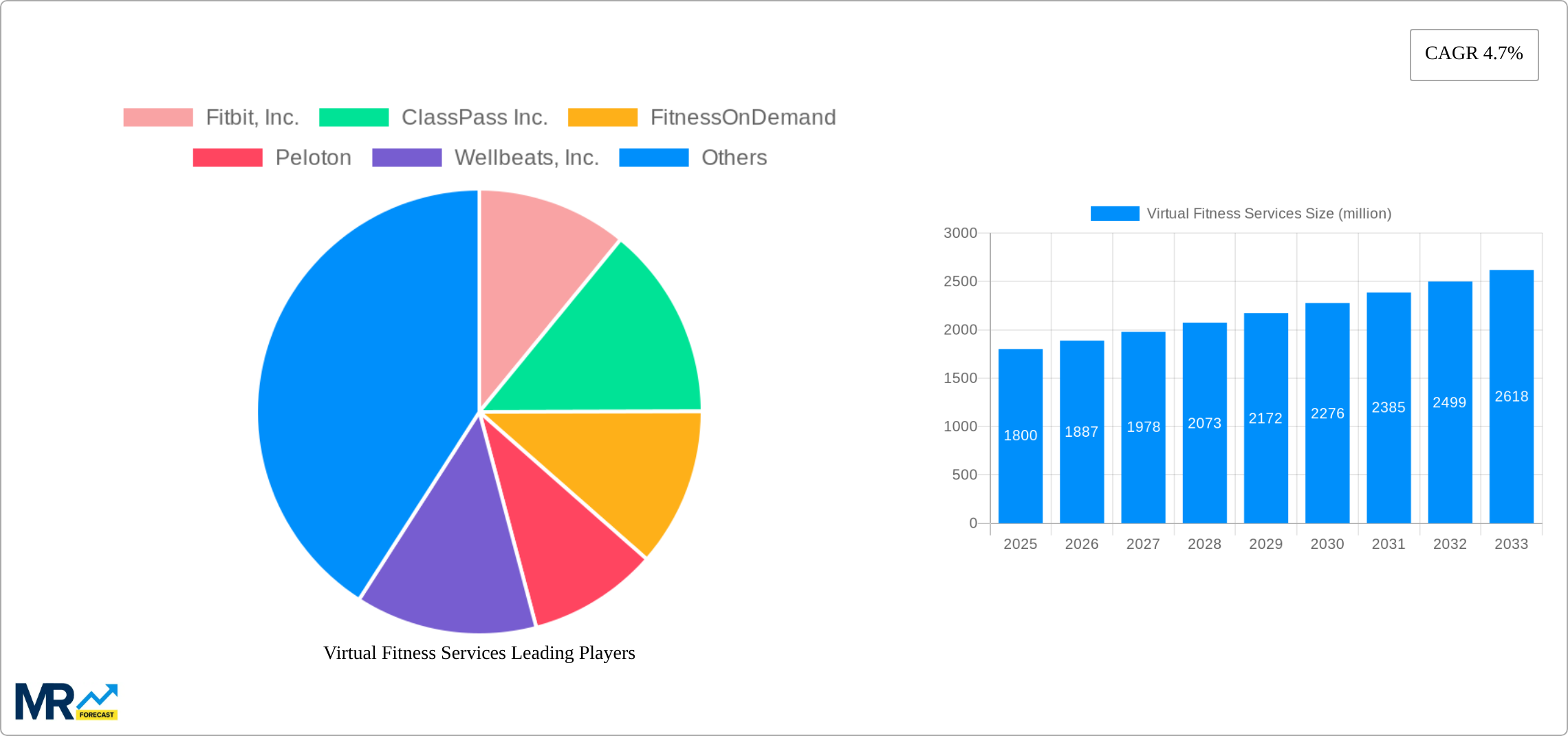

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Fitness Services?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Virtual Fitness Services

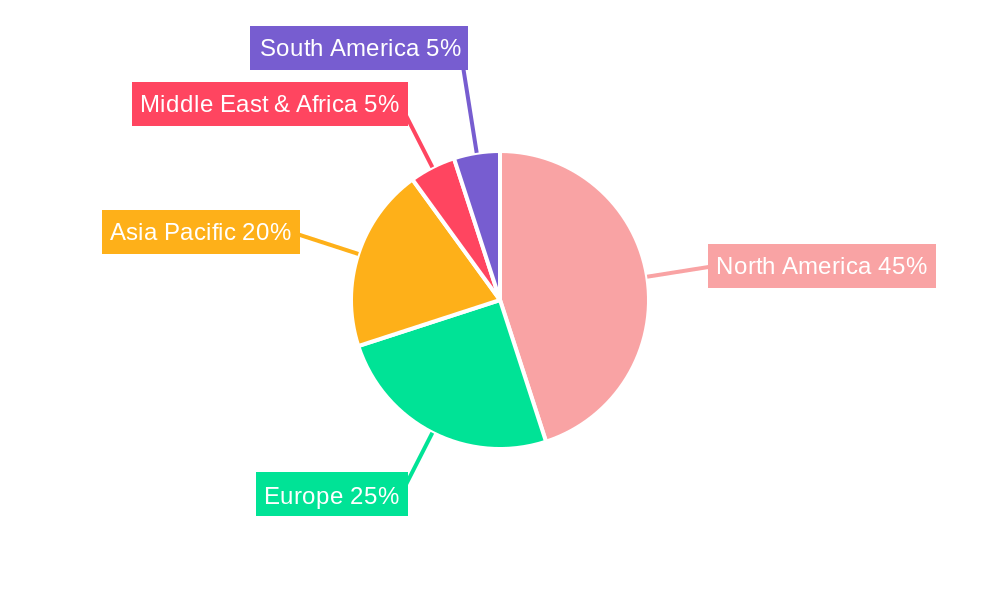

Virtual Fitness ServicesVirtual Fitness Services by Type (Video Teaching, Live Teaching, Other), by Application (Professional Gyms, Educational and Sports Institutes, Corporate Institutions, Individuals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

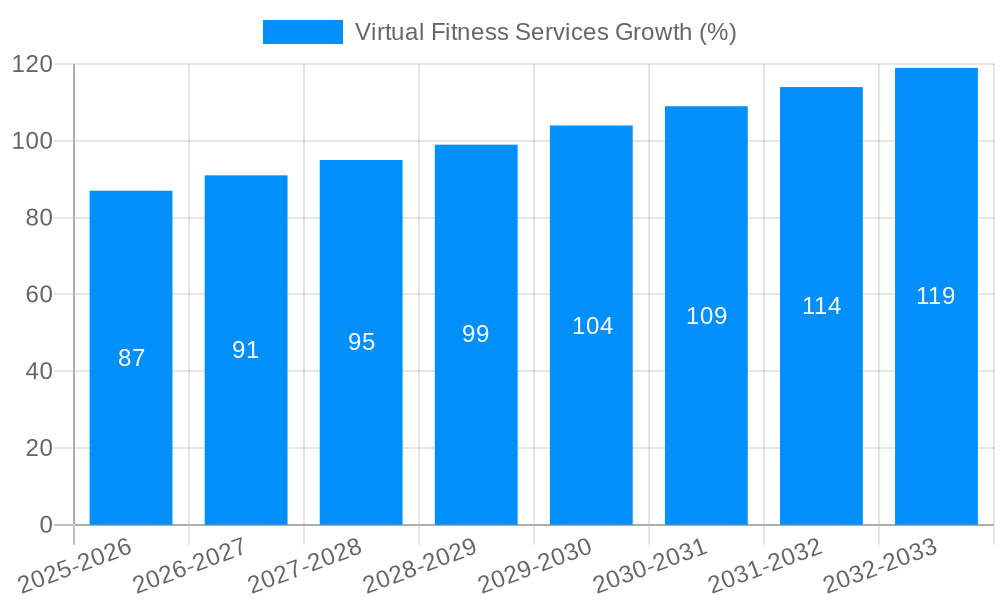

The global virtual fitness services market is experiencing robust growth, projected to reach $2067 million by 2027, exhibiting a Compound Annual Growth Rate (CAGR) of 4.7%. This expansion is fueled by several key factors. The increasing adoption of smartphones and wearable technology provides convenient access to fitness programs, anytime, anywhere. The rising prevalence of chronic diseases and a growing emphasis on preventative healthcare are driving demand for accessible and personalized fitness solutions. Furthermore, the convenience and cost-effectiveness of virtual fitness, compared to traditional gym memberships, are significant contributing factors to its popularity. The market is segmented by teaching method (video, live, other) and application (professional gyms, educational and sports institutes, corporate institutions, and individuals). North America currently holds a significant market share, driven by high technological adoption and disposable income levels, but growth is expected across all regions, particularly in Asia-Pacific due to increasing internet penetration and a rising middle class. Key players like Peloton, Fitbit, and ClassPass are constantly innovating with new technologies and program offerings to maintain their competitive edge and capture market share in this dynamic landscape.

The competitive landscape is characterized by a mix of established fitness brands and emerging technology companies. While large corporations benefit from brand recognition and established distribution networks, smaller, agile companies are leveraging technological advancements to offer innovative and personalized fitness experiences. Challenges include ensuring the quality and effectiveness of virtual training, addressing concerns about user engagement and motivation, and overcoming the digital divide in certain regions. However, ongoing improvements in virtual reality (VR) and augmented reality (AR) technologies, combined with the integration of artificial intelligence (AI) for personalized fitness plans, are expected to overcome these hurdles and propel further market expansion. The future growth of the virtual fitness market hinges on continuous technological innovation, strategic partnerships, and the successful adaptation of virtual programs to cater to diverse user needs and preferences.

The global virtual fitness services market is experiencing explosive growth, projected to reach multi-million dollar valuations by 2033. This surge is fueled by several converging factors, including the increasing prevalence of smart devices, the rising adoption of health and wellness lifestyles, and the convenience and accessibility offered by virtual platforms. The historical period (2019-2024) witnessed significant adoption, laying the foundation for the impressive projected growth during the forecast period (2025-2033). While the base year (2025) provides a snapshot of the current market landscape, the study period (2019-2033) offers a comprehensive view of the market's evolution. Key market insights reveal a strong preference for on-demand video content, driven by its flexibility and affordability. Live teaching sessions, while experiencing growth, are still a smaller segment compared to pre-recorded content. The individual segment remains the dominant application area, reflecting the widespread appeal of home-based fitness solutions. However, corporate institutions are increasingly incorporating virtual fitness into employee wellness programs, indicating a significant untapped market opportunity. The integration of gamification and personalized training plans further enhances user engagement and retention, contributing to the overall market expansion. Furthermore, technological advancements such as virtual reality (VR) and augmented reality (AR) are expected to significantly enhance the user experience and drive market growth in the coming years. The competitive landscape is dynamic, with established players facing competition from new entrants offering innovative solutions. This rivalry is driving innovation and enhancing the overall value proposition for consumers.

Several powerful forces are driving the phenomenal growth of the virtual fitness services market. The COVID-19 pandemic significantly accelerated the adoption of online fitness, highlighting the convenience and safety of home workouts. This trend, coupled with the rising awareness of the importance of physical health and wellness, has created a massive demand for accessible and affordable fitness solutions. Technological advancements, including high-quality streaming capabilities, sophisticated fitness tracking apps (like those offered by Fitbit), and immersive VR/AR experiences, are continuously enhancing the user experience, making virtual fitness more engaging and effective. The affordability of virtual fitness compared to traditional gym memberships is another key driver, making it accessible to a wider demographic. Furthermore, the flexibility and personalization offered by virtual platforms cater to diverse lifestyles and fitness goals. The increasing integration of virtual fitness programs into corporate wellness initiatives also plays a significant role, driving substantial adoption among employees. This holistic approach, combining convenience, affordability, and personalized solutions, positions virtual fitness services for sustained and significant growth in the years to come.

Despite its considerable growth potential, the virtual fitness services market faces several challenges. One major obstacle is the lack of social interaction, which many individuals find essential for motivation and engagement in their fitness routines. The lack of personalized, real-time feedback from instructors compared to in-person training sessions can also hinder progress and potentially lead to injuries if proper form isn't maintained. Technical issues, such as internet connectivity problems and compatibility issues with various devices, can disrupt workouts and negatively impact user experience. Maintaining user engagement over extended periods is another challenge; the novelty of virtual fitness can wear off, leading to lower adherence rates. Furthermore, the market is becoming increasingly saturated, leading to intense competition among providers, demanding continuous innovation and marketing efforts to retain users. Data privacy and security concerns are also crucial, as these services collect significant user data that must be protected responsibly. Addressing these challenges effectively is critical for sustained market growth and the long-term success of virtual fitness providers.

The virtual fitness services market shows significant growth potential across various regions and segments. However, North America and Europe currently lead the way in terms of adoption and market value, driven by high internet penetration, disposable income, and increased health awareness. Asia-Pacific is expected to experience rapid growth in the coming years, propelled by a burgeoning middle class and rising smartphone penetration.

In Paragraph Form: While North America and Europe currently hold the largest market share due to higher disposable incomes and technology adoption, the Asia-Pacific region is poised for rapid expansion, driven by economic growth and increasing smartphone penetration. The individual user segment remains dominant, with the rise of convenient on-demand video workouts. However, the corporate segment represents a substantial, under-developed market. Companies are beginning to integrate virtual fitness programs into their employee wellness initiatives, promising substantial future growth. The high demand for flexibility and convenience makes video-based teaching the most popular format, though live teaching offers a significant advantage in terms of personalized feedback and interaction, further expanding its potential.

The virtual fitness services industry is experiencing significant growth driven by a confluence of factors including the increasing affordability and accessibility of high-speed internet, rising health awareness, technological advancements enhancing the user experience (like gamification and VR integration), and the growing integration of virtual fitness into corporate wellness initiatives. These combined elements create a robust ecosystem conducive to sustained market expansion.

This report provides a comprehensive analysis of the virtual fitness services market, covering historical trends, current market dynamics, and future projections. It examines key market segments, identifies major players, and analyses the driving forces and challenges shaping the industry's evolution. The report also offers valuable insights for businesses looking to enter or expand their presence in this rapidly growing market. The analysis considers factors ranging from technological advancements and consumer preferences to regulatory changes and competitive landscapes, offering a complete and nuanced perspective of the virtual fitness services sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include Fitbit, Inc., ClassPass Inc., FitnessOnDemand, Peloton, Wellbeats, Inc., Zwift Inc, REH-FIT, Les Mills International Ltd., Sworkit, Navigate Wellbeing Solutions., .

The market segments include Type, Application.

The market size is estimated to be USD 2067 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Virtual Fitness Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Virtual Fitness Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.