1. What is the projected Compound Annual Growth Rate (CAGR) of the Station-based Carsharing?

The projected CAGR is approximately 20%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Station-based Carsharing

Station-based CarsharingStation-based Carsharing by Type (Time Billing, Mileage Billing), by Application (Corporate Users, Residential Users), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The station-based carsharing market, while facing competition from free-floating services, continues to demonstrate significant growth potential. Driven by increasing urbanization, rising fuel costs, and a growing preference for sustainable transportation solutions, this sector is poised for expansion. The convenience of pre-booked vehicles at designated stations appeals to both corporate and residential users, particularly those requiring vehicles for short-term rentals or regular commutes. Key market segments like corporate users, who benefit from streamlined expense management and predictable vehicle access, are expected to fuel growth. Technological advancements, such as improved mobile applications for booking and access, are also enhancing user experience and driving market penetration. However, factors like limited vehicle availability at certain locations and potential competition from public transportation systems pose challenges. Despite these challenges, strategic partnerships between carsharing operators and municipalities, aiming to expand station networks in densely populated areas, are expected to overcome these hurdles. The market's expansion is further supported by the development of electric vehicle fleets, aligning with environmental sustainability goals and attracting environmentally conscious consumers.

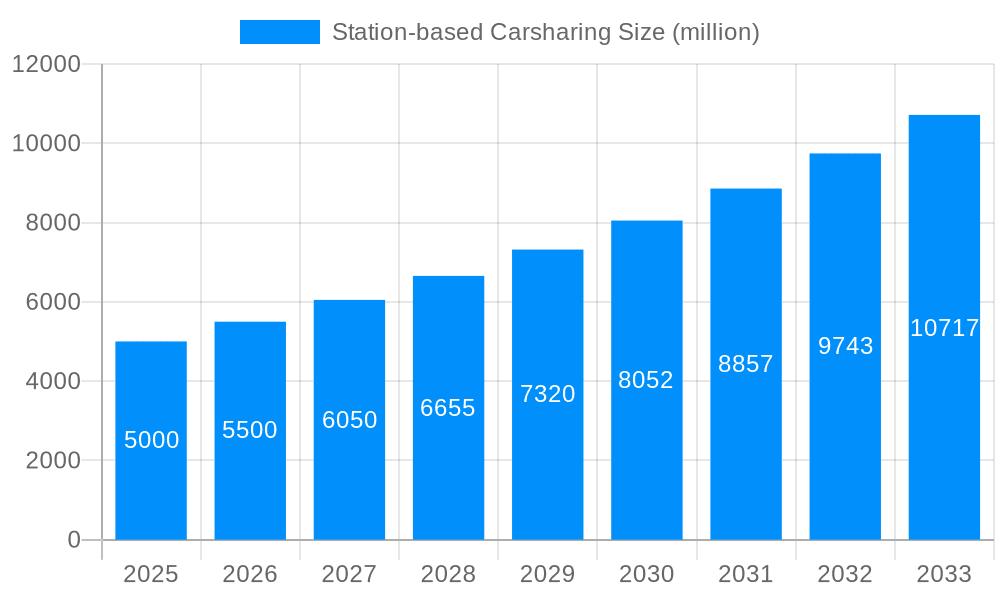

The global station-based carsharing market is projected to experience considerable growth over the next decade. Assuming a conservative CAGR of 10% based on industry trends, the market size, currently estimated at $5 billion in 2025, could reach approximately $13 billion by 2033. While North America and Europe currently dominate the market, significant growth opportunities exist in rapidly developing Asian economies, particularly in China and India, fueled by increasing disposable incomes and improving urban infrastructure. Competition within the sector is intense, with established players constantly innovating to maintain their market share and attract new users. This competitiveness, however, fosters innovation and further contributes to the overall market expansion, driving down prices and improving service quality for the end consumer. Successful players will likely be those who adapt quickly to changing technological landscapes and effectively leverage data analytics to optimize fleet management and operational efficiency.

The station-based carsharing market, valued at approximately $X billion in 2024, is projected to witness substantial growth, reaching an estimated $Y billion by 2033. This represents a Compound Annual Growth Rate (CAGR) of Z% during the forecast period (2025-2033). Key market insights reveal a shifting preference towards flexible, on-demand mobility solutions, particularly in urban areas grappling with traffic congestion, parking limitations, and escalating vehicle ownership costs. The historical period (2019-2024) showcased fluctuating growth influenced by economic conditions and technological advancements. However, the base year of 2025 marks a turning point, with a projected surge driven by increased environmental awareness, improved technological integration within the station-based platforms (such as streamlined booking processes and enhanced user interfaces), and the expansion of service areas to cater to a wider range of customer needs. The market is observing a gradual yet notable transition from primarily time-based billing models to a blend of time and mileage-based options, providing greater flexibility and cost-effectiveness for users. Furthermore, the emergence of corporate partnerships and strategic collaborations with municipalities is significantly propelling the market expansion. While residential users continue to form a substantial segment, the increasing adoption by corporate users is driving a new wave of growth, offering businesses alternative fleet management solutions and cost savings. The integration of electric vehicles within station-based carsharing networks is also gaining traction, contributing to the market’s overall sustainability and appeal among environmentally conscious consumers.

Several factors contribute to the rapid expansion of the station-based carsharing market. Firstly, the rising costs associated with personal vehicle ownership – encompassing purchase price, insurance, maintenance, parking, and fuel – are compelling individuals and businesses to explore more economical alternatives. Station-based carsharing offers a pay-per-use model, eliminating the burden of long-term commitments and fixed costs. Secondly, increasing urbanization and traffic congestion in major cities are leading to heightened demand for convenient and efficient transportation solutions. Station-based carsharing addresses this demand by providing easily accessible vehicles strategically located throughout urban areas. Thirdly, growing environmental concerns and the push towards sustainable transportation are driving adoption. Many providers are incorporating electric vehicles into their fleets, aligning with global efforts to reduce carbon emissions. Finally, technological advancements, such as improved mobile applications, real-time vehicle tracking, and seamless booking processes, are significantly enhancing user experience and contributing to wider market appeal. These factors collectively create a potent synergy, propelling the station-based carsharing market toward sustained growth.

Despite its promising growth trajectory, the station-based carsharing market faces several challenges. Firstly, the initial investment required to establish and maintain a network of stations, including land acquisition, vehicle procurement, and technological infrastructure, can be substantial. This poses a barrier to entry for smaller operators and necessitates strategic partnerships or significant funding for expansion. Secondly, operational complexities, such as vehicle maintenance, damage management, and ensuring consistent vehicle availability, require robust operational systems and efficient resource allocation. Thirdly, competition from other shared mobility services, such as ride-hailing apps and free-floating carsharing programs, intensifies the pressure on station-based providers to differentiate their services and attract and retain customers. Lastly, regulatory hurdles and varying licensing requirements across different regions can create complexities for operators aiming for widespread market penetration. Addressing these challenges effectively will be critical in sustaining the growth of the station-based carsharing market in the long term.

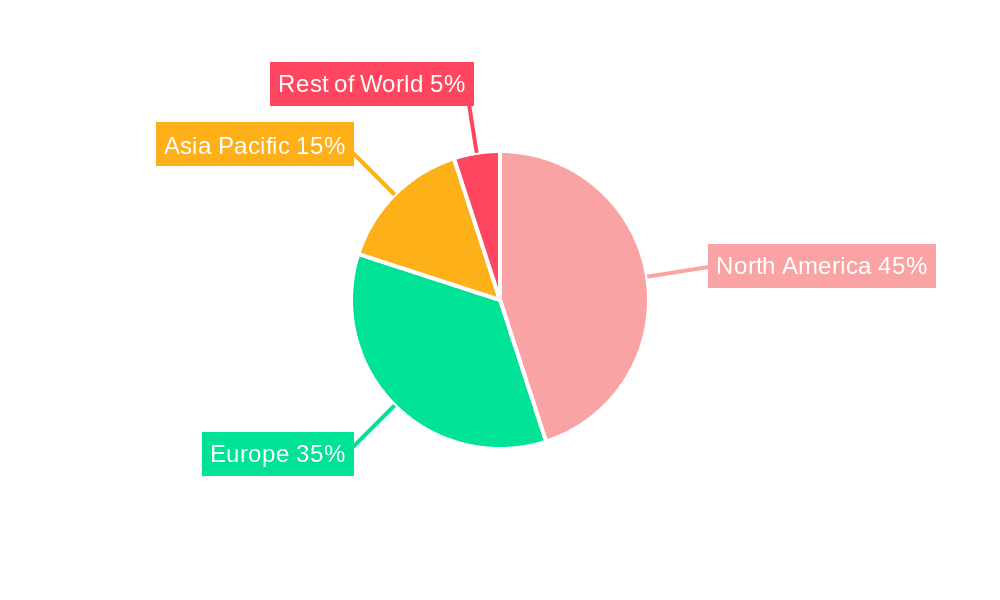

The station-based carsharing market exhibits diverse growth patterns across different regions and segments. While precise market share data requires in-depth analysis, certain trends are apparent.

Residential Users: This segment remains the largest contributor to the overall market size. The convenience and flexibility of station-based carsharing for personal transportation, especially in urban environments, strongly appeals to individual users. The projected growth within this segment is driven by factors like rising living costs in densely populated urban centers, increased awareness of the environmental benefits of shared mobility, and improved user interfaces making the platform easier to use. Millions of individuals are choosing this mode of transportation due to cost-effectiveness and environmental friendliness. As technology improves and more electric vehicles are integrated into station-based fleets, this segment is poised for continued significant growth in the coming years.

North America and Europe: These regions are expected to dominate the market due to high levels of urbanization, strong consumer acceptance of shared mobility services, and supportive regulatory frameworks. The presence of established players and substantial investments in infrastructure are further driving market expansion in these key geographical areas. The mature market in these regions provides insights and valuable data that help influence the growth trajectory in other parts of the world. We expect continued high growth rates in this segment in the forecast period.

Time Billing: While mileage-based options are gaining traction, time-based billing remains the dominant model, owing to its simplicity and ease of implementation. The straightforward pricing structure makes it widely attractive to a larger user base. The forecast shows that this will likely continue to remain a prominent segment, however, the blend with mileage billing models is likely to increase.

The station-based carsharing industry’s growth is fueled by several key catalysts, including the increasing affordability and convenience it offers compared to private car ownership, particularly in urban areas. Furthermore, growing environmental awareness and a shift towards sustainable transportation contribute significantly to the market's expansion. The ongoing technological advancements enhancing user experience through improved mobile applications and efficient vehicle management systems also boost market adoption. Lastly, supportive government policies and initiatives promoting shared mobility solutions further accelerate industry growth.

This report provides a comprehensive overview of the station-based carsharing market, encompassing historical data, current market trends, and future projections. It identifies key drivers, challenges, and growth opportunities, presenting a detailed analysis of various segments, including billing models (time and mileage) and user types (corporate and residential). Further, the report profiles leading players in the industry, highlighting significant developments and market dynamics. The analysis provides invaluable insights for businesses and stakeholders seeking to navigate the evolving landscape of the station-based carsharing market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20%.

Key companies in the market include Getaround, Turo, OCTO, Convadis, Getaround, Zipcar, Maven Gig, SIXT, HyreCar, Share Now, DriveNow, Gig Car Share, BeeRides, TravelCar, Tripndrive, e.GO Mobile, Free2Move, WeShare (Miles), KINTO, Flinkster, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Station-based Carsharing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Station-based Carsharing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.