1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Millimeter Wave Technology?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Telecom Millimeter Wave Technology

Telecom Millimeter Wave TechnologyTelecom Millimeter Wave Technology by Type (Under 50 GHz, Between 50 and 80 GHz, Above 80 GHz), by Application (Telecommunications, Healthcare, Industrial, Security, Transportation & Automotive, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

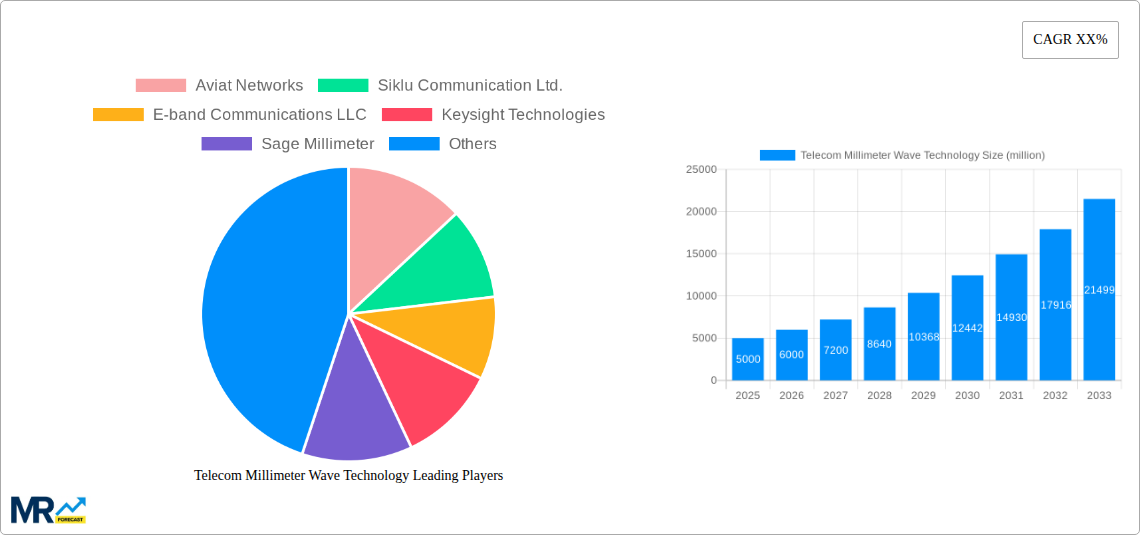

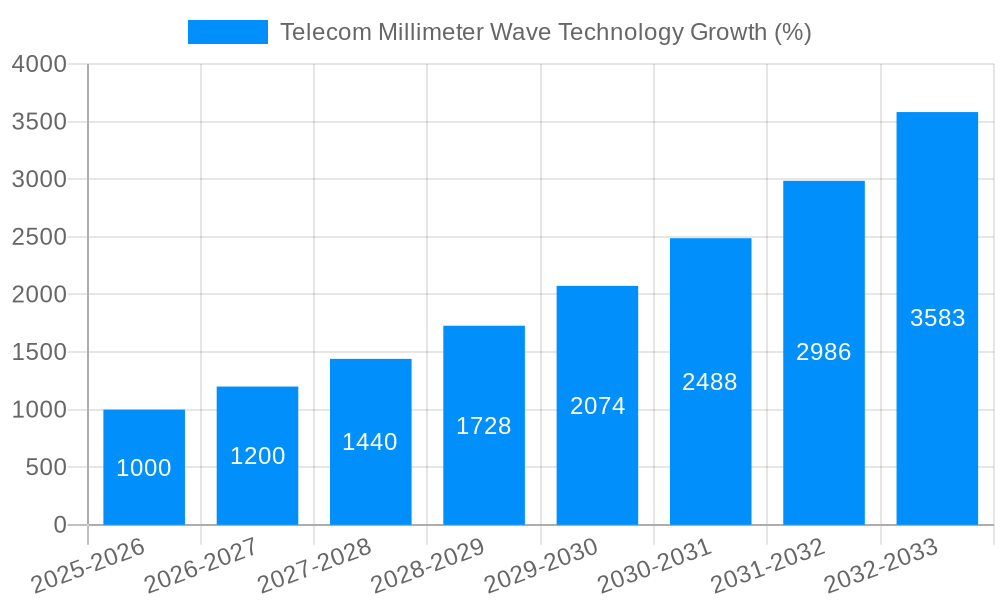

The global telecom millimeter wave (mmWave) technology market is experiencing robust growth, driven by the increasing demand for high-bandwidth applications and the need for faster data speeds. The market, estimated at $5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 20% from 2025 to 2033, reaching approximately $20 billion by 2033. This expansion is fueled by several key factors, including the proliferation of 5G networks, the growing adoption of fixed wireless access (FWA) solutions, and the development of innovative mmWave technologies for various applications. The deployment of private 5G networks in industrial settings and the increasing demand for high-speed internet access in underserved areas are also contributing to market growth. Major players such as Aviat Networks, Siklu Communication, and others are actively engaged in developing advanced mmWave solutions, stimulating competition and innovation. However, challenges such as the high cost of mmWave infrastructure, signal attenuation, and regulatory hurdles remain significant barriers to market penetration.

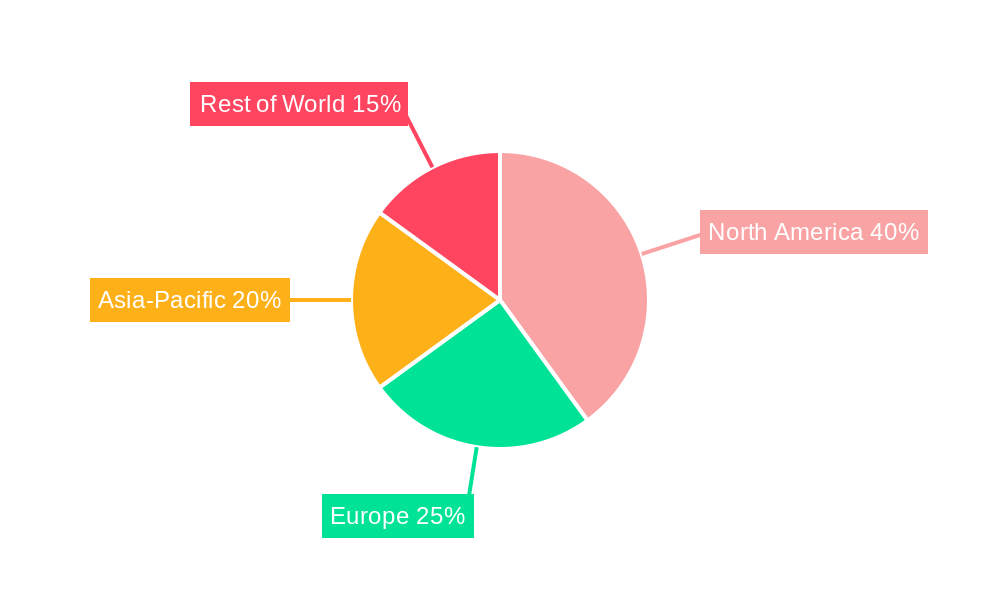

Despite these restraints, the long-term outlook for the telecom mmWave technology market remains positive. Ongoing advancements in mmWave antenna design, improved signal processing techniques, and the development of cost-effective solutions are expected to mitigate some of the current challenges. Furthermore, government initiatives aimed at promoting 5G deployment and the increasing adoption of cloud-based services are likely to further boost market growth in the coming years. The market is segmented by technology, application, and geography. The North American region is currently dominating the market, but significant growth is anticipated in Asia-Pacific and Europe driven by rising infrastructure investments and increasing adoption of 5G networks.

The telecom millimeter wave (mmWave) technology market is experiencing explosive growth, projected to reach several billion USD by 2033. This surge is driven by the insatiable demand for higher bandwidth and faster data speeds to support burgeoning applications like 5G and beyond. The historical period (2019-2024) witnessed significant technological advancements, paving the way for wider adoption. The estimated market size in 2025 is already in the hundreds of millions of USD, representing a substantial increase from previous years. This growth is fueled by the deployment of mmWave technology in various sectors, including fixed wireless access (FWA), backhaul networks, and enterprise applications. The forecast period (2025-2033) anticipates continued expansion, with the market likely exceeding several billion USD, driven by factors such as increasing 5G network deployments, advancements in mmWave antenna design and beamforming, and the development of cost-effective mmWave devices and infrastructure. The increasing adoption of cloud computing and the Internet of Things (IoT) will further contribute to this growth trajectory. While challenges remain, including higher signal attenuation and the need for denser deployments, innovative solutions and technological breakthroughs are steadily mitigating these hurdles. The market is witnessing a shift towards integrated solutions, combining mmWave technology with other technologies to improve performance and reduce costs. This integration strategy is key to unlocking the full potential of mmWave and driving its widespread adoption across various segments and geographies. This report comprehensively analyzes the market dynamics, highlighting key trends, growth drivers, and potential challenges faced by the industry.

Several key factors are propelling the rapid growth of the telecom mmWave technology market. The foremost driver is the increasing demand for higher data speeds and capacity. Existing cellular networks are struggling to meet the ever-growing demand for bandwidth, particularly in densely populated areas. MmWave's vast bandwidth potential offers a solution, enabling significantly faster data rates and greater network capacity. The deployment of 5G networks is another major catalyst, with mmWave playing a critical role in delivering the promised speeds and low latency of this next-generation technology. Furthermore, the rise of IoT and the proliferation of connected devices are putting immense pressure on network infrastructure. MmWave's ability to support numerous devices simultaneously makes it an ideal solution for managing this increased connectivity. Technological advancements in mmWave antenna design, beamforming, and signal processing are also contributing to the growth. Improved antenna designs are leading to higher efficiency and reduced interference. Advanced beamforming techniques allow for better signal focusing, enhancing range and reliability. Meanwhile, cost reductions in mmWave devices and infrastructure are making the technology more accessible to a broader range of users. Finally, government initiatives and regulatory support in many regions are further accelerating market adoption by creating favorable environments for mmWave deployment.

Despite the significant potential of mmWave technology, several challenges and restraints hinder its widespread adoption. One major limitation is the high signal attenuation of mmWave signals, resulting in limited range and requiring denser network deployments compared to lower-frequency technologies. This necessitates a higher density of base stations, increasing infrastructure costs. Another challenge is the susceptibility of mmWave signals to atmospheric interference like rain, fog, and foliage, leading to signal degradation and reduced reliability. The relatively high cost of mmWave equipment, including antennas, radios, and other infrastructure components, also presents a barrier to entry for smaller operators and service providers. The lack of standardization in mmWave technologies and the limited availability of skilled personnel for designing and deploying mmWave systems also pose challenges to the industry. Moreover, regulatory hurdles and spectrum allocation complexities vary significantly across regions, delaying deployment and increasing implementation costs. Finally, overcoming security concerns and developing effective countermeasures against potential vulnerabilities are crucial for fostering wider trust and acceptance of this rapidly expanding technology.

North America (United States and Canada): North America is expected to lead the market due to early adoption of 5G networks, robust investment in telecommunications infrastructure, and presence of major technology companies actively involved in mmWave technology development. The region benefits from a highly developed ecosystem of vendors, integrators, and service providers, further driving market growth. Government support and regulatory clarity also create a favorable environment for mmWave deployments. The high density of urban populations and the demand for high-speed internet connectivity in these areas are further contributing to this region's dominance.

Europe (Germany, UK, France): While slightly behind North America, Europe is experiencing considerable growth in mmWave adoption, driven by increased 5G network rollouts and growing demand for improved mobile broadband services. The ongoing digitalization efforts across European countries are further bolstering demand for advanced network infrastructure. However, regulatory complexities and varying spectrum allocation policies across different European nations might slow down adoption in certain areas. Nevertheless, the market is anticipated to show significant growth throughout the forecast period.

Asia-Pacific (China, Japan, South Korea): The Asia-Pacific region is witnessing rapid growth in mmWave deployment, fueled by the massive expansion of 5G networks and the increasing penetration of smartphones and other connected devices. Significant investments in infrastructure development and the presence of major technology players are driving this expansion. However, differences in regulations and varying infrastructure levels across different countries in this region may lead to uneven growth patterns.

Fixed Wireless Access (FWA): The FWA segment is anticipated to dominate the market because of its ability to provide high-speed broadband internet access to areas with limited or no wired infrastructure. This is particularly relevant in rural and underserved areas, where deploying fiber optic cables is often expensive and challenging. The cost-effectiveness and relatively faster deployment time of mmWave-based FWA solutions compared to wired alternatives are making it a preferred choice for many service providers and consumers.

Backhaul Networks: This segment benefits from mmWave's high bandwidth and capacity to effectively handle the increasing volume of data traffic in cellular networks. The ability of mmWave to provide high-capacity links between base stations and core networks is crucial for supporting the demands of 5G and future mobile technologies.

Enterprise Applications: mmWave technology's capacity to enable high-speed, low-latency private networks is attractive to enterprises for applications like IoT deployment, automation, and real-time data analysis. The growth of this segment is driven by the increasing need for reliable and high-performance connectivity within industrial environments and large corporate campuses.

The telecom mmWave technology industry's growth is fueled by several key catalysts: the burgeoning demand for high-speed data fueled by 5G adoption; cost reductions in mmWave devices and infrastructure; technological innovations resulting in improved antenna design and signal processing; increased investments in research and development by both public and private sectors; and supportive government policies and regulatory frameworks promoting the deployment of mmWave networks in various regions. These catalysts are synergistically pushing the market towards substantial expansion in the coming years.

This report provides a comprehensive overview of the telecom mmWave technology market, including detailed analysis of market size, trends, growth drivers, challenges, and key players. It offers valuable insights into the market dynamics, technological advancements, and future prospects, enabling informed decision-making for stakeholders across the value chain. The report's in-depth segmentation analysis, covering key regions, countries, and application segments, provides a granular view of market opportunities and potential challenges.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Aviat Networks, Siklu Communication Ltd., E-band Communications LLC, Keysight Technologies, Sage Millimeter, Bridgewave Communications, Farran Technology Ltd., LightPointe Communications, Inc., Millitech, Inc., QuinStar Technology, Inc., YeniWave Telecommunication, Millimeter Wave Products Inc. (Mi-Wave), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Telecom Millimeter Wave Technology," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Telecom Millimeter Wave Technology, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.