1. What is the projected Compound Annual Growth Rate (CAGR) of the Tax Relief Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tax Relief Services

Tax Relief ServicesTax Relief Services by Type (Income Tax Relief Services, Property Tax Relief Services, Others), by Application (Personal, Family), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

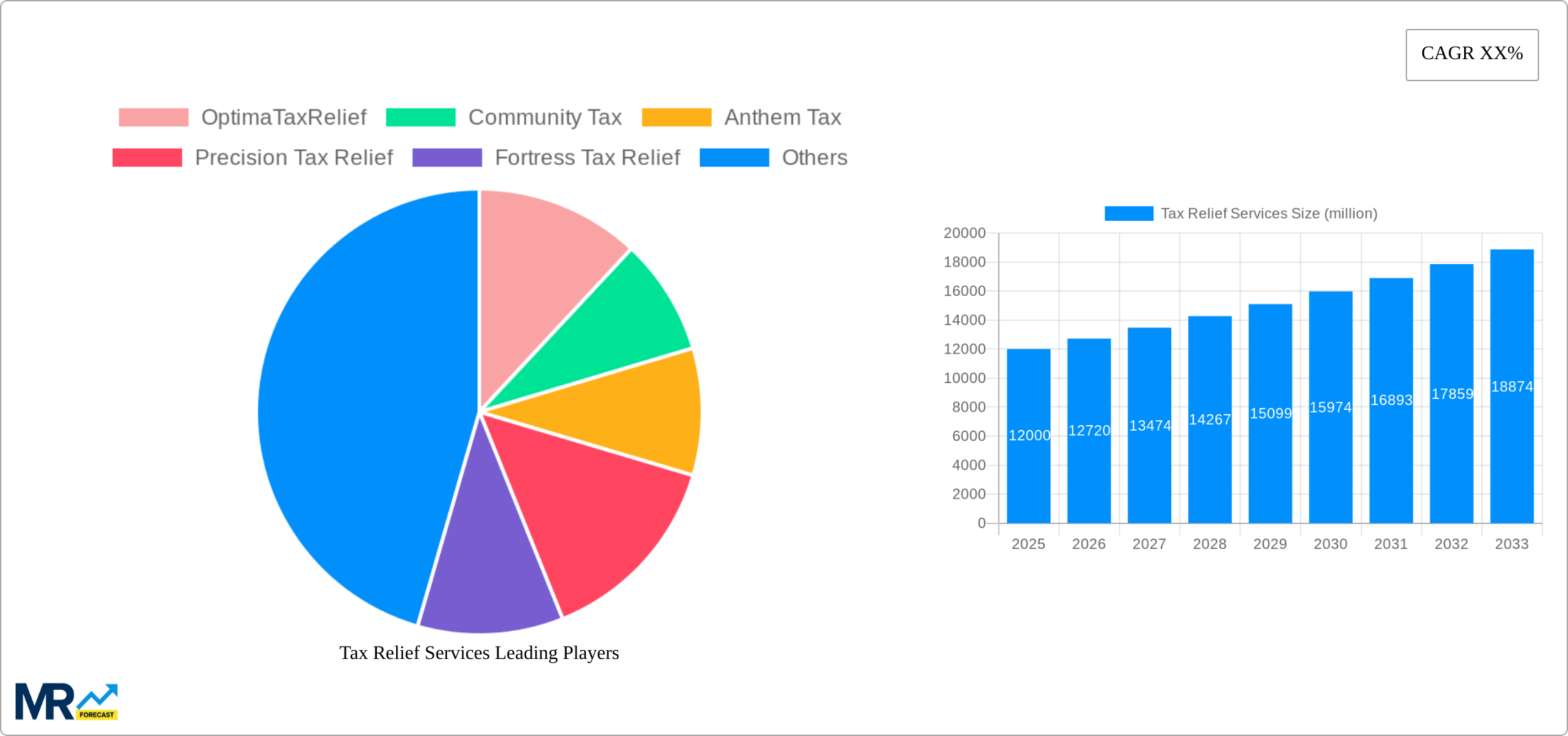

The tax relief services market is experiencing robust growth, driven by increasing complexities in tax regulations, a rise in individual and corporate tax burdens, and a growing need for professional assistance in navigating the tax system. The market's expansion is fueled by a surge in demand for both income tax and property tax relief services, particularly among individuals and families facing financial hardship or seeking to optimize their tax liabilities. While precise market sizing data is unavailable, considering a plausible CAGR (assuming a conservative 8% based on industry trends), a 2025 market value of approximately $15 billion is reasonable. This signifies a substantial opportunity for service providers, as the market is poised for considerable expansion in the forecast period (2025-2033). Further growth is expected due to technological advancements improving service delivery (e.g., online platforms, AI-driven tax solutions) and increasing awareness of available tax relief options among the target population.

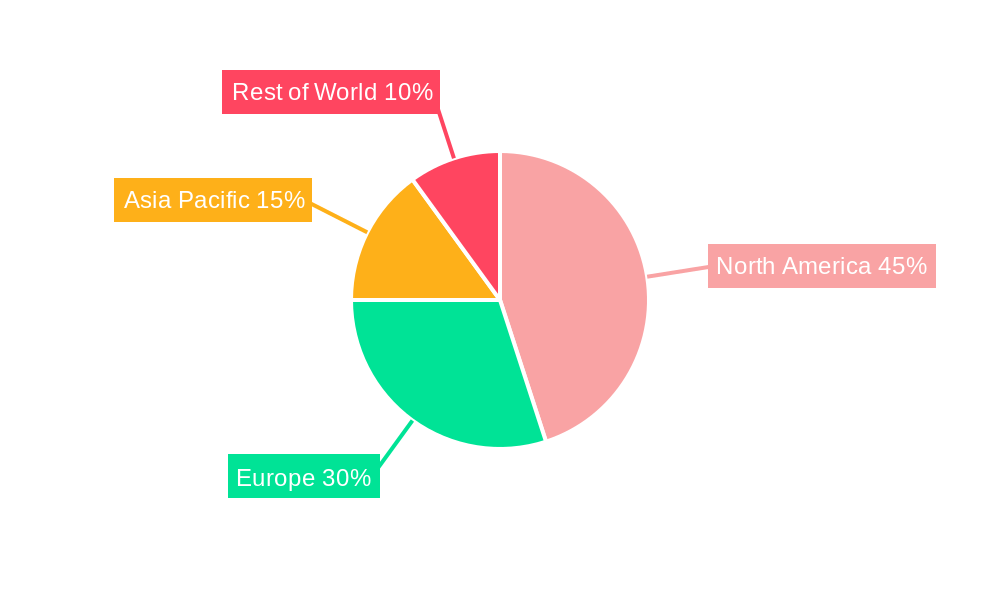

The market segmentation reveals a clear preference for personal applications, although family-oriented services are also gaining traction. North America currently dominates the market share, followed by Europe and Asia Pacific. However, emerging economies in Asia Pacific and the Middle East & Africa present significant untapped potential, suggesting future growth drivers are likely to stem from these regions. Restrictive government regulations, the risk of scams within the industry, and economic downturns pose potential restraints to market growth. Nevertheless, the long-term outlook for the tax relief services market remains positive, given the consistent need for expert tax guidance and the evolving tax landscape. Key players are continually innovating and expanding their service offerings to maintain a competitive edge in this dynamically growing market.

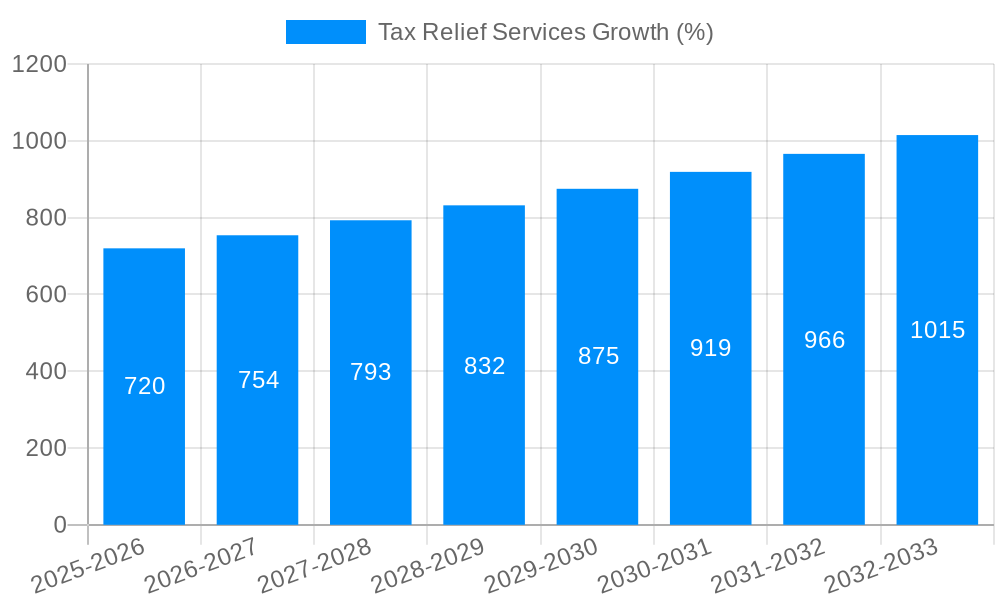

The tax relief services market, valued at $XX million in 2025, is projected to experience robust growth, reaching $YY million by 2033, exhibiting a CAGR of Z% during the forecast period (2025-2033). This growth is fueled by a confluence of factors, including increasing complexities in tax regulations, a rise in individual and business tax burdens, and a growing awareness among taxpayers of the availability of professional assistance in navigating the tax system. The historical period (2019-2024) witnessed a steady upward trend, with significant acceleration observed post-2020, likely driven by economic uncertainties and changes in tax legislation. The market is segmented by service type (income tax relief, property tax relief, and others) and application (personal, family, and business). While income tax relief currently dominates, the property tax relief segment is anticipated to witness significant growth, driven by increasing property values and associated tax liabilities in several regions. The increasing prevalence of digital platforms and online services is streamlining access to tax relief solutions, further contributing to market expansion. However, challenges such as stringent regulatory compliance requirements and the need for skilled professionals capable of handling complex tax issues pose some limitations to the market’s growth trajectory. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Strategic partnerships, technological advancements, and expansion into new geographical markets will be key differentiators in the years to come. The report provides a granular analysis of these trends across different segments and regions, offering a comprehensive perspective on the market's evolution. The base year for this analysis is 2025, providing a current snapshot of the market dynamics, and the study period covers 2019-2033.

Several factors are driving the expansion of the tax relief services market. The ever-increasing complexity of tax laws and regulations globally makes it challenging for individuals and businesses to navigate the tax system effectively, increasing the demand for expert assistance. Furthermore, economic fluctuations and changing tax policies frequently lead to unforeseen tax liabilities, prompting taxpayers to seek professional guidance. The growth of small and medium-sized enterprises (SMEs) adds to the demand, as many lack the internal expertise to handle complex tax compliance and often face challenges in navigating tax audits and disputes. Technological advancements, particularly the development of sophisticated tax software and online platforms, are also playing a significant role. These platforms streamline processes, enhance efficiency, and improve accessibility for taxpayers. Finally, increased awareness campaigns educating taxpayers about available tax relief options are contributing to market expansion. This combined effect of regulatory complexity, economic uncertainty, technological advancement, and heightened awareness is fueling significant growth within the tax relief services sector.

Despite the promising growth outlook, the tax relief services market faces several challenges. Stringent regulatory compliance requirements imposed on service providers demand significant investment in maintaining compliance, potentially impacting profitability. The need to attract and retain qualified professionals with specialized expertise in tax law and accounting is another considerable hurdle. Competition is intense, with numerous players vying for market share, requiring providers to differentiate their offerings and maintain competitive pricing. Economic downturns can negatively impact demand as individuals and businesses reduce discretionary spending, including tax relief services. Furthermore, the risk of litigation and potential penalties for errors in tax filings represents a significant liability for service providers. Public perception and trust are also vital, with negative publicity from incidents of professional misconduct affecting overall market sentiment. Effective mitigation strategies will involve continuous adaptation to regulatory changes, investment in talent acquisition and training, and the development of robust quality control systems.

The United States is currently the dominant market for tax relief services, driven by the complexities of the US tax code and the high number of taxpayers. Within the US, the income tax relief segment holds the largest market share, reflecting the widespread need for assistance in navigating individual and business income tax obligations. However, the property tax relief segment demonstrates high growth potential, primarily due to increasing property valuations and related tax burdens in several states. The family application segment also presents a substantial market opportunity, with families seeking tax relief for various family-related financial circumstances.

High Growth Potential Regions: While the US leads, other developed countries with sophisticated tax systems, such as Canada, the UK, and Australia, are also showing strong growth. Emerging economies, while currently possessing smaller market sizes, present considerable long-term potential due to economic expansion and increasing tax burdens.

Segment Analysis: Income tax relief remains dominant due to the volume of individual and business tax filings and the complexity of related tax laws. However, the rising cost of property and associated taxes makes property tax relief an increasingly significant segment, particularly in high-value property areas. The “others” segment encompasses a diverse range of services like tax audit representation, tax appeals, and other specialized tax-related consultations, offering opportunities for niche service providers. The personal and family application segments contribute to the majority of the current market, but the business application segment shows significant promise for future growth, particularly for SMEs seeking effective tax management solutions.

Geographic Factors: Population density, median income levels, and regional variations in tax regulations heavily influence market dynamics. States and regions with complex tax laws, high property values, or a large proportion of small businesses tend to exhibit higher demand for tax relief services.

Market Segmentation Deep Dive: The report delves into the nuances of market segmentation, providing detailed analysis and projections for each segment across different regions, enabling businesses to identify optimal investment and expansion opportunities.

Continued growth in the tax relief services industry is fueled by increasing tax complexity, economic uncertainty driving higher tax burdens, and expanding awareness of the services' value proposition among taxpayers. Technological advancements are streamlining access and service efficiency, while regulatory changes and increased scrutiny often create a heightened demand for expert assistance. The market will continue expanding as individuals and businesses seek professional guidance to navigate the intricate landscape of tax laws and optimize their tax liabilities.

This report offers a comprehensive analysis of the tax relief services market, providing detailed insights into market size, growth trends, key drivers and challenges, competitive landscape, and future outlook. The granular segmentation by service type, application, and geography offers valuable data for strategic decision-making. This in-depth analysis is essential for businesses, investors, and policymakers seeking a comprehensive understanding of this evolving sector. The report also features detailed company profiles of leading players in the industry, providing a competitive intelligence advantage.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OptimaTaxRelief, Community Tax, Anthem Tax, Precision Tax Relief, Fortress Tax Relief, Tax Hardship Center, Tax Rise, Larson Tax Relief, Tax Defense Network, Liberty Tax, Alleviate Tax, DTCC, ALG Tax Solutions, Enterprise Consultants Group, Approved Accounting, Tax Group Center, Creative Tax Reliefs, Blueprint Financial Consulting, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Tax Relief Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tax Relief Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.