1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Watch Resale Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Watch Resale Service

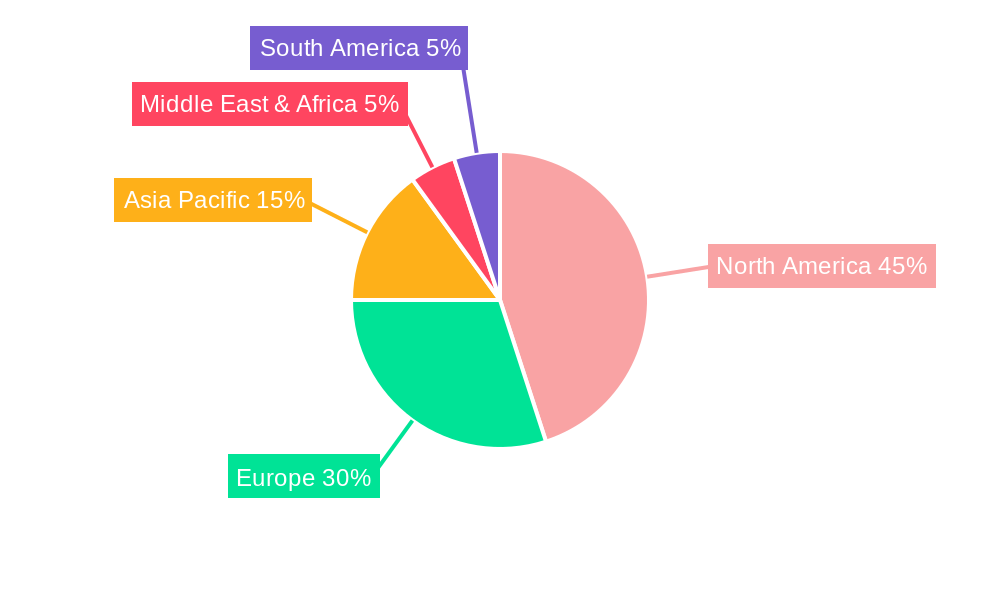

Used Watch Resale ServiceUsed Watch Resale Service by Type (Men's Watch, Women's Watch), by Application (Online Resale Service, Offline Resale Service), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

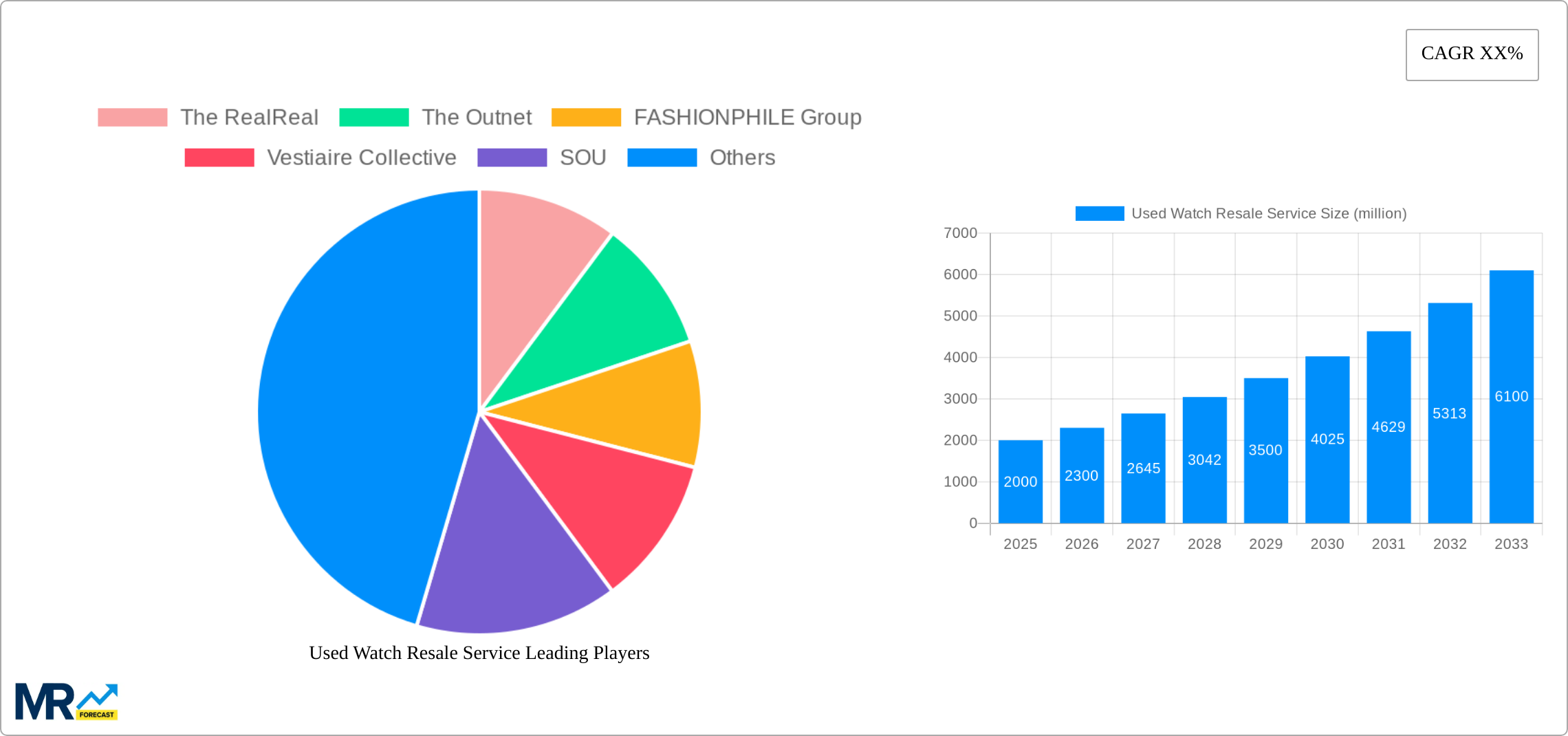

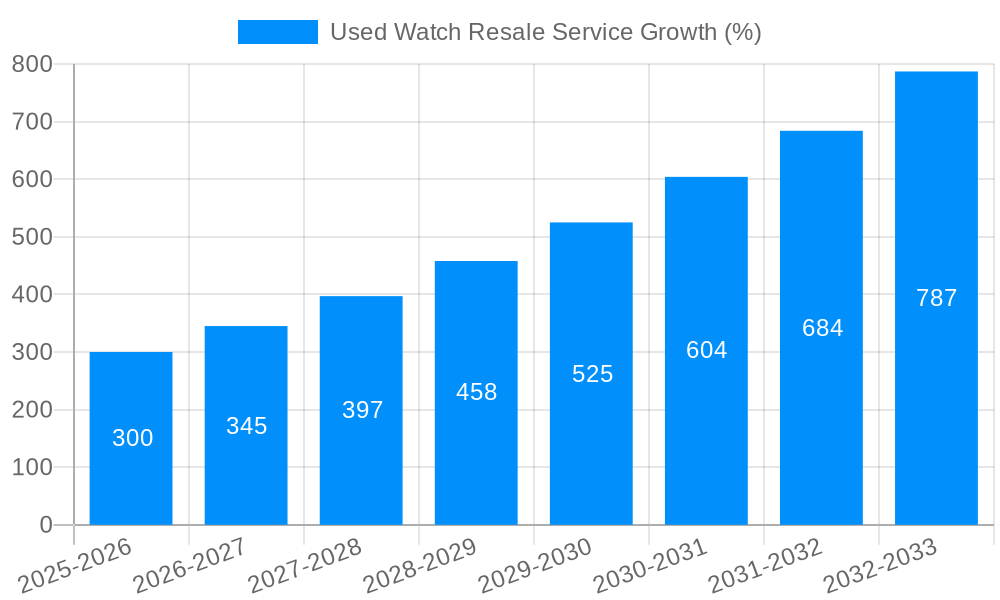

The used watch resale market is experiencing robust growth, driven by increasing consumer preference for pre-owned luxury goods, the desire for sustainable consumption, and the appeal of acquiring high-value timepieces at discounted prices. The market's segmentation, encompassing both men's and women's watches sold through online and offline channels, reflects diverse consumer preferences and purchasing habits. Online resale services, in particular, are experiencing significant traction due to their convenience, wider reach, and ability to connect buyers and sellers globally. Key players in this space, including The RealReal, Watchfinder, and Chrono24 (implied by the presence of similar players), are actively shaping the market through their brand reputation, curated inventory, and authentication services. The market's geographical spread, with notable strength in North America and Europe, points to a significant opportunity for expansion in developing economies with a growing affluent class. While economic downturns could potentially restrain growth, the inherent value retention of luxury watches and the increasing acceptance of pre-owned goods suggest that the market's long-term trajectory remains positive. A conservative estimate suggests a 2025 market size of approximately $2 billion, considering the presence of numerous established players and a global reach. This market size, projected at a 15% Compound Annual Growth Rate (CAGR) over the forecast period, indicates a significant expansion potential over the next decade, reaching an estimated $5 billion by 2033. The continued rise in luxury watch popularity, coupled with responsible consumption trends, further supports this growth projection.

The competitive landscape is characterized by a mix of established online marketplaces and specialized luxury watch resellers. The success of these platforms hinges on their ability to build trust through rigorous authentication processes, provide high-quality customer service, and offer a secure transaction environment. Future growth will likely be fueled by technological advancements in authentication, improved online experiences, and the expansion into emerging markets. Furthermore, the increasing integration of social commerce and the adoption of innovative marketing strategies will be crucial factors in shaping the market's future. The strong brand recognition and established customer base of many players underscore the resilience and long-term potential of this dynamic market sector. However, challenges such as counterfeit goods and the need for robust authentication procedures will require continuous attention and innovative solutions from market participants.

The used watch resale service market is experiencing explosive growth, driven by a confluence of factors including increased consumer awareness of sustainability, the desire for luxury goods at accessible prices, and the evolving perception of pre-owned items. The market, valued at several hundred million USD in 2019, is projected to reach multi-billion USD valuations by 2033. This expansion is fueled by a significant shift in consumer behavior, with millennials and Gen Z leading the charge towards purchasing pre-owned luxury goods. The rise of online marketplaces and specialized platforms dedicated to authenticating and reselling luxury watches has significantly lowered the barriers to entry for both buyers and sellers. This trend is further amplified by the increasing popularity of watches as investment assets, with certain models appreciating substantially in value over time. The market is witnessing a diversification of offerings, with platforms catering to various price points and watch types, ranging from vintage Rolexes to contemporary smartwatches. This segmentation allows for a broader appeal, attracting a wider range of consumers. Furthermore, the industry is witnessing increasing consolidation, with larger players acquiring smaller businesses to expand their market share and enhance their technological capabilities. This consolidation is expected to further streamline the authentication and logistics processes, leading to increased trust and efficiency within the market. The growth trajectory strongly suggests a continued expansion of the used watch resale market, attracting both new consumers and established players in the luxury goods sector. The emergence of new technologies in authentication and verification is further contributing to the stability and growth of the market, inspiring greater consumer confidence. Finally, the increasing emphasis on circular economy principles is driving significant market growth, making this sector more attractive to ethically-conscious buyers and sellers.

Several key factors are driving the phenomenal growth of the used watch resale service market. Firstly, the rising popularity of pre-owned luxury goods reflects a growing consumer awareness of sustainable consumption. Buying pre-owned reduces the environmental impact associated with producing new items. Secondly, the affordability factor is undeniable. Luxury watches, often beyond the reach of many, become accessible through the resale market, opening up a significant customer base. Thirdly, the increased authenticity and verification services offered by platforms like The RealReal and WatchBox are crucial, building consumer trust and mitigating the risk of buying counterfeit products. This instills confidence among consumers who may have previously been hesitant to purchase pre-owned luxury items. Fourthly, the rise of online marketplaces and social media platforms has significantly simplified the buying and selling process. Users can browse a vast selection of watches from the comfort of their homes, leading to increased accessibility and convenience. Lastly, the potential for investment appreciation on certain watch models further fuels the market. Many luxury watches appreciate in value over time, making them attractive investments in addition to fashion accessories. The interplay of these elements creates a robust and dynamic market primed for continued expansion.

Despite the impressive growth, the used watch resale service market faces significant challenges. Counterfeit products remain a major concern, requiring robust authentication processes and potentially impacting consumer trust. Maintaining consistent pricing remains difficult, as the value of a used watch can fluctuate depending on various factors including market trends, condition, and rarity. Logistics, particularly international shipping, can be costly and complex, potentially impacting profit margins and customer satisfaction. The authentication process itself is time-consuming and resource-intensive, requiring specialized expertise and technology. Furthermore, building and maintaining consumer trust is an ongoing challenge, particularly for newer players in the market. This requires extensive investment in transparency, customer service, and rigorous quality control. Finally, regulating the market and ensuring compliance with various legal and ethical standards adds to the operational complexity and cost. These challenges, while significant, are not insurmountable. Continued investment in technology, robust authentication practices, and strong customer service strategies can mitigate many of these challenges and ensure continued market growth.

Online Resale Service: This segment is projected to dominate the market due to the increasing accessibility and convenience it offers. Consumers can browse a vast selection of watches from anywhere in the world, at any time. This eliminates geographical limitations and expands the market reach significantly.

Key Regions: North America and Western Europe are expected to maintain leading positions due to their established luxury watch markets, high disposable incomes, and established online retail infrastructure.

The combination of online distribution and the focus on key geographic regions with robust luxury goods markets ensures the highest market penetration and profitability within the used watch resale service sector.

Several factors are catalyzing growth within the used watch resale service industry. Technological advancements in watch authentication and verification significantly enhance consumer trust and reduce the risk of purchasing counterfeit products. The increasing popularity of sustainable consumption further drives demand for pre-owned goods, making the used watch market an attractive option for environmentally conscious consumers. Finally, the strategic partnerships between online resale platforms and luxury watch brands legitimize the secondary market and expand the overall appeal to luxury consumers.

This report provides a detailed analysis of the used watch resale service market, covering market trends, driving forces, challenges, key players, and significant developments from 2019 to 2033. The report offers invaluable insights for businesses looking to enter or expand within this rapidly growing sector, providing forecasts and recommendations for future success. This analysis uses a combination of qualitative and quantitative data to provide a comprehensive view of the market dynamics, including detailed regional breakdowns and segment analysis to pinpoint key opportunities and potential challenges.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include The RealReal, The Outnet, FASHIONPHILE Group, Vestiaire Collective, SOU, Tradesy, Etsy, Luxepolis, Crown & Calibre, The Luxury Closet, Watchfinder, WatchBox, Cresus, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Used Watch Resale Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Watch Resale Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.