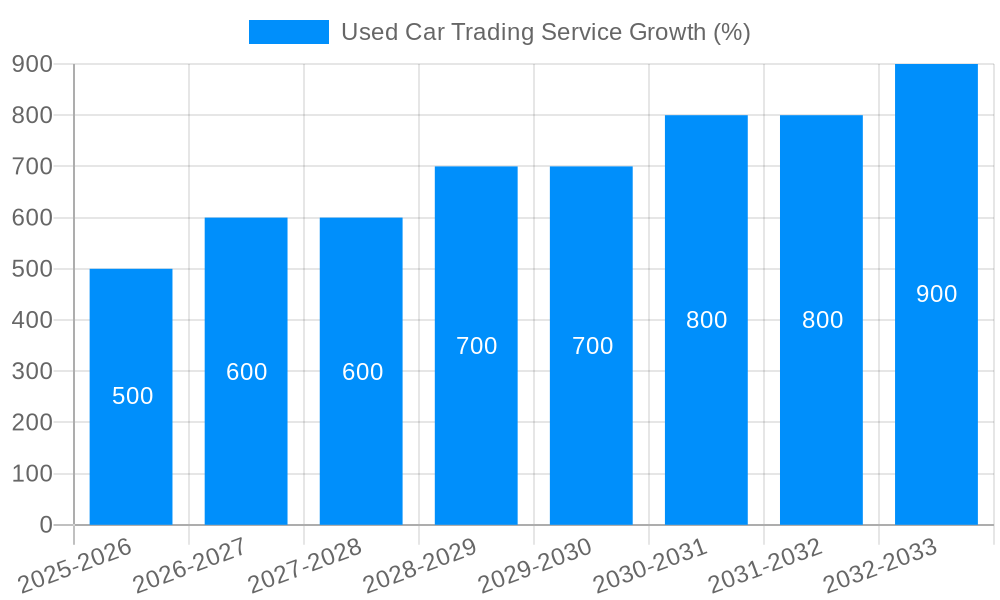

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Trading Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Car Trading Service

Used Car Trading ServiceUsed Car Trading Service by Application (Personal Owners, Car Rental Company, Government, Others), by Type (Auction, Consignment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

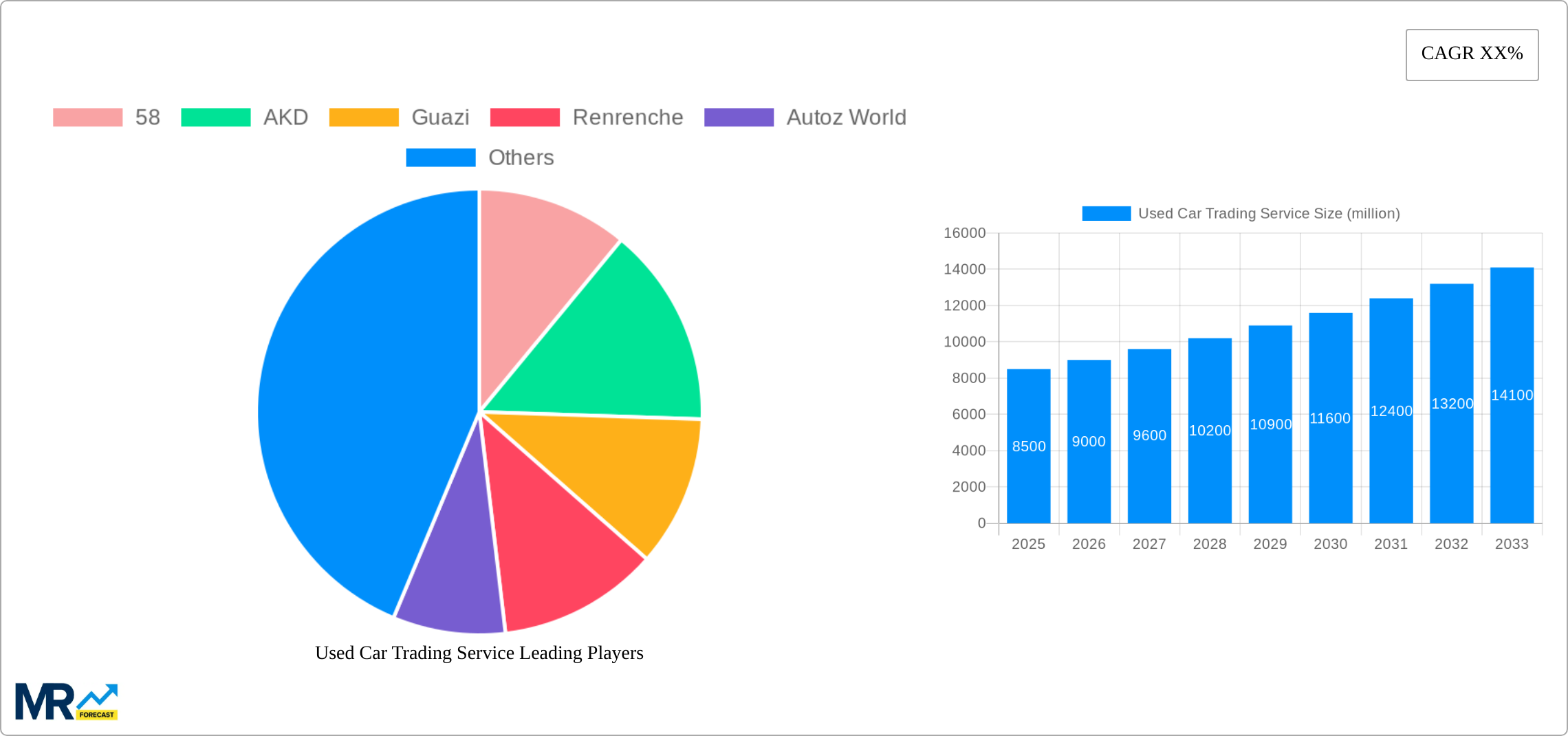

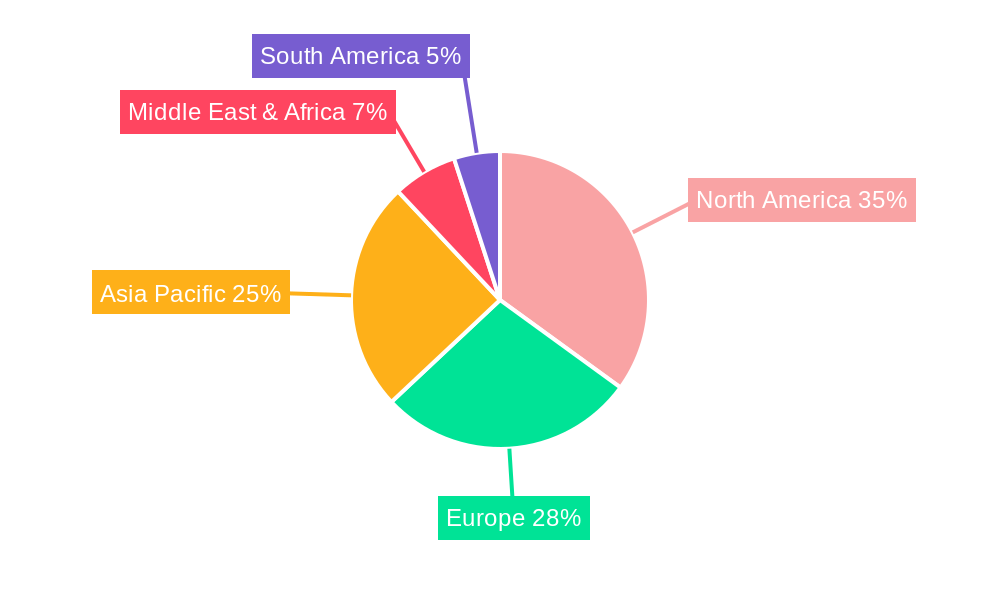

The used car trading service market is experiencing robust growth, driven by increasing consumer preference for pre-owned vehicles due to affordability and the impact of inflation on new car prices. The market's expansion is further fueled by the rise of online platforms facilitating convenient transactions and increased transparency. Technological advancements, such as AI-powered valuation tools and virtual inspections, are streamlining the buying and selling process, attracting a wider range of users. Key market segments include personal owners, car rental companies, and government agencies, each contributing significantly to overall market volume. The auction and consignment sales models dominate the market, reflecting different consumer preferences and risk tolerances. While the market faces challenges such as concerns over vehicle history and maintenance costs, these are being mitigated by the emergence of certified pre-owned programs and extended warranties. Geographic distribution is varied, with North America and Asia Pacific currently leading in market share. However, developing economies in regions such as South America and Africa exhibit high growth potential due to increasing car ownership and the expansion of digital infrastructure. This market is highly competitive, with established players like AutoTrader, Edmunds, and Kelley Blue Book alongside emerging online marketplaces such as Guazi and Renrenche vying for market dominance through innovative features and targeted marketing. The forecast for the next decade indicates sustained growth, propelled by technological innovation and evolving consumer behaviors.

The future of the used car trading service market hinges on addressing evolving consumer needs and technological advancements. This includes enhancing trust and transparency through robust vehicle history reporting and improved quality control measures. The integration of blockchain technology holds significant potential for enhancing security and efficiency in transactions. Furthermore, the expansion of financing options and personalized service offerings will further cater to diverse consumer segments. Expansion into underserved markets, particularly in developing regions, offers significant growth opportunities. The market's competitive landscape will continue to evolve, with established players adapting their strategies to compete with innovative startups leveraging cutting-edge technologies. Strategic partnerships and acquisitions will be key drivers in shaping the market’s future landscape.

The used car trading service market is experiencing explosive growth, projected to reach multi-million unit transactions by 2033. The historical period (2019-2024) witnessed significant market expansion driven by factors such as increasing vehicle ownership, particularly in developing economies, coupled with a rising preference for pre-owned vehicles due to their affordability compared to new cars. The base year (2025) provides a crucial snapshot of the market's current trajectory, with a substantial number of transactions already underway across various segments. The forecast period (2025-2033) anticipates continued robust growth, propelled by technological advancements within the industry, such as online platforms and improved vehicle inspection services that increase consumer confidence. This trend is further amplified by the shift in consumer preferences towards convenience and transparency, which online platforms excel at providing. While traditional auction methods continue to hold a significant share, the rapid growth of online consignment models and other innovative trading mechanisms is reshaping the competitive landscape. This shift towards digitalization is not only boosting transaction volumes but also fostering greater price transparency and facilitating more efficient market matching, benefiting both buyers and sellers. The growing adoption of subscription models for vehicle ownership is also impacting the market, introducing a new dynamic to used car trading. This trend allows consumers access to various vehicles without the long-term commitment of ownership, potentially influencing the volume and frequency of used car transactions. Finally, the evolving regulatory landscape and environmental concerns surrounding vehicle emissions are also influencing the market by driving demand for specific types of used vehicles and impacting trading practices. The market size, measured in millions of units traded annually, demonstrates a strong upward trajectory, reflecting its dynamism and potential for further expansion.

Several key factors are driving the phenomenal growth of the used car trading service market. The affordability of used vehicles compared to new cars is a primary driver, especially in emerging markets and among budget-conscious consumers. The rise of online marketplaces and mobile applications has dramatically increased accessibility and transparency, simplifying the buying and selling process. These platforms offer greater convenience, wider selection, and detailed vehicle history reports, thereby building consumer confidence. Furthermore, the increasing penetration of smartphones and internet access globally is further fueling this digital transformation. The expansion of third-party inspection services and certifications adds another layer of trust, mitigating the risks associated with purchasing used cars. These services provide independent assessments of vehicle condition, reducing information asymmetry and promoting fairer transactions. Government regulations, while sometimes posing challenges, can also indirectly boost the market by promoting vehicle safety standards and mandating vehicle inspections, encouraging safer and more reliable used car transactions. Finally, the growth of the car rental and ride-hailing industries contributes significantly by creating a continuous supply of used vehicles entering the market after their operational lifespan in commercial fleets. This cycle sustains market dynamism and volume.

Despite its remarkable growth, the used car trading service market faces several challenges. Maintaining data integrity and combating fraudulent activities are crucial concerns. Ensuring the accuracy and reliability of vehicle history reports and preventing the sale of vehicles with undisclosed damage or issues requires robust mechanisms and regulatory oversight. The fluctuating prices of used cars, influenced by various economic factors and market trends, present a challenge for both buyers and sellers. Accurate pricing and valuation are critical for successful transactions. The lack of standardization in vehicle inspection and grading systems across different regions and platforms creates inconsistencies and may lead to disputes. Establishing a widely accepted and transparent standard for assessing vehicle condition is necessary to build consumer confidence and facilitate smoother transactions. Furthermore, logistical challenges, including vehicle transportation and delivery, can impact the efficiency and cost-effectiveness of the trading process. Developing efficient and reliable logistics solutions is essential, especially for online marketplaces operating across wide geographical areas. Finally, addressing environmental concerns related to used vehicle emissions and promoting sustainable trading practices are increasingly important considerations for the long-term growth and sustainability of the market.

The used car trading service market displays significant regional variations. While precise market share data by country is unavailable for this report, some key observations can be made:

China: Given its sheer population and rapidly expanding automotive sector, China is likely a major player, with platforms like Guazi and Renrenche showcasing strong growth.

USA: The USA represents another substantial market, with established players like Edmunds and KBB holding significant influence.

Dominant Segments:

Application: Personal Owners: This segment consistently represents the largest share of the market, driven by individual consumers seeking affordable transportation. The convenience and accessibility offered by online platforms cater directly to this substantial user base. This segment will remain the key driver of market growth in the forecast period, with sustained demand for used vehicles from both first-time buyers and individuals upgrading their vehicles. The affordability factor, combined with the increased transparency and ease of online transactions, is driving a significant portion of this segment's growth.

Type: Online Consignment: This rapidly expanding segment leverages technology to streamline the process, offering sellers a convenient platform to list their vehicles and buyers a wide selection to choose from. Online consignment is rapidly overtaking traditional auction methods due to its improved transparency, greater reach, and convenience. The growth of this segment is a testament to the accelerating adoption of technology within the used car market. Features such as detailed vehicle history reports, virtual inspections, and secure payment gateways contribute to its appeal, driving its dominance.

(The paragraph above provides further explanation of the dominant segment of Online Consignment.)

The used car trading service industry's growth is fueled by several factors: rising vehicle ownership globally, especially in developing nations; increasing consumer preference for affordable, pre-owned vehicles; technological advancements simplifying the buying and selling process through online platforms; and the expansion of third-party inspection and certification services enhancing transparency and trust. Furthermore, the integration of innovative financing options and subscription models is broadening market access and fostering further growth.

This report provides a comprehensive overview of the used car trading service market, encompassing historical data, current market dynamics, and future projections. It analyzes key market segments, identifies major players, and assesses the driving forces and challenges influencing the market's growth trajectory. This in-depth analysis offers valuable insights for stakeholders seeking a deeper understanding of this dynamic and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AKD, Guazi, Renrenche, Autoz World, 58, Auto Home, Cars, Ture Car, Edmunds, Kbb, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Used Car Trading Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Car Trading Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.