1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV Aerial Survey Service?

The projected CAGR is approximately 5.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

UAV Aerial Survey Service

UAV Aerial Survey ServiceUAV Aerial Survey Service by Type (Orthophoto, Oblique Image), by Application (Forestry and Agriculture, Construction, Power and Energy, Oil and Gas, Environment Studies, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

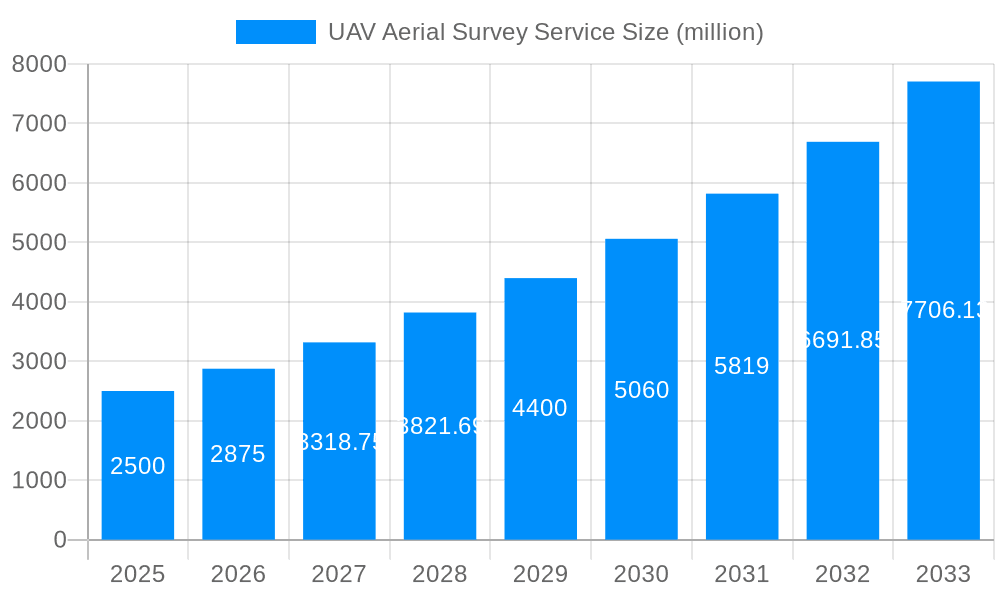

The UAV Aerial Survey Services market is experiencing robust growth, driven by increasing demand across diverse sectors. Technological advancements in drone technology, coupled with falling costs and improved image processing capabilities, are significantly contributing to this expansion. The market's versatility is evident in its application across forestry and agriculture (monitoring crop health, deforestation analysis), construction (site surveying, progress monitoring), power and energy (infrastructure inspection, pipeline surveillance), oil and gas (pipeline inspection, exploration), and environmental studies (land cover mapping, pollution monitoring). While precise market sizing data was not provided, considering similar markets and growth trends, a reasonable estimation places the 2025 market value at approximately $2.5 billion USD, with a compound annual growth rate (CAGR) of 15% projected through 2033. This significant growth is fueled by the efficiency and cost-effectiveness of UAV surveys compared to traditional methods, allowing for quicker data acquisition, reduced manpower needs, and improved accessibility to challenging terrains.

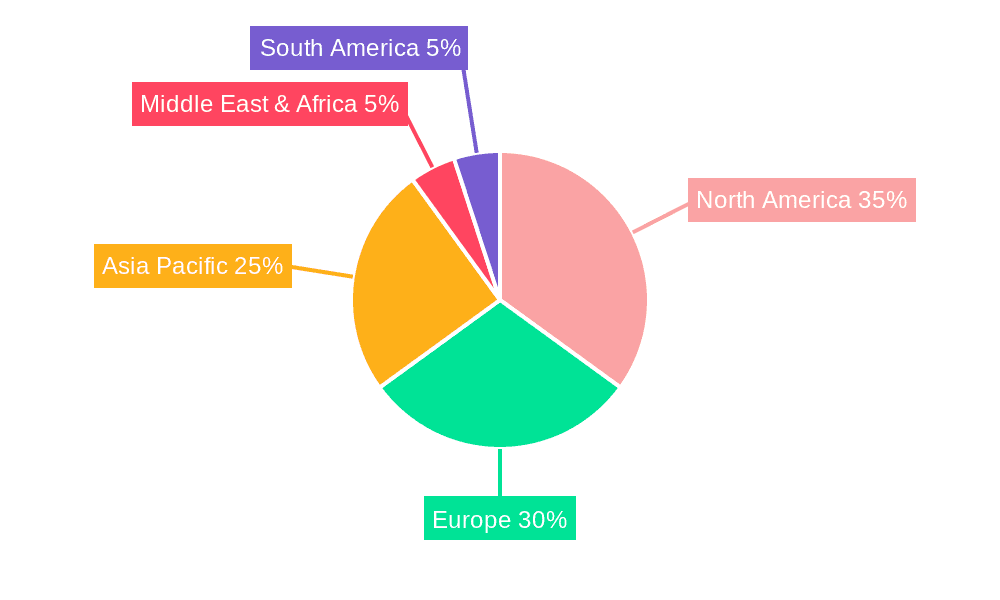

However, market expansion faces certain restraints. Regulatory hurdles surrounding drone operations, including licensing requirements and airspace restrictions, pose challenges to market penetration. Furthermore, data security concerns and the need for skilled professionals to operate and analyze the collected data represent potential limitations. The market is segmented geographically, with North America and Europe currently holding significant market share due to advanced technological infrastructure and higher adoption rates. However, rapidly developing economies in Asia-Pacific are expected to witness significant growth in the coming years, driven by increasing infrastructure development and government initiatives. Key players in this market, including Kokusai Kogyo, Pasco, Asia Air Survey, Zenrin, NV5 Global, and others, are focusing on technological innovation, strategic partnerships, and geographic expansion to maintain their competitive edge. The future of UAV aerial survey services looks promising, with continuous advancements in drone technology and increasing industry adoption expected to drive further market growth in the years to come.

The global UAV aerial survey service market is experiencing significant growth, driven by the increasing adoption of unmanned aerial vehicles (UAVs) or drones across diverse sectors. The market, valued at USD X million in 2025, is projected to reach USD Y million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). This expansion is fueled by several key factors. Firstly, the decreasing cost of UAV technology makes it accessible to a broader range of businesses, including small and medium-sized enterprises (SMEs), who previously lacked the resources for traditional aerial surveys. Secondly, UAVs offer superior speed, efficiency, and precision compared to conventional methods, resulting in cost savings and faster project turnaround times. The ability to capture high-resolution imagery and data in challenging or inaccessible locations further enhances their appeal. Data analysis advancements, including AI-powered solutions for image processing and 3D modeling, are streamlining workflows and unlocking valuable insights from the captured data, boosting productivity and accuracy. The historical period (2019-2024) witnessed steady growth, laying the foundation for the projected exponential expansion in the coming years. Market segmentation reveals a strong demand for orthophoto and oblique image services across diverse applications, with significant contributions from the construction, power & energy, and environmental sectors. This report provides in-depth analysis of this market, examining key trends, driving forces, challenges, and the leading players shaping its future. The study period covered is 2019-2033, with 2025 serving as both the base and estimated year.

Several factors are driving the rapid expansion of the UAV aerial survey service market. The primary force is the technological advancements in drone technology, leading to enhanced capabilities like longer flight times, improved image quality, and increased payload capacity. This translates to more efficient and cost-effective surveys, covering larger areas in shorter timeframes. Furthermore, the development of sophisticated software for data processing and analysis is crucial. These advancements enable quick and accurate extraction of valuable information from aerial imagery, accelerating project completion and reducing reliance on manual interpretation. The growing demand for precise and up-to-date spatial data across various industries, including construction, agriculture, and environmental monitoring, is another significant driver. Businesses are increasingly recognizing the value of UAV-based surveys for informed decision-making, project optimization, and risk mitigation. Finally, the supportive regulatory environment in many regions is simplifying the process of obtaining permits for UAV operations, making drone surveys more readily accessible to businesses. These factors, in combination, ensure the continued growth and widespread adoption of UAV aerial survey services.

Despite its rapid growth, the UAV aerial survey service market faces certain challenges and restraints. Firstly, stringent regulations and airspace restrictions in some regions can limit operational flexibility and increase the complexity of obtaining necessary permits. This adds to the overall cost and time required for projects. Secondly, concerns regarding data security and privacy are emerging as the amount of sensitive geographical information captured increases. Robust data security protocols and compliance with relevant regulations are crucial to address these concerns. The weather dependency of UAV operations also poses a significant challenge. Adverse weather conditions can disrupt survey schedules and potentially delay project timelines. Furthermore, the skilled workforce needed for operating UAVs, processing data, and interpreting results is still in development. Training and development programs are necessary to meet the growing demand for qualified professionals in this sector. Finally, the competitive landscape, with several established players and new entrants, requires companies to continuously innovate and offer competitive pricing strategies to maintain market share. Addressing these challenges will be key to unlocking the full potential of the UAV aerial survey service market.

The North American and European markets are currently leading the UAV aerial survey service market, followed by rapidly developing markets in Asia-Pacific. This leadership is driven by several factors: established regulatory frameworks, early adoption of technology, strong investments in infrastructure projects, and the presence of key players in these regions. However, the Asia-Pacific region is projected to experience the fastest growth rate in the coming years, fueled by increasing infrastructure development, economic growth, and government initiatives promoting the use of UAV technology. Within market segments, orthophoto services are currently dominating the market due to their widespread application in various sectors, including construction, mapping, and agriculture. Orthophotos provide highly accurate and detailed two-dimensional representations of the earth's surface, making them indispensable for numerous applications.

The construction application segment is another significant driver of growth. UAVs are increasingly utilized for site surveying, progress monitoring, 3D modeling, and volume calculations. The accuracy and speed offered by drone-based surveys are transforming construction project management, leading to reduced costs and improved efficiency. This trend is expected to continue, contributing significantly to the overall growth of the UAV aerial survey service market.

The UAV aerial survey service industry's growth is primarily fueled by the continuous technological advancements in drone technology, improved data analytics capabilities, and the increasing demand for precise and efficient surveying solutions across various sectors. The cost-effectiveness and superior efficiency offered by UAVs compared to traditional methods are further driving market adoption. Governmental support and supportive regulatory environments are also contributing significantly to the industry's expansion.

This report provides a comprehensive analysis of the UAV aerial survey service market, offering valuable insights into market trends, growth drivers, challenges, and key players. The report includes detailed forecasts for the period 2025-2033, covering various market segments and geographical regions. It also examines the competitive landscape and identifies opportunities for growth and innovation in this rapidly expanding sector. The report’s findings are based on extensive research and analysis, utilizing both primary and secondary data sources. It is designed to provide businesses and investors with the critical information needed to make informed decisions in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include Kokusai Kogyo, Pasco, Asia Air Survey, Zenrin, NV5 Global, Aerial Data Service, Keystone Aerial Surveys, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "UAV Aerial Survey Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the UAV Aerial Survey Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.