1. What is the projected Compound Annual Growth Rate (CAGR) of the Subscription E-commerce?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Subscription E-commerce

Subscription E-commerceSubscription E-commerce by Type (Replenishment, Curation, Access), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

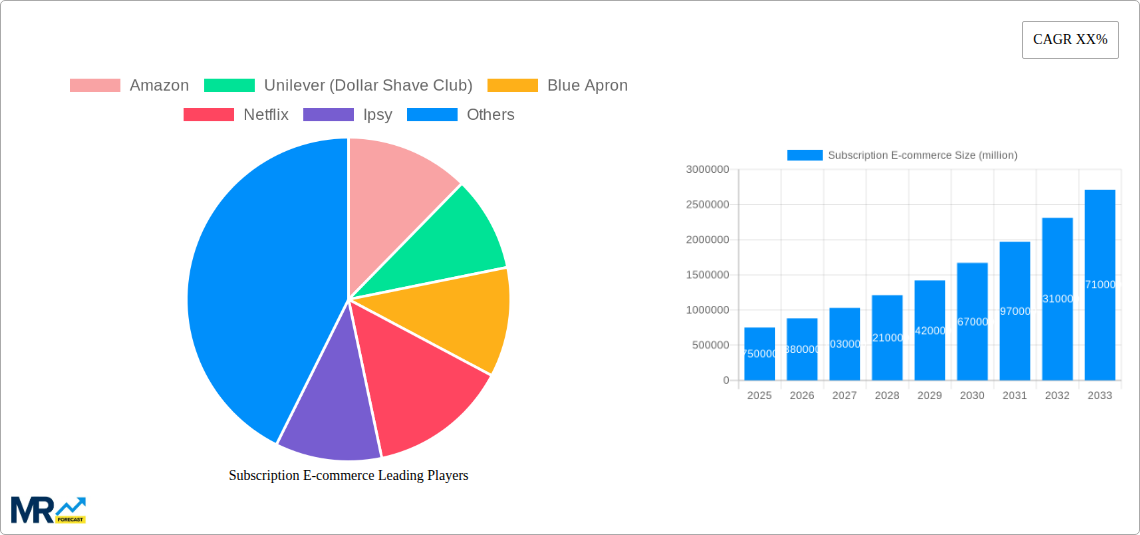

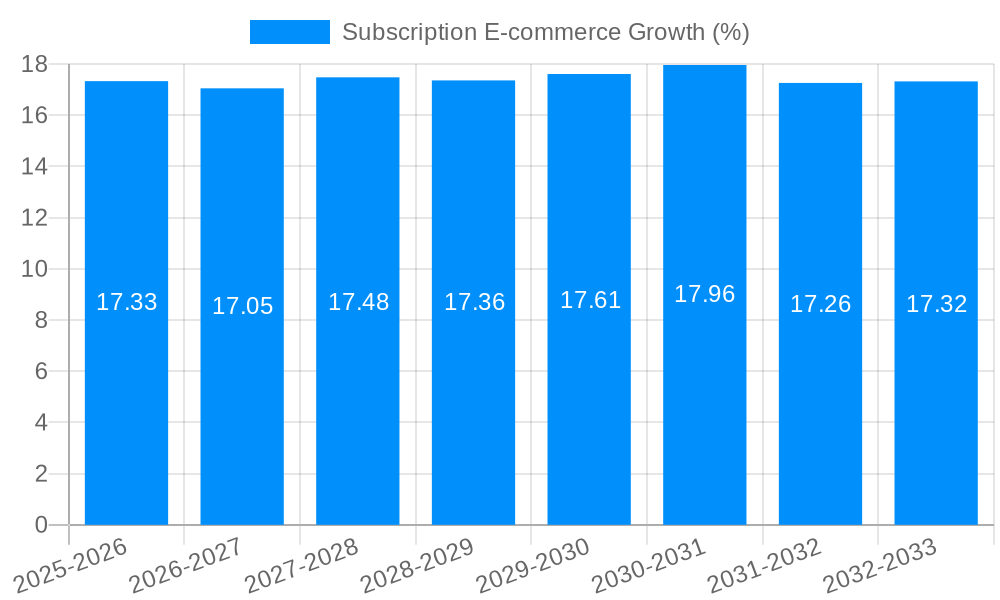

The global Subscription E-commerce market is poised for significant expansion, projected to reach an estimated USD 750 billion by 2025. This growth is fueled by a burgeoning CAGR of approximately 20% over the forecast period of 2025-2033. Consumers are increasingly embracing the convenience, personalization, and cost-effectiveness offered by subscription models across a wide array of product and service categories. Key drivers include the rising disposable incomes, a growing preference for curated experiences, and the seamless integration of subscription services into daily life. The e-commerce boom, accelerated by digital adoption, further solidifies the foundation for this market's upward trajectory. Companies like Amazon, with its Prime subscription, and specialized players such as Netflix for entertainment, Ipsy for beauty, and HelloFresh for meal kits, exemplify the successful implementation of diverse subscription strategies. The market is segmented into Replenishment, Curation, and Access types, with both Online and Offline application channels contributing to its broad reach.

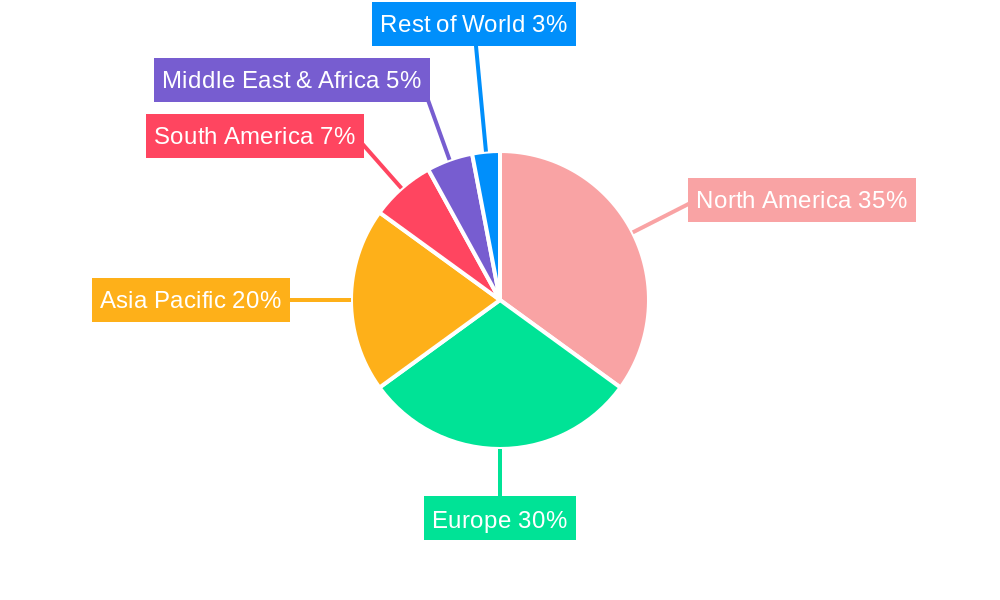

The subscription e-commerce landscape is characterized by several prominent trends and a few underlying restraints. The increasing demand for personalized and curated offerings is a major trend, with businesses leveraging data analytics to tailor subscriptions to individual customer preferences, as seen with services like Sephora Play and Birchbox. The "access over ownership" model, particularly in digital content and services like Disney+, is gaining traction. Furthermore, the integration of advanced technologies, including AI for product recommendation and blockchain for supply chain transparency, is enhancing customer experience and operational efficiency. However, challenges such as subscription fatigue, where consumers feel overwhelmed by multiple recurring payments, and high customer acquisition costs can pose restraints. Maintaining customer loyalty and reducing churn rates through continuous value addition and excellent customer service are critical for sustained success. Geographically, North America and Europe currently dominate the market, with Asia Pacific demonstrating the fastest growth potential due to its large, digitally savvy population and expanding middle class.

The subscription e-commerce landscape, projected to flourish significantly between 2019 and 2033 with a base year estimation of 2025, is characterized by a dynamic evolution driven by changing consumer behaviors and technological advancements. During the historical period of 2019-2024, we witnessed a substantial surge in the adoption of subscription models across diverse industries, fundamentally altering how consumers engage with products and services. This growth is not merely a fleeting trend but a systemic shift towards convenience, personalization, and value-driven consumption. By the estimated year of 2025, the market is poised to reach a significant milestone, with projections indicating that tens of millions of units will be transacted within this segment, a testament to its pervasive influence. The study period up to 2033 further suggests a sustained upward trajectory, implying a robust future for this e-commerce vertical.

The core of this evolution lies in the consumer's desire for seamless access and predictable costs. For instance, companies like Netflix and The Walt Disney Company have revolutionized the media consumption model, offering vast libraries of content for a recurring fee, fundamentally disrupting traditional entertainment distribution. In the consumer goods sector, Unilever (Dollar Shave Club) and Edgewell Personal Care (Harry’s) have demonstrated the power of replenishment subscriptions, ensuring customers never run out of essential products like razors and toiletries, thereby fostering immense customer loyalty. Meanwhile, Blue Apron and Hello Fresh have carved a niche in the meal kit industry, delivering curated culinary experiences directly to consumers' doors, simplifying home cooking and reducing food waste. The rise of beauty boxes, exemplified by Ipsy and Sephora Play, highlights the success of curated subscriptions, offering personalized selections of beauty products, allowing consumers to discover new brands and tailor their routines. Even niche markets are seeing significant traction, with Barkbox providing tailored dog treat and toy assortments and Flintobox catering to early childhood development with educational kits. These diverse examples underscore the adaptability and broad appeal of subscription e-commerce, demonstrating its ability to cater to a wide spectrum of consumer needs and preferences across millions of units. The increasing integration of these models by major players like Amazon, with its vast Prime subscription service encompassing e-commerce, streaming, and more, further solidifies its position as a dominant force in shaping the future of retail.

Several potent forces are synergistically propelling the subscription e-commerce market into its current and future growth trajectory. Foremost among these is the escalating consumer demand for unparalleled convenience and personalized experiences. In today's fast-paced world, individuals are increasingly willing to pay a premium for services that simplify their lives, automate recurring purchases, and offer tailored selections that align with their unique preferences. This is vividly demonstrated by the success of replenishment models, where companies like Unilever (Dollar Shave Club) and Petsmart ensure that essential goods are delivered automatically, eliminating the need for frequent shopping trips and fostering a sense of effortless consumption. Furthermore, the rise of curated subscriptions, as seen with Ipsy and Birch Box, taps into the consumer's desire for discovery and personalized recommendations, offering a delightful unboxing experience and introducing them to new products they might not have found otherwise. The predictable nature of subscription pricing also appeals to budget-conscious consumers, allowing them to manage their expenses effectively and avoid unexpected costs. This consistent revenue stream also provides businesses with valuable predictability and customer lifetime value, fostering loyalty and reducing customer acquisition costs. The increasing affordability and accessibility of these services, coupled with a growing comfort with online transactions, further bolsters this momentum.

Despite its remarkable growth, the subscription e-commerce sector is not without its inherent challenges and restraints that can impede its progress. A significant hurdle is the increasing customer churn rate, often referred to as "subscription fatigue," where consumers, overwhelmed by multiple recurring payments, may cancel subscriptions they no longer perceive as valuable. This necessitates a continuous effort from businesses to provide ongoing value, innovation, and excellent customer service to retain subscribers. For instance, Blue Apron has faced challenges in maintaining subscriber loyalty amidst intense competition and evolving consumer tastes. Another considerable challenge lies in the effective management of inventory and logistics, especially for businesses dealing with perishable goods or a wide variety of SKUs, as seen with companies like Hello Fresh. The cost of customer acquisition can also be substantial, requiring significant marketing investment to attract new subscribers, and if churn rates are high, this can lead to unsustainable business models. The complexity of managing recurring billing and payment processing, especially across different regions and payment methods, presents a technical challenge, though platforms like Recurly and Magento are continuously evolving to address these. Furthermore, maintaining differentiation in an increasingly crowded market requires constant innovation and a deep understanding of customer needs, as evidenced by the competitive landscape of beauty boxes like Ipsy and Sephora Play.

The subscription e-commerce market is experiencing significant dominance from specific regions and segments, with North America and Europe emerging as frontrunners, primarily driven by their mature e-commerce infrastructure and high disposable incomes. However, the Asia-Pacific region is rapidly gaining traction, fueled by a burgeoning middle class, increasing internet penetration, and a growing acceptance of digital payment methods, indicating immense future potential. Within this global landscape, the Replenishment segment, focusing on the automatic delivery of essential goods, stands out as a key dominator. This segment’s success is underpinned by its inherent convenience and predictability, directly addressing a fundamental consumer need. Companies like Amazon, with its ubiquitous Prime subscription service that encompasses replenishment of everyday items, have solidified this segment's stronghold. Similarly, Unilever's acquisition of Dollar Shave Club and Edgewell Personal Care's Harry's have revolutionized the personal care market, demonstrating how recurring deliveries of essentials can build immense customer loyalty and predictable revenue streams, impacting millions of units annually. The direct-to-consumer (DTC) model, often facilitated by platforms like Wix and Subbly, further empowers brands to establish these replenishment services, bypassing traditional retail channels and fostering direct relationships with millions of consumers.

Beyond replenishment, the Online application segment overwhelmingly dominates the subscription e-commerce market. The digital nature of online platforms allows for seamless subscription management, personalized recommendations, and efficient delivery of digital and physical goods. This has been the primary vehicle for the growth of services like Netflix and The Walt Disney Company in the entertainment industry, where digital content is delivered instantly and accessibly. For physical goods, online marketplaces and dedicated e-commerce websites, often built using platforms like Magento and powered by subscription management software like Sellfy, enable businesses to reach a global audience and manage millions of transactions efficiently. The ability to offer personalized product discovery and recurring deliveries through online channels has been a critical success factor. While offline subscription models exist, such as localized book clubs or curated gift boxes sold through physical retail partnerships, their scale and reach are significantly limited compared to their online counterparts. The convenience of managing subscriptions from anywhere, at any time, through a digital interface, makes the online application a clear leader in driving the volume of units transacted within the subscription e-commerce ecosystem. The future growth of the market will continue to be heavily influenced by advancements in online payment gateways, data analytics for personalization, and efficient last-mile delivery solutions, all of which are integral to the online subscription experience.

The subscription e-commerce industry is fueled by several potent growth catalysts. The increasing consumer preference for convenience and personalization remains a primary driver, with subscription models offering automated deliveries and curated selections that cater to individual needs. The rise of direct-to-consumer (DTC) brands, empowered by user-friendly e-commerce platforms, allows businesses to directly connect with customers, build loyalty, and gather valuable data for further personalization. Furthermore, the proliferation of digital content and services has created a fertile ground for access-based subscriptions, as demonstrated by the success of streaming services.

This comprehensive report delves into the intricate dynamics of the subscription e-commerce market, providing an in-depth analysis from 2019 to 2033, with a focused estimation for 2025. It meticulously examines market trends, dissects the driving forces behind its exponential growth, and identifies the inherent challenges that businesses must navigate. The report further sheds light on key regions and dominant segments, offering strategic insights for market players. Key growth catalysts that are shaping the industry's future are explored, alongside a detailed overview of the leading companies and significant developments that have marked the sector's evolution. This analysis offers a holistic view, equipping stakeholders with the knowledge to capitalize on the vast opportunities within this ever-evolving e-commerce vertical, impacting millions of units and consumer interactions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amazon, Unilever (Dollar Shave Club), Blue Apron, Netflix, Ipsy, Personalized Beauty Discovery (Ipsy), Petsmart, Hello Fresh, Flintobox, Nature Delivered, the Walt Disney Company, Edgewell Personal Care (Harry’S), Birch Box, Sephora Play, Barkbox, Magento, Wix, Subbly, Sellfy, Recurly, Justfab, Porsche, Woocommerce.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Subscription E-commerce," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Subscription E-commerce, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.