1. What is the projected Compound Annual Growth Rate (CAGR) of the Television Advertising?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Television Advertising

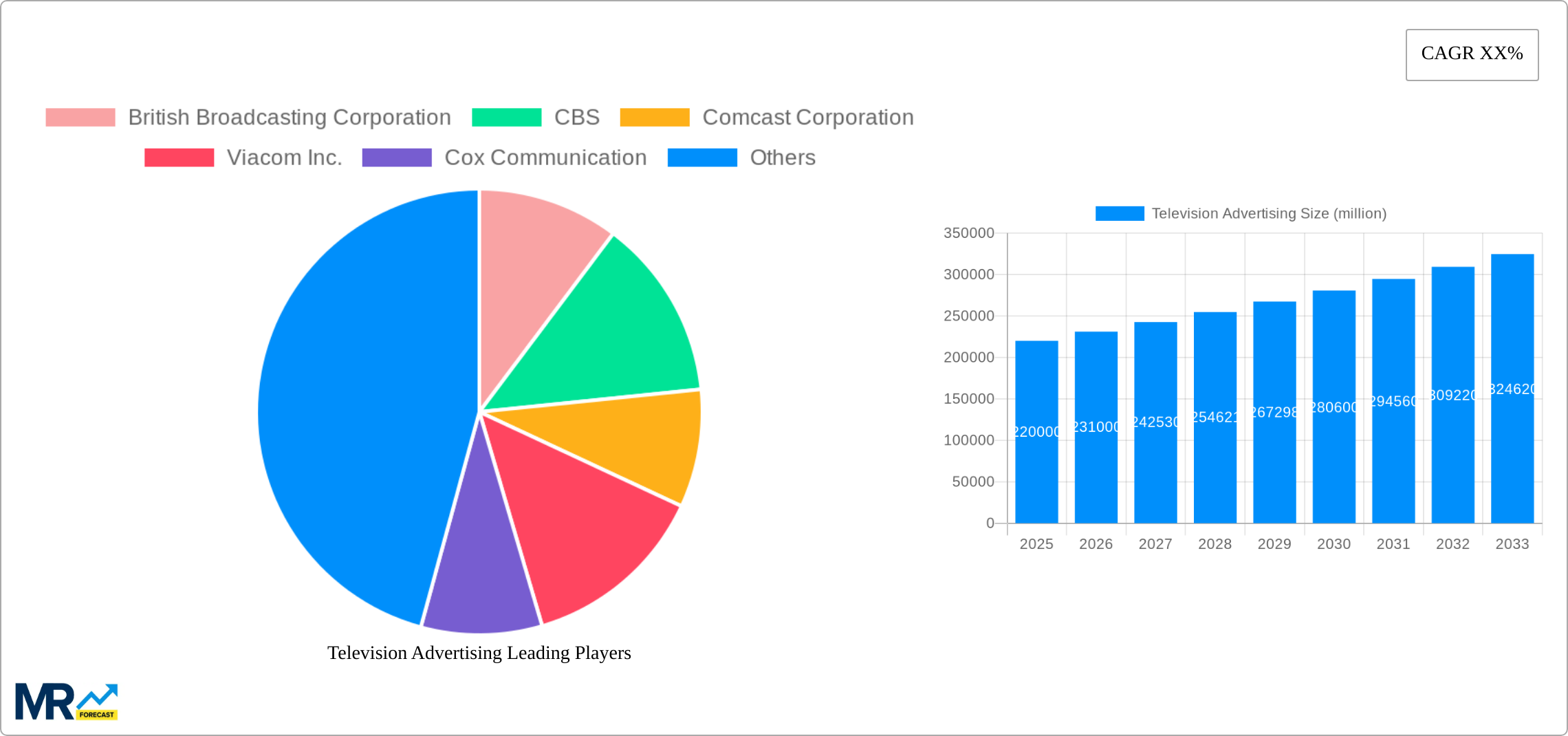

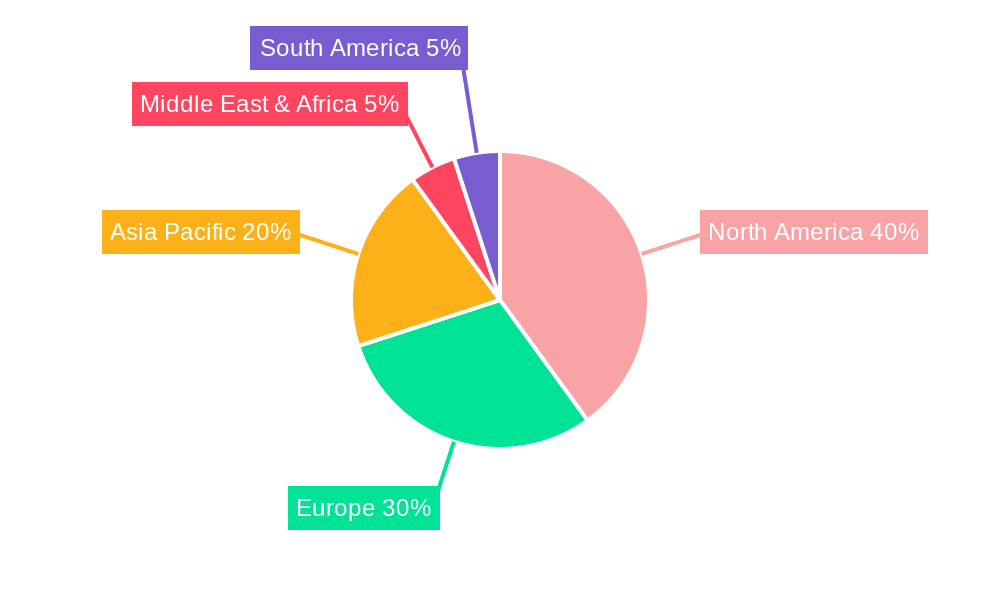

Television AdvertisingTelevision Advertising by Application (Companies, Government, Other), by Type (Terrestrial Advertisement, Multichannel Advertisement, Online Advertisement), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global television advertising market is a dynamic landscape exhibiting substantial growth potential. While precise figures for market size and CAGR are unavailable in the provided data, industry trends suggest a considerable market value, potentially exceeding $200 billion in 2025, considering the scale of operations of listed companies like Disney and Comcast, and the widespread use of television advertising globally. The market is driven by factors such as the continued popularity of television programming, especially among older demographics, the increasing sophistication of targeted advertising technologies allowing for precise audience segmentation, and the integration of television advertising with digital platforms through streaming services and connected TVs. Growth is further fueled by the increasing use of data analytics to optimize ad campaigns and measure their effectiveness. However, the market faces challenges such as the rise of streaming services offering ad-free subscriptions, cord-cutting, and increased competition from other advertising mediums like digital and social media. The market segmentation reveals strong performance across various applications (companies, government, other) and types (terrestrial, multichannel, online). Companies such as Disney, Comcast, and ViacomCBS are key players leveraging their extensive content libraries and distribution networks to dominate market share. Regional data suggests a strong presence in North America and Europe, although the Asia-Pacific region exhibits considerable growth potential given its expanding middle class and rising consumption of media. Future growth will likely depend on the ability of television advertisers to innovate and adapt to changing viewer habits and technological advancements.

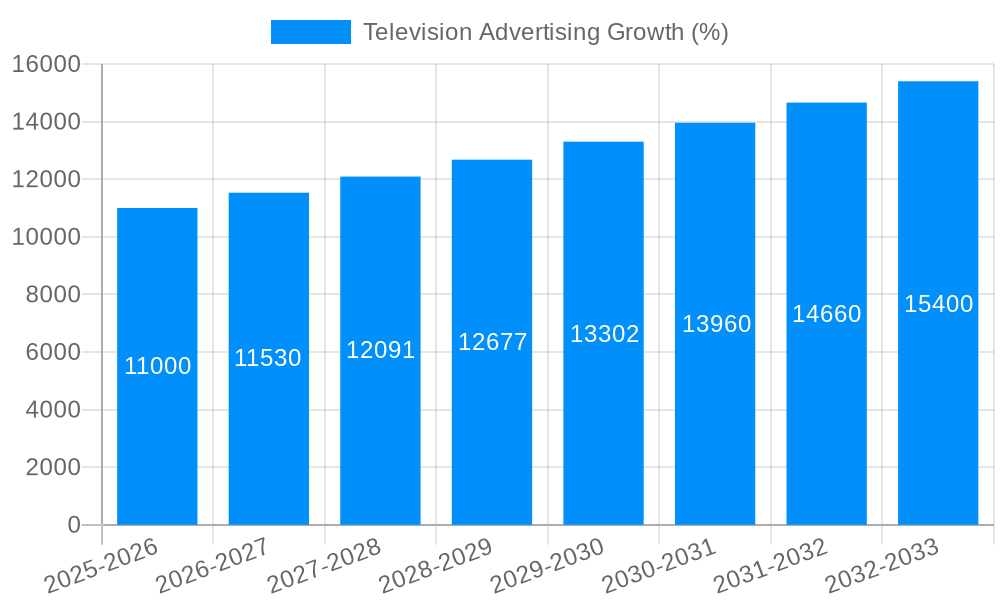

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially decelerating rate, influenced by the aforementioned challenges. Strategic alliances and acquisitions amongst major players are likely, driving further consolidation within the market. Investment in advanced advertising technologies, such as programmatic buying and addressable TV advertising, will be crucial for future success. Geographical expansion into emerging markets will also remain a key focus for major players, contributing to the overall growth of the television advertising market. The integration of traditional television advertising with digital platforms will become even more critical, creating synergistic opportunities and bridging the gap between linear and on-demand viewing. Successfully navigating these evolving dynamics will determine the long-term trajectory of success for companies within the television advertising sector.

The global television advertising market is experiencing a dynamic shift, transitioning from traditional terrestrial broadcasting towards a more diversified landscape encompassing multichannel and online platforms. The study period (2019-2033), with a base year of 2025, reveals a complex interplay of factors influencing market growth. While the historical period (2019-2024) saw a decline in traditional terrestrial advertising revenue for some players due to cord-cutting and the rise of streaming services, the forecast period (2025-2033) projects a moderate rebound driven by innovative advertising strategies and the integration of television advertising into broader digital marketing campaigns. The estimated market value for 2025 is projected to be in the hundreds of millions, with a significant portion contributed by multichannel advertising, particularly through streaming services. This growth, however, is not uniform across all segments. Terrestrial advertising, while still significant, is facing continuous pressure from digital alternatives. The increasing sophistication of targeted advertising, coupled with the growing adoption of programmatic advertising, allows for more efficient campaign deployment and better measurement of return on investment. This shift requires advertisers to adopt more data-driven approaches and to develop strategies that effectively integrate television advertising with other media channels for a holistic marketing strategy. The increasing use of analytics and data-driven insights further enhances the precision and effectiveness of advertising campaigns, optimizing budget allocation and maximizing reach. Major players are actively investing in new technologies, such as addressable TV advertising, which allows for personalized messaging, and connected TV advertising, leveraging the growing popularity of streaming devices. This evolution necessitates that broadcasters adapt to the changing media consumption habits of viewers and develop robust, data-driven solutions to maintain their relevance. The market's future trajectory hinges on the ongoing convergence of traditional and digital advertising, driven by innovation and a willingness to embrace new technological capabilities.

Several key factors are driving the growth of the television advertising market despite the challenges posed by digital media. The increasing sophistication of targeted advertising techniques allows advertisers to reach specific demographics with greater precision, improving campaign effectiveness and return on investment. This is particularly important in a fragmented media landscape where consumers have more choices than ever. The rise of connected TV (CTV) advertising opens up new avenues for reaching audiences on streaming platforms, expanding the reach of television advertising beyond traditional broadcast channels. Programmatic advertising, which automates the buying and selling of ad inventory, increases efficiency and optimizes ad spending. Furthermore, the continued popularity of television content, particularly in the form of streaming services, provides a captive audience for advertisers. The increasing integration of television advertising with broader digital marketing campaigns enables a more holistic and coordinated approach, enhancing overall campaign performance and brand building. Finally, the development of new advertising formats, such as addressable TV advertising which allows for personalized messaging tailored to individual viewers, enhances the effectiveness and engagement of television advertising. These combined factors fuel the evolution and sustained relevance of television advertising in the broader media landscape.

The television advertising market faces significant challenges. The rise of cord-cutting, with consumers increasingly abandoning traditional cable television subscriptions in favor of streaming services, reduces the potential audience for traditional terrestrial advertising. This necessitates a shift towards digital platforms and a greater reliance on data-driven strategies to reach target audiences effectively. The increasing fragmentation of the media landscape, with viewers having access to a wider range of entertainment options, makes it more difficult to capture audience attention and achieve significant reach. Moreover, the rising cost of television advertising, combined with the need for sophisticated targeting and measurement techniques, can strain advertising budgets and increase overall campaign costs. The proliferation of ad blockers and the growing consumer awareness of intrusive advertising practices necessitate a more mindful and less disruptive approach to advertising. Finally, the need for continuous innovation and adaptation to the ever-evolving technological landscape presents a major hurdle, requiring significant investments in new technologies and expertise.

The multichannel advertisement segment is poised to dominate the television advertising market in the forecast period. This is primarily due to the increasing popularity of streaming services and the opportunities they present for targeted advertising.

Multichannel Advertisement specifics:

The convergence of traditional and digital advertising, fueled by technological advancements and changing consumer behavior, is a major catalyst. The adoption of data-driven strategies and personalized advertising significantly enhances campaign effectiveness. Increased investment in programmatic advertising and addressable TV technology further propels the market's expansion.

This report provides a comprehensive overview of the television advertising market, analyzing historical trends, current market dynamics, and future growth projections. The report encompasses key market segments, leading players, and emerging technological advancements, providing valuable insights for industry stakeholders. The analysis highlights both the opportunities and challenges in the sector, including the ongoing shift from traditional to digital advertising and the implications for advertisers and broadcasters alike. The report's findings offer strategic guidance for businesses navigating the evolving landscape of television advertising.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include British Broadcasting Corporation, CBS, Comcast Corporation, Viacom Inc., Cox Communication, Gray Television Inc., Sinclair Broadcast Group, Sun TV Network, The Walt Disney Company, Charter Communications, Discovery Communications Inc., TV Today Network, Vivendi SA., Comcast Corporation, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Television Advertising," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Television Advertising, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.