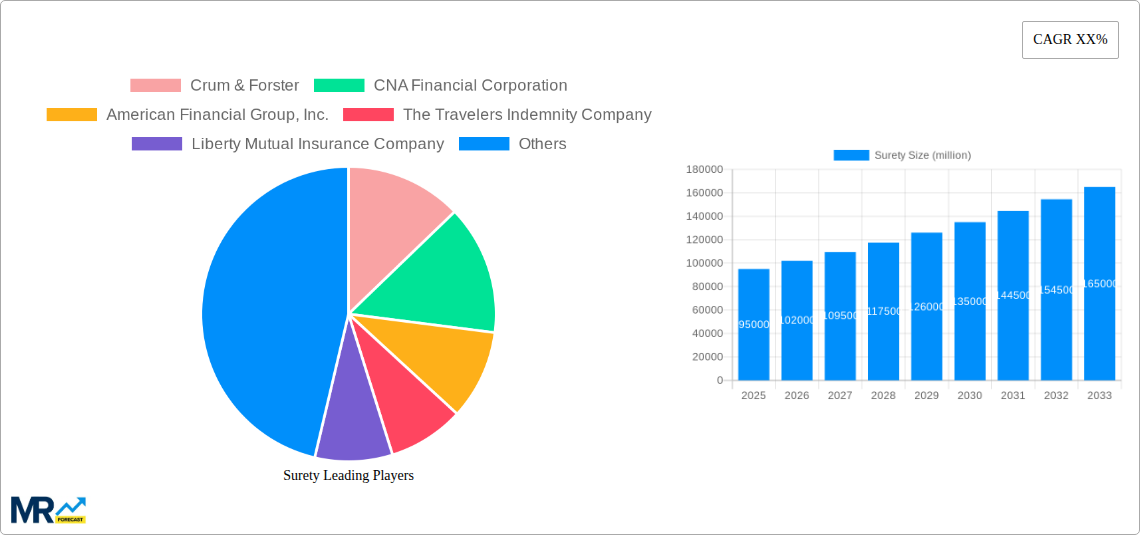

1. What is the projected Compound Annual Growth Rate (CAGR) of the Surety?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Surety

SuretySurety by Type (/> Contract Surety Bond, Commercial Surety Bond, Court Surety Bond, Fidelity Surety Bond), by Application (/> Government Agency, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Surety market is poised for robust expansion, projected to reach a substantial market size by 2033. Fueled by increasing infrastructure development worldwide, stringent regulatory requirements across various industries, and the growing need for financial guarantees in construction and commercial projects, the market demonstrates significant upward momentum. The Compound Annual Growth Rate (CAGR) of XX% indicates a consistent and healthy expansion trajectory over the forecast period of 2025-2033. Key drivers such as government initiatives for infrastructure spending, especially in developing economies, and the rising complexity of business transactions necessitating surety bonds for risk mitigation, will propel this growth. Furthermore, the expanding adoption of surety bonds in new application areas, beyond traditional construction, to cover a wider spectrum of contractual obligations and financial assurances, will contribute to market dynamism.

The market is segmented by type, with Contract Surety Bonds and Commercial Surety Bonds anticipated to dominate due to their widespread application in public and private sector projects. The increasing emphasis on compliance and risk management by enterprises, coupled with government mandates for securing performance and payment obligations, further solidifies the demand for these bond types. While the market exhibits strong growth, certain restraints may include the complex underwriting process, potential for economic downturns affecting project financing, and evolving regulatory landscapes that could necessitate adjustments in product offerings. However, the overarching positive outlook, driven by economic recovery and a sustained focus on secure financial transactions, suggests a resilient and expanding surety market.

This in-depth report provides a thorough analysis of the global surety market, encompassing a detailed examination of its historical performance, current state, and projected future. Utilizing a robust study period from 2019 to 2033, with a specific focus on the base year 2025 and the forecast period 2025-2033, the report leverages data from the historical period (2019-2024) to offer actionable insights. The comprehensive coverage includes an intricate breakdown of key market trends, the driving forces behind market expansion, the inherent challenges and restraints, dominant regional and segmental landscapes, significant growth catalysts, and a detailed profile of leading industry players. The estimated market size, projected to be in the hundreds of millions of dollars, is meticulously dissected to provide stakeholders with a clear understanding of investment opportunities and strategic positioning within this vital financial sector.

The surety market, projected to be valued in the hundreds of millions of dollars, has demonstrated a dynamic evolution throughout the historical period of 2019-2024, with significant implications for the forecast period of 2025-2033. A key overarching trend observed is the increasing complexity of project financing and infrastructure development, which directly fuels the demand for surety bonds. For instance, the surge in government investment in public works, coupled with private sector initiatives in energy and transportation, has propelled the Contract Surety Bond segment to become a cornerstone of the market. This is further amplified by stringent regulatory frameworks across various jurisdictions, mandating the use of surety to mitigate financial risks for obligee parties. Consequently, the market has witnessed a steady uptick in premium volumes, reflecting both increased issuance and the inherent value proposition of surety instruments.

Furthermore, the Fidelity Surety Bond segment has experienced robust growth, driven by rising concerns around corporate fraud and employee dishonesty. As businesses increasingly rely on digital transactions and complex internal processes, the need for robust fidelity coverage to protect against financial losses from internal malfeasance has become paramount. This trend is particularly pronounced in industries with high transaction volumes and sensitive data management. Simultaneously, the Commercial Surety Bond sector, encompassing a diverse range of obligations such as license and permit bonds, has also shown resilience. This segment's growth is intrinsically linked to the overall health of small and medium-sized enterprises (SMEs) and the ease of doing business, as these bonds are often prerequisites for obtaining licenses and permits essential for operational commencement and continuity. The market is also observing a subtle yet significant shift towards greater digitalization in underwriting and claims processing. Insurers are investing in advanced analytics and artificial intelligence to streamline risk assessment, improve efficiency, and enhance customer experience. This technological adoption is expected to further optimize market operations and potentially lead to more competitive pricing structures in the coming years.

The interplay between these segments, influenced by economic cycles, regulatory landscapes, and technological advancements, paints a picture of a mature yet evolving market. The base year of 2025 serves as a crucial pivot point, where these established trends are expected to solidify, laying the groundwork for continued expansion and potential disruption in the forecast period. The report's detailed analysis will delve into the specific growth rates and market shares attributed to each segment, providing a granular understanding of where the most significant opportunities and challenges lie. The increasing sophistication of risk management strategies adopted by both obligors and obligees will continue to shape the surety landscape, pushing for innovative product offerings and more tailored risk transfer solutions.

The global surety market, with its projected valuation in the hundreds of millions of dollars, is propelled by a confluence of robust economic and regulatory factors, particularly evident as we move through the study period of 2019-2033. A primary driver is the sustained global focus on infrastructure development and renewal. Governments worldwide are prioritizing significant investments in transportation networks, renewable energy projects, and public utilities, necessitating the issuance of Contract Surety Bonds to guarantee project completion and financial solvency. This monumental undertaking creates a consistent and substantial demand for surety products, as these bonds provide essential financial protection to public entities and private investors, mitigating risks associated with contractor default or non-performance. The estimated market size is directly influenced by the scale of these public and private sector expenditures.

Furthermore, the increasing complexity of business operations and the growing emphasis on corporate governance are significant contributors to the growth of the Fidelity Surety Bond segment. As organizations expand their global reach and adopt intricate financial systems, the potential for internal fraud and financial mismanagement escalates. Consequently, businesses are proactively seeking surety solutions to safeguard their assets against such losses. This heightened awareness of internal risk, coupled with evolving compliance requirements, ensures a steady demand for fidelity coverage. The Commercial Surety Bond sector, while diverse, is also benefiting from an environment of increased entrepreneurial activity and the liberalization of business regulations in various regions. As more businesses seek to establish and expand their operations, they encounter a multitude of licensing and permit requirements, many of which necessitate the procurement of surety bonds. This symbiotic relationship between business growth and regulatory compliance acts as a continuous catalyst for the commercial surety market.

The overall economic stability and growth projections are also fundamental to the surety market's upward trajectory. A healthy economy typically translates to increased construction activity, expanded business ventures, and greater financial confidence, all of which directly stimulate the need for surety instruments. The base year of 2025, with its projected economic outlook, is expected to be a pivotal point where these driving forces coalesce to further accelerate market expansion.

Despite the robust growth trajectory and positive outlook for the surety market, which is poised to reach hundreds of millions of dollars in valuation, several challenges and restraints continue to shape its dynamics throughout the study period of 2019-2033. A significant hurdle is the inherent cyclical nature of the construction industry, a primary consumer of Contract Surety Bonds. Economic downturns or fluctuations in government spending can lead to a reduction in project pipelines, thereby impacting the demand for new surety bonds and potentially increasing claims. This cyclicality necessitates careful risk management and capital allocation by surety providers. The potential for increased claims frequency and severity during economic slowdowns presents a constant underwriting challenge, requiring rigorous risk assessment and pricing strategies.

Another notable restraint is the increasingly competitive landscape, with numerous established players and emerging entrants vying for market share. This intense competition, especially in mature markets, can exert downward pressure on premium rates, impacting profitability. Surety companies must continually innovate and differentiate their offerings to maintain a competitive edge. Furthermore, regulatory changes and evolving compliance requirements, while often driving demand, can also introduce complexities and additional operational costs. Adapting to diverse and frequently updated regulations across different jurisdictions demands significant investment in compliance infrastructure and expertise. For instance, changes in contract law or performance standards can necessitate adjustments to underwriting policies and claims handling procedures, adding layers of complexity.

The availability and cost of reinsurance also pose a potential restraint. Surety companies rely on reinsurance to manage their exposure to large or catastrophic losses. Fluctuations in the reinsurance market, including rising costs or reduced capacity, can impact the profitability and risk appetite of primary surety underwriters. Moreover, the potential for adverse selection, where higher-risk principals are more likely to seek surety bonds, presents an ongoing challenge for underwriting profitability. Ensuring accurate risk assessment and appropriate pricing for all principals is critical to mitigating this challenge. The report will delve into the specific impact of these challenges on different segments and regions, providing insights into how market participants are navigating these complexities.

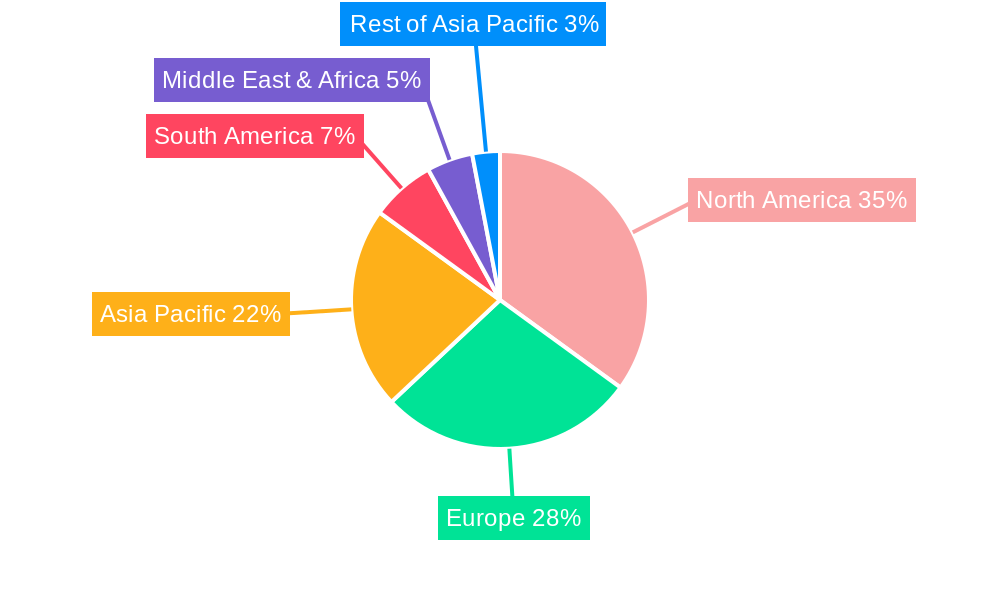

The global surety market, valued in the hundreds of millions of dollars, is characterized by distinct regional and segmental dominance that is expected to evolve throughout the study period of 2019-2033.

Dominant Segments:

Contract Surety Bond: This segment consistently stands out as the largest and most influential component of the surety market. Its dominance is inextricably linked to the robust global infrastructure development agenda.

Commercial Surety Bond: While smaller in absolute terms than Contract Surety, the Commercial Surety Bond segment is experiencing robust growth and is expected to play an increasingly significant role.

Dominant Regions/Countries:

North America (United States & Canada): This region is the undisputed leader in the global surety market. The United States, in particular, accounts for a substantial portion of the global premium volume, driven by its massive construction sector, robust regulatory environment, and diversified economy.

Europe (Western Europe): Western European countries, with their developed economies and extensive infrastructure, constitute another significant region for surety.

Asia-Pacific: This region, led by China, is emerging as a critical growth engine for the surety market.

The dominance of these segments and regions is further reinforced by specific industry developments and the application of surety bonds across government agencies and enterprises. The report will provide a granular breakdown of market share and growth projections for each region and segment, offering a comprehensive view of the global surety landscape.

Several key factors are acting as significant growth catalysts for the surety industry, projected to be valued in the hundreds of millions of dollars. The most prominent is the sustained global push for infrastructure development and modernization, fueled by government initiatives and private sector investments. This directly boosts the demand for Contract Surety Bonds, as these are essential for guaranteeing project completion. Furthermore, an increasing awareness of risk management and a heightened focus on corporate governance are driving the uptake of Fidelity Surety Bonds, protecting businesses against internal fraud. The growing entrepreneurial spirit and the need to comply with various licensing and permit requirements are also spurring growth in the Commercial Surety Bond segment. Lastly, technological advancements in underwriting and claims processing are enhancing efficiency and customer experience, making surety products more accessible and attractive.

The global surety market is characterized by a competitive landscape with several prominent players contributing significantly to its growth and evolution. These companies are instrumental in providing financial guarantees and risk mitigation solutions across various segments.

The surety sector has witnessed several pivotal developments throughout the historical and forecast periods, shaping its operational landscape and market dynamics:

This comprehensive report serves as an indispensable guide to understanding the multifaceted global surety market, poised to reach hundreds of millions of dollars in valuation. It meticulously analyzes the forces driving its expansion, including the insatiable demand for infrastructure development and heightened corporate risk awareness, which are propelling the Contract and Fidelity Surety Bond segments respectively. The report also critically examines the inherent challenges and restraints, such as market cyclicality and intense competition, that require strategic navigation by industry stakeholders. Furthermore, it identifies the key regions and segments set to dominate the market, offering insights into where future growth and opportunities lie. By detailing significant developments and highlighting leading players, this report provides a holistic view of the surety landscape, empowering businesses and investors with the knowledge to capitalize on emerging trends and make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Crum & Forster, CNA Financial Corporation, American Financial Group, Inc., The Travelers Indemnity Company, Liberty Mutual Insurance Company, The Hartford, HCC Insurance Holdings Inc., Chubb, AmTrust Financial Services, IFIC Security Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Surety," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Surety, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.