, including the increasing popularity of bulk buying among both individual families and commercial entities. The convenience of purchasing large quantities at discounted prices is particularly appealing in times of economic uncertainty or for households with larger families. The shift toward value-conscious consumerism significantly boosts this sector. Furthermore, the industry's diversification into product categories beyond traditional food and beverages, including household goods, medicines, and supplements, broadens its appeal and caters to a wider customer base. The rise of online ordering and delivery services has also played a crucial role in expanding market reach and accessibility, overcoming geographical limitations and attracting a younger, digitally savvy consumer segment. However, the sector faces challenges such as intense competition, rising operating costs (including real estate and logistics), and the need to adapt to shifting consumer demands and technological advancements. The industry’s success hinges on its ability to offer a seamless omnichannel experience, leverage data analytics to personalize offerings, and maintain stringent supply chain management to ensure product availability and quality. Market players are constantly innovating their offerings, exploring new membership models, and enhancing in-store experiences to maintain their competitive edge and capitalize on the projected growth. The forecast period of 2025-2033 promises substantial expansion, with significant regional variations and potential shifts in consumer preferences that need to be carefully monitored.

Several key factors are propelling the growth of the warehouse supermarket and warehouse club industry. Firstly, the increasing preference for bulk purchasing, driven by both economic considerations and convenience, is a significant driver. Consumers, particularly families and businesses, find value in buying in larger quantities at lower per-unit costs. This trend is especially pronounced during periods of economic uncertainty when consumers seek to maximize their purchasing power. Secondly, the diversification of product offerings beyond traditional food and beverages to include household goods, health and wellness products, and other essential items significantly broadens the market's appeal and caters to a wider customer demographic. Thirdly, the strategic expansion into new geographical regions and the adoption of omnichannel strategies, incorporating both physical stores and robust online platforms with delivery options, have expanded market reach and accessibility. The incorporation of advanced technologies like data analytics to personalize marketing and inventory management further enhances efficiency and customer engagement. Furthermore, the growing popularity of private labels and exclusive brands allows warehouse clubs to offer uniquely competitive pricing and drive customer loyalty. Finally, the industry's focus on providing a value-driven shopping experience, combined with a membership model that encourages repeat business, contributes to its sustained growth and market dominance.

Despite the promising growth trajectory, the warehouse supermarket and warehouse club industry faces significant challenges. Intense competition among established players and the emergence of new entrants create a highly dynamic and competitive landscape. Maintaining a competitive pricing strategy while managing rising operating costs, including real estate, logistics, and labor, presents a considerable hurdle. Fluctuating commodity prices and global supply chain disruptions pose a threat to profit margins and product availability. Meeting the evolving needs and expectations of a diverse customer base necessitates continuous innovation and adaptation, requiring significant investments in technology and infrastructure. The industry also faces pressure to enhance sustainability practices, address environmental concerns, and promote ethical sourcing, impacting operational efficiency and potentially adding to costs. Furthermore, adapting to shifting consumer preferences and technological advancements requires significant investment in digital infrastructure and e-commerce capabilities. Maintaining customer loyalty in a competitive environment requires continuous efforts to enhance the shopping experience and offer value-added services. Finally, regulatory changes and compliance requirements across various regions can add complexity and impact operational efficiency.

The North American market (specifically the US) currently dominates the warehouse supermarket and warehouse club sector, largely due to the established presence of major players like Costco, Sam's Club, and BJ's Wholesale Club. However, significant growth potential exists in developing economies of Asia and parts of Europe, fueled by rising middle-class populations and increasing disposable incomes. Within the product segments, Food and Beverages remains a dominant category, accounting for a significant portion of sales. The convenience of buying large quantities of staple food items at discounted prices strongly attracts both individual and commercial customers.

North America: This region benefits from established infrastructure, high consumer spending power, and the presence of major industry players. The strong loyalty programs and established brand recognition of key players contribute to the region's dominance.

Asia: Rapid economic growth and a burgeoning middle class in countries like China and India present significant growth opportunities. However, varying cultural preferences and infrastructural challenges need careful consideration.

Europe: The European market presents a mature landscape with established players, yet growth remains driven by increasing demand for value-oriented shopping and omnichannel solutions.

Food and Beverages Segment: This segment's dominance stems from the high frequency of purchase, everyday necessity, and significant cost savings for consumers who buy in bulk.

Household Goods Segment: This segment is increasingly important, with significant growth driven by the convenience of purchasing larger quantities of household essentials at a discounted price.

The forecast period suggests continued dominance of North America, particularly the US, but with strong growth potential in Asia. The Food and Beverages segment is expected to remain dominant, followed by increasing contribution from the Household Goods segment.

Several factors are poised to catalyze growth in this sector. First, the continued expansion into emerging markets, leveraging the rising middle class's disposable incomes, offers substantial opportunities. Second, the increasing adoption of omnichannel strategies, integrating online platforms with physical stores, enhances accessibility and expands reach. Finally, strategic investments in data analytics, tailored marketing, and personalized offerings will enhance customer engagement and loyalty, maximizing the value proposition for members.

This report provides a comprehensive overview of the warehouse supermarket and warehouse club industry, analyzing market trends, driving forces, challenges, key players, and future growth prospects. The report’s in-depth analysis offers invaluable insights for businesses operating within this sector and those considering entry. The detailed segmentation and regional analysis further enhances understanding of the market dynamics and opportunities. Utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), the report provides a robust and reliable outlook for investors and industry stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 0.5%.

Key companies in the market include Costco, Sam's Club, BJ's Wholesale Club, City Club, Metro AG, PriceSmart, Selgros, Yonghui, Hema, Fudi, Makro, .

The market segments include Application, Type.

The market size is estimated to be USD 1417.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Warehouse Supermarket and Warehouse Club," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Warehouse Supermarket and Warehouse Club, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.