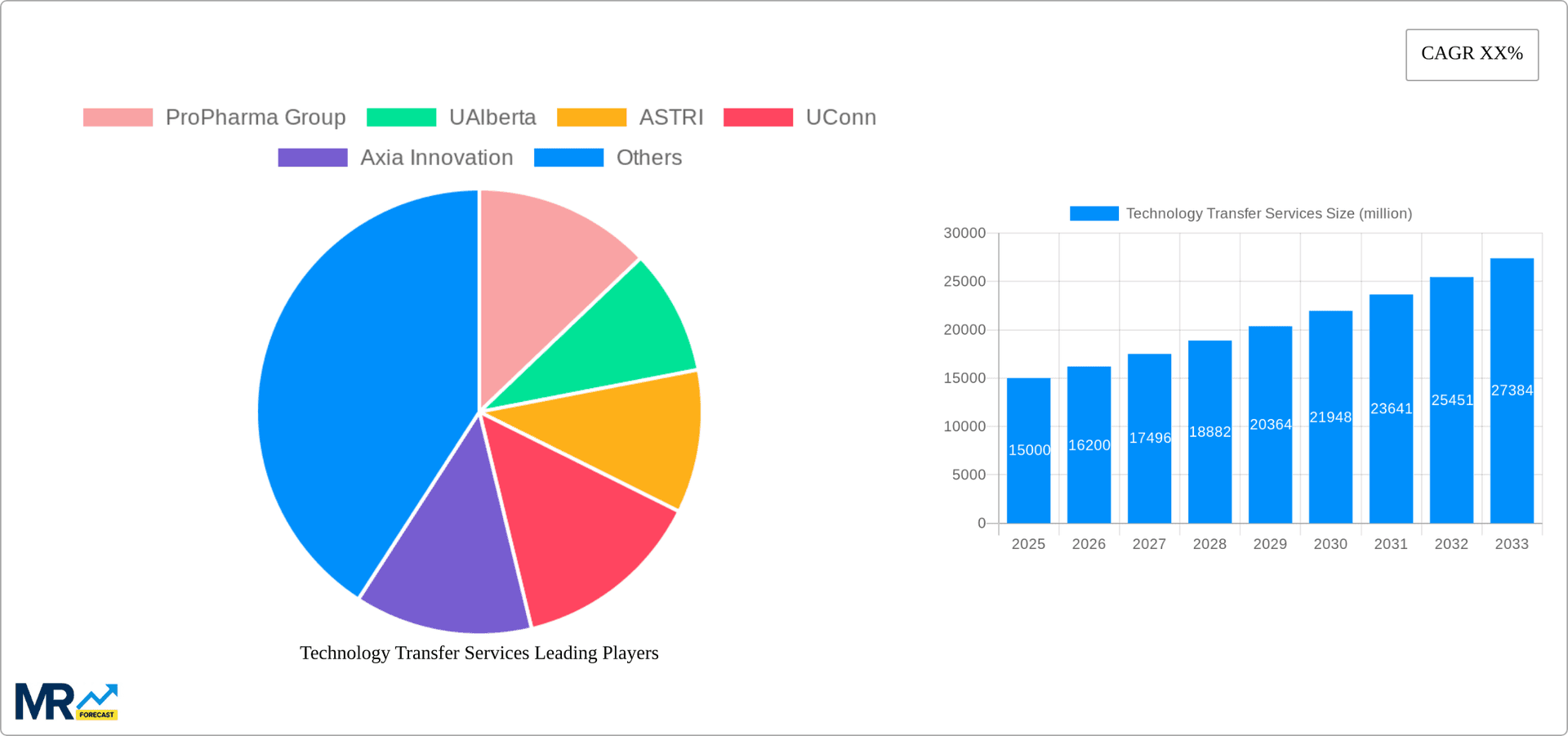

1. What is the projected Compound Annual Growth Rate (CAGR) of the Technology Transfer Services?

The projected CAGR is approximately 9.86%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Technology Transfer Services

Technology Transfer ServicesTechnology Transfer Services by Type (Patents, Trademarks, Copyrights, Others), by Application (Universities, Businesses, Research Centers, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global technology transfer services market is experiencing robust growth, driven by increasing R&D investments across various sectors, particularly pharmaceuticals, biotechnology, and higher education. The market's expansion is fueled by a growing need for commercializing research breakthroughs, fostering innovation, and strengthening collaborative partnerships between academia, industry, and research institutions. A significant trend is the rise of specialized technology transfer offices (TTOs) within universities and research centers, actively managing intellectual property (IP) portfolios and facilitating licensing agreements. Furthermore, the increasing complexity of IP rights, coupled with regulatory hurdles, is creating demand for specialized services, such as patent prosecution, licensing negotiations, and compliance support. While the market faces challenges like lengthy technology commercialization processes and varying levels of IP awareness across different regions, the overall outlook remains positive, driven by continuous innovation and government initiatives promoting technology transfer. We estimate the 2025 market size to be around $15 billion, considering typical market sizes for similar services and the provided CAGR. This figure is expected to see a steady increase, with a projected CAGR of approximately 8% through 2033. This growth will be further fueled by increasing globalization and cross-border collaborations.

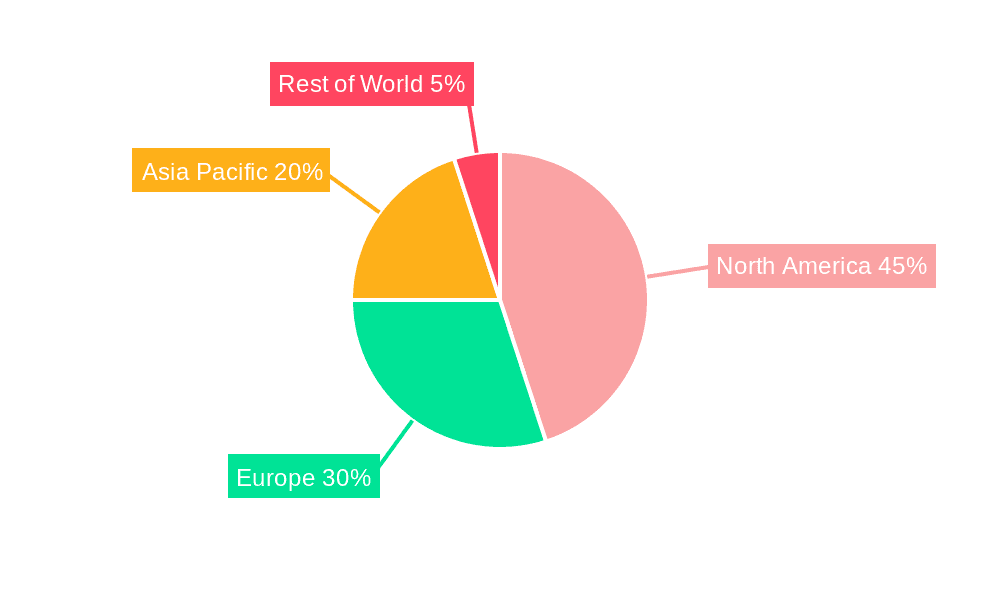

The market segmentation reveals a significant concentration in the pharmaceutical and biotechnology sectors, driven by the high value of intellectual property generated in these fields. The application segment shows universities and businesses as major players, with research centers holding a sizable but potentially less rapidly growing share. North America currently holds the largest market share, owing to established research ecosystems and robust IP protection frameworks. However, regions like Asia-Pacific are exhibiting rapid growth, driven by expanding R&D spending and government support for technology transfer initiatives. Companies like ProPharma Group, Almac, and specialized TTOs are key players, competing on the basis of expertise, network reach, and service offerings. Future growth will likely depend on successful collaborations and the ability of service providers to effectively navigate regulatory landscapes and facilitate seamless technology transfer across borders.

The global technology transfer services market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The study period (2019-2033), encompassing a historical period (2019-2024), base year (2025), and forecast period (2025-2033), reveals a consistently upward trajectory. This expansion is driven by several converging factors. Firstly, the increasing emphasis on research and development (R&D) across various sectors, particularly pharmaceuticals, biotechnology, and information technology, fuels the demand for efficient technology transfer mechanisms. Universities, research institutions, and corporations are increasingly recognizing the commercial potential of their intellectual property (IP), leading to a surge in licensing agreements and technology transfer activities. The globalization of innovation further contributes to market growth, as companies seek access to cutting-edge technologies across geographical boundaries. Moreover, the emergence of sophisticated technology transfer offices (TTOs) with specialized expertise in IP management, commercialization strategies, and negotiation significantly streamlines the process and attracts more participants. This trend is particularly evident in regions with robust innovation ecosystems, such as North America and Europe. The estimated market value in 2025 already showcases significant growth, and projections indicate continued expansion, exceeding several billion dollars within the next decade. This growth is further fueled by government initiatives promoting technology transfer, fostering collaboration between academia and industry, and providing funding for commercialization efforts. The complexity of navigating intellectual property rights and the need for specialized expertise are key factors driving the demand for professional technology transfer services. Companies are increasingly outsourcing these functions to specialized firms, contributing significantly to the market's revenue streams. The market's diverse application across universities, businesses, and research centers showcases its versatility and broad appeal.

Several key drivers fuel the expansion of the technology transfer services market. The rising investments in R&D across industries are a primary catalyst, leading to a substantial increase in the volume of patentable innovations. This surge necessitates efficient mechanisms for transferring these technologies from their originators (universities, research institutions, or companies) to commercial entities capable of bringing them to market. Government initiatives worldwide are actively promoting technology transfer through funding programs, tax incentives, and regulatory frameworks that streamline the process. Furthermore, the growing awareness of the economic benefits derived from effective IP management motivates organizations to prioritize technology transfer. The increasing number of collaborative research projects between academia and industry creates a fertile ground for technology transfer, as these collaborations often lead to innovations ready for commercialization. The trend toward open innovation, where companies collaborate with external partners to access new technologies and expertise, also contributes to market growth. Finally, the rise of specialized technology transfer offices (TTOs) equipped with experienced professionals simplifies the complex process, making it more accessible and attractive to a wider range of stakeholders. The expertise offered by these TTOs in areas like IP valuation, licensing negotiations, and market analysis is proving invaluable in optimizing the return on investment for technology transfer activities.

Despite the robust growth, the technology transfer services market faces several challenges. One major obstacle is the inherent complexity of intellectual property (IP) rights and regulations, which vary significantly across jurisdictions. Navigating these complexities requires specialized expertise, increasing the cost and time associated with technology transfer. Moreover, the valuation of intellectual property can be subjective and challenging, making it difficult to establish fair and mutually agreeable licensing terms. The often-lengthy process of technology transfer can also be a deterrent, as it may involve multiple stakeholders with diverse interests and priorities. There can also be a mismatch between the expectations of technology providers (e.g., universities) and commercial entities, leading to negotiations breakdowns and delays. Furthermore, ensuring the appropriate protection of IP rights throughout the transfer process is crucial to prevent infringement and maintain the value of the technology. Finally, lack of awareness among technology creators about the importance of IP protection and commercialization strategies can hinder the effectiveness of technology transfer initiatives. Addressing these challenges requires a multi-faceted approach, including improved regulatory frameworks, increased awareness campaigns, and the development of standardized procedures for IP valuation and licensing.

The Patents segment is expected to hold a significant share of the technology transfer services market during the forecast period. This is primarily due to the high economic value associated with patents and the rigorous protection they offer to innovative technologies. Patents represent a tangible asset that can be licensed or sold to generate substantial revenue, making them a highly sought-after commodity in the technology transfer landscape. The increasing number of patent filings globally underscores the growing importance of this segment.

North America (United States and Canada): This region is expected to remain a dominant player, driven by strong R&D spending, a robust intellectual property protection system, and the presence of major technology transfer hubs within leading universities and research institutions. The region's well-established ecosystem fosters collaboration between academia, industry, and government, creating a favorable environment for technology transfer. Companies like Merck and ProPharma Group are significant contributors to the market in this region.

Europe (Germany, UK, France): Europe also holds a significant market share, fueled by substantial investments in research and development, a large pool of talented researchers, and government initiatives to support technology transfer. The European Union's focus on innovation and knowledge-based economy contributes to a positive market outlook.

Asia-Pacific (China, Japan, South Korea): This region is witnessing rapid growth, driven by increased R&D activities and government support for technology transfer initiatives. Countries like China and South Korea are investing heavily in innovation infrastructure and fostering collaboration between academia and industry, contributing to the expanding market in this region. ASTRI and IPOPHL are notable players in this area.

The Universities segment represents another crucial sector. Universities are prolific generators of intellectual property, often possessing sophisticated technology transfer offices to manage and commercialize their inventions. These institutions play a crucial role in bridging the gap between academic research and commercial applications. The revenue generated from licensing technologies developed by their faculty and researchers makes this a significant part of their operational budget and contributes to their ability to fund further research and development. UAlberta and UConn are prime examples of universities heavily involved in this sector. The strong link between university research output and commercial success contributes to the growth of the segment and makes it a key market player in the overall technology transfer services landscape.

The technology transfer services industry is propelled by the growing recognition of intellectual property as a valuable asset. This increased awareness is driving companies and institutions to seek professional expertise in managing and commercializing their innovations. Simultaneously, government initiatives, including funding programs and streamlined regulations, are facilitating technology transfer activities. The surge in strategic alliances between academia and industry, coupled with the rise of open innovation models, further contributes to the sector's expansion and its role in creating valuable economic opportunities.

This report provides a comprehensive analysis of the technology transfer services market, offering detailed insights into market trends, driving forces, challenges, key players, and regional dynamics. The comprehensive coverage ensures a complete understanding of the market landscape, providing valuable information for businesses, investors, and stakeholders interested in this dynamic sector. The report utilizes extensive data and analysis to paint a realistic picture of current market conditions and future growth projections.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.86% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.86%.

Key companies in the market include ProPharma Group, UAlberta, ASTRI, UConn, Axia Innovation, GHB Intellect, Bushu Pharma, Almac, IPOPHL, Alien Technology Transfer, Merck, Technology Transfer Service Corp, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Technology Transfer Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Technology Transfer Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.