1. What is the projected Compound Annual Growth Rate (CAGR) of the Trade Finance Instruments?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Trade Finance Instruments

Trade Finance InstrumentsTrade Finance Instruments by Application (/> Machinery, Energy, Food and Consumer, Transport, Chemical, Metals & Non Metallic Minerals, Others), by Type (/> Letters of Credit (LCs), Forfaiting, Factoring, Export Finance, Trade Credit Insurance), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

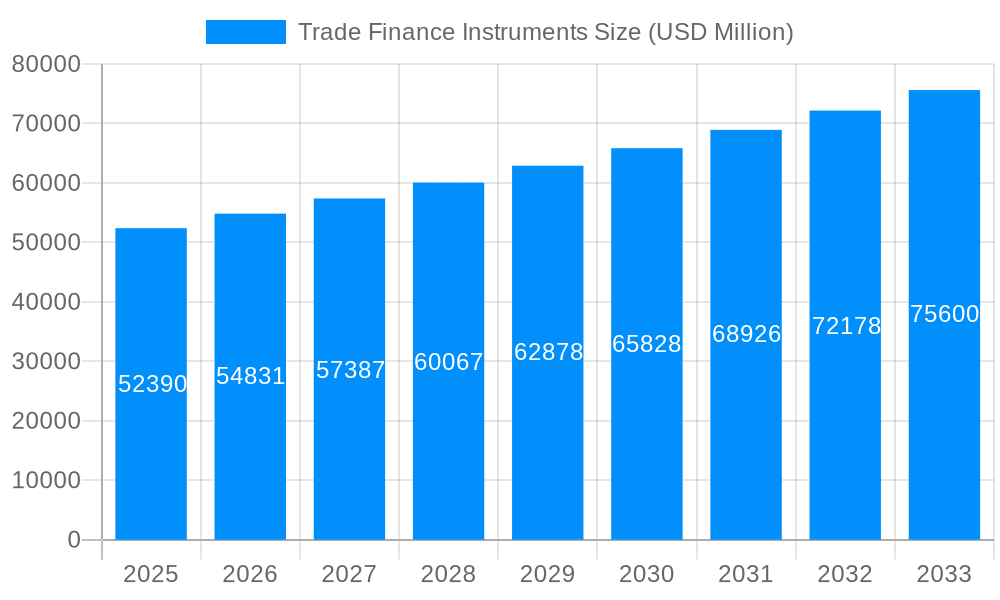

The global Trade Finance Instruments market is projected to reach an estimated $52.39 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.7% throughout the forecast period of 2025-2033. This sustained growth is primarily fueled by the increasing complexity and volume of international trade, coupled with a rising demand for efficient and secure cross-border transactions. Key drivers include the expanding global supply chains, the emergence of new and developing economies as significant trade participants, and the continuous innovation in financial products designed to mitigate trade-related risks. For instance, the growing reliance on digital platforms for trade facilitation and the increasing adoption of solutions like export finance and trade credit insurance are playing a pivotal role in bolstering market expansion. The market's resilience is also testament to the critical role trade finance plays in supporting small and medium-sized enterprises (SMEs) in their international endeavors, providing them with the necessary liquidity and risk mitigation tools to compete on a global scale.

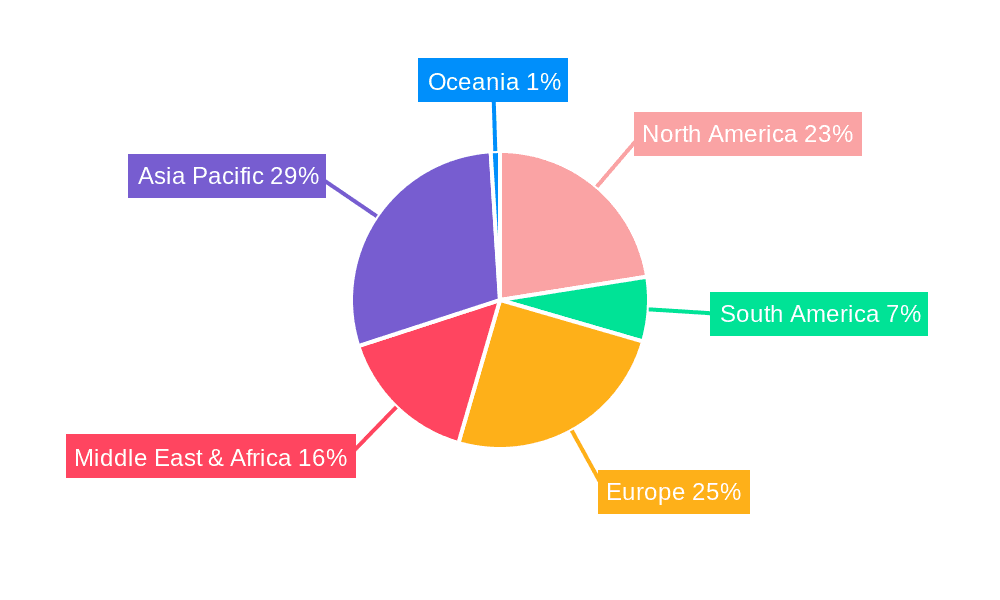

The market's segmentation reveals a diverse landscape of instruments catering to varied trade needs. Letters of Credit (LCs) continue to be a foundational instrument, offering a secure payment mechanism for international transactions. However, the evolving nature of trade is witnessing a heightened adoption of alternative solutions such as Factoring and Forfaiting, which offer more flexibility and liquidity to exporters, particularly in managing their accounts receivable. Export Finance and Trade Credit Insurance are also gaining significant traction as businesses seek comprehensive protection against non-payment risks and access to longer-term financing. Geographically, the Asia Pacific region is expected to lead market growth, driven by China and India's strong export-oriented economies and their increasing integration into global trade networks. North America and Europe remain significant markets due to their established trade infrastructure and the presence of major financial institutions. The competitive landscape is characterized by a mix of large multinational banks and specialized trade finance providers, all vying for market share through product innovation, digital transformation, and strategic partnerships.

The global trade finance instruments market, projected to reach an impressive value of $27.5 trillion by the Estimated Year 2025, is experiencing a dynamic evolution. This robust growth trajectory, spanning from a historical period of 2019-2024 and extending through a forecast period of 2025-2033, is underpinned by several interconnected trends. The increasing complexity of international supply chains, coupled with the persistent need for risk mitigation in cross-border transactions, continues to drive demand for a diverse range of trade finance solutions. Letters of Credit (LCs), historically a cornerstone of trade finance, remain a critical instrument, facilitating billions of dollars in transactions annually by providing assurance to both buyers and sellers. Their adoption is further bolstered by technological advancements that are streamlining their issuance and management. Forfaiting and Factoring are also experiencing significant expansion, particularly as businesses seek to unlock liquidity from their accounts receivable and manage payment risks more effectively, collectively handling over $5.2 trillion in the base year. The surge in global trade volumes, particularly in sectors like Energy and Machinery, which accounted for over $8.1 trillion in applications during the historical period, directly fuels the demand for these financial instruments. Furthermore, the growing emphasis on sustainable and ethical trade practices is subtly influencing the landscape, with financiers increasingly factoring in ESG considerations, potentially leading to new product developments and modified risk assessments. The market is also witnessing a geographical rebalancing, with emerging economies playing an increasingly prominent role, both as sources of demand and as burgeoning centers for trade finance innovation. The sheer scale of global commerce, projected to exceed $32 trillion by 2033, ensures that trade finance instruments will remain indispensable tools for facilitating the flow of goods and capital worldwide. The interplay between technological integration, evolving regulatory frameworks, and the inherent volatility of the global economic environment will continue to shape the growth and diversification of this essential financial sector. The base year of 2025 sets a critical benchmark, with preliminary estimates suggesting a market size of $27.5 trillion, reflecting the cumulative impact of these trends.

The burgeoning global trade landscape is the primary propellant for the trade finance instruments market. As businesses increasingly venture into international markets, the inherent risks associated with cross-border transactions necessitate robust financial solutions. The growing need for working capital to support large-scale import and export operations, particularly in sectors like Machinery and Energy, where deals can run into hundreds of billions of dollars, drives the demand for instruments like Export Finance. The digitalization of trade processes is another significant catalyst. As more transactions move online and become more streamlined, the demand for integrated trade finance solutions that can be accessed and managed digitally is surging. This includes the adoption of blockchain technology and AI-powered platforms, which promise to enhance efficiency, transparency, and security. Furthermore, the increasing interconnectedness of global supply chains means that disruptions, whether economic, political, or environmental, can have far-reaching consequences. Trade Credit Insurance, for instance, has seen substantial growth as companies seek to protect themselves against the risk of buyer default, thereby safeguarding their cash flows and market positions. The expansion of e-commerce also plays a crucial role, creating new avenues for smaller businesses to engage in international trade and thereby increasing the overall demand for accessible trade finance solutions. The sheer volume of international transactions, estimated to be in the trillions of dollars annually, inherently requires financial instruments to facilitate and secure these exchanges.

Despite the robust growth, the trade finance instruments market faces several significant challenges and restraints that can temper its expansion. Regulatory complexity and fragmentation across different jurisdictions represent a substantial hurdle. Navigating diverse compliance requirements, anti-money laundering (AML) regulations, and know-your-customer (KYC) protocols can be costly and time-consuming for financial institutions and businesses alike. The ongoing threat of cyber-attacks and data breaches also poses a significant risk, particularly as trade finance becomes increasingly digitalized. Ensuring the security of sensitive financial information and transaction data is paramount, and the potential for sophisticated cyber threats can deter the adoption of new technologies or necessitate substantial investment in cybersecurity measures. Geopolitical instability and trade wars can create an environment of uncertainty, leading to a contraction in cross-border trade volumes and a subsequent decline in demand for trade finance instruments. Sanctions and trade restrictions imposed by various countries can also limit the scope and applicability of certain financial instruments, forcing institutions to re-evaluate their risk exposure. Furthermore, a persistent shortage of liquidity in the trade finance market, particularly for smaller and medium-sized enterprises (SMEs), remains a persistent challenge. While large corporations can often secure adequate financing, SMEs may struggle to access the necessary capital to participate effectively in international trade. Finally, the inherent credit risk associated with international trade, especially in emerging markets, can lead to higher borrowing costs and stricter lending criteria, thereby acting as a restraint on market growth.

The trade finance instruments market is poised for significant dominance by Asia Pacific, driven by its burgeoning economies, massive manufacturing capabilities, and the sheer volume of international trade it facilitates. Within this region, China stands out as a pivotal player, not only as a major exporter and importer but also as a significant provider of trade finance through institutions like the Bank of China, China Exim Bank, ICBC, and HSBC, which have a substantial presence there. The application segments that are expected to dominate within Asia Pacific, and globally, are Machinery and Energy. The ongoing industrialization and infrastructure development in many Asian countries, alongside their significant energy consumption and production, necessitate billions of dollars in financing for the import and export of related goods. The Machinery segment, estimated to be worth over $6 trillion in the base year 2025, encompasses everything from heavy industrial equipment to sophisticated manufacturing tools, all of which require substantial trade finance support. Similarly, the Energy sector, encompassing oil, gas, and renewable energy projects, involves massive capital outlays and intricate supply chains, demanding sophisticated financial instruments.

In terms of Type, Letters of Credit (LCs) will continue to be a dominant force, accounting for an estimated 40% of the market share, processing transactions worth upwards of $11 trillion in the base year. Their role in mitigating payment risk for high-value transactions in machinery and energy is unparalleled. However, Export Finance is expected to witness the most rapid growth, particularly in supporting the export of capital-intensive goods like machinery and large-scale energy infrastructure. This segment is projected to grow at a CAGR of 7.8% between 2025 and 2033, potentially reaching over $3.5 trillion by the end of the forecast period. Countries within Asia Pacific are actively promoting their exports through dedicated export credit agencies like Japan Exim Bank and Export-Import Bank of India, further bolstering this segment.

Furthermore, the Food and Consumer segment, valued at approximately $3.5 trillion in the base year, will also see robust activity, driven by the increasing global demand for food products and consumer goods, with a significant portion of this trade originating from or flowing into Asia. The sheer volume of transactions in these key segments, coupled with the financial clout of institutions like JPMorgan Chase & Co, Citigroup Inc, and BNP Paribas operating within and supporting these regions, solidifies Asia Pacific's leading position. The underlying trend of globalization, coupled with the continuous need for goods and capital across these vital sectors, ensures their sustained dominance in the trade finance instruments market throughout the study period.

The trade finance instruments industry is experiencing accelerated growth fueled by several key catalysts. The continuous expansion of global trade volumes, propelled by increasing interdependency between nations, directly translates into a higher demand for secure and efficient transaction mechanisms. Digital transformation is a paramount growth driver, with the adoption of advanced technologies like blockchain and AI streamlining processes, enhancing transparency, and reducing operational costs, thereby making trade finance more accessible and attractive. The growing emphasis on supporting Small and Medium-sized Enterprises (SMEs) in international trade, with governments and financial institutions developing tailored solutions, is also opening up new market segments. Furthermore, the increasing need for risk mitigation in an unpredictable global economic and geopolitical landscape is driving demand for instruments like Trade Credit Insurance, safeguarding businesses against payment defaults.

This report provides an exhaustive analysis of the global trade finance instruments market, offering a comprehensive outlook from the historical period of 2019-2024 through to a projected 2033. It delves into the intricate trends shaping the market, with a base year valuation of $27.5 trillion in 2025 and a robust forecast extending beyond. The report meticulously examines the driving forces, including the surge in global trade and digital transformation, and sheds light on the challenges that restrain growth, such as regulatory complexities and geopolitical risks. A significant portion of the analysis is dedicated to identifying key regions and segments poised for dominance, with a particular focus on Asia Pacific and applications like Machinery and Energy, as well as instrument types like Letters of Credit and Export Finance. It further highlights the critical growth catalysts and provides a detailed overview of leading players, supported by significant developments and their timelines. This comprehensive coverage ensures stakeholders are equipped with the insights needed to navigate this vital financial landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include BNP Paribas, Bank of China, Citigroup Inc, China Exim Bank, ICBC, JPMorgan Chase & Co, Mizuho Financial Group, Standard Chartered, MUFG, Sumitomo Mitsui Banking Corporation, Credit Agricole, Commerzbank, HSBC, Riyad Bank, Saudi British Bank, ANZ, EBRD, Japan Exim Bank, Banque Saudi Fransi, Afreximbank, AlAhli Bank, Export-Import Bank of India.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Trade Finance Instruments," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Trade Finance Instruments, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.