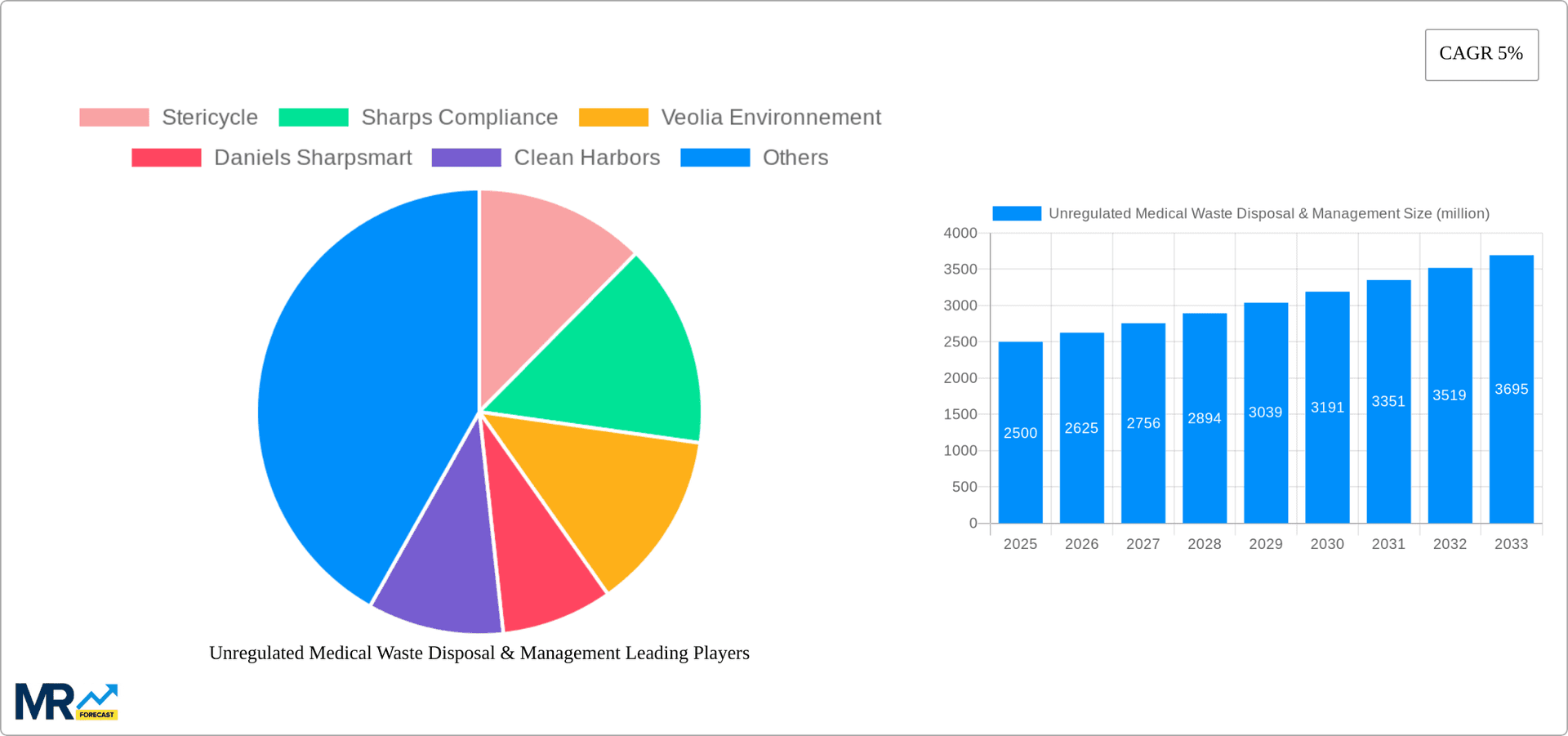

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unregulated Medical Waste Disposal & Management?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Unregulated Medical Waste Disposal & Management

Unregulated Medical Waste Disposal & ManagementUnregulated Medical Waste Disposal & Management by Type (Incineration, Autoclaves, Others), by Application (Hospitals, Clinics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The unregulated medical waste disposal and management market faces significant challenges and opportunities. While precise market sizing data is unavailable, based on industry reports and the provided CAGR of 5%, we can infer substantial growth. The market's value likely sits in the billions, considering the sheer volume of medical waste generated globally and the increasing regulatory scrutiny in many regions. Key drivers include the rising prevalence of infectious diseases, the expansion of healthcare infrastructure in developing nations, and growing awareness of the environmental and public health risks associated with improper waste disposal. Emerging trends include advancements in waste treatment technologies (like improved incineration and autoclave systems), a push towards sustainable waste management practices (including recycling and energy recovery), and the increasing adoption of digital tracking systems for better waste management chain accountability. However, the market faces restraints such as high initial investment costs for advanced technologies, a lack of robust regulatory frameworks in some regions, and the persistent challenge of effectively managing the increasing volumes of diverse medical waste streams, particularly in resource-constrained settings. The segmentation by waste type (incineration, autoclaves, others) and application (hospitals, clinics, others) highlights the varied nature of the market, with hospitals and clinics forming the largest segments. The competitive landscape includes both large multinational corporations and smaller specialized firms, suggesting a mix of established players and innovative startups vying for market share.

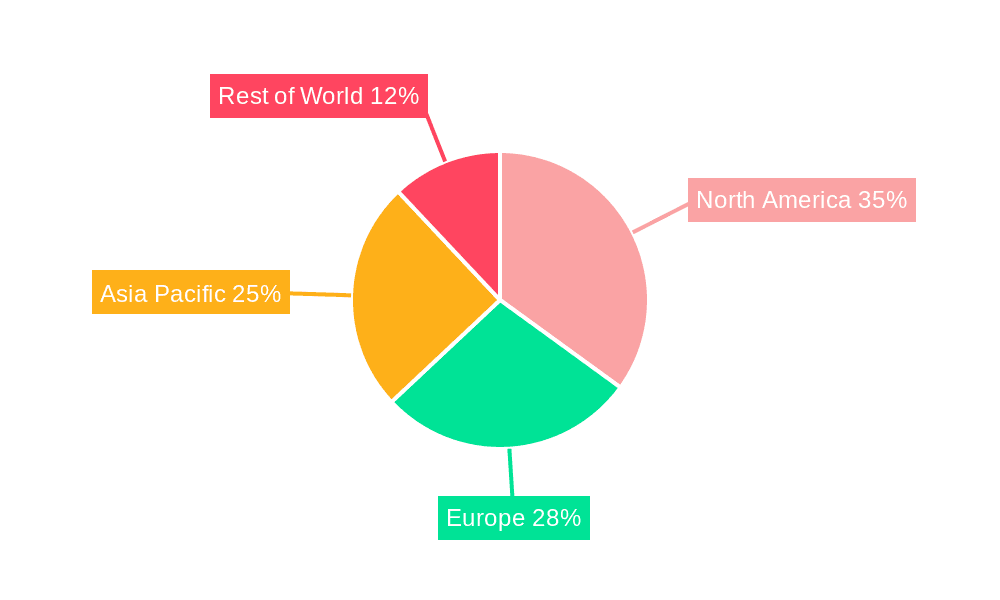

The geographical distribution reveals significant market potential across all regions, with North America and Europe currently holding larger market shares due to stricter regulations and higher healthcare spending. However, rapid growth is expected in Asia-Pacific and other developing regions as healthcare infrastructure improves and awareness of safe waste management increases. The forecast period of 2025-2033 promises further expansion driven by technological advancements and strengthening regulatory enforcement. Companies must prioritize compliance, investment in sustainable technologies, and international collaborations to capitalize on this growing and evolving market. The unregulated nature of a portion of the market presents both a challenge and an opportunity, particularly for companies offering compliant and efficient solutions.

The unregulated medical waste disposal and management market presents a complex and concerning picture. While the overall medical waste management market is experiencing significant growth, driven by increasing healthcare spending and stricter regulations in many developed nations, the unregulated segment represents a significant challenge. This sector, characterized by inadequate disposal practices, poses substantial risks to public health and the environment. The lack of proper treatment and disposal methods leads to widespread contamination, impacting soil, water, and air quality. This report analyzes the market dynamics of this unregulated sector, focusing on the study period from 2019 to 2033, with a base year of 2025. Our estimations suggest a market size of several hundred million dollars in 2025, projected to experience substantial growth throughout the forecast period (2025-2033). However, this growth is not indicative of positive trends; rather, it reflects the sheer volume of medical waste improperly managed globally. The historical period (2019-2024) saw a concerning rise in incidents related to unregulated waste, highlighting the urgent need for improved infrastructure and regulatory frameworks. This growth, therefore, underscores the need for increased investment in proper waste management solutions and stringent enforcement of regulations, to mitigate the severe health and environmental risks associated with this issue. The market’s growth in this segment reflects a failure rather than success, representing missed opportunities for both public health and the potential for a legitimate, regulated industry to thrive. Further analysis reveals geographical variations, with developing nations exhibiting higher proportions of unregulated waste disposal due to limited resources and infrastructure. The lack of awareness regarding the associated risks further exacerbates the situation. This report will delve into these specific challenges and opportunities, outlining potential pathways to curtail the growth of this unregulated sector and promote sustainable, responsible medical waste management practices.

Several factors contribute to the persistence of unregulated medical waste disposal and management. Firstly, the significant cost associated with proper disposal methods often deters small clinics and healthcare facilities, particularly in developing countries, leading them to resort to cheaper, but highly risky, alternatives. This is further compounded by a lack of readily available and affordable regulated disposal services in many regions. Secondly, inadequate regulatory frameworks and enforcement mechanisms allow for the proliferation of unsafe practices. Weak penalties and a lack of consistent oversight enable illegal dumping and informal disposal methods to persist, hindering effective waste management. The absence of proper training and awareness among healthcare personnel regarding safe disposal practices also plays a significant role. Improper handling and segregation of waste at the source contribute directly to the problem. Finally, rapid urbanization and population growth in many developing nations strain existing waste management systems, leading to an increase in the volume of unregulated medical waste generated. These combined pressures create a complex challenge that requires a multi-faceted approach involving enhanced regulation, financial incentives for compliance, and robust public awareness campaigns to effectively address the issue. The sheer volume of medical waste produced, coupled with lax enforcement, continues to fuel the market size, although this “growth” is a negative indicator of widespread systemic failures.

The primary challenge lies in the inherent health and environmental risks posed by unregulated medical waste disposal. Improper disposal leads to the spread of infectious diseases, water contamination, and soil pollution. This poses significant risks to human health and ecosystem integrity. Furthermore, the lack of data and transparency makes it difficult to accurately assess the true extent of the problem. This hinders the development of effective mitigation strategies and the allocation of necessary resources. The economic burden associated with the consequences of unregulated disposal is considerable, including healthcare costs, environmental remediation, and loss of productivity. The enforcement of regulations is consistently hampered by inadequate infrastructure, corruption, and limited resources. The lack of awareness among healthcare providers and the general public about the importance of proper waste management further compounds the challenge. Finally, the lack of standardized disposal practices and technologies creates inconsistency in management methods, exacerbating the risks and limiting the effectiveness of existing interventions. Overcoming these challenges necessitates a concerted effort involving policymakers, healthcare providers, waste management companies, and communities alike.

While precise market share data for the unregulated sector is difficult to obtain due to its clandestine nature, several regions and segments stand out as likely contributors to the overall volume of improperly managed waste.

Developing Countries: Sub-Saharan Africa, parts of South Asia, and Latin America likely represent areas with the highest percentage of unregulated medical waste due to limited resources, weak regulatory frameworks, and a lack of robust waste management infrastructure. Millions of tons of unregulated waste are likely generated in these regions annually, far exceeding the capacity of available, formal disposal methods. The sheer scale of the population and healthcare needs in these regions contribute significantly to the problem.

Hospitals: Hospitals generate significantly higher volumes of medical waste compared to clinics or other healthcare settings. The higher concentration of infectious and hazardous waste in hospitals makes proper management crucial. However, budgetary constraints or a lack of stringent internal protocols in some facilities might lead to shortcuts in disposal practices, contributing significantly to the unregulated sector.

Incineration (Improperly managed): Though incineration is a common and sometimes necessary method of medical waste disposal, when conducted improperly without proper emission controls and safety measures, it poses significant environmental and health hazards, falling squarely into the unregulated market.

Paragraph summarizing the dominant regions and segments: The unregulated medical waste market is not a positive growth story. It is, in fact, a stark indicator of significant failings in global healthcare infrastructure. Developing nations, due to resource limitations and regulatory gaps, likely dominate this market segment. Within these regions, hospitals, owing to their high volume of hazardous waste, contribute disproportionately. Furthermore, improper incineration—a failure to properly manage the incineration process—adds to the significant environmental and health risks. The substantial and rapid increase in unregulated waste in these areas underlines the urgent need for international cooperation, investment in sustainable waste management solutions, and strong enforcement of environmental regulations.

Ironically, the very factors that fuel growth in this sector – population growth, increased healthcare access (without proper infrastructure), and rapid urbanization – also highlight the urgent need for effective intervention. These catalysts underscore the need to proactively develop and implement comprehensive medical waste management strategies, rather than simply reacting to the growing problem. Without focused effort, the “growth” in unregulated medical waste will continue unabated, posing an ever-increasing threat to public health and the environment.

This section focuses on companies actively involved in regulated medical waste management; the unregulated sector is, by its nature, difficult to pinpoint specific players. These companies, through their operations, indirectly limit the unregulated market by offering compliant solutions.

Due to the clandestine nature of unregulated waste disposal, tracking specific developments is challenging. However, the following represent overall trends that are relevant:

This report provides a crucial overview of the unregulated medical waste disposal and management market. While the market size reflects a significant and concerning problem, the focus is not on celebrating growth but on highlighting the urgent need for systemic changes. This report serves as a call to action, providing insight into the drivers of this alarming trend and outlining the key challenges and potential strategies for mitigation. Understanding the scale of the unregulated sector is critical to developing effective solutions and preventing further environmental and health damage.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Stericycle, Sharps Compliance, Veolia Environnement, Daniels Sharpsmart, Clean Harbors, Citiwaste, ATI, Sanpro Waste, Waste Management, Medical Waste Management, MedPro Waste Disposal, Cyntox, Triumvirate, Bertin Medical Waste, BioServeUSA, PureWay Total Compliance, Medasend, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Unregulated Medical Waste Disposal & Management," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Unregulated Medical Waste Disposal & Management, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.