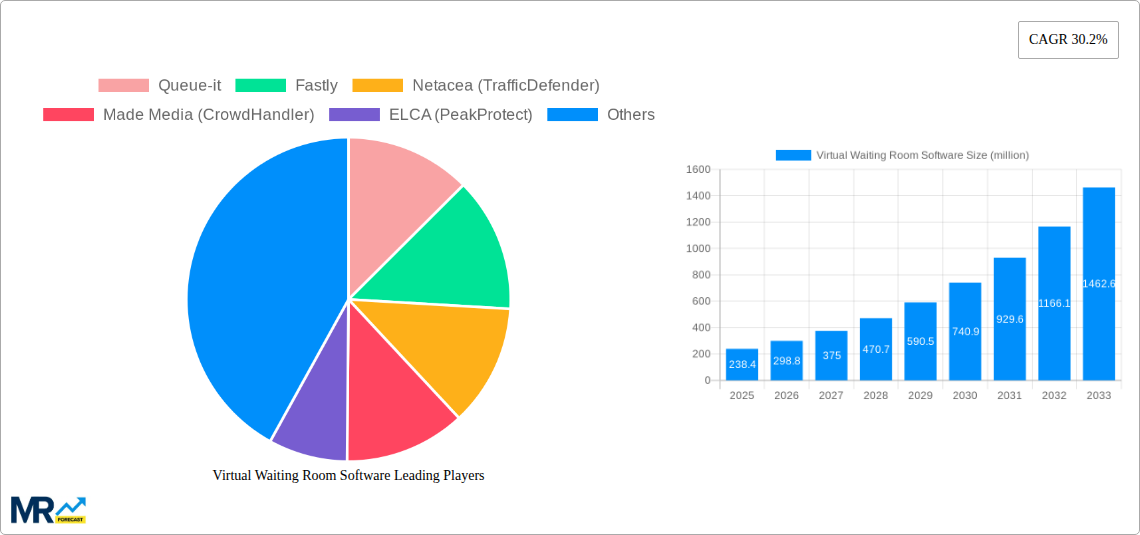

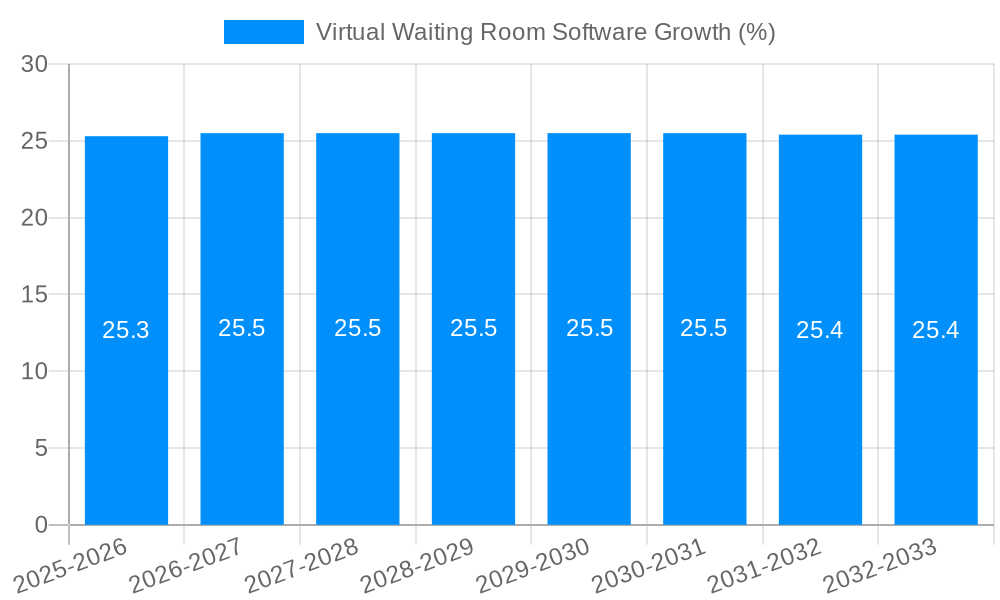

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Waiting Room Software?

The projected CAGR is approximately 30.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Virtual Waiting Room Software

Virtual Waiting Room SoftwareVirtual Waiting Room Software by Type (Online Retail, Ticketing, Education, Public Sector, Other), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Virtual Waiting Room Software market is poised for explosive growth, projected to reach an impressive market size of $238.4 million by 2025, with a staggering Compound Annual Growth Rate (CAGR) of 30.2% expected to sustain this trajectory through 2033. This rapid expansion is primarily fueled by the increasing need for robust website performance and customer experience management during high-traffic events. Key drivers include the surge in e-commerce sales, the proliferation of online ticketing for events and travel, and the growing adoption of digital learning platforms. Businesses across sectors are recognizing the critical role virtual waiting rooms play in preventing website crashes, managing customer queues effectively, and ultimately preserving brand reputation and revenue. The software's ability to ensure a fair and orderly access to limited resources, whether it's a flash sale, a popular concert ticket, or limited educational course enrollment, is becoming indispensable.

The market is segmented into diverse applications, with Online Retail and Ticketing leading the charge due to their direct reliance on managing sudden influxes of users. The Public Sector is also a significant and growing segment, leveraging these solutions for citizen services and online applications. The adoption by both Large Enterprises and Small and Medium-sized Enterprises (SMEs) indicates a broad appeal and scalability of virtual waiting room solutions. Leading companies like Queue-it, Fastly, and Akamai are innovating to offer advanced features such as AI-powered traffic prediction, customizable branding, and seamless integration with existing infrastructure. While the market demonstrates immense potential, it faces certain restraints, including the initial cost of implementation for smaller businesses and the ongoing need for sophisticated technical expertise to optimize performance. However, the clear benefits of mitigating lost sales, enhancing customer satisfaction, and ensuring operational stability during peak demand are strongly outweighing these challenges, driving widespread adoption across global markets.

XXX The global Virtual Waiting Room Software market, projected to reach $8,500 million by 2033, is experiencing an unprecedented surge in adoption driven by a confluence of digital transformation, escalating online traffic, and the imperative for enhanced customer experience. During the historical period of 2019-2024, the market witnessed a foundational growth as businesses began to recognize the critical need for managing sudden spikes in website visitors. The base year, 2025, sets the stage for robust expansion, with estimates suggesting a market value of $3,200 million in this year alone, highlighting its immediate and substantial impact. The forecast period, 2025-2033, anticipates a compound annual growth rate (CAGR) of approximately 15%, underscoring the sustained demand and the software's evolving importance across diverse industries. Key trends shaping this market include the increasing sophistication of queuing algorithms, moving beyond simple first-come, first-served models to more dynamic and fair distribution methods. The integration of AI and machine learning is becoming paramount, enabling predictive traffic management and personalized user journeys within the waiting room. Furthermore, there is a growing demand for customizable branding and user interface elements to ensure a seamless brand experience even during peak loads, preventing customer frustration and deterring abandonment. The emphasis is shifting from merely holding users to actively engaging them with relevant content, offers, or updates, thereby transforming the waiting room from a passive barrier into an active touchpoint. The rise of hybrid cloud solutions and specialized APIs for seamless integration with existing e-commerce platforms and CRMs are also significant trends, making virtual waiting rooms more accessible and efficient for businesses of all sizes. The market is also witnessing a greater focus on analytics and reporting capabilities, providing businesses with invaluable insights into traffic patterns, customer behavior, and the effectiveness of their queuing strategies. This data-driven approach empowers organizations to optimize their operations and improve overall customer satisfaction, solidifying the role of virtual waiting room software as an essential tool in the modern digital landscape. The evolving threat landscape, including bot attacks and denial-of-service attempts, further amplifies the need for robust traffic management solutions that virtual waiting rooms provide, acting as a crucial line of defense.

The exponential growth of the Virtual Waiting Room Software market is primarily propelled by the ever-increasing volume and unpredictability of online traffic across virtually all sectors. Businesses are grappling with the reality that sudden surges in website visitors, often triggered by product launches, flash sales, or critical public announcements, can overwhelm their infrastructure, leading to downtime, lost sales, and irreparable damage to brand reputation. This direct threat to revenue and customer loyalty necessitates proactive solutions like virtual waiting rooms. Moreover, the heightened expectations of consumers in the digital age play a pivotal role. Customers are no longer willing to tolerate slow-loading websites or frustrating errors; they demand immediate access and a smooth, uninterrupted experience. Virtual waiting rooms address this by providing a controlled and transparent queuing system, managing user flow effectively and setting clear expectations about wait times. The increasing reliance on online channels for commerce, education, and essential services has amplified the criticality of website availability. From e-commerce platforms launching limited-edition products to government agencies releasing critical information or educational institutions managing admissions, the need for robust traffic management is undeniable. The competitive landscape also fuels this growth, as businesses recognize that providing a superior online experience, even during peak demand, can be a significant differentiator, attracting and retaining customers while their competitors falter.

Despite its burgeoning growth, the Virtual Waiting Room Software market faces several inherent challenges and restraints that temper its expansion. A primary concern revolves around the potential for customer frustration and abandonment if the waiting room experience is poorly implemented or perceived as overly lengthy and unengaging. Customers arriving with the intent to purchase or access a service expect immediacy, and a poorly designed virtual queue can lead to a negative perception and lost opportunities, directly impacting conversion rates. Another significant challenge lies in the complexity of integration with existing IT infrastructures and e-commerce platforms. For many businesses, especially Small and Medium-sized Enterprises (SMEs), integrating sophisticated virtual waiting room solutions can be technically demanding and costly, requiring specialized IT expertise. Furthermore, the cost of implementing and maintaining these systems, while often offset by prevented losses, can still be a deterrent for some organizations, particularly those with tighter budget constraints. The perception that virtual waiting rooms are solely for crisis management, rather than a proactive customer experience enhancement tool, can also limit their widespread adoption. Misunderstanding the software's capabilities and its potential to foster brand loyalty and gather valuable customer insights hinders its strategic implementation. Finally, the ongoing evolution of bot traffic and sophisticated denial-of-service attacks necessitates continuous updates and advancements in virtual waiting room technology, posing a constant development challenge for software providers and potentially increasing operational costs for end-users.

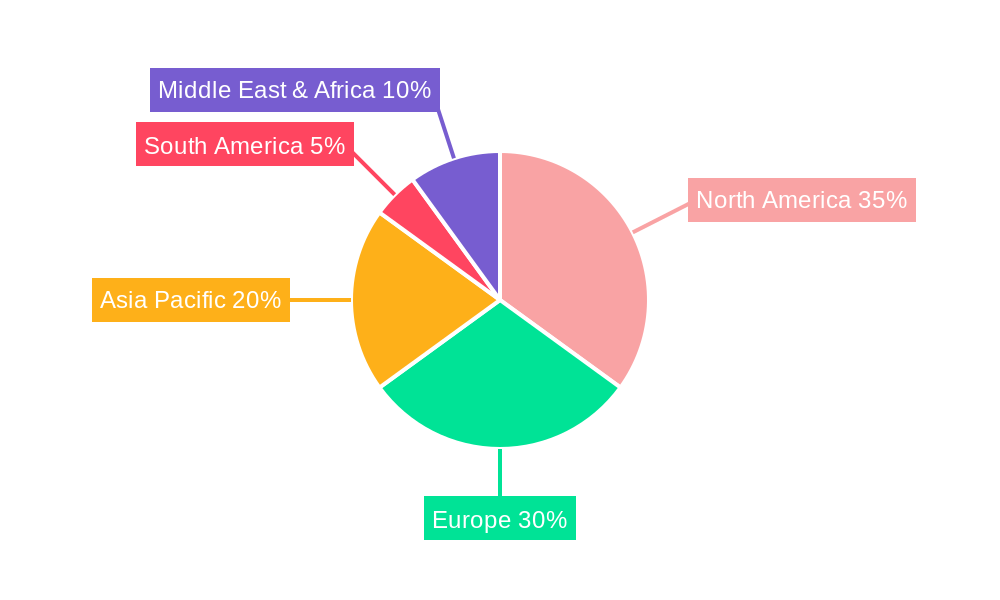

The Online Retail segment and Large Enterprises within the North America region are poised to dominate the Virtual Waiting Room Software market, projected to collectively contribute a significant portion of the estimated $8,500 million by 2033.

Online Retail Dominance: The online retail sector is inherently susceptible to massive and unpredictable traffic fluctuations, particularly during major shopping events like Black Friday, Cyber Monday, Prime Day, and holiday seasons. These events can see website traffic multiply exponentially within minutes, overwhelming traditional server capacities and leading to catastrophic website crashes. Virtual Waiting Room Software offers an indispensable solution for online retailers to manage these surges effectively, ensuring a smooth and equitable customer experience. For instance, during a highly anticipated product launch, a virtual waiting room can prevent a stampede of visitors from crashing the site, instead placing them in a queue and providing estimated wait times, thereby preserving sales and brand reputation. The ability to maintain uptime and manage customer flow directly translates to sustained revenue and customer loyalty, making this segment a primary driver of demand. The increasing adoption of e-commerce globally, further accelerated by recent global events, solidifies online retail's position as a cornerstone of the virtual waiting room market. Companies like Queue-it and Fastly have particularly strong offerings tailored to the unique needs of online retailers, focusing on scalability and seamless integration with popular e-commerce platforms. The market value within this segment alone is anticipated to reach upwards of $3,500 million by 2033.

Large Enterprises as Key Adopters: Large enterprises, characterized by their extensive customer bases, high-volume transactions, and critical online services, are major beneficiaries and drivers of the virtual waiting room software market. These organizations, operating across various industries including online retail, ticketing, and public sector, often face the most significant traffic spikes and have the most to lose from website downtime. The potential financial impact of even a few hours of inaccessibility can run into millions of dollars. Therefore, large enterprises are willing to invest in robust and scalable virtual waiting room solutions to safeguard their operations, protect their brand image, and ensure continuous service delivery. Their sophisticated IT departments are also more equipped to integrate and manage advanced features, such as AI-driven traffic management and in-queue engagement strategies. The Application: Large Enterprises segment is expected to contribute an estimated $4,000 million to the overall market value by 2033. Leading players such as Akamai, Netacea (TrafficDefender), and ELCA (PeakProtect) often focus on enterprise-grade solutions that can handle immense traffic volumes and offer comprehensive security and analytics.

North America's Leadership: North America, comprising the United States and Canada, stands out as the dominant region in the virtual waiting room software market. This leadership is attributed to several factors, including the early and widespread adoption of digital technologies, a mature e-commerce ecosystem, and a high concentration of large enterprises across various sectors. The region's strong economy and robust technological infrastructure enable businesses to invest in advanced solutions like virtual waiting rooms to maintain a competitive edge. Furthermore, a culture that highly values customer experience and efficiency drives the demand for tools that can ensure seamless online interactions, even during peak demand periods. The presence of leading technology companies and a vibrant startup scene also contributes to innovation and market growth within North America. The market value within North America is projected to reach approximately $3,000 million by 2033, underscoring its significant influence on global trends.

The virtual waiting room software industry is experiencing substantial growth catalyzed by the persistent increase in digital traffic, amplified by e-commerce expansion and the growing reliance on online services for critical functions. The escalating customer expectations for instant access and seamless user experiences during high-demand periods is a major driver. Furthermore, the increasing awareness among businesses about the detrimental impact of website downtime on revenue, brand reputation, and customer loyalty is pushing them towards proactive traffic management solutions. The ongoing advancements in AI and machine learning are enabling more sophisticated and efficient queuing algorithms, enhancing the software's value proposition.

This report offers an in-depth and comprehensive analysis of the global Virtual Waiting Room Software market, encompassing a meticulous study period from 2019 to 2033, with a detailed focus on the base year 2025 and a robust forecast period of 2025-2033. It delves into the intricate dynamics driving market growth, including the escalating need for robust online traffic management, the imperative to enhance customer experience during peak demand, and the evolving digital landscape. The report meticulously outlines the key challenges and restraints that may impede market expansion, such as integration complexities and potential customer frustration. It further identifies and analyzes dominant market segments and regions, projecting significant contributions from Online Retail and Large Enterprises, particularly within North America. The report also highlights crucial growth catalysts and provides a detailed overview of leading market players and their offerings. This comprehensive coverage ensures stakeholders gain a profound understanding of the market's current state, future trajectory, and the strategic imperatives for success in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 30.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 30.2%.

Key companies in the market include Queue-it, Fastly, Netacea (TrafficDefender), Made Media (CrowdHandler), ELCA (PeakProtect), Section.io, Simple Servers, Akamai, .

The market segments include Type, Application.

The market size is estimated to be USD 238.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Virtual Waiting Room Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Virtual Waiting Room Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.