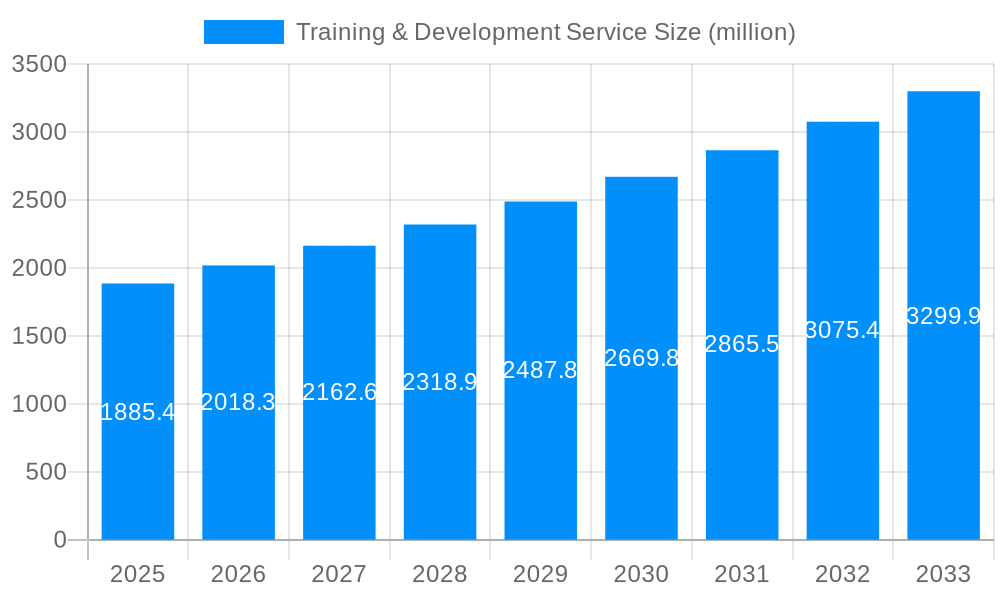

1. What is the projected Compound Annual Growth Rate (CAGR) of the Training & Development Service?

The projected CAGR is approximately 7.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Training & Development Service

Training & Development ServiceTraining & Development Service by Type (Online Service, Offline Service), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Training & Development Services market, valued at $1885.4 million in 2025, is poised for significant growth. This robust market is driven by increasing corporate investments in employee upskilling and reskilling to adapt to rapidly evolving technological landscapes and competitive pressures. The demand for specialized skills across diverse sectors, coupled with a growing emphasis on employee engagement and productivity, fuels this expansion. The market exhibits strong segmentation, with online services gaining traction due to their accessibility and cost-effectiveness. Large enterprises and SMEs both contribute substantially, but the former often allocate larger budgets for comprehensive training programs. While the offline service segment remains relevant, particularly for hands-on training, its market share is likely to be gradually overtaken by online alternatives. Key trends include the adoption of microlearning, gamification of training modules, and the increased utilization of virtual reality and augmented reality for immersive learning experiences. The market faces challenges in ensuring consistent training quality across diverse platforms and maintaining learner engagement in online environments. Furthermore, high initial investment costs for companies and the scarcity of skilled trainers can act as constraints on market growth. However, technological advancements and a growing awareness of the importance of continuous learning are expected to mitigate these restraints.

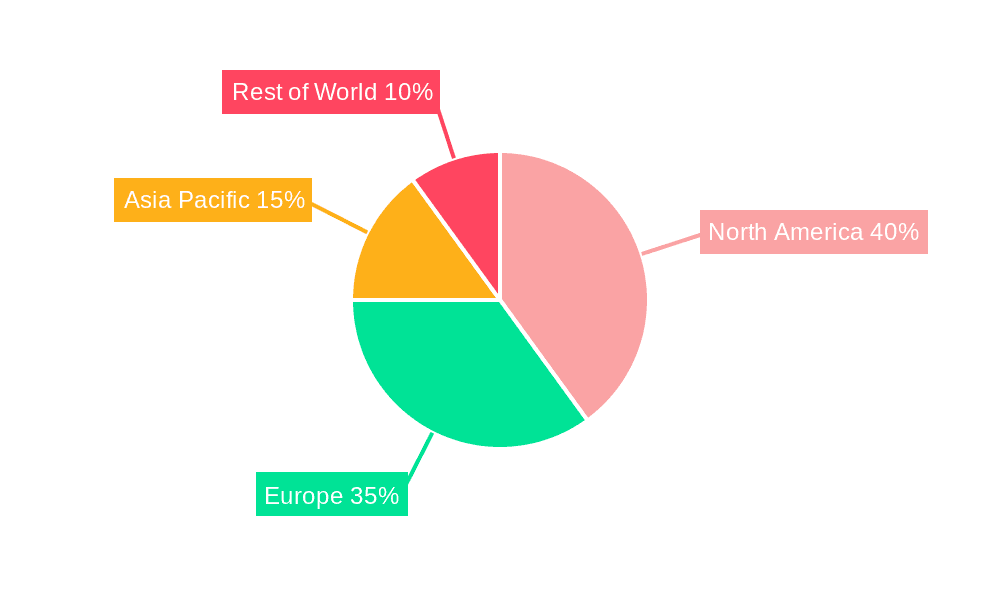

Considering the 2019-2024 historical period and the projected growth until 2033, we can assume a moderate compound annual growth rate (CAGR) of, for example, 7%. This is a reasonable estimate, considering industry growth trends. Utilizing this CAGR, the market is expected to expand significantly over the forecast period. The geographical distribution shows a concentration in North America and Europe, reflective of mature economies with established corporate training practices. However, developing regions such as Asia-Pacific are exhibiting rapid growth, driven by increasing urbanization and a burgeoning middle class, creating a substantial pool of potential trainees. This trend underscores the global nature of the opportunity and the potential for further expansion into emerging markets.

The global Training & Development (T&D) service market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The study period from 2019 to 2033 reveals a dynamic shift in how organizations approach employee learning and development. The historical period (2019-2024) saw a significant increase in demand for online T&D solutions, driven by the pandemic and the rise of remote work. This trend is expected to continue throughout the forecast period (2025-2033), with online services dominating the market share. However, the offline service sector, while smaller, retains a significant position, particularly within large enterprises that value in-person interactions for team-building and specialized training. The base year of 2025 serves as a crucial benchmark, highlighting the increasing adoption of blended learning models, which combine both online and offline components to cater to diverse learning styles and organizational needs. The estimated year 2025 figures indicate a substantial market capitalization, demonstrating the considerable investment organizations are making in upskilling and reskilling their workforce to meet evolving business demands. Key insights from the market indicate a growing focus on personalized learning experiences, leveraging technology like AI and data analytics to tailor training programs to individual employee needs and learning preferences. This personalized approach is crucial for improving employee engagement, knowledge retention, and overall return on investment for T&D initiatives. Furthermore, the integration of gamification and microlearning techniques are gaining traction, making the learning experience more engaging and accessible, leading to greater employee participation and better skill acquisition. The market's growth is further fueled by the increasing need for specialized skills in emerging technologies, requiring organizations to invest heavily in reskilling and upskilling initiatives.

Several key factors are driving the expansion of the T&D services market. Firstly, the intense competition in the global business landscape compels organizations to invest heavily in talent development to retain their competitive edge. Upskilling and reskilling initiatives are no longer optional but crucial for survival and success. Secondly, the rapid pace of technological advancements necessitates continuous learning and adaptation for employees to remain relevant in their roles. This demand is pushing organizations to adopt innovative T&D methodologies and technologies. Thirdly, a changing workforce demographic, characterized by diverse age groups and skill sets, requires flexible and personalized learning solutions. This necessitates a shift towards adaptable training programs designed to cater to individual needs and preferences. Fourthly, government initiatives and policies focused on workforce development are also positively influencing market growth. These policies often include funding and support for skills training programs, incentivizing organizations to invest in employee development. Lastly, the increasing awareness of the importance of employee engagement and retention is driving demand for robust T&D programs. By investing in their employees’ growth, organizations can foster a culture of continuous learning, leading to higher job satisfaction, improved productivity, and reduced employee turnover.

Despite the significant growth potential, several challenges hinder the T&D service market's progress. One major challenge is the high cost of developing and implementing effective training programs, especially for smaller and medium-sized enterprises (SMEs). Budgetary constraints often limit SMEs' access to advanced technologies and high-quality training materials. The challenge of measuring the return on investment (ROI) of T&D initiatives is also significant. Quantifying the impact of training on organizational performance remains a complex issue, potentially deterring investment from organizations seeking concrete evidence of value. Another constraint is the lack of skilled training professionals capable of designing and delivering engaging and effective learning experiences. The need for professionals with expertise in modern learning technologies and pedagogical approaches is paramount. Furthermore, keeping up with the ever-evolving technological landscape presents a considerable challenge. Organizations must continuously adapt their training programs to incorporate new technologies and methodologies. Finally, ensuring employee engagement and participation in training programs is crucial. A lack of engagement can result in low knowledge retention and a poor return on investment. Addressing these challenges requires a multi-faceted approach, involving collaboration between training providers, technology developers, and organizations to develop cost-effective, measurable, and engaging training solutions.

The Large Enterprises segment is poised to dominate the T&D service market throughout the forecast period. Large enterprises possess the resources and infrastructure necessary to invest in comprehensive T&D programs that encompass both online and offline components. They often have dedicated learning and development departments, enabling them to effectively manage and monitor training initiatives.

North America and Europe are expected to maintain their leading positions in the market, due to high levels of technological advancement, a highly skilled workforce, and a strong emphasis on continuous learning and development.

The substantial investments made by large enterprises in advanced technologies, such as AI-powered learning platforms and virtual reality (VR) simulations, are further boosting the market's expansion within this segment. These technologies enable personalized learning experiences, improve knowledge retention, and enhance the overall effectiveness of training programs.

Large enterprises also benefit from economies of scale, which allow them to negotiate better deals with T&D service providers, reducing costs and maximizing the return on investment.

The ability of large enterprises to integrate training programs seamlessly into their existing HR systems and workflows further contributes to the segment's dominance. This integration allows for efficient tracking of employee progress, assessment of learning outcomes, and alignment with overall business objectives.

Furthermore, the increasing awareness of the importance of compliance training, especially within regulated industries, is driving demand for comprehensive T&D programs within large enterprises. This has led to significant investments in training to meet regulatory requirements and mitigate potential risks.

In summary, the combination of ample resources, technological adoption, and a focus on continuous improvement allows large enterprises to leverage the full potential of T&D services, solidifying their position as the dominant segment in the market.

The T&D service industry's growth is propelled by several key factors: increased corporate investment in employee development to enhance productivity and competitiveness, the rising adoption of online learning platforms offering flexibility and scalability, and a growing demand for specialized skills training across diverse industries. Government initiatives promoting workforce development further stimulate this growth, coupled with the increasing emphasis on personalized learning experiences tailored to individual employee needs and preferences.

This report provides a comprehensive overview of the Training & Development service market, analyzing key trends, drivers, challenges, and growth opportunities from 2019 to 2033. It covers various segments including online and offline services for large enterprises and SMEs, offering detailed insights into market size, growth projections, and competitive landscapes. The report identifies leading players and explores significant developments shaping the industry's evolution. This analysis provides valuable insights for businesses seeking to navigate this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.8%.

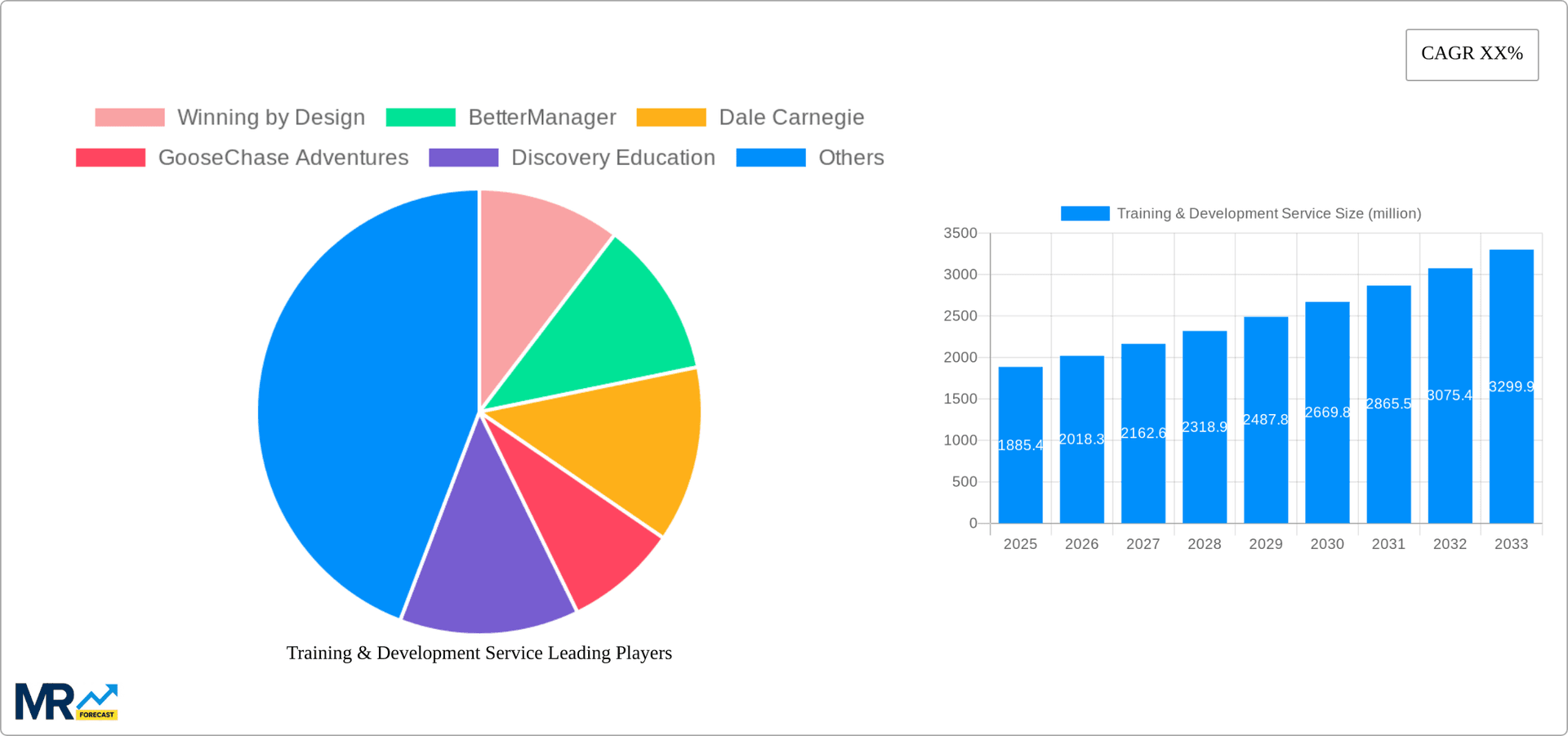

Key companies in the market include Winning by Design, BetterManager, Dale Carnegie, GooseChase Adventures, Discovery Education, SHRM, Project Management Institute, Cognician, American Management Association, Berlitz Languages, FranklinCovey, Threads, Trupp HR, Applied Lear, Berlitz US, Mercer, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Training & Development Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Training & Development Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.