1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Investment Consulting?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sustainable Investment Consulting

Sustainable Investment ConsultingSustainable Investment Consulting by Type (Policy and Regulatory Consulting, Risk Assessment, Management Consulting, ESG Consulting, Others), by Application (Large Enterprises, Small and Medium Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

Market Analysis for Sustainable Investment Consulting

The global market for Sustainable Investment Consulting is projected to expand rapidly, driven by rising investor demand for responsible and impact-driven investments. In 2025, the market size stood at approximately USD XX million, and it is estimated to reach USD XX million by 2033, exhibiting a CAGR of XX% during the forecast period. The increasing awareness of environmental, social, and governance (ESG) factors, coupled with regulatory mandates and stakeholder pressure, is propelling the demand for sustainable investment advisory services.

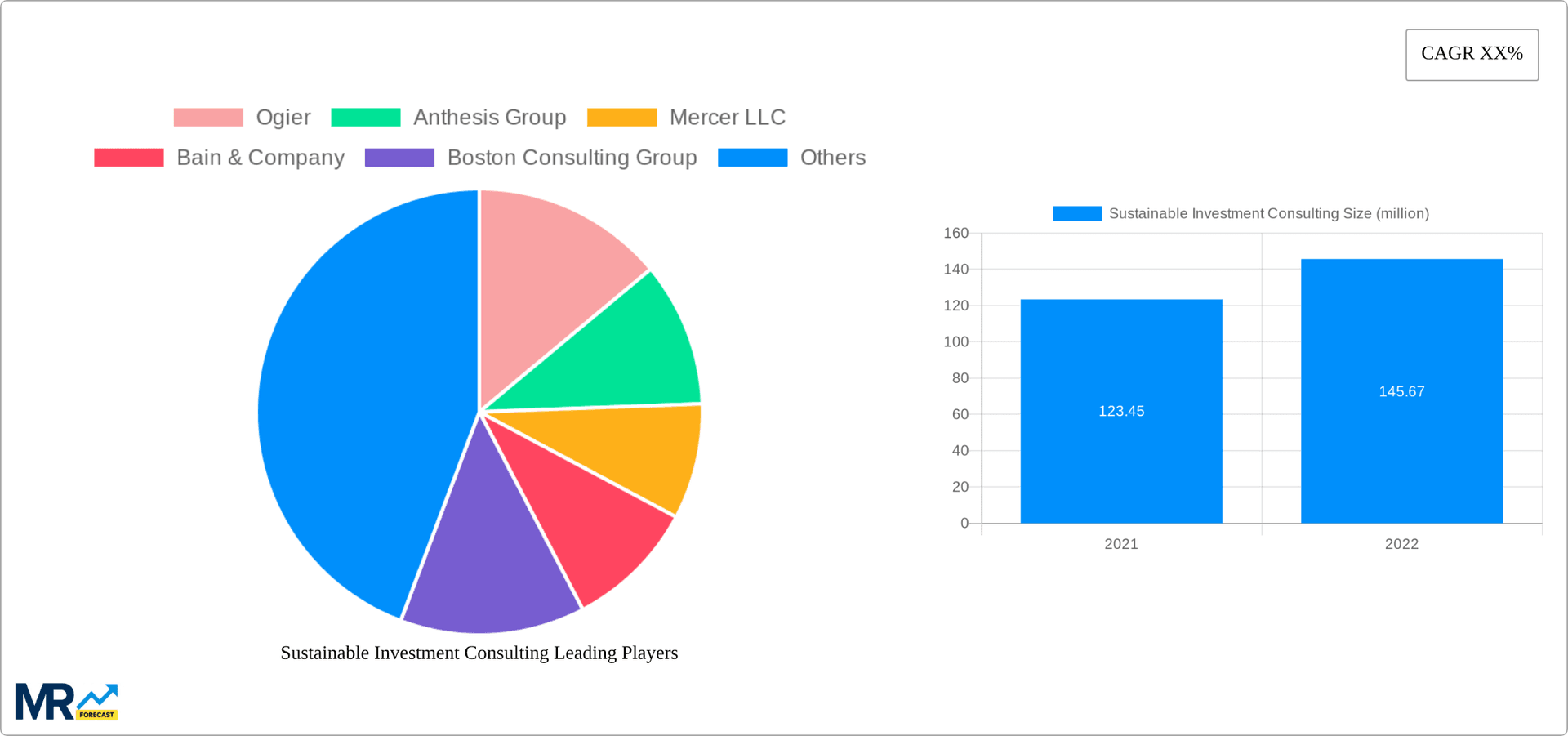

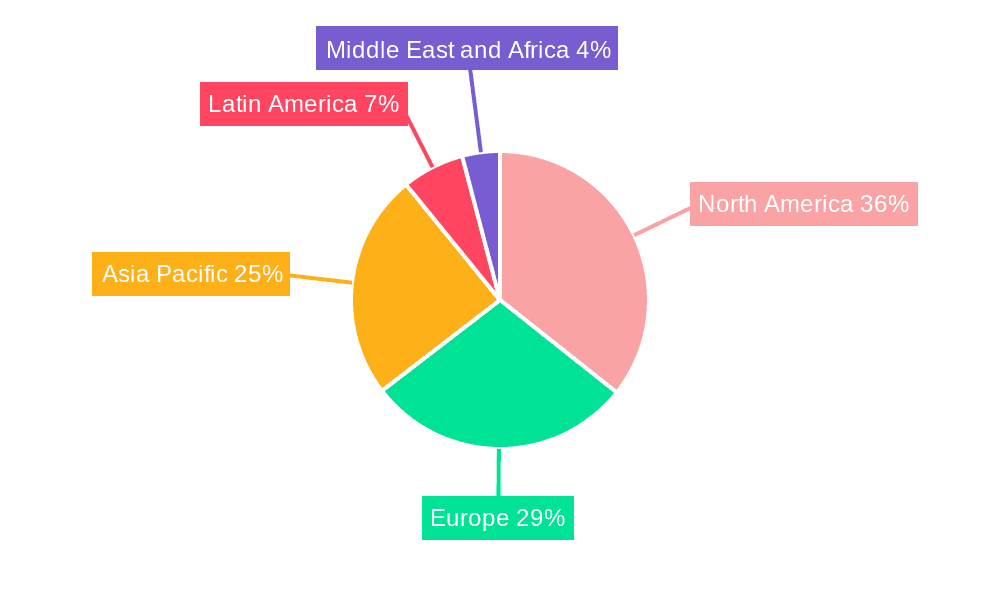

The market is segmented into different types of consulting services, including policy and regulatory consulting, risk assessment, management consulting, ESG consulting, and others. The application segments comprise large enterprises and small and medium enterprises. Key companies in this space include Ogier, Anthesis Group, Mercer LLC, Bain & Company, Boston Consulting Group, Ksapa, EcoVadis, Marquette, Brown Advisory, Position Green, Savage Investment Consulting, and Hedgehog Company. The market is expected to witness growth across various regions, with North America, Europe, and Asia Pacific being major contributors.

The global sustainable investment consulting market is projected to reach USD 15 billion by 2027, growing at a CAGR of 12.3%. The market is driven by increasing awareness of environmental, social, and governance (ESG) issues, as well as the growing demand for sustainable investment products and services.

Key market insights include:

The sustainable investment consulting industry is being propelled by several key factors:

The sustainable investment consulting industry faces several challenges and restraints, including:

The following key regions and segments are expected to dominate the sustainable investment consulting market:

Key Regions:

Key Segments:

The following factors are expected to drive growth in the sustainable investment consulting industry:

Recent developments in the sustainable investment consulting sector include:

This report provides a comprehensive overview of the global sustainable investment consulting market, including key market insights, driving forces, challenges and restraints, key region and segment analysis, growth catalysts, leading players, and significant developments. The report is designed to provide investors, financial advisors, and other stakeholders with the information they need to make informed decisions about sustainable investment consulting services.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ogier, Anthesis Group, Mercer LLC, Bain & Company, Boston Consulting Group, Ksapa, EcoVadis, Marquette, Brown Advisory, Position Green, Savage Investment Consulting, Hedgehog Company.

The market segments include Type, Application.

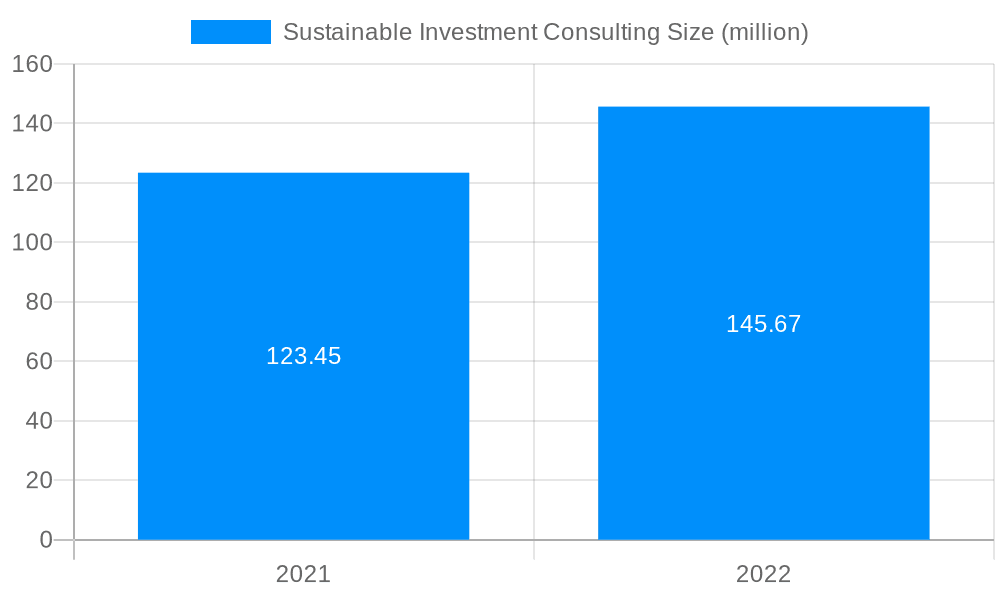

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Sustainable Investment Consulting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sustainable Investment Consulting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.