1. What is the projected Compound Annual Growth Rate (CAGR) of the Station Group Server Host?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Station Group Server Host

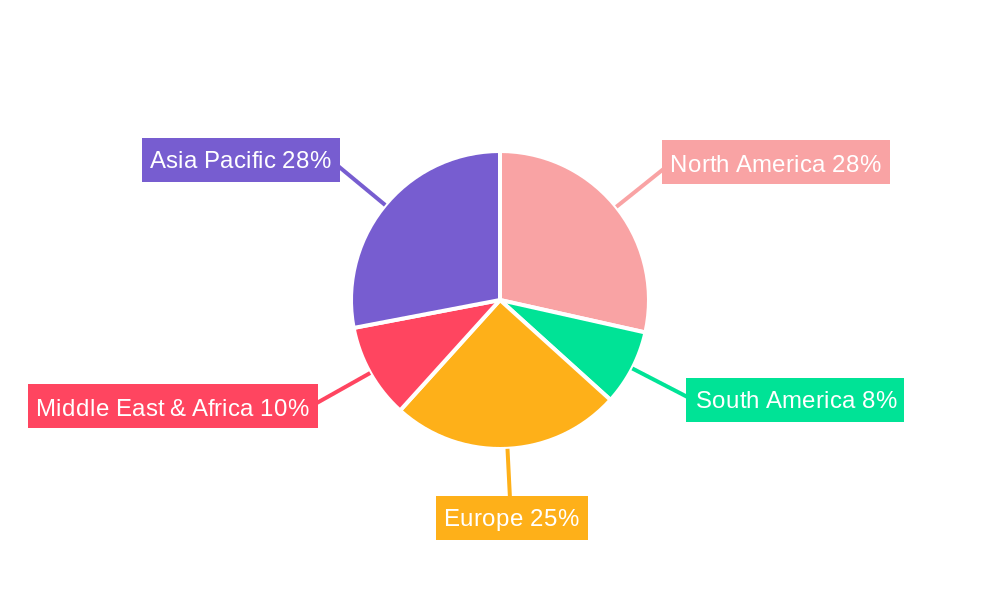

Station Group Server HostStation Group Server Host by Type (Domestic Station Group, American Station Group, Hong Kong Station Group, Others, World Station Group Server Host Production ), by Application (Small Enterprises, Medium and Large Enterprises, Personal, World Station Group Server Host Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

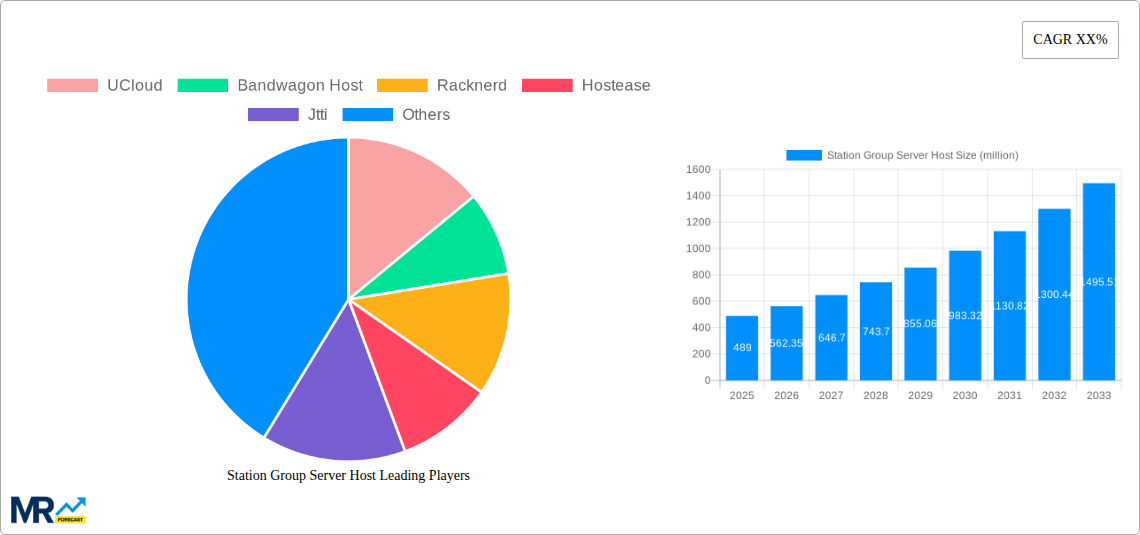

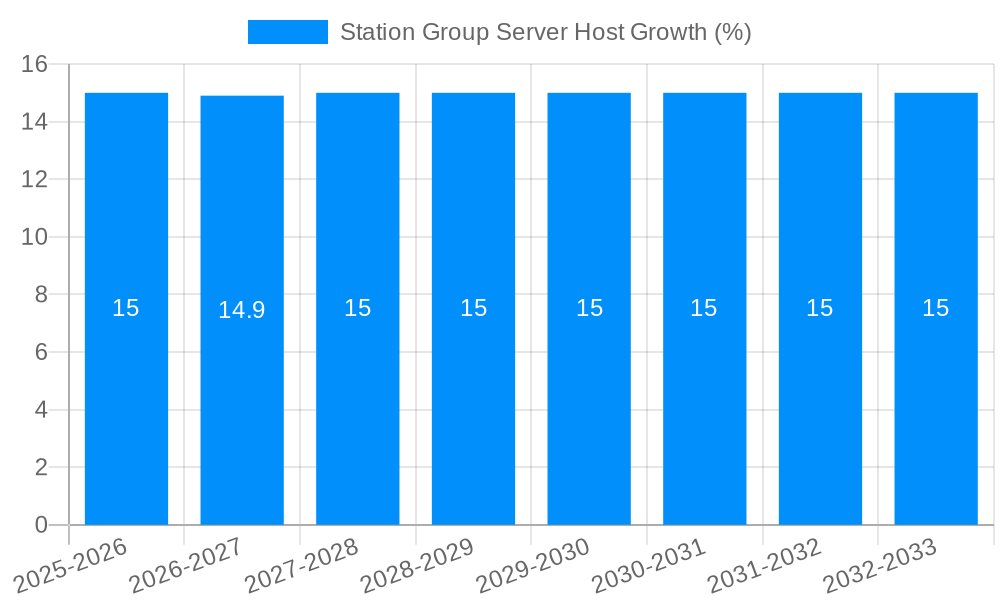

The global Station Group Server Host market is poised for significant expansion, projected to reach an estimated USD 489 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 15% anticipated throughout the forecast period of 2025-2033. This impressive growth is propelled by several key drivers, including the escalating demand for reliable and scalable hosting solutions from burgeoning enterprises and individuals alike. The proliferation of online services, e-commerce platforms, and content delivery networks necessitates powerful and efficiently managed server infrastructure. Furthermore, the increasing adoption of cloud-based solutions and the growing need for dedicated hosting for complex applications and data-intensive operations are significant contributors to market momentum. As businesses across various sectors continue to digitize their operations and expand their online presence, the demand for specialized server hosting designed to cater to interconnected groups of users or services, such as station groups, will inevitably rise.

Emerging trends such as the focus on high-performance computing, enhanced security protocols, and the demand for geographically distributed server locations to ensure low latency and optimal user experience are shaping the market landscape. The market is segmented by Type, with the "World Station Group Server Host Production" and "Server Host Production" categories likely to dominate due to their broad applicability across diverse user bases and enterprise needs. Application-wise, "Medium and Large Enterprises" are expected to be the primary consumers, leveraging these hosting solutions for their critical business operations and extensive network requirements. However, the "Personal" and "Small Enterprises" segments are also showing considerable growth potential as the accessibility and affordability of advanced hosting solutions improve. Geographically, the Asia Pacific region, particularly China and India, is anticipated to be a leading market, driven by rapid digitalization and a substantial increase in internet penetration, alongside a strong presence in North America and Europe.

The global Station Group Server Host market is poised for significant expansion, projected to reach \$XXX million by 2033. This robust growth trajectory is underpinned by an escalating demand for reliable, scalable, and geographically diverse server solutions across a myriad of applications. During the study period of 2019-2033, the market has witnessed a substantial transformation, driven by technological advancements, evolving business needs, and an increasing reliance on cloud-based infrastructure. The base year of 2025 sets a crucial benchmark for understanding the current market landscape, with the estimated year of 2025 reflecting immediate projections. The forecast period, 2025-2033, anticipates continued, albeit potentially moderated, expansion as the industry matures and consolidates. The historical period from 2019-2024 showcases the foundational growth and emerging trends that have shaped the current market dynamics.

Key market insights reveal a discernible shift towards specialized server hosting solutions catering to specific regional demands and industry verticals. The proliferation of e-commerce, the burgeoning data economy, and the increasing adoption of edge computing are directly contributing to this trend. Businesses are no longer solely seeking generic server capacity; they require tailored solutions that offer optimized latency, enhanced security, and compliance with regional data sovereignty regulations. This has led to a fragmentation and diversification of the market, with specialized providers gaining traction by focusing on niche segments. Furthermore, the integration of advanced networking technologies and the continuous pursuit of cost-effectiveness are paramount drivers. As businesses increasingly outsource their IT infrastructure to specialized hosting providers, the emphasis on performance, reliability, and competitive pricing will continue to shape purchasing decisions. The market is characterized by a dynamic interplay between technological innovation, economic factors, and regulatory landscapes, all of which contribute to its complex and evolving nature. The sheer volume of data being generated and processed globally necessitates a robust and distributed server infrastructure, making the Station Group Server Host market a critical component of the modern digital ecosystem.

Several potent forces are collectively propelling the growth of the Station Group Server Host market. Foremost among these is the relentless digital transformation sweeping across industries. Businesses of all sizes, from burgeoning startups to established global corporations, are increasingly migrating their operations, applications, and data to server hosts. This migration is driven by the need for enhanced agility, scalability, and cost efficiency that dedicated on-premise infrastructure often struggles to provide. The explosion of data generated by these digital operations, fueled by IoT devices, social media, and advanced analytics, necessitates robust and readily available server capacity for storage, processing, and analysis. Furthermore, the growing prevalence of remote work and the increasing reliance on cloud-based services for collaboration and productivity have amplified the demand for accessible and reliable server infrastructure. The development and widespread adoption of technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics further accentuate this demand, as these applications require significant computational power and storage.

The ongoing evolution of networking technologies, including the rollout of 5G, plays a crucial role by enabling faster data transfer speeds and lower latency, which in turn enhances the performance of hosted applications and services. This improved network performance encourages more businesses to adopt cloud-centric strategies, thereby increasing their reliance on server hosts. Moreover, the competitive landscape among server hosting providers, driven by a desire to capture market share, often leads to continuous innovation and price optimization. This competition benefits end-users by offering a wider range of services at more attractive price points. The increasing emphasis on data security and disaster recovery also acts as a significant driver, as businesses recognize the importance of entrusting their critical data and applications to specialized providers who can offer robust security measures and backup solutions.

Despite its promising growth trajectory, the Station Group Server Host market is not without its inherent challenges and restraints. A primary concern revolves around the increasing complexity of managing distributed server environments. As businesses opt for multi-cloud or hybrid cloud strategies, the integration and orchestration of servers across different providers and geographies can become technically demanding and resource-intensive. This complexity can lead to operational inefficiencies and increased costs if not managed effectively. Another significant restraint is the ever-evolving threat landscape concerning cybersecurity. Data breaches, ransomware attacks, and other cyber threats pose a constant risk to server infrastructure, necessitating continuous investment in robust security measures and vigilant monitoring. The reputational and financial damage from a successful cyberattack can be substantial, making security a paramount concern for both providers and users.

The fluctuating economic conditions and potential for global economic downturns can also impact market growth. Reduced IT spending by businesses during economic slowdowns can directly affect demand for server hosting services. Furthermore, the increasing regulatory scrutiny and data privacy laws in various regions, such as GDPR and CCPA, impose stringent compliance requirements on server hosting providers. Meeting these diverse and evolving regulatory demands can be costly and complex, potentially hindering expansion into new markets or requiring significant investment in compliance infrastructure. The perception of vendor lock-in, where businesses feel tied to a specific provider due to the complexity and cost of migrating data and applications, can also act as a restraint, limiting the flexibility for some to switch providers even if more cost-effective or performant options exist. Lastly, the intense competition within the market can lead to price wars, potentially squeezing profit margins for providers and limiting their ability to invest heavily in research and development.

The World Station Group Server Host Production segment is poised to exhibit significant dominance within the global Station Group Server Host market, particularly when considering the World Station Group type. This dominance is propelled by the interconnected nature of the modern digital economy and the overarching trend of globalization. Businesses are increasingly operating on an international scale, necessitating server infrastructure that can cater to a global customer base. The World Station Group Server Host Production segment encompasses the provision of server solutions designed to serve users across multiple continents, often through a distributed network of data centers. This allows companies to deliver content and applications with low latency and high availability to a worldwide audience, which is crucial for e-commerce giants, global SaaS providers, and multinational corporations.

In parallel, within the Application segmentation, Medium and Large Enterprises are expected to be the primary drivers of market growth and dominance. These organizations typically possess the most substantial IT budgets, complex operational requirements, and the greatest need for scalable, secure, and reliable server infrastructure to support their extensive business operations. Their reliance on sophisticated applications, vast datasets, and global reach makes them prime candidates for advanced server hosting solutions.

Several factors contribute to the anticipated dominance of these segments:

While other segments like American Station Group and Hong Kong Station Group will hold significant market share due to their strategic locations and established technological infrastructure, the overarching need for a truly global reach and the capacity to serve diverse international markets positions World Station Group Server Host Production as the most dominant segment. Similarly, the sheer scale and complexity of IT needs for Medium and Large Enterprises ensure their continued leadership in driving demand within the application segmentation.

The Station Group Server Host industry is fueled by several key growth catalysts. The continuous digital transformation across all sectors necessitates ever-increasing demands for robust and scalable server infrastructure. The burgeoning adoption of cloud-native architectures, microservices, and containerization technologies further drives the need for flexible and dynamic server solutions. Furthermore, the rapid advancements in AI, machine learning, and big data analytics require immense processing power and storage, directly benefiting server host providers. The expansion of edge computing, which brings computation closer to data sources, also creates new opportunities for distributed server deployments.

This report offers a comprehensive analysis of the Station Group Server Host market, providing invaluable insights for stakeholders. It delves deep into market trends, driving forces, and potential challenges, painting a clear picture of the industry's trajectory. The report meticulously examines key regions and segments poised for dominance, offering a strategic outlook on where market opportunities lie. Furthermore, it identifies critical growth catalysts and highlights the leading players shaping the competitive landscape. The extensive coverage includes detailed market sizing, segmentation, and forecast data, crucial for strategic decision-making, investment planning, and understanding the future evolution of the Station Group Server Host sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include UCloud, Bandwagon Host, Racknerd, Hostease, Jtti, Dedipath, Megalayer, Zji, Kvmla, Sharktech.

The market segments include Type, Application.

The market size is estimated to be USD 489 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Station Group Server Host," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Station Group Server Host, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.