1. What is the projected Compound Annual Growth Rate (CAGR) of the Voluntary Carbon Credit Trading?

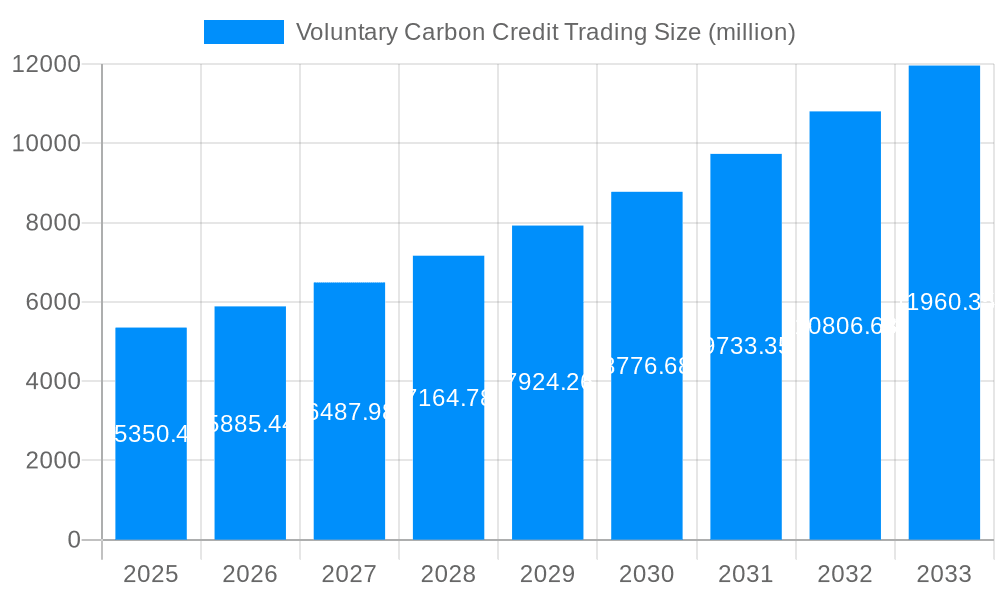

The projected CAGR is approximately 15.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Voluntary Carbon Credit Trading

Voluntary Carbon Credit TradingVoluntary Carbon Credit Trading by Type (Forestry, Renewable Energy, Waste Disposal, Others, Personal, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The voluntary carbon credit trading market is projected for significant expansion, with an estimated market size of $114.3 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 15.9%. This growth is propelled by heightened corporate net-zero commitments, amplified climate change awareness, and increasing demand across sectors like forestry, renewable energy, and waste management. Technological advancements in carbon monitoring and verification are bolstering market transparency and confidence. While challenges concerning project additionality, permanence, and market integrity persist, the market outlook remains strong, supported by evolving regulations and the expanding influence of Environmental, Social, and Governance (ESG) investing.

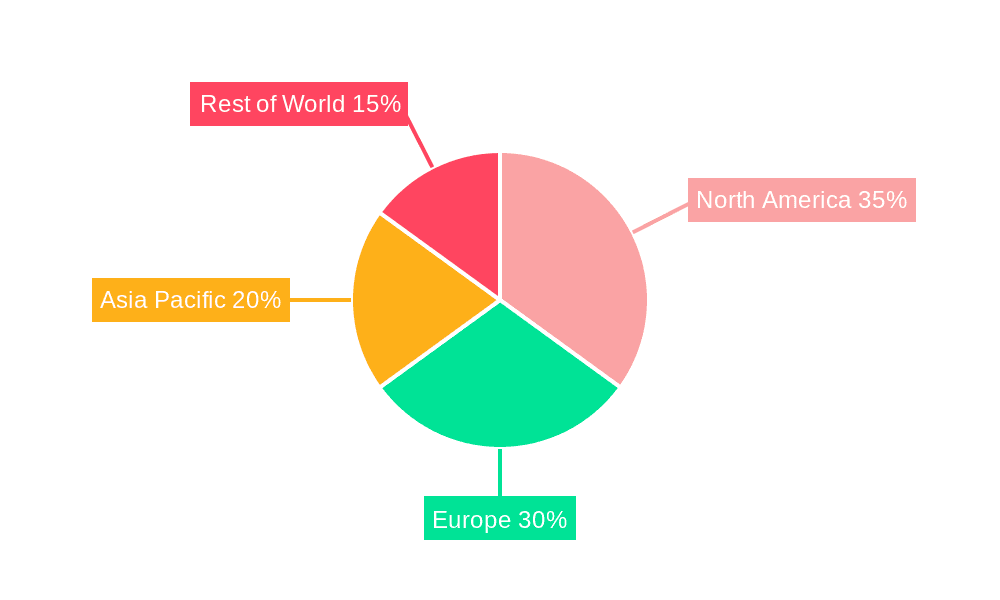

Market segmentation highlights key contributions from Forestry, Renewable Energy, and Waste Disposal projects. North America and Europe currently lead market share, with the Asia-Pacific region poised for rapid growth, particularly in China and India, driven by industrial expansion and supportive government policies. Leading market participants include established offset developers and brokers, alongside innovative technology firms enhancing project verification and credit trading. The increasing complexity of carbon accounting and reporting frameworks is expected to favor integrated companies offering comprehensive solutions. The forecast period anticipates sustained expansion driven by consistent demand and the development of robust market infrastructure.

The voluntary carbon credit trading market is experiencing explosive growth, projected to reach XXX million by 2033 from XXX million in 2024. This surge reflects a growing corporate commitment to achieving net-zero emissions targets and a heightened awareness of environmental, social, and governance (ESG) factors among investors and consumers. The historical period (2019-2024) witnessed a steady rise in market volume, driven primarily by increased corporate demand for offsetting unavoidable emissions. The estimated market size in 2025, at XXX million, underscores the momentum. The forecast period (2025-2033) anticipates continued robust expansion, fueled by increasingly stringent regulations, technological advancements in carbon accounting, and the emergence of innovative carbon credit projects. While the forestry sector currently holds a significant share, renewable energy credits are gaining traction, presenting a compelling investment opportunity for the future. The market is characterized by a growing number of players, ranging from established consultancies and project developers to emerging technology platforms facilitating transparent and efficient trading. However, the market faces challenges regarding standardization, verification, and potential for greenwashing, necessitating robust regulatory frameworks and industry self-regulation to ensure market integrity. The increased focus on high-quality credits, particularly those aligned with verified additionality and permanence, is shaping market trends and attracting discerning buyers. This shift is promoting a transition away from lower-quality offsets towards projects with demonstrable environmental and social benefits, further driving market sophistication and potentially influencing pricing.

Several factors are driving the expansion of the voluntary carbon credit market. The increasing urgency of climate change mitigation efforts, coupled with the growing awareness of corporate environmental responsibilities, is a key driver. Corporations are increasingly adopting science-based targets and committing to net-zero emissions, recognizing the business imperative of sustainable practices and investor pressure. Furthermore, rising consumer demand for environmentally friendly products and services encourages businesses to invest in carbon offsetting as a means of demonstrating their commitment to sustainability. The emergence of innovative carbon credit projects, spanning various sectors like renewable energy, reforestation, and waste management, provides a wider range of offsetting options for businesses. Technological advancements in carbon accounting and monitoring, enhancing transparency and accountability, also play a significant role. Government policies and regulations, while still evolving, are increasingly supporting the development and trading of voluntary carbon credits by creating frameworks and incentives. Finally, the growing participation of financial institutions and investors further legitimizes and expands the market, facilitating greater capital flows into climate-friendly projects.

Despite its rapid growth, the voluntary carbon market faces several challenges. A lack of standardized methodologies for measuring, reporting, and verifying carbon reductions across different project types creates inconsistencies and can hinder market transparency and trust. Concerns regarding the additionality of projects—whether emissions reductions would have occurred anyway without the carbon credit mechanism—are frequently raised. Furthermore, the risk of greenwashing, where companies falsely claim environmental benefits, undermines market integrity. The verification process itself can be complex and costly, posing a barrier to entry for smaller project developers. Price volatility, influenced by factors such as supply and demand fluctuations, market speculation, and the quality of available credits, creates uncertainty for buyers and sellers. The emergence of diverse credit standards adds complexity, potentially leading to fragmentation and confusion. Finally, ensuring the long-term permanence of emission reductions, especially in projects related to forestry and land use, remains a crucial but challenging aspect. Addressing these challenges requires concerted efforts from governments, industry players, and standard-setting bodies to enhance market transparency, build trust, and promote high-quality carbon credits.

The Enterprise segment is poised to dominate the voluntary carbon credit market. Large corporations face increasing pressure from investors, consumers, and regulators to demonstrate their commitment to climate action.

Geographically, developed economies in North America and Europe are currently leading in terms of demand, driven by strong regulatory frameworks and corporate sustainability initiatives. However, growth in emerging markets like Asia is expected to accelerate significantly in the coming years as these regions embrace carbon reduction goals and their economic activity expands.

The voluntary carbon credit market is experiencing rapid expansion fueled by several key catalysts: increasing corporate sustainability goals, growing investor interest in ESG factors, innovative project development, technological advancements improving transparency, and supportive governmental policies creating favorable regulatory frameworks. These factors are collectively driving substantial market growth and attracting significant investment.

This report provides a comprehensive analysis of the voluntary carbon credit trading market, covering market trends, driving forces, challenges, key players, and future growth projections. The detailed analysis encompasses key segments, regional breakdowns, and significant industry developments, offering valuable insights for investors, businesses, and policymakers seeking to understand and participate in this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.9%.

Key companies in the market include South Pole Group, 3Degrees, EcoAct, Terrapass, Green Mountain Energy, First Climate Markets AG, ClimatePartner GmbH, Aera Group, Forliance, Element Markets, Bluesource, Allcot Group, Swiss Climate, Schneider, NatureOffice GmbH, Planetly, GreenTrees, Bischoff & Ditze Energy GmbH, NativeEnergy, Carbon Credit Capital, UPM Umwelt-Projekt-Management GmbH, CBEEX, Bioassets, Biofílica, .

The market segments include Type.

The market size is estimated to be USD 114.3 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Voluntary Carbon Credit Trading," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Voluntary Carbon Credit Trading, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.