1. What is the projected Compound Annual Growth Rate (CAGR) of the Trade Finance?

The projected CAGR is approximately 3.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Trade Finance

Trade FinanceTrade Finance by Type (Guarantees, Letters of Credit, Documentary Collection, Supply Chain Financing, Factoring), by Application (Machinery, Energy, Food and Consumer, Transport, Chemical, Metals & Non Metallic Minerals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

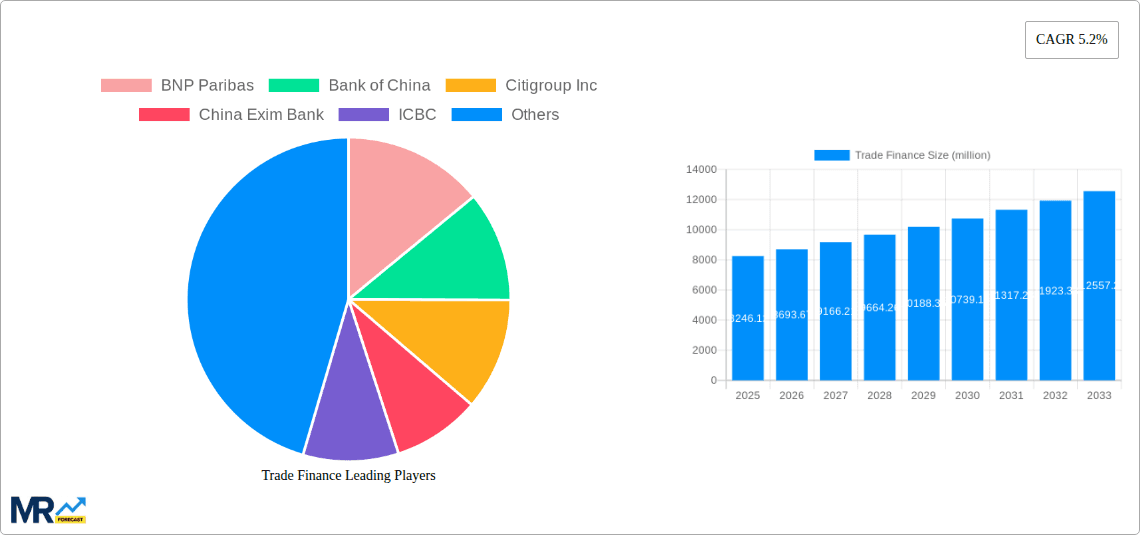

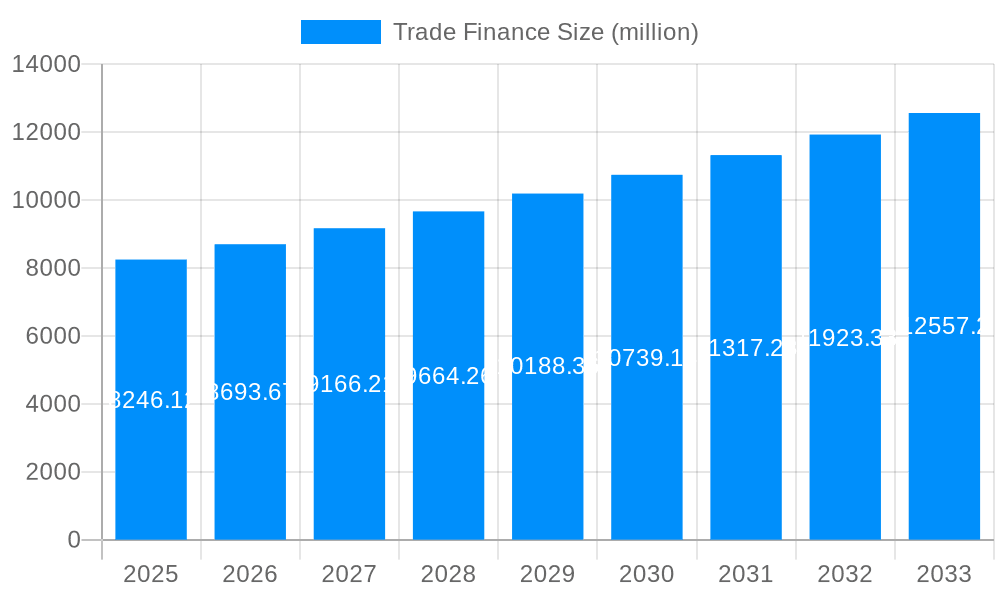

The global trade finance market, valued at $8,246.12 million in 2025, is projected to experience robust growth, driven by the increasing volume of international trade and the rising demand for secure and efficient financial solutions for cross-border transactions. A Compound Annual Growth Rate (CAGR) of 5.2% is anticipated from 2025 to 2033, indicating a significant expansion in market size. This growth is fueled by several key factors. The expansion of e-commerce and globalization necessitates sophisticated trade finance mechanisms for managing risks and streamlining payment processes. Further, the increasing adoption of digital technologies within the financial sector is enhancing operational efficiency and transparency, contributing to market expansion. Growth is also seen across various application segments, including machinery, energy, food & consumer goods, transport, chemicals, and metals & non-metallic minerals, reflecting the diverse needs of businesses involved in global trade. While challenges such as geopolitical instability and regulatory changes may pose some restraints, the overall outlook remains positive, driven by the fundamental need for efficient trade finance solutions in an interconnected global economy.

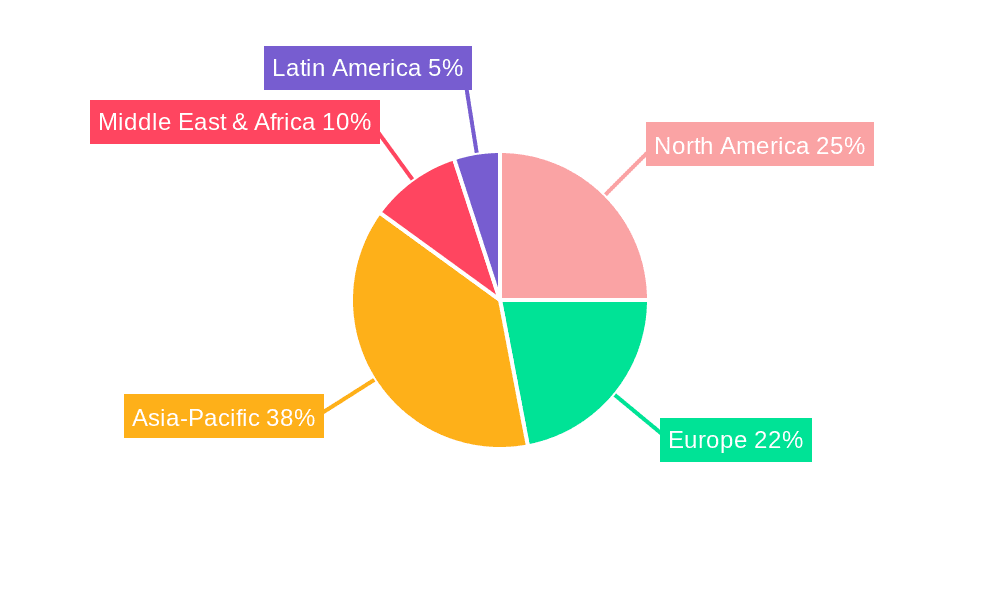

The market's segmentation by type (Guarantees, Letters of Credit, Documentary Collection, Supply Chain Financing, Factoring) reflects the varied financial instruments available to meet specific trade needs. Major players like BNP Paribas, Bank of China, Citigroup, and others compete intensely, offering a wide range of solutions. Regional variations are expected, with North America, Europe, and Asia Pacific likely to dominate due to their established trade networks and robust financial infrastructure. However, emerging markets in the Middle East & Africa and South America are projected to see accelerated growth, driven by increasing economic activity and trade liberalization. The substantial presence of major banks in various regions highlights the competitive landscape and opportunities for growth. The diverse range of service offerings and the growing need for secure trade transactions will continue to shape the market's evolution over the forecast period.

The global trade finance market, valued at $10 trillion in 2024, is projected to reach $15 trillion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025-2033). This growth is fueled by the increasing volume of international trade, particularly within emerging economies. The historical period (2019-2024) saw fluctuating growth due to global events such as the COVID-19 pandemic and the subsequent supply chain disruptions, but the market demonstrated remarkable resilience and is poised for sustained expansion. While Letters of Credit remain a dominant instrument, the demand for innovative solutions like Supply Chain Finance and digitalization of trade processes is rapidly increasing. This shift is driven by the need for enhanced efficiency, transparency, and risk mitigation. Key players are constantly adapting their offerings to cater to these evolving needs, incorporating technologies such as blockchain and artificial intelligence to streamline operations and reduce costs. The geographic distribution of trade finance activity is also undergoing transformation, with Asia and Africa showing particularly promising growth trajectories. The rise of e-commerce and the expansion of cross-border transactions are further contributing to the market's dynamism. The estimated market size for 2025 stands at $12 trillion, reflecting the market's robust recovery and the anticipation of stronger future growth.

Several factors are propelling the growth of the trade finance market. The expansion of global trade, particularly among emerging economies, creates a greater demand for financing solutions to facilitate international transactions. The increasing complexity of supply chains necessitates sophisticated trade finance products such as supply chain finance and factoring, helping businesses manage their working capital efficiently. Technological advancements, including blockchain and AI, are streamlining processes, reducing costs, and enhancing transparency, making trade finance more accessible and efficient for businesses of all sizes. Government initiatives aimed at promoting international trade and supporting small and medium-sized enterprises (SMEs) are creating a favorable regulatory environment. Finally, the increasing need for risk mitigation in international transactions is driving demand for various trade finance instruments, including guarantees and letters of credit, which help protect buyers and sellers from potential losses. These combined forces ensure the sustained growth and evolution of the trade finance sector.

Despite its promising growth trajectory, the trade finance market faces several challenges. Geopolitical uncertainties and trade wars can disrupt global trade flows and negatively impact demand for trade finance services. Regulatory complexities and compliance requirements across different jurisdictions pose significant hurdles for businesses, especially SMEs, seeking to engage in international trade. Credit risk remains a major concern, especially in emerging markets with less developed financial infrastructure. Cybersecurity threats and data breaches pose a significant risk to the security and integrity of trade finance transactions. Furthermore, the lack of access to trade finance for SMEs in developing countries hinders their participation in global trade. Lastly, adapting to new technologies and integrating them effectively within existing operations requires significant investment and expertise from market participants. Addressing these challenges is crucial for unlocking the full potential of the trade finance market.

Asia is projected to dominate the trade finance market due to its rapid economic growth, expanding industrial base, and substantial volume of international trade. Within Asia, China stands out as a key market player.

Letters of Credit: This remains the most widely used trade finance instrument globally, with a significant portion of transactions taking place in Asia, particularly for imports and exports of machinery, energy, and consumer goods. The value of Letters of Credit processed in Asia in 2024 exceeded $3 trillion.

Supply Chain Financing: This segment is experiencing rapid growth in Asia driven by the need for efficient working capital management among large manufacturing and retail companies. The market for Supply Chain Finance within Asia is expected to surpass $1.5 trillion by 2033.

Specific Applications: The high demand for machinery, energy, and consumer goods within Asia fuels a significant portion of overall trade finance volume. The transport sector also represents a sizable segment, facilitated by extensive infrastructure projects throughout the region.

Paragraph: The dominance of Asia, especially China, is a result of several factors. The region's manufacturing prowess and burgeoning consumer market lead to high volumes of imports and exports. Furthermore, the significant growth in intra-Asian trade further boosts the demand for trade finance solutions. The increasing adoption of technology within Asian markets enables streamlined processes and improved efficiency, accelerating the growth of trade finance in the region. The projected value of the trade finance market within Asia for 2033 is close to $7 trillion, illustrating its considerable contribution to global market growth.

The integration of technological innovations such as blockchain, AI, and big data analytics is a major catalyst for growth. These technologies streamline processes, enhance transparency, reduce fraud, and improve efficiency, thereby attracting a wider range of users. Government initiatives supporting SMEs and fostering international trade also play a significant role. Finally, the increasing demand for risk mitigation and the need for efficient working capital management in global supply chains will continue to drive demand for sophisticated trade finance solutions.

This report provides a comprehensive overview of the global trade finance market, analyzing historical trends, current market dynamics, and future growth prospects. It offers in-depth insights into key segments, including Letters of Credit, Guarantees, and Supply Chain Finance, and highlights the leading players shaping the industry. Furthermore, it explores the key driving forces and challenges faced by the market, providing valuable information for stakeholders seeking to understand and navigate the evolving landscape of international trade finance. The report also incorporates forecasts for the coming years, based on sophisticated analytical models and market intelligence, providing valuable insight for strategic planning and investment decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.1%.

Key companies in the market include BNP Paribas, Bank of China, Citigroup Inc, China Exim Bank, ICBC, JPMorgan Chase & Co, Mizuho Financial Group, Standard Chartered, MUFG, Sumitomo Mitsui Banking Corporation, Credit Agricole, Commerzbank, HSBC, Riyad Bank, Saudi British Bank, ANZ, EBRD, Japan Exim Bank, Banque Saudi Fransi, Afreximbank, AlAhli Bank, Export-Import Bank of India, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Trade Finance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Trade Finance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.