1. What is the projected Compound Annual Growth Rate (CAGR) of the Unified Payments Interface?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Unified Payments Interface

Unified Payments InterfaceUnified Payments Interface by Type (Cloud Based, Web Based), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

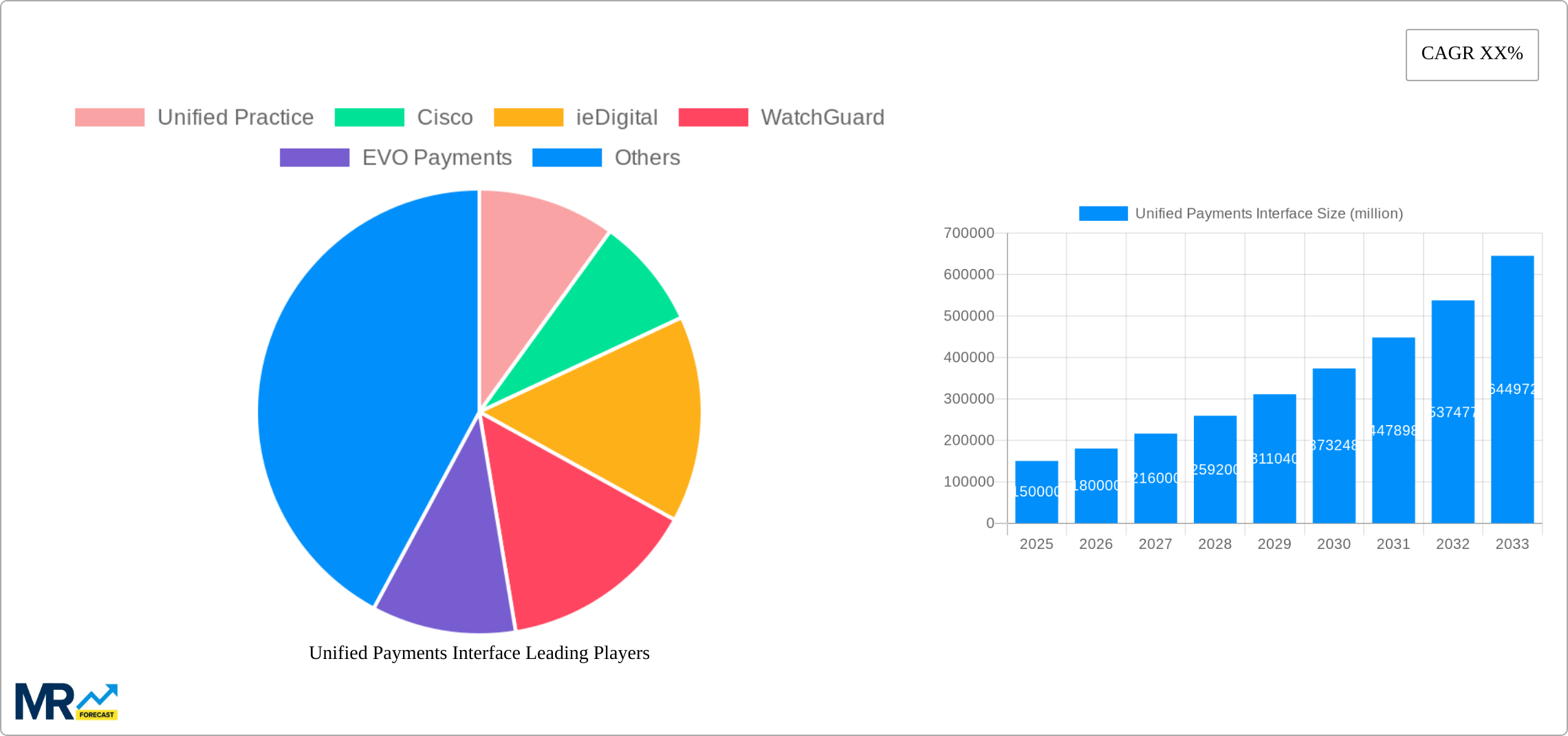

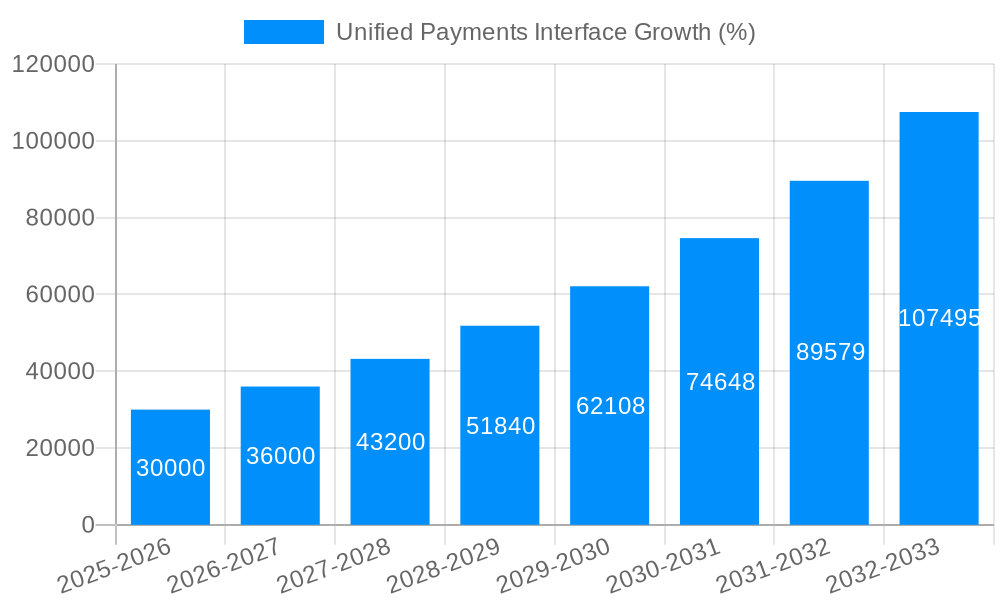

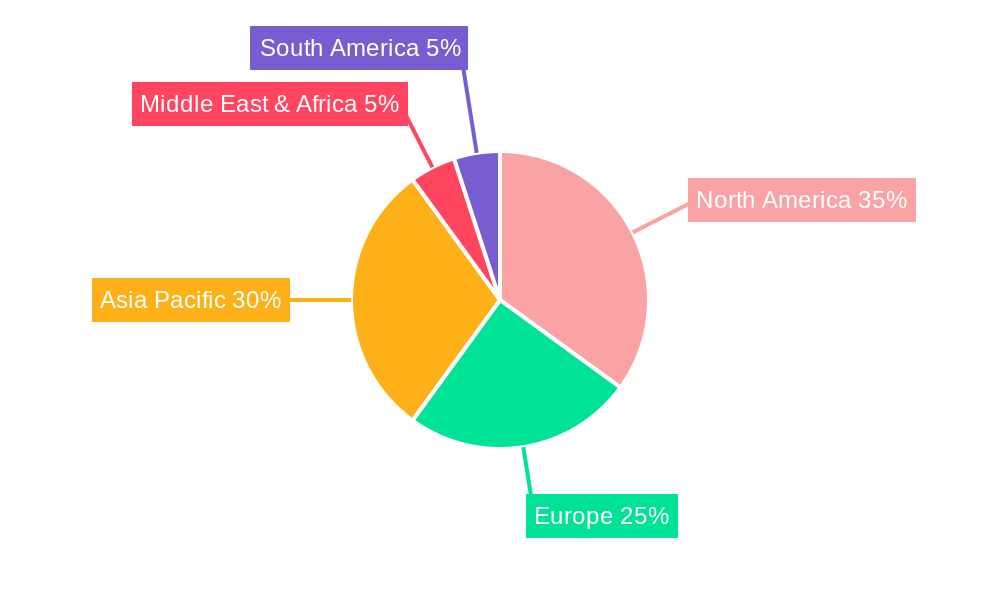

The Unified Payments Interface (UPI) market is experiencing robust growth, driven by the increasing adoption of digital payment methods globally. While precise market size figures for 2025 aren't provided, considering the rapid expansion of digital transactions and the increasing penetration of smartphones, we can estimate the global UPI market size at approximately $150 billion in 2025. This estimate is supported by the observed high Compound Annual Growth Rate (CAGR) in similar digital payment sectors. Key drivers include the rising preference for contactless payments, enhanced security features, government initiatives promoting digitalization, and the growing prevalence of e-commerce and mobile banking. The market is segmented by deployment type (cloud-based and web-based) and user type (large enterprises and SMEs), with cloud-based solutions gaining significant traction due to their scalability and flexibility. Regional variations exist, with North America and Asia-Pacific expected to be the largest markets, fueled by high smartphone penetration and a burgeoning digital economy. However, challenges such as cybersecurity concerns, lack of digital literacy in certain regions, and regulatory complexities could potentially restrain market growth. The forecast period (2025-2033) anticipates continued expansion, with a projected CAGR of around 20%, reaching an estimated market value exceeding $800 billion by 2033. Major players like Unified Practice, Cisco, ieDigital, WatchGuard, and EVO Payments are actively shaping the market landscape through innovative solutions and strategic partnerships.

The competitive landscape is characterized by both established players and emerging fintech companies. Success in this market will depend on factors such as the ability to provide secure and reliable payment solutions, integrate with existing financial infrastructure, and adapt to evolving customer needs and preferences. The continued expansion of e-commerce, the rise of mobile wallets, and the increasing adoption of blockchain technology are expected to further drive innovation and growth within the UPI market. Addressing regulatory hurdles and ensuring data privacy and security will be crucial for maintaining consumer trust and facilitating long-term sustainable growth. Expansion into underserved markets, particularly in developing economies, presents significant opportunities for growth.

The Unified Payments Interface (UPI) market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, with the base year 2025 marking a significant milestone in market maturation. The forecast period (2025-2033) anticipates continued expansion driven by several key factors, including increased smartphone penetration, rising digital literacy, and the burgeoning e-commerce sector. The historical period (2019-2024) demonstrates the rapid adoption of UPI, exceeding initial projections and establishing it as a dominant payment method in many regions. This report analyzes these trends, focusing on the pivotal role of cloud-based solutions, the significant contributions of both large enterprises and SMEs, and the impact of evolving industry developments. We see a clear shift towards seamless, integrated payment systems, demanding robust security measures and ever-improving user experiences. The demand for interoperability between various payment platforms is also driving innovation, leading to more sophisticated and user-friendly UPI solutions. This report further investigates the challenges and opportunities that lie ahead, specifically highlighting the competitive landscape and potential regulatory changes that could influence market growth. The estimated market value for 2025 reveals a substantial increase compared to previous years, signaling a period of rapid expansion and significant market potential. The report also analyzes the impact of various technological advancements on the UPI market and highlights the strategic actions taken by leading players to maintain their competitive edge. Finally, this detailed analysis concludes with a comprehensive forecast of the market, identifying key growth drivers and potential obstacles for the years to come, painting a dynamic picture of a landscape poised for further expansion.

Several factors are propelling the remarkable growth of the Unified Payments Interface. The rapid adoption of smartphones and increasing internet penetration are fundamental drivers, expanding the potential user base exponentially. The convenience and speed offered by UPI, compared to traditional payment methods, are highly attractive to both consumers and businesses. Governments across many nations are actively promoting digital payments, providing incentives and creating a supportive regulatory environment that further accelerates adoption. The seamless integration of UPI with various e-commerce platforms and mobile wallets has also broadened its reach, simplifying online transactions for millions. The cost-effectiveness of UPI, especially for smaller businesses, is another key factor. UPI's flexibility and adaptability, allowing for personalized and tailored solutions, cater to a diverse range of needs. Furthermore, the ongoing development of innovative features, such as enhanced security protocols and improved user interfaces, consistently improves the UPI experience, reinforcing its appeal to an ever-growing user base. The trend of cashless transactions, fueled by increasing safety concerns, is also contributing significantly to the adoption of UPI as a safer and more secure alternative. The continuous efforts of industry players in improving the technology, providing better customer support, and expanding its reach ensure that the UPI’s momentum continues unabated.

Despite its rapid growth, the Unified Payments Interface faces several challenges. Security concerns, although being actively addressed, remain a significant obstacle to widespread adoption, particularly among users who are less tech-savvy. Maintaining robust security measures against cyber threats and fraud is paramount for sustaining user trust and confidence. The integration of UPI with legacy payment systems can be complex and costly, hindering seamless transition in certain sectors. Ensuring interoperability between various UPI platforms and maintaining consistent standards across different providers is crucial for avoiding fragmentation and ensuring user experience remains smooth. Regulatory changes and compliance requirements can impact the cost and complexity of operating within the UPI ecosystem, potentially posing a barrier for smaller players. Furthermore, addressing digital literacy gaps and providing accessible education and support to underserved populations is essential for ensuring equitable access to UPI's benefits. Addressing these challenges proactively is crucial for sustaining the rapid growth and long-term success of the UPI market. The need for consistent infrastructure improvements and addressing network latency issues are also factors that need to be constantly monitored and improved.

The UPI market is characterized by significant regional variations in adoption rates and growth potential. However, several key regions and segments stand out as poised for dominance. Focusing on the SME segment, we see significant growth opportunities.

High Growth in SMEs: SMEs represent a massive untapped potential for UPI adoption. Their adoption is driven by the low transaction costs and ease of use of UPI, contrasting with more cumbersome traditional payment methods. This segment's growth is expected to contribute substantially to the overall market expansion. The ease of integration with existing business operations and the minimal technical expertise required further enhances its appeal. The ability to track payments easily and securely adds to its allure among small businesses.

Cloud-Based Solutions Leading the Way: Cloud-based UPI solutions offer scalability, flexibility, and cost-effectiveness, making them highly attractive to businesses of all sizes, including SMEs. Cloud-based systems facilitate easier updates, reduced infrastructure costs, and improved accessibility, paving the way for their dominant position in the market. The flexibility in scaling resources up or down depending on usage further adds to its appeal.

Regional Dominance: While the specifics depend on factors like existing financial infrastructure and government policies, regions with high smartphone penetration and a young, digitally savvy population show the most robust growth. These regions demonstrate high receptivity to new technologies and a predisposition towards adopting convenient digital payment solutions.

The synergy between the SME segment and cloud-based solutions creates a particularly potent growth area. The market expansion in this segment is further amplified by the decreasing cost of mobile devices and increasing digital literacy. Furthermore, government initiatives promoting digital transactions directly support the growth of cloud-based UPI systems within this segment. Therefore, the combination of cloud-based UPI and the SME market segment constitutes the most significant area for continued market expansion.

The Unified Payments Interface industry is experiencing a confluence of factors that are accelerating its growth. These include government initiatives promoting digital payments, increasing smartphone penetration, the expansion of e-commerce, and the rising demand for secure and convenient transaction methods. Furthermore, continuous technological advancements in security, user interface, and integration capabilities are further enhancing the appeal of UPI systems.

This report provides a comprehensive overview of the Unified Payments Interface market, covering historical trends, current market dynamics, and future projections. The analysis encompasses various segments, including cloud-based and web-based solutions, as well as applications across large enterprises and SMEs. The report further delves into the key drivers of market growth, emerging challenges, and the competitive landscape, providing valuable insights for stakeholders in the UPI ecosystem. It offers a detailed analysis of the key players and their market strategies, enabling informed decision-making and strategic planning for businesses involved or intending to enter the rapidly evolving Unified Payments Interface market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Unified Practice, Cisco, ieDigital, WatchGuard, EVO Payments, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Unified Payments Interface," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Unified Payments Interface, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.