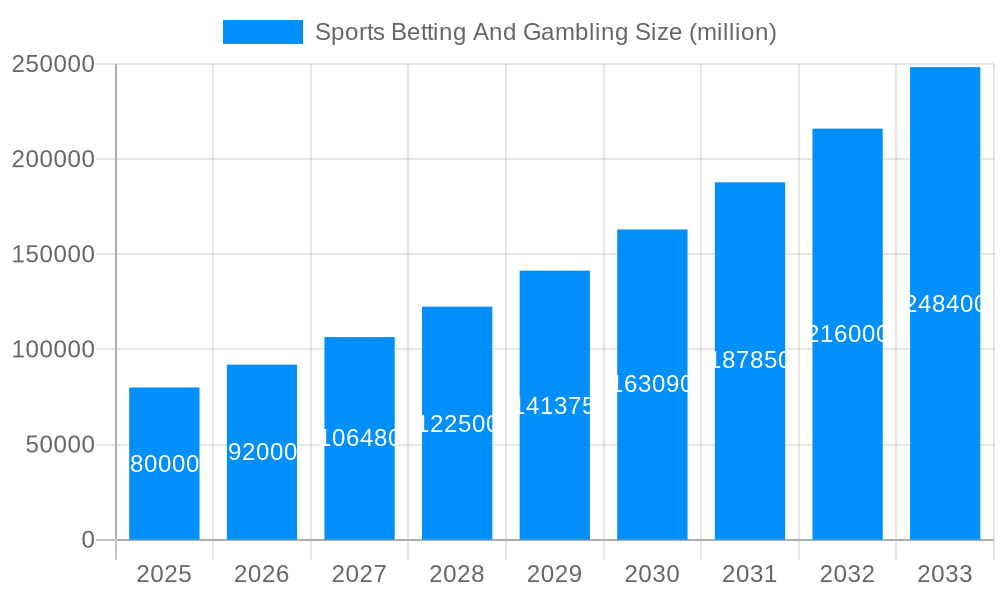

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Betting And Gambling?

The projected CAGR is approximately 10.54%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sports Betting And Gambling

Sports Betting And GamblingSports Betting And Gambling by Application (Desktop, Mobile Devices), by Type (Soccer, American Football, Basketball, Hockey, Mixed Martial Arts and Boxing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

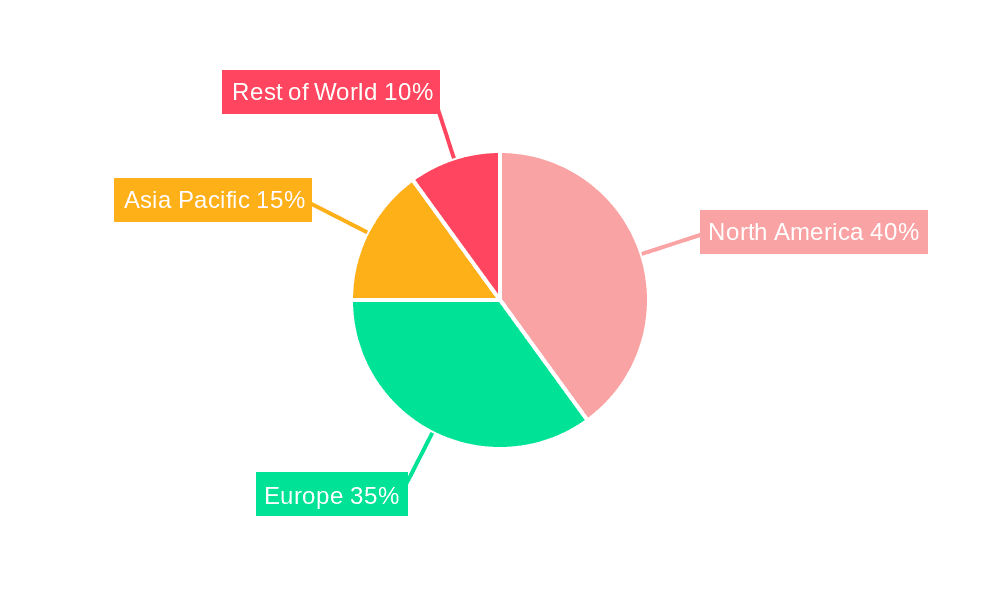

The global sports betting and gambling market is exhibiting significant expansion, propelled by escalating smartphone adoption, the surging popularity of esports, and the legalization of online betting in key regions. Innovation in betting platforms, encompassing in-play and virtual sports, alongside sophisticated marketing by industry leaders, further fuels this growth. A growing societal acceptance of gambling as entertainment also contributes. Despite regulatory complexities and responsible gambling concerns, the market is poised for sustained expansion. Soccer, American football, and basketball remain dominant sports for betting. Both desktop and mobile platforms are experiencing robust growth, mirroring the market's adaptability to technological advancements. North America and Europe currently lead in market share due to mature regulatory environments and a high concentration of key players, with emerging markets in Asia and Latin America presenting substantial future potential. The competitive arena features established entities and agile newcomers, fostering continuous innovation and aggressive marketing initiatives. The market is projected to experience a Compound Annual Growth Rate (CAGR) of 10.54% over the forecast period.

The market size, estimated at $155.423 billion in the 2025 base year, is anticipated to grow substantially. This upward trend is primarily driven by the increasing number of online bettors, particularly within younger demographics, and the expanding legalization of sports betting across new territories. The diverse array of betting options, including live betting, virtual sports, and fantasy sports, continues to attract and retain users. Key challenges include navigating evolving regulations, increased scrutiny of responsible gambling, and potential market consolidation. Strategic adoption of responsible gambling initiatives and leveraging technological advancements for enhanced user experience will be critical for sustained market growth.

The global sports betting and gambling market experienced explosive growth throughout the historical period (2019-2024), exceeding several billion dollars in revenue. This upward trajectory is projected to continue into the forecast period (2025-2033), with estimations reaching tens of billions by 2033. Several factors contribute to this sustained expansion. The increasing accessibility of online betting platforms through both desktop and mobile applications has broadened the market's reach to a significantly larger and more diverse audience. The rising popularity of sports, particularly e-sports, and the associated surge in viewership fuel the demand for betting options, creating a symbiotic relationship between sports entertainment and gambling. Furthermore, sophisticated marketing and advertising strategies employed by major players, coupled with the introduction of innovative betting formats and features such as in-play betting and enhanced odds, contribute significantly to market growth. Geopolitical shifts and legal reforms in numerous jurisdictions that have legalized or are in the process of legalizing sports betting are crucial drivers, bringing previously untapped markets into the fold. While the market is fragmented with various established players and new entrants, consolidation and partnerships are also becoming increasingly common, impacting the market dynamics. The consistent evolution of technology continues to shape the industry's infrastructure, from improved security measures to personalized user experiences, further driving growth. Finally, although concerns around responsible gaming persist, industry initiatives to promote safer gambling practices suggest a move toward greater sustainability and ethical considerations within the sector. The overall trend indicates a market poised for continued expansion, driven by technological advancements, legal changes, and shifting consumer behavior. The estimated market value for 2025 is projected to be in the tens of billions of dollars, with substantial further growth predicted throughout the forecast period.

Several key factors propel the growth of the sports betting and gambling market. The increasing legalization and regulation of online gambling in various countries significantly expand the market's addressable audience. This regulatory shift, coupled with the convenience and accessibility offered by mobile betting apps, drives substantial adoption among a broader demographic. Technological advancements, such as improved user interfaces, enhanced security measures, and the incorporation of live streaming and in-play betting features, contribute greatly to the market's appeal. Marketing strategies focusing on personalized experiences and targeted advertising successfully engage and retain users. The rising popularity of esports and the growing engagement with traditional sports further amplify demand, fostering a larger and more engaged betting audience. Moreover, the strategic mergers, acquisitions, and partnerships within the industry lead to enhanced market consolidation, economies of scale, and increased investment in product development and market expansion. Furthermore, the development of innovative betting products and formats keeps the experience exciting and draws new participants into the market. Finally, increasing disposable incomes in developing economies present new opportunities for market growth and expansion.

Despite the significant growth, the sports betting and gambling market faces several challenges and restraints. Stringent regulatory frameworks and compliance requirements in some jurisdictions can limit market expansion and increase operational costs. Concerns surrounding responsible gambling and the potential for addiction pose significant social and ethical concerns, leading to increased scrutiny and potentially restrictive regulations. The risk of fraud and money laundering remains a persistent threat, requiring substantial investment in security measures and compliance protocols. Competition within the market is intense, with both established players and emerging companies vying for market share. This necessitates continuous investment in innovation and marketing to maintain a competitive edge. Fluctuations in sports results and unexpected events can significantly impact betting outcomes and investor confidence. Economic downturns and changes in consumer spending habits can also negatively affect the demand for gambling services. Finally, negative public perception and media portrayals of gambling can create barriers to market growth and negatively impact the overall industry image.

The mobile devices segment is poised to dominate the sports betting and gambling market. The widespread adoption of smartphones and tablets, coupled with the development of user-friendly mobile betting applications, has driven significant growth in this segment. The convenience and accessibility offered by mobile betting make it exceptionally popular among consumers, who can place bets anytime, anywhere.

North America and Europe are projected to be the leading geographic regions for market growth. The increasing legalization of sports betting in North America, particularly in the United States, has unlocked significant potential for market expansion. Europe, with its established gambling markets and regulatory frameworks, continues to be a major contributor to global revenue.

Soccer remains the dominant sport in terms of betting volume globally, due to its widespread popularity and frequent fixture schedules. However, the popularity of American Football betting is significantly increasing in North America, alongside the growth in basketball and mixed martial arts (MMA) and boxing. The diversity of betting options across different sports and leagues caters to varied consumer preferences and contributes to market expansion.

The substantial growth of mobile betting is attributed to:

The convenience and accessibility offered by mobile platforms, combined with the increasing popularity of sports betting, make the mobile segment a key driver of the overall market growth, surpassing the desktop segment in both revenue and user base within the forecast period. This trend is expected to persist throughout the forecast period (2025-2033).

The industry's growth is significantly bolstered by technological advancements leading to innovative betting platforms, enhanced user experiences, and sophisticated data analytics to optimize strategies. Legalization and regulatory changes in various countries, alongside the rising popularity of esports and an increase in viewership of traditional sports, fuel the market’s expansion. Effective marketing campaigns and an increasingly diverse range of betting options contribute to user engagement and market diversification.

This report provides a comprehensive analysis of the global sports betting and gambling market, covering historical data (2019-2024), current estimations (2025), and future projections (2025-2033). The report delves into market trends, driving forces, challenges, key segments (including mobile applications and specific sports), major players, and significant industry developments. It offers valuable insights into the dynamic landscape of the sports betting and gambling industry, assisting stakeholders in making informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.54% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.54%.

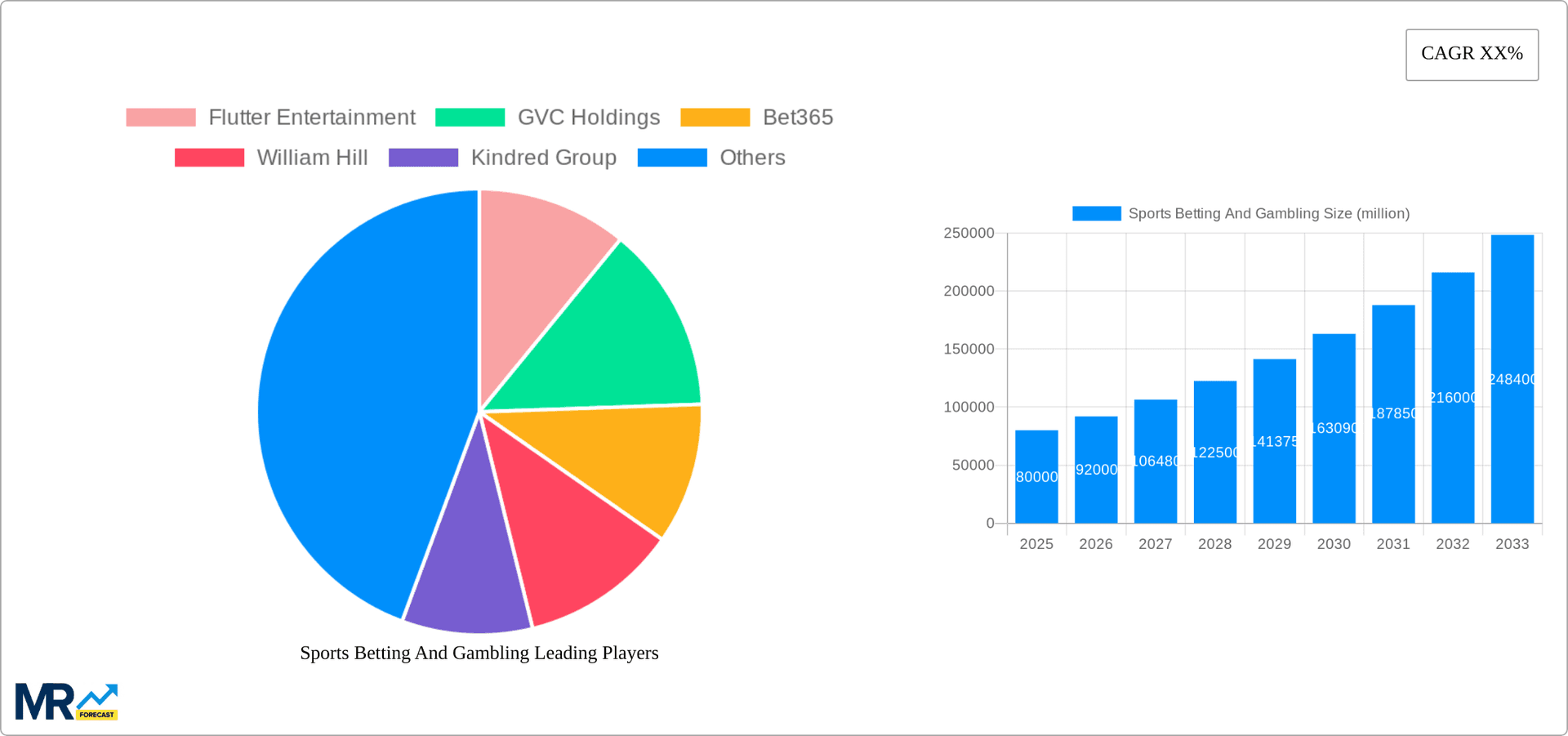

Key companies in the market include Flutter Entertainment, GVC Holdings, Bet365, William Hill, Kindred Group, 888 Holdings, Betsson AB, DraftKings, Pinnacle, Betway, Betfred, Bet-at-home.com, BetAmerica, BetVictor, Sports Interaction, BetWinner, SBOBET, .

The market segments include Application, Type.

The market size is estimated to be USD 155.423 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Sports Betting And Gambling," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sports Betting And Gambling, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.