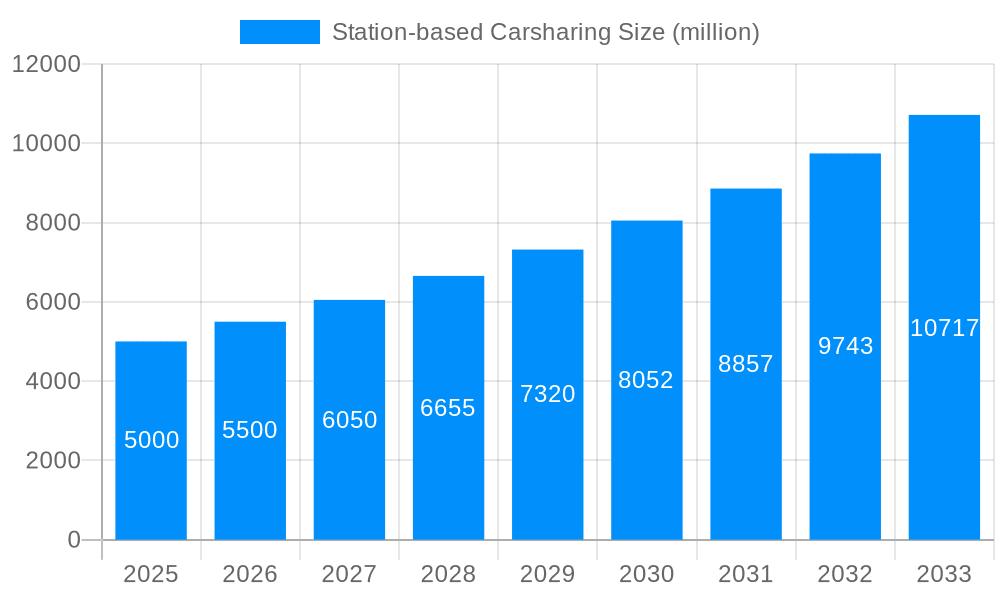

1. What is the projected Compound Annual Growth Rate (CAGR) of the Station-based Carsharing?

The projected CAGR is approximately 20%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Station-based Carsharing

Station-based CarsharingStation-based Carsharing by Type (Time Billing, Mileage Billing), by Application (Corporate Users, Residential Users), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The station-based carsharing market, while facing competition from free-floating models, continues to demonstrate significant growth potential. Driven by increasing urbanization, rising fuel costs, and a growing preference for sustainable transportation solutions, the market is expected to experience substantial expansion over the next decade. The convenience of pre-booked vehicles located at designated stations appeals to a wide range of users, including both corporate clients needing reliable transportation for business trips and residential users seeking affordable short-term rentals. The market segmentation, encompassing both time-based and mileage-based billing, allows for tailored pricing models catering to diverse needs and usage patterns. Key players such as Zipcar and Getaround have established strong market positions, but the competitive landscape is dynamic, with the entry of new players and ongoing innovations in technology and service offerings contributing to market evolution.

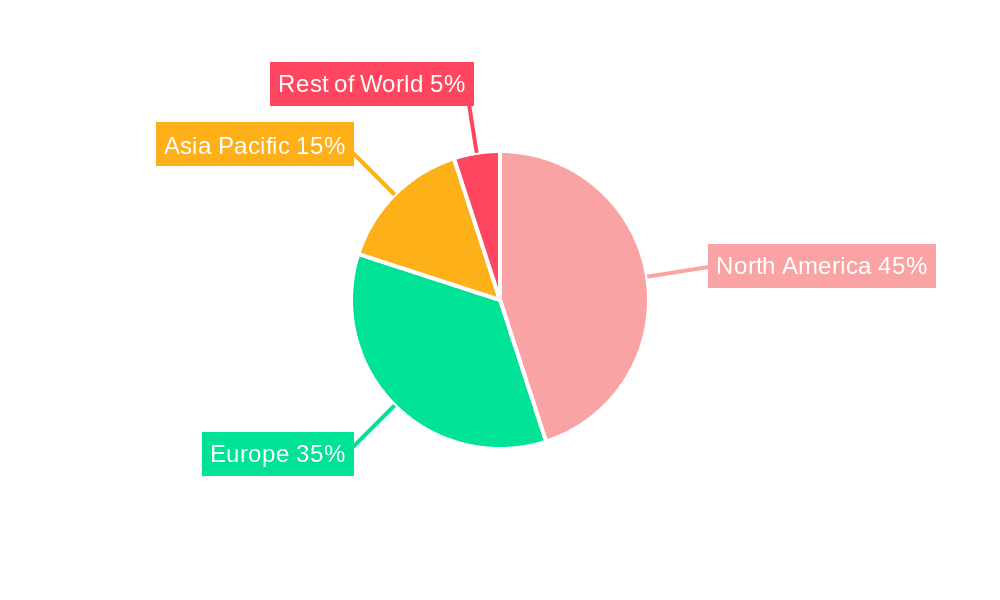

Significant regional variations exist within the station-based carsharing market. North America and Europe currently hold the largest market share, primarily due to established infrastructure and high adoption rates. However, Asia-Pacific is poised for substantial growth, driven by rapid urbanization and increasing disposable incomes in key economies like China and India. Market penetration in emerging markets presents significant opportunities for expansion. Continued technological advancements, such as improved reservation systems, integrated payment solutions, and the integration of electric vehicle fleets, will play a crucial role in shaping the future trajectory of the market. Regulatory frameworks and government initiatives promoting sustainable transportation also influence market growth. Challenges include managing operational costs, ensuring vehicle availability, and addressing concerns related to vehicle maintenance and insurance.

The station-based carsharing market, while facing competition from free-floating models, continues to demonstrate significant resilience and evolution. The historical period (2019-2024) saw a consolidation phase, with several smaller players merging or exiting the market. This led to a more concentrated landscape dominated by established players with robust operational infrastructures. The estimated market size in 2025 is projected to be in the hundreds of millions of dollars, with a forecast indicating substantial growth through 2033. This growth is fueled by several key factors, including increasing urbanization, growing environmental concerns, and the rising cost of car ownership. However, the market isn't monolithic; it's nuanced by diverse billing models (time-based and mileage-based) and caters to distinct user segments (corporate and residential). The balance between these segments shifts regionally, influenced by local transportation infrastructure, government policies promoting sustainable mobility, and the availability of alternative transportation options. The forecast for 2025-2033 shows considerable potential for expansion, particularly in regions with high population density and strong public transportation networks that complement, rather than compete with, station-based carsharing. This report delves into these trends, highlighting the opportunities and challenges shaping the future of this dynamic sector. The market's evolution reflects a shift towards integrated mobility solutions, where station-based carsharing acts as a vital component within a broader ecosystem of transportation options.

Several factors contribute to the continued growth of the station-based carsharing market. Firstly, the rising cost of personal vehicle ownership, including purchase price, insurance, maintenance, and parking, makes carsharing an attractive alternative, particularly for urban dwellers. Secondly, environmental concerns are pushing consumers and businesses towards more sustainable transportation choices. Station-based carsharing, by providing access to vehicles without requiring individual ownership, contributes to reduced carbon emissions and traffic congestion. Thirdly, the increasing adoption of technology enhances the user experience, with streamlined booking processes, mobile payment options, and integrated navigation systems. The expansion of corporate carsharing programs further boosts market growth. Companies are recognizing the financial benefits and employee satisfaction gains from offering station-based carsharing as a flexible and cost-effective alternative to company-owned fleets. Finally, government initiatives promoting sustainable transportation and reducing traffic congestion often incentivize the adoption of carsharing programs, creating a favorable regulatory environment in many regions.

Despite its growth potential, the station-based carsharing market faces several challenges. Competition from free-floating carsharing services, offering greater convenience and flexibility in terms of pickup and drop-off locations, is a significant hurdle. The operational complexity of managing a network of stations, ensuring vehicle availability, and addressing maintenance needs requires significant investment and efficient logistics. Furthermore, the reliance on fixed station locations can limit accessibility in certain areas, particularly those with limited parking availability or less dense population centers. Weather conditions can also impact vehicle availability and usage, especially in regions with harsh winters or frequent inclement weather. Pricing strategies are crucial; striking the right balance between affordability and profitability is essential to attract and retain users. Finally, regulatory frameworks vary across regions, leading to inconsistencies in licensing requirements and operational guidelines, potentially hindering market expansion.

The Residential User segment is poised for significant growth within the station-based carsharing market. This segment's expansion is primarily driven by the factors mentioned previously: the increasing cost of car ownership, environmental concerns, and the convenience of access to vehicles on demand.

The residential user segment's dominance stems from its broad appeal. Individuals in densely populated urban areas often find station-based carsharing a more affordable and practical alternative to car ownership than those in suburban or rural areas. The convenience of short-term rentals for errands, weekend trips, or occasional transportation needs contributes to this segment's substantial market share. The ease of use and technological enhancements further amplify the appeal, enhancing customer satisfaction and fostering repeat usage. The Time Billing model also benefits this segment, as it allows for flexibility in usage durations and simplifies pricing.

Several factors will significantly boost the station-based carsharing market's growth. Technological innovations, such as improved booking systems, vehicle management software, and integrated mobile applications, will enhance the user experience and streamline operations. Government regulations and incentives promoting sustainable transportation will create a more favorable regulatory environment. Increased partnerships between carsharing companies and businesses will expand corporate adoption. Furthermore, the integration of station-based carsharing with other mobility services, such as public transport, bike-sharing, and ride-hailing, will create a more comprehensive and attractive transportation ecosystem. This integrated approach will improve accessibility and address the limitations of solely relying on station-based carsharing.

This report provides a comprehensive overview of the station-based carsharing market, encompassing historical data, current market trends, and future projections. It offers valuable insights into the key drivers and challenges shaping the industry, enabling stakeholders to make informed decisions about their strategies and investments in this evolving sector. The analysis of key players, regions, and segments provides a granular understanding of the market dynamics, making it a valuable resource for businesses, investors, and policymakers involved in or interested in the station-based carsharing market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20%.

Key companies in the market include Getaround, Turo, OCTO, Convadis, Getaround, Zipcar, Maven Gig, SIXT, HyreCar, Share Now, DriveNow, Gig Car Share, BeeRides, TravelCar, Tripndrive, e.GO Mobile, Free2Move, WeShare (Miles), KINTO, Flinkster, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Station-based Carsharing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Station-based Carsharing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.