1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV Aerial Survey Service?

The projected CAGR is approximately 5.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

UAV Aerial Survey Service

UAV Aerial Survey ServiceUAV Aerial Survey Service by Type (Orthophoto, Oblique Image), by Application (Forestry and Agriculture, Construction, Power and Energy, Oil and Gas, Environment Studies, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

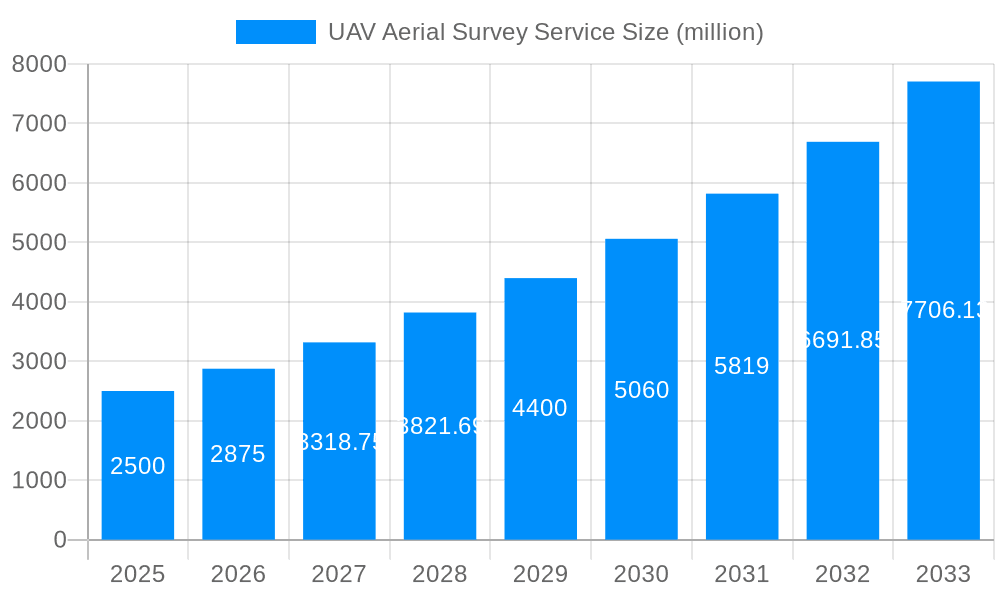

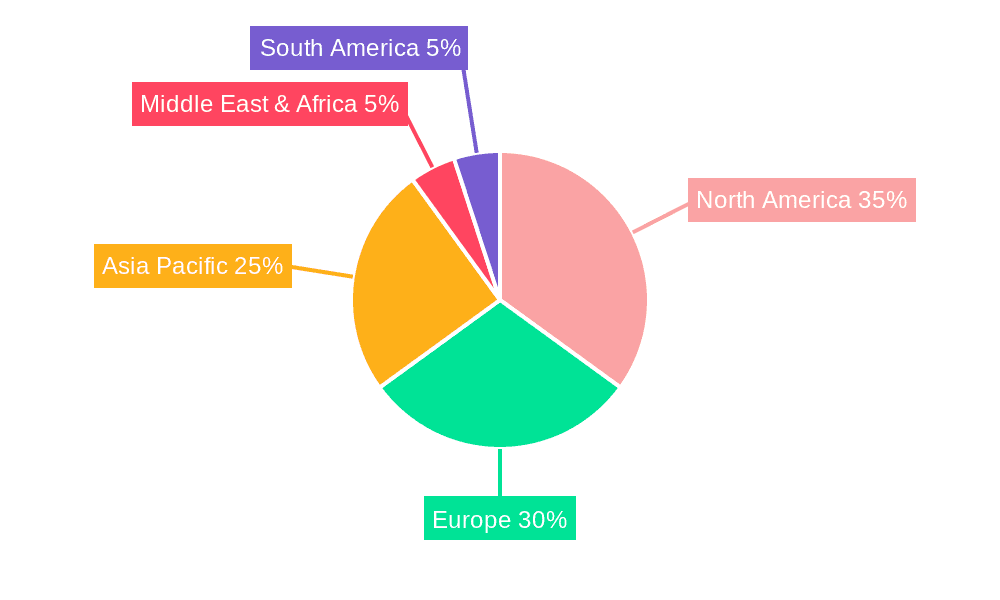

The UAV Aerial Survey Service market is experiencing robust growth, driven by increasing demand across diverse sectors. Technological advancements in drone technology, offering higher resolution imagery and improved data processing capabilities, are significantly contributing to market expansion. The integration of AI and machine learning for automated data analysis further enhances efficiency and reduces operational costs, making UAV surveys a cost-effective alternative to traditional methods. Key application areas include precision agriculture (optimizing crop yields and resource management), construction (monitoring project progress and identifying potential risks), infrastructure inspection (assessing damage to bridges, pipelines, and power lines), and environmental monitoring (mapping deforestation, assessing pollution levels, and managing natural resources). The market is segmented by both UAV type (orthophoto and oblique imagery) and application, with significant growth projected across all segments. While regulatory hurdles and concerns regarding data privacy and security pose challenges, the overall market outlook remains positive. Competition is relatively fragmented, with several established players and emerging companies vying for market share. Geographically, North America and Europe currently hold significant market shares, however, rapid technological adoption in Asia-Pacific is driving substantial growth in this region, particularly in countries like China and India. The projected CAGR, although not explicitly stated, is likely in the range of 15-20% given the rapid technological advancements and expanding applications. This rapid growth is expected to continue throughout the forecast period (2025-2033), making it a lucrative market for investors and industry players.

The market's future growth hinges on several factors. Continued innovation in drone technology, including longer flight times, improved sensor capabilities, and enhanced data analytics, will be critical. The development of robust regulatory frameworks that address safety and data privacy concerns will foster market expansion. Furthermore, increasing awareness among end-users regarding the benefits of UAV aerial surveys – including improved accuracy, reduced costs, and faster turnaround times – will drive adoption. The integration of UAV services with other technologies, such as GIS and BIM, will create synergistic opportunities. Competition will likely intensify, necessitating strategic partnerships and innovation to maintain a competitive edge. Companies will need to focus on offering comprehensive solutions, integrating data acquisition, processing, and analysis services to cater to diverse customer needs.

The global UAV aerial survey service market is experiencing robust growth, projected to reach multi-million-dollar valuations by 2033. The market's expansion is fueled by several factors, including the decreasing cost of UAV technology, advancements in sensor technology offering higher resolution imagery and data processing capabilities, and the increasing demand for efficient and cost-effective surveying solutions across diverse industries. Between 2019 and 2024 (the historical period), the market demonstrated significant expansion, setting the stage for even more substantial growth in the forecast period (2025-2033). The base year for this analysis is 2025, reflecting the current market dynamics and providing a benchmark for future projections. Key market insights reveal a shift towards the adoption of advanced analytics and AI-powered data processing, enabling faster turnaround times and more detailed insights from aerial surveys. This trend is particularly evident in applications like precision agriculture, where real-time data analysis informs optimized resource allocation. The increasing availability of skilled professionals adept at operating UAVs and processing the resulting data further contributes to market growth. Furthermore, regulatory frameworks are evolving to support the safe and responsible integration of UAVs into various airspace, mitigating previous concerns and opening up new avenues for market penetration. The competitive landscape is dynamic, with established players alongside emerging technology companies innovating in areas such as sensor technology and data processing software. This fosters a continuous improvement cycle driving overall market advancement. The market is segmented by type (orthophoto, oblique image), application (forestry and agriculture, construction, power and energy, oil and gas, environment studies, others), and geographic region. While certain segments exhibit faster growth rates than others, the overall upward trend is consistent across the board.

Several key factors are driving the rapid expansion of the UAV aerial survey service market. The most prominent is the significant cost reduction in UAV technology. Initially expensive, UAVs are now much more affordable, making them accessible to a broader range of businesses and organizations. This accessibility, coupled with advancements in sensor technology, results in higher-quality data acquisition at lower costs compared to traditional surveying methods. Moreover, the increasing demand for efficient and timely data acquisition across various sectors is a powerful catalyst. Industries such as construction, agriculture, and environmental studies heavily rely on accurate and up-to-date spatial information, and UAVs provide an unparalleled speed and efficiency advantage in this regard. The ability to conduct surveys in hazardous or hard-to-reach areas adds to the appeal. Finally, the development of sophisticated data processing software and AI-powered analytics significantly reduces the time and resources required to analyze the vast amounts of data collected by UAVs, transforming raw imagery into actionable insights. This combination of affordability, efficiency, and advanced data processing capabilities makes UAV aerial survey services a highly attractive option for numerous applications, fueling market growth.

Despite its promising trajectory, the UAV aerial survey service market faces several challenges. Regulatory hurdles remain a significant obstacle in some regions, with airspace restrictions and licensing requirements varying considerably across jurisdictions. Navigating these complexities can be time-consuming and costly for operators. Furthermore, weather conditions can severely impact the effectiveness of UAV operations, leading to delays and increased operational costs. Data security and privacy concerns are also emerging, requiring robust data encryption and management protocols. The need for skilled personnel to operate UAVs and process the collected data creates a demand for specialized training and workforce development. Competition from established surveying firms offering traditional methods poses another challenge, particularly in sectors where familiarity with traditional techniques is deeply entrenched. Finally, the rapid pace of technological advancements necessitates continuous investment in new equipment and software, representing a significant financial commitment for businesses in this sector. Overcoming these challenges will be crucial for sustained growth and wider market adoption.

The Construction segment is poised for significant dominance within the UAV aerial survey service market. The demand for precise and up-to-date data is particularly high in construction projects, where accurate surveying is crucial for planning, progress monitoring, and ensuring compliance.

High-Resolution Data Needs: Construction projects increasingly rely on high-resolution imagery and 3D modeling to optimize workflows, minimize errors, and accelerate project completion. UAVs excel in providing this level of detail.

Efficiency and Cost Savings: UAVs offer substantial cost and time savings compared to traditional surveying methods, making them highly attractive for large-scale construction projects. Faster data acquisition leads to quicker decision-making and reduced project timelines.

Safety Enhancement: Employing UAVs for surveying mitigates safety risks associated with traditional methods, especially in challenging or hazardous environments, leading to fewer accidents on the job sites.

Progress Monitoring & Reporting: UAV surveys facilitate continuous monitoring of construction progress, enabling early identification of potential issues and proactive mitigation strategies. This improves overall project management and reduces costly delays.

Volume Measurement & Quantification: Accurate volume measurements of earthworks, materials, and other elements are crucial for cost control and efficient resource allocation. UAV-based surveying precisely delivers this data.

Geographic Dominance: North America and Europe are expected to lead the market due to a higher rate of construction activity, advanced technological adoption, and well-established regulatory frameworks supporting UAV integration. However, regions with rapidly developing infrastructure in Asia and the Middle East are witnessing rapid growth in this market segment as well.

Furthermore, within the "Type" segment, Orthophoto services are expected to maintain a significant market share due to their application in creating precise maps and accurate measurements, fulfilling a core need across multiple sectors. The high demand for precise spatial information, crucial across a variety of application segments mentioned above, makes orthophotos a dominant type of UAV survey product.

The UAV aerial survey service industry is experiencing accelerated growth driven by a confluence of factors including increasing affordability and accessibility of UAV technology, advancements in sensor technology and data analytics, expanding regulatory support for UAV operations, and rising demand for efficient and cost-effective surveying across various industries. This convergence is fueling market expansion and creating significant opportunities for both established and emerging players in this rapidly evolving sector.

This report provides a comprehensive overview of the UAV aerial survey service market, encompassing market size estimations (in millions), key growth drivers and challenges, regional analysis, competitive landscape, and significant industry developments. It presents detailed insights into market trends, segment-wise analysis (Type and Application), and future growth projections, offering valuable strategic information for businesses operating within this rapidly evolving sector. The report aims to assist stakeholders in making informed decisions related to investments, technological advancements, and market entry strategies within the UAV aerial survey service industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include Kokusai Kogyo, Pasco, Asia Air Survey, Zenrin, NV5 Global, Aerial Data Service, Keystone Aerial Surveys, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "UAV Aerial Survey Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the UAV Aerial Survey Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.