1. What is the projected Compound Annual Growth Rate (CAGR) of the TV Set-Top Decoders?

The projected CAGR is approximately 4.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

TV Set-Top Decoders

TV Set-Top DecodersTV Set-Top Decoders by Application (Household, Commercial), by Type (Professional STB, Hybrid Box, IPTV Receiver, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

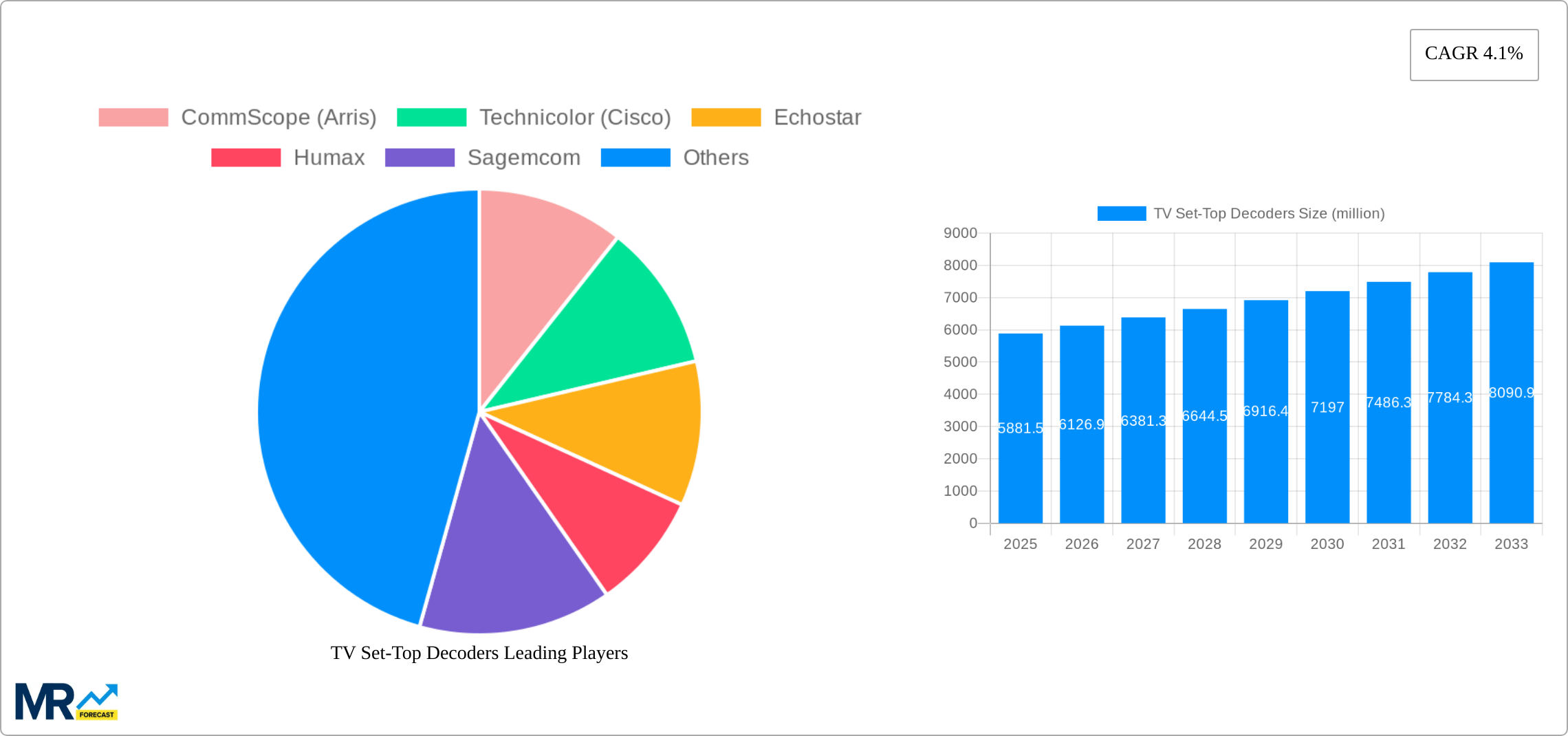

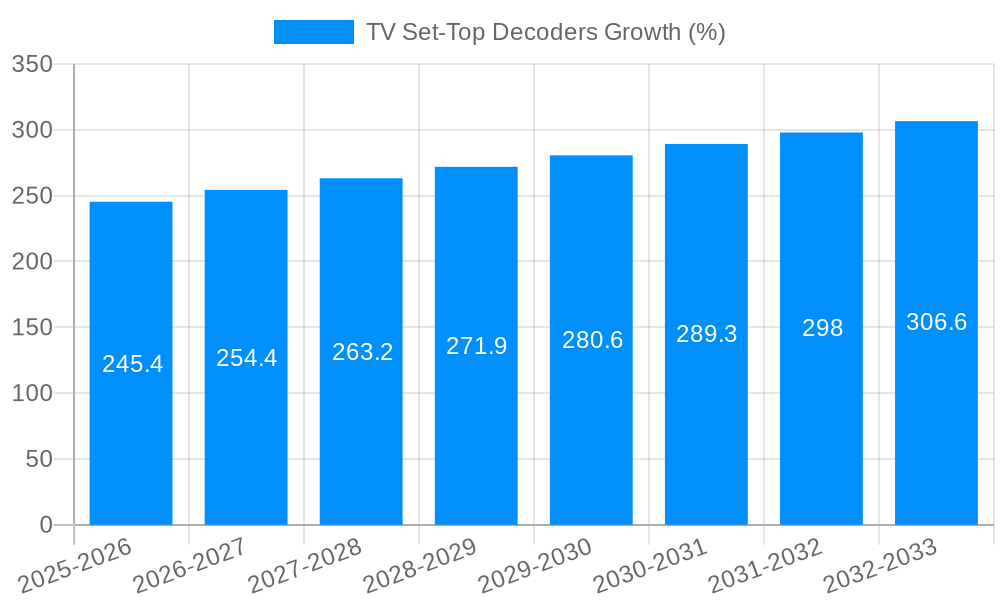

The global TV Set-Top Decoders market is projected for robust growth, with a current market size of approximately $8311 million in 2025, and an anticipated Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This sustained expansion is primarily fueled by the increasing adoption of high-definition (HD) and ultra-high-definition (UHD) content, driving demand for advanced set-top boxes capable of delivering superior video and audio quality. The proliferation of internet-connected households globally, coupled with the rising popularity of Over-the-Top (OTT) streaming services, has further augmented the market. Consumers are increasingly seeking integrated solutions that combine traditional broadcast television with on-demand content, pushing manufacturers to innovate with hybrid boxes and IPTV receivers. The ongoing transition from analog to digital broadcasting in various emerging economies also represents a significant growth driver, creating substantial opportunities for decoder manufacturers.

The market is segmented by application into household and commercial uses, with the household segment dominating due to widespread consumer ownership. Within the type segmentation, Professional STBs, Hybrid Boxes, and IPTV Receivers are key segments, each catering to specific consumer needs and technological advancements. While the market benefits from strong growth drivers, it also faces certain restraints. The increasing prevalence of smart TVs with built-in streaming capabilities and the growing adoption of cloud-based gaming platforms could potentially limit the demand for standalone set-top boxes in the long term. However, the continuous innovation in features such as 4K/8K support, advanced digital video recording (DVR) functionalities, and seamless integration with smart home ecosystems are expected to mitigate these challenges. Key players like CommScope (Arris), Technicolor (Cisco), Echostar, Humax, and Samsung are actively investing in research and development to stay ahead in this competitive landscape.

This report offers an in-depth analysis of the global TV Set-Top Decoders market, providing comprehensive insights into its current landscape and future trajectory. Spanning a study period from 2019 to 2033, with a detailed focus on the Base Year (2025) and Forecast Period (2025-2033), this research delves into the intricate dynamics shaping the industry. The historical performance from 2019 to 2024 is meticulously examined to establish a robust foundation for future projections.

The report quantifies market opportunities and challenges, utilizing market sizes expressed in the million unit scale. A thorough evaluation of key industry developments, driving forces, and restraints is presented, along with an assessment of the competitive landscape. The analysis categorizes the market by application (Household, Commercial) and type (Professional STB, Hybrid Box, IPTV Receiver, Others), providing granular insights into segment-specific trends. Furthermore, it highlights key regions and countries poised for significant growth and identifies leading players contributing to market evolution.

XXX, the global TV Set-Top Decoders market is undergoing a transformative shift, driven by an insatiable consumer demand for enhanced viewing experiences and the relentless evolution of digital broadcasting technologies. The study period of 2019-2033, with a sharp focus on the Base Year of 2025 and the subsequent Forecast Period of 2025-2033, reveals a market characterized by increasing sophistication and diversification. During the Historical Period (2019-2024), we witnessed a steady rise in the adoption of smart set-top boxes (STBs), integrating internet connectivity and app ecosystems, moving beyond their traditional role of signal decoding. This trend is projected to accelerate significantly.

The proliferation of high-definition (HD) and ultra-high-definition (UHD) content is a paramount driver, compelling manufacturers to produce STBs capable of delivering superior visual fidelity. This demand is particularly acute in the Household segment, where consumers are increasingly investing in premium entertainment setups. The IPTV Receiver segment, in particular, is experiencing exponential growth as internet service providers leverage their infrastructure to offer bundled TV services, providing a seamless and integrated entertainment solution. Moreover, the increasing adoption of Over-The-Top (OTT) services necessitates STBs that can efficiently manage and stream content from multiple platforms, leading to the rise of hybrid boxes that combine terrestrial, satellite, and IP reception capabilities. The commercial sector, while a smaller but growing market, is also seeing an uptake in professional STBs for digital signage and hospitality solutions, demanding robust performance and management features. The interplay between these segments and technological advancements points towards a future where STBs are not just decoders but central hubs for all forms of digital media consumption.

The TV Set-Top Decoders market is experiencing robust growth, propelled by a confluence of powerful driving forces that are reshaping the entertainment landscape. Foremost among these is the escalating consumer demand for immersive and high-quality viewing experiences. As resolutions like 4K and even 8K become more mainstream, the need for advanced set-top boxes capable of processing and delivering these high-fidelity signals is paramount. This demand is further fueled by the increasing availability of premium content, including live sports in high definition and cinematic releases, which consumers are eager to enjoy from the comfort of their homes.

Furthermore, the widespread availability of high-speed internet has been a critical enabler, particularly for the growth of IPTV Receiver solutions. Internet service providers are increasingly integrating TV services into their broadband packages, offering a bundled approach that simplifies access and often provides a superior viewing experience compared to traditional methods. This trend is significantly bolstering the adoption of IPTV receivers globally. The expansion of Over-The-Top (OTT) streaming services has also played a pivotal role. Consumers are no longer content with a limited selection of broadcast channels; they desire access to a vast library of on-demand content from platforms like Netflix, Amazon Prime Video, and Disney+. This has led to a surge in demand for smart set-top boxes and hybrid boxes that can seamlessly integrate these streaming services, offering a unified and user-friendly entertainment hub. The continuous innovation in content delivery mechanisms, such as the ongoing transition from MPEG-2 to more efficient codecs like HEVC, also necessitates regular upgrades in set-top box technology, thereby creating a consistent demand for new devices.

Despite the promising growth trajectory, the TV Set-Top Decoders market is not without its significant challenges and restraints that could potentially impede its expansion. One of the most prominent hurdles is the increasing prevalence of smart TVs. With integrated functionalities for streaming and internet access, many newer televisions are diminishing the necessity of a separate set-top box for basic smart functionality, particularly in the household segment. This direct competition from smart TV manufacturers poses a substantial threat to the traditional STB market.

Another significant restraint stems from the evolving nature of content consumption. The rise of mobile devices and personal computers as primary viewing platforms, especially among younger demographics, is diverting attention and, consequently, market share away from traditional television-based viewing. This shift necessitates that set-top box manufacturers innovate to offer more than just broadcast reception, integrating advanced features that can cater to a broader range of digital content and delivery methods. Furthermore, the global economic uncertainties and fluctuating disposable incomes in various regions can impact consumer spending on premium entertainment devices. While the desire for advanced viewing experiences remains, economic downturns can lead to delayed upgrades or a preference for more budget-friendly solutions. The high cost of advanced set-top boxes, especially those supporting the latest codecs and highest resolutions, can also be a barrier to adoption for a segment of the market. Finally, the increasing complexity of digital rights management (DRM) and the constant threat of piracy require continuous investment in security technologies for set-top boxes, adding to manufacturing costs and potentially slowing down product development cycles.

The global TV Set-Top Decoders market exhibits a dynamic regional and segment-specific dominance, with several key areas and categories poised for significant growth and market share during the study period of 2019-2033.

Dominant Segments:

Household Application: This segment is unequivocally the largest and most influential driver of the TV Set-Top Decoders market. The insatiable consumer appetite for enhanced home entertainment, coupled with increasing disposable incomes in emerging economies and a continued focus on premium viewing experiences in developed nations, underpins its dominance. The desire for high-definition (HD) and ultra-high-definition (UHD) content, immersive gaming, and seamless access to a vast array of streaming services makes the household segment a consistent source of demand for advanced set-top boxes. The trend towards smart homes and integrated entertainment systems further solidifies the position of the household application.

IPTV Receiver Type: The IPTV Receiver segment is experiencing phenomenal growth and is expected to be a major contributor to market expansion. The global shift towards fiber-optic broadband infrastructure has enabled internet service providers (ISPs) to offer robust and high-quality television services over their IP networks. This has led to a significant increase in the adoption of IPTV services as a primary mode of television consumption, often bundled with internet and telephony services, offering convenience and competitive pricing. The superior picture and sound quality, interactive features, and on-demand capabilities of IPTV further enhance its appeal to consumers, driving the demand for dedicated IPTV receivers.

Dominant Regions:

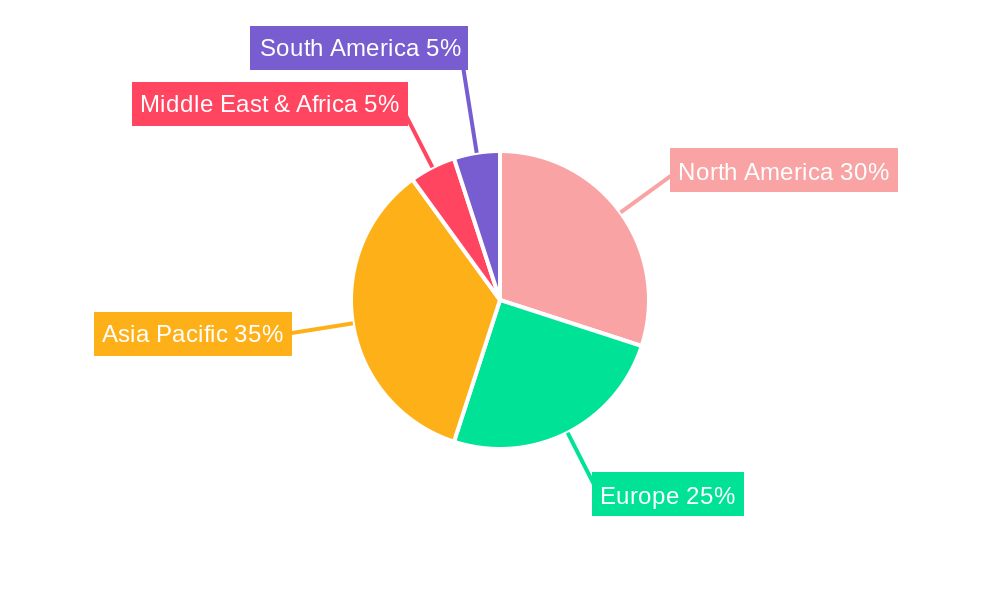

Asia-Pacific: This region stands out as a dominant force in the TV Set-Top Decoders market and is projected to maintain its leadership. The sheer population size, coupled with rapid economic development and increasing urbanization in countries like China, India, and Southeast Asian nations, creates a massive consumer base. The ongoing digital terrestrial television (DTT) migration, coupled with the widespread adoption of broadband internet and the burgeoning popularity of IPTV and Over-The-Top (OTT) streaming services, fuels the demand for a diverse range of set-top boxes. Governments in many Asia-Pacific countries are actively promoting digital broadcasting, further accelerating STB adoption. The region also serves as a major manufacturing hub for set-top boxes, leading to competitive pricing and wider availability.

North America: This region continues to be a significant market for TV Set-Top Decoders, characterized by a mature but evolving landscape. The high penetration of broadband internet, the strong presence of cable and satellite TV providers, and the early adoption of advanced technologies like 4K resolution and HDR content contribute to sustained demand for sophisticated set-top boxes. The strong consumer preference for premium entertainment experiences and the continued popularity of subscription-based video-on-demand services ensure a steady market for both traditional and smart set-top boxes. The ongoing rollout of advanced network infrastructure and the increasing integration of smart home technologies also contribute to the region's market strength.

The interplay between these dominant segments and regions creates a complex yet predictable market landscape. The sustained demand from the Household segment, particularly for IPTV Receivers, coupled with the immense market potential and technological adoption in the Asia-Pacific and North American regions, will shape the trajectory of the global TV Set-Top Decoders market for the foreseeable future.

Several key growth catalysts are propelling the TV Set-Top Decoders industry forward. The escalating demand for high-definition (HD) and ultra-high-definition (UHD) content, coupled with the increasing availability of premium content on streaming platforms, is a primary driver. The widespread expansion of high-speed broadband infrastructure globally is a critical enabler for IPTV services, fostering significant growth in this segment. Furthermore, the continuous innovation in set-top box technology, leading to more feature-rich and user-friendly devices, including smart and hybrid functionalities, caters to evolving consumer preferences for integrated entertainment solutions. Government initiatives promoting digital broadcasting transitions also contribute to market expansion.

This comprehensive report provides an exhaustive examination of the global TV Set-Top Decoders market, offering unparalleled insights into its present state and future potential. It encompasses a detailed analysis of market trends, driving forces, challenges, and restraints, supported by quantitative data presented in million units. The report segments the market by application (Household, Commercial) and type (Professional STB, Hybrid Box, IPTV Receiver, Others), enabling granular understanding of sector-specific dynamics. It further highlights key regions and countries poised for dominance and identifies leading market players. The report's meticulous study period (2019-2033), with a sharp focus on the Base Year (2025) and Forecast Period (2025-2033), ensures a robust and actionable analysis for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.2%.

Key companies in the market include CommScope (Arris), Technicolor (Cisco), Echostar, Humax, Sagemcom, Samsung, Roku, Skyworth Digital Technology Co.,Ltd, HUAWEI, JEZETEC, COSHIP, SICHUAN CHANGHONG, UNION MAN, YINHE ELECTRONICS, ZTE.

The market segments include Application, Type.

The market size is estimated to be USD 8311 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "TV Set-Top Decoders," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the TV Set-Top Decoders, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.