1. What is the projected Compound Annual Growth Rate (CAGR) of the Streaming Spending?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Streaming Spending

Streaming SpendingStreaming Spending by Type (/> SVOD (Subscription-based Video on Demand), TVOD (Transactional-based Video on Demand), AVOD (Advertisement-based Video on Demand)), by Application (/> Media, Education, Sports, Music), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

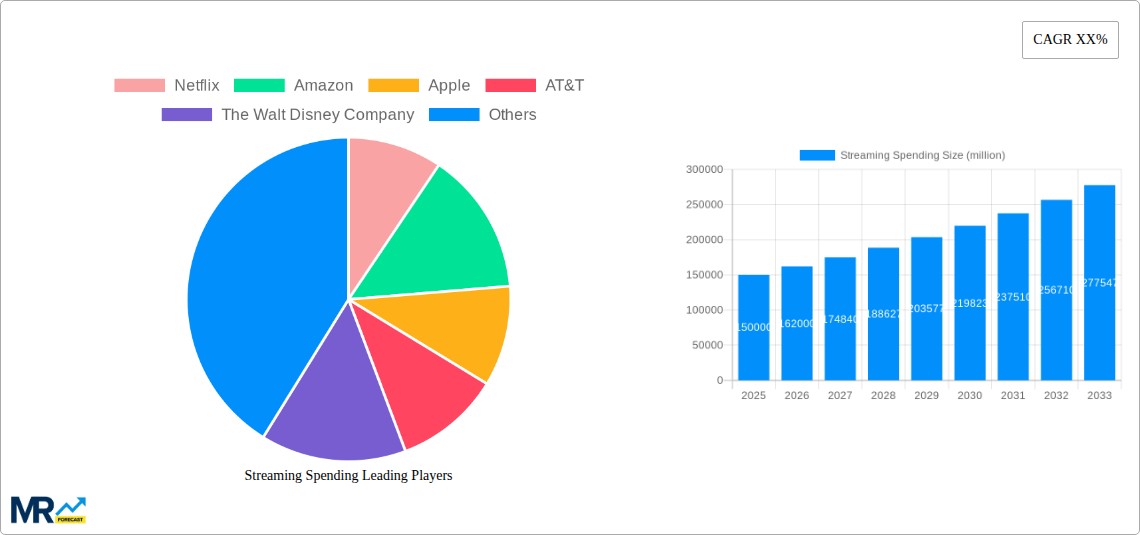

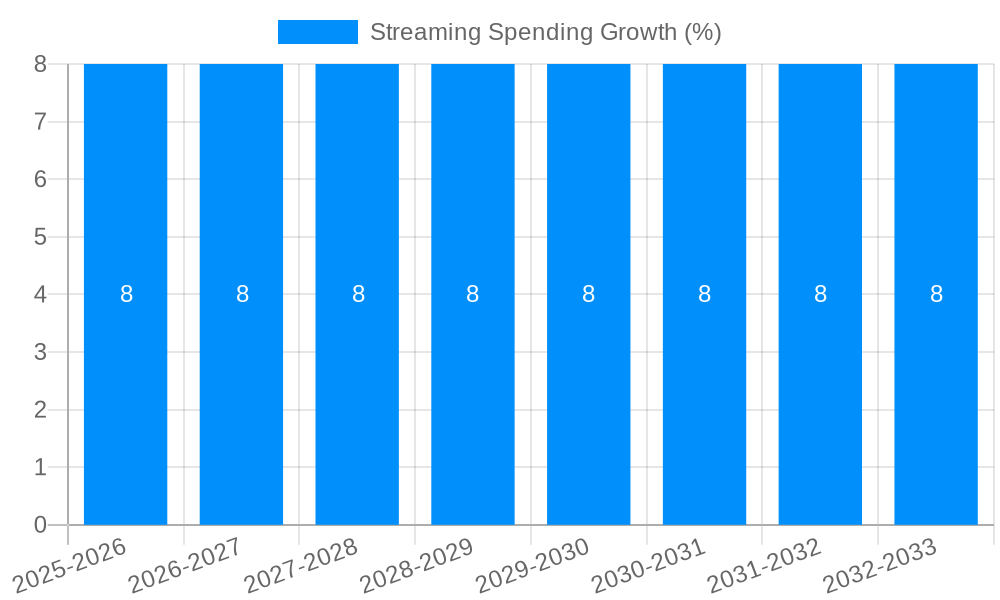

The global Streaming Spending market is projected for significant expansion, with an estimated market size of $150 billion in 2025, expected to reach $275 billion by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of approximately 8%. This impressive trajectory is primarily fueled by the escalating consumer demand for on-demand entertainment, the continuous innovation in content creation and delivery, and the widespread adoption of high-speed internet infrastructure across the globe. The proliferation of smart devices, from smartphones to smart TVs, has further democratized access to streaming services, making them an indispensable part of daily life for billions. Key growth drivers include the increasing investments by major players like Netflix, Amazon Prime Video, Disney+, and Apple TV+ in original content, catering to diverse audience preferences and fostering a competitive landscape that benefits consumers with more choices and higher quality programming. The rise of niche streaming services also contributes to market fragmentation and specialized growth.

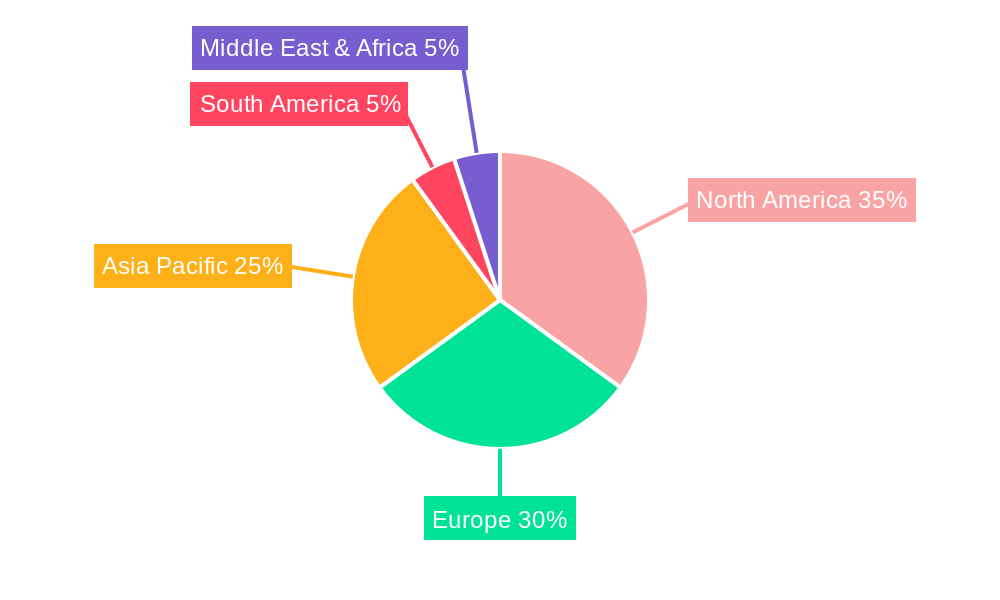

The market's dynamism is further shaped by evolving consumption patterns and technological advancements. Subscription Video on Demand (SVOD) continues to dominate, driven by bundled offerings and exclusive content. However, Transactional Video on Demand (TVOD) and Advertisement-based Video on Demand (AVOD) are also poised for growth, especially in emerging markets and as a means to reach a broader audience. Restraints, such as subscription fatigue, rising content acquisition costs, and the need for robust digital rights management, are being addressed through innovative pricing models, strategic partnerships, and technological solutions. Geographically, the Asia Pacific region is emerging as a critical growth engine, propelled by a large and increasingly affluent population, rapid digitalization, and the strong influence of local content producers. North America and Europe remain mature markets with consistent demand, while South America and the Middle East & Africa present substantial untapped potential for future expansion.

This comprehensive report delves into the dynamic landscape of streaming spending, offering an in-depth analysis of market trends, key drivers, significant challenges, and future projections. Covering a robust study period from 2019 to 2033, with a detailed focus on the base and estimated year of 2025 and a forecast period from 2025 to 2033, this report leverages historical data from 2019-2024 to paint a complete picture of the market's evolution. We will explore the intricate interplay of various streaming models, including SVOD, TVOD, and AVOD, alongside their application across diverse sectors such as Media, Education, Sports, and Music. The report aims to equip stakeholders with actionable insights to navigate this rapidly evolving industry, projecting a significant market expansion.

XXX Global streaming spending is on an unprecedented trajectory, projected to reach an astounding $XXX million by 2025, with further growth anticipated to $XXX million by 2033. This surge is not merely an incremental increase but a fundamental shift in how consumers and businesses engage with content. The historical period from 2019 to 2024 witnessed the foundational growth of streaming, characterized by aggressive subscriber acquisition by major players and the proliferation of niche services. During this phase, SVOD dominated the market, fueled by the unbundling of traditional cable packages and the allure of on-demand libraries. Companies like Netflix and The Walt Disney Company led this charge, investing billions in original content to differentiate their offerings and capture market share. However, the landscape began to diversify as the forecast period commenced.

As we move into the 2025-2033 forecast period, the market is expected to exhibit a more nuanced growth pattern. While SVOD will continue to be a significant segment, its growth rate may moderate as market saturation becomes a factor in established regions. This presents opportunities for innovative business models and underserved demographics. TVOD, though historically smaller, is poised for resurgence, particularly with the increasing availability of premium new releases and theatrical windows shortening. AVOD, on the other hand, is projected for substantial expansion, driven by the desire for free or lower-cost content and the increasing sophistication of ad-tech. Companies are leveraging this model to reach a wider audience and monetize content through targeted advertising. The integration of streaming across various applications, from educational platforms to live sports broadcasts, is further broadening the scope of spending. This intricate web of evolving consumer preferences, technological advancements, and strategic business decisions is shaping a streaming spending market that is both expansive and increasingly complex, requiring strategic foresight and adaptability from all participants. The sheer scale of investment, estimated to cross $XXX million in the coming years, underscores the critical importance of understanding these evolving trends.

The exponential growth in streaming spending is propelled by a confluence of powerful factors, fundamentally altering entertainment consumption and content distribution. The widespread adoption of high-speed internet infrastructure globally has laid a robust foundation, enabling seamless delivery of high-definition content to an ever-increasing number of devices. This accessibility is further amplified by the proliferation of smart TVs, smartphones, and tablets, making streaming a ubiquitous and convenient entertainment option. A primary driver is the continuous innovation in content creation and a relentless pursuit of exclusive, high-quality programming. Major players are heavily investing in original series, films, and documentaries, creating compelling reasons for consumers to subscribe and remain engaged. This content arms race is a key differentiator and a significant expenditure.

Furthermore, the evolving consumer preference for flexibility and personalization plays a crucial role. Viewers now demand the ability to watch what they want, when they want, and on any device, a paradigm shift away from linear television. This demand for on-demand access directly fuels the growth of SVOD and TVOD services. The economic viability of AVOD is also on the rise, attracting a segment of the market seeking cost-effective entertainment options, which in turn provides advertisers with highly targeted engagement opportunities. The integration of streaming into broader ecosystems, such as bundled services and educational platforms, also contributes to its pervasive reach and increased spending. Companies like Apple, with its ecosystem play, and Tencent, with its vast reach in Asia, are leveraging these integrated strategies. The competitive pressure among established giants like Netflix, Amazon, and The Walt Disney Company, along with emerging players, intensifies investment in content and technology, creating a virtuous cycle of innovation and spending.

Despite its robust growth, the streaming spending market is not without its significant challenges and restraints, which could temper future expansion. A primary concern is subscription fatigue and churn. With an ever-increasing number of streaming services available, consumers are finding it difficult to manage multiple subscriptions and are increasingly selective about which services they maintain. This leads to higher churn rates, forcing companies to continuously invest in content acquisition and retention strategies to offset subscriber losses. The intense competition also results in rising content production costs, as companies battle for talent, intellectual property, and the creation of must-watch original content. This escalating expenditure can strain profitability, especially for newer entrants or smaller players.

Another significant restraint is the increasingly fragmented market. While a multitude of services offers choice, it also means that popular content can be spread across various platforms, requiring consumers to subscribe to multiple services to access their desired shows and movies. This fragmentation can lead to consumer frustration and a desire for consolidation or simplified access. Piracy and intellectual property theft remain persistent threats, leading to revenue losses for content creators and distributors. While technological advancements are being made to combat piracy, it continues to be a challenge. Furthermore, regulatory scrutiny and potential government interventions in areas like content moderation, data privacy, and antitrust concerns could impact business models and add operational complexities. The economic sensitivity of discretionary spending, particularly during periods of economic downturn, can also pose a restraint on consumer subscription growth, impacting the overall streaming spending.

The streaming spending market exhibits distinct dominance across both geographical regions and specific segments, driven by varying levels of digital penetration, economic development, and cultural preferences.

Dominant Regions/Countries:

North America (United States & Canada): Historically and presently, North America remains the bedrock of global streaming spending. The region boasts the highest per capita income, advanced digital infrastructure, and a deeply ingrained culture of entertainment consumption. Companies like Netflix, Amazon Prime Video, Disney+, and Apple TV+ have a strong established presence, with significant investments in original content tailored to the North American audience. The sheer volume of subscriptions and the willingness of consumers to spend on premium content solidify its leading position. The presence of major studios and production houses further fuels content creation and innovation within this region. The projected spending in this region alone is expected to represent a substantial portion of the global $XXX million market by 2025 and beyond.

Asia-Pacific (particularly China and India): While North America leads, the Asia-Pacific region is emerging as a powerhouse of growth, driven by its massive population, increasing disposable incomes, and rapidly expanding internet and smartphone penetration.

Europe: Western European countries, including the UK, Germany, France, and the Nordic nations, represent mature streaming markets with high digital penetration and a strong appetite for premium content. While growth may be more incremental compared to emerging markets, the established consumer base and significant spending power make it a crucial region. The presence of strong local broadcasters and their foray into streaming also shapes this market.

Dominant Segments:

SVOD (Subscription-based Video on Demand): SVOD continues to be the dominant segment by revenue. The perceived value proposition of unlimited access to a vast library of content for a recurring fee remains highly attractive to consumers. Companies have perfected the art of subscriber acquisition and retention through exclusive content, original series, and bundled offerings. The sheer volume of global subscriptions to services like Netflix, Disney+, and Amazon Prime Video underpins its market leadership. However, the growth trajectory is being influenced by the increasing number of players and the potential for subscriber fatigue. By 2025, SVOD is projected to contribute significantly to the $XXX million market, with continued dominance, albeit with evolving growth rates.

AVOD (Advertisement-based Video on Demand): While SVOD has historically led, AVOD is experiencing the most rapid expansion and is poised to capture a substantial market share in the coming years. This surge is driven by several factors:

While TVOD remains a relevant segment, particularly for transactional purchases of new releases and niche content, and applications like Music and Education are growing rapidly, the SVOD and AVOD segments are the primary drivers of current and future streaming spending dominance.

The sustained growth in the streaming spending industry is propelled by several key catalysts. The continuous innovation in content creation, with billions invested in high-quality, exclusive original programming, acts as a major draw for consumers. The increasing global penetration of high-speed internet and the widespread availability of affordable smart devices have made streaming content accessible to a broader audience than ever before. Furthermore, the evolving consumer preference for on-demand viewing, flexibility, and personalized content experiences is a fundamental driver. The expansion of AVOD models, fueled by sophisticated ad-tech and a desire for cost-effective entertainment, is unlocking new revenue streams and widening the market's reach. Finally, the integration of streaming services into broader digital ecosystems and the ongoing competitive pressure among major players are spurring further investment and innovation.

This report offers an all-encompassing view of the streaming spending market, providing deep insights into its multifaceted nature. From analyzing the intricate dynamics of SVOD, TVOD, and AVOD segments to understanding their application across Media, Education, Sports, and Music, the report leaves no stone unturned. It meticulously examines the historical trajectory from 2019-2024, provides a detailed snapshot of the market in 2025, and offers robust forecasts extending to 2033. The analysis of driving forces, challenges, and growth catalysts equips stakeholders with a strategic roadmap for navigating this complex and rapidly evolving industry. The report aims to provide a foundational understanding of the market's present state and future potential, highlighting the significant financial opportunities and strategic considerations for all participants.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Netflix, Amazon, Apple, AT&T, The Walt Disney Company, Tecent, MNC Corporation, Saban Capital Group,Inc., Baidu, Pacific Century Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Streaming Spending," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Streaming Spending, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.