1. What is the projected Compound Annual Growth Rate (CAGR) of the Sport and Leisure Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sport and Leisure Insurance

Sport and Leisure InsuranceSport and Leisure Insurance by Application (For Professional Sports, For Amateur Sports, For School Sports, Other), by Type (Sports Insurance, Leisure Insurance), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

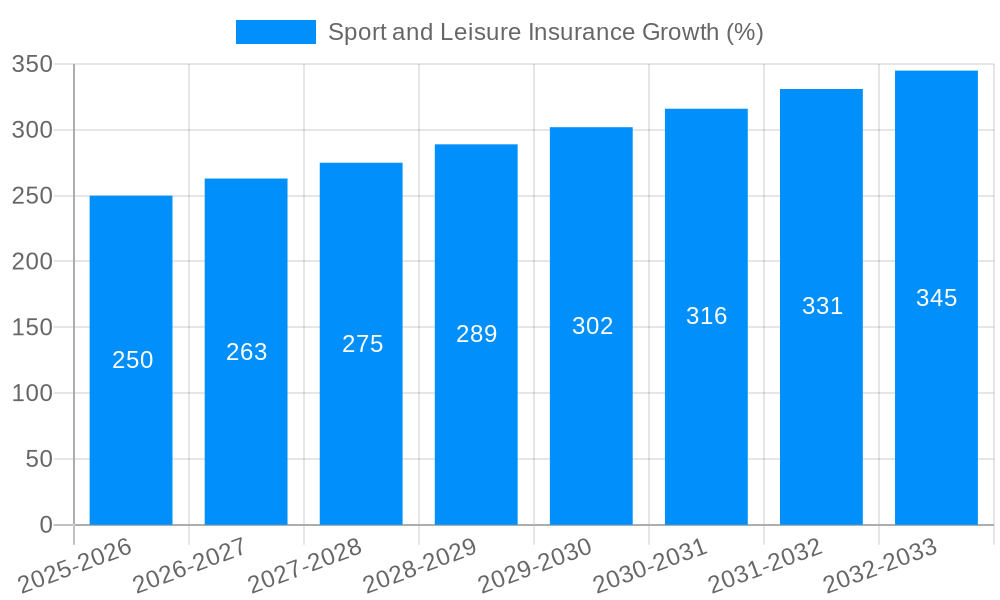

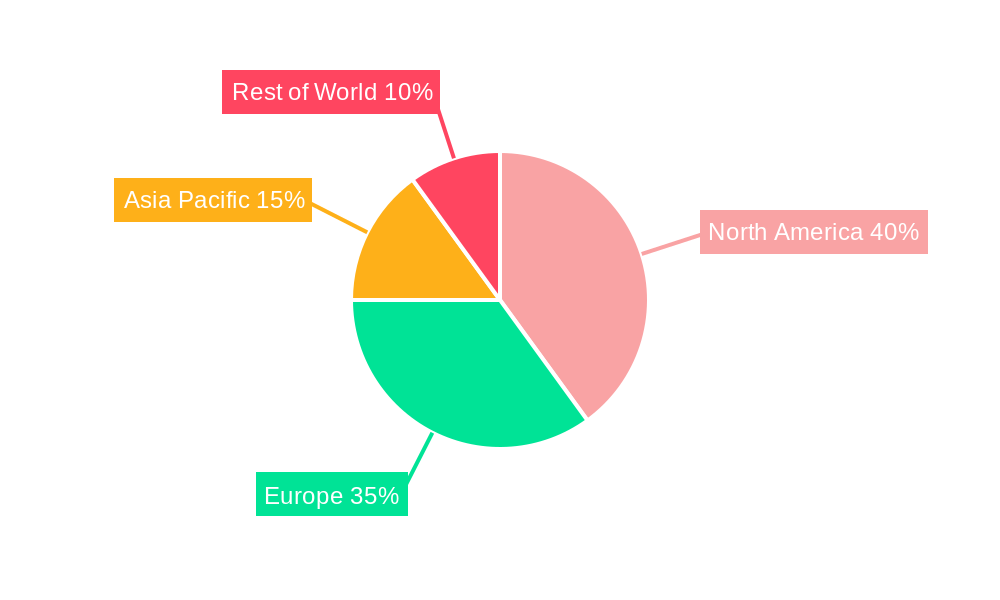

The global sports and leisure insurance market is experiencing robust growth, driven by rising participation in sporting activities, increasing awareness of personal liability, and the expanding middle class with greater disposable income. The market's segmentation reveals significant opportunities across various applications (professional, amateur, school sports) and insurance types (sports-specific and broader leisure coverage). While precise market sizing data is unavailable, a logical estimation based on industry trends and the provided growth rate (CAGR) indicates a substantial market value, likely exceeding several billion dollars globally by 2025. North America and Europe currently dominate market share, reflecting higher participation rates and established insurance infrastructures. However, significant growth potential exists in the Asia-Pacific region, particularly in rapidly developing economies like China and India, fueled by rising disposable incomes and increased participation in various sports and leisure activities. Market restraints include the perceived high cost of insurance, particularly for less-common sports, and the complexity of insurance policies, potentially deterring individuals from purchasing coverage. Furthermore, the insurance industry’s need to adapt policies for emerging sports and activities like e-sports presents both a challenge and opportunity for future growth.

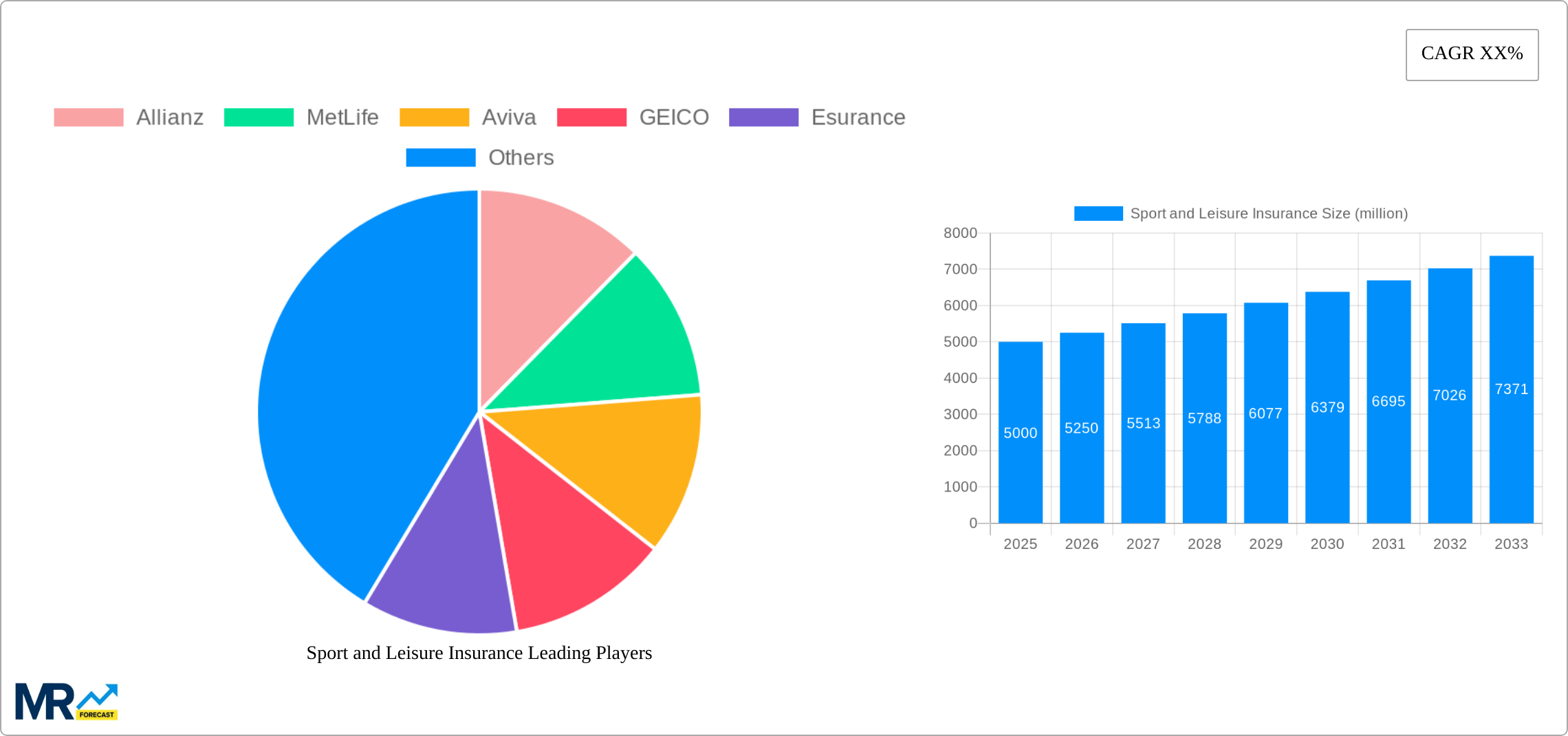

The competitive landscape is characterized by a mix of global insurance giants (Allianz, MetLife, Aviva) and regional players catering to niche markets. The success of companies hinges on their ability to provide tailored products, leveraging technology for efficient claims processing and customer engagement. Future growth will be influenced by factors including technological advancements (e.g., wearable tech for risk assessment), increasing government regulations in sports safety, and expanding awareness campaigns highlighting the importance of sports and leisure insurance. The forecast period (2025-2033) indicates continued expansion, driven by the aforementioned trends, suggesting significant investment and strategic opportunities within this dynamic market segment. This necessitates an ongoing assessment of the market to understand the specific needs of various customer groups, ensuring a competitive edge for businesses operating within the sector.

The global sport and leisure insurance market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The study period of 2019-2033 reveals a consistent upward trajectory, fueled by several key factors. Increased participation in both professional and amateur sports, coupled with a rising awareness of the potential risks associated with these activities, is driving demand for comprehensive insurance coverage. The market is segmented by application (professional, amateur, school, and other) and type (sports and leisure insurance), with significant variations in growth rates across these segments. Professional sports, with its high-value athletes and associated risks, represents a significant revenue stream. However, the amateur sports segment is demonstrating impressive growth, driven by an expanding participation base across various age groups and activity levels. Furthermore, the increasing prevalence of school sports programs globally is fueling demand for insurance solutions designed to protect students and institutions. The rising disposable incomes in developing economies contribute significantly to market expansion as more individuals can afford insurance premiums. The shift toward a more health-conscious lifestyle and an increase in adventure tourism are also significant trends. Technological advancements, such as improved data analytics and digital distribution channels, are streamlining operations and enhancing customer experiences. The estimated market value in 2025 serves as a crucial benchmark to gauge the pace of this expansion, providing valuable insights for stakeholders involved in the sport and leisure insurance sector. The forecast period (2025-2033) will likely witness innovative product offerings and strategic partnerships, particularly given the competitive landscape involving both established players and emerging insurers. The historical period (2019-2024) shows a strong foundation for continued growth. The base year of 2025 offers a vital snapshot for future projections.

Several key factors are propelling the growth of the sport and leisure insurance market. Firstly, the rising global participation in various sporting activities, from professional leagues to amateur clubs and individual pursuits, creates a vast pool of potential customers requiring insurance against injuries, accidents, and equipment damage. Secondly, increasing public awareness of the potential financial liabilities associated with sports-related accidents and injuries is significantly driving demand. This heightened awareness is leading individuals, schools, and sports organizations to proactively seek insurance protection. Thirdly, stringent regulations and legal requirements in several countries mandate specific insurance coverage for organized sports events and professional athletes, creating a substantial demand for these services. The expansion of the tourism sector, especially adventure tourism, is also a crucial driver. Individuals engaging in high-risk activities like skiing, scuba diving, or mountain climbing often seek specialized insurance coverage. Finally, the continuous improvement in insurance products and services, coupled with advanced digital platforms for efficient policy management and claims processing, contributes positively to market growth. These advancements enhance customer satisfaction and attract a broader client base.

Despite the significant growth potential, the sport and leisure insurance market faces several challenges. One major hurdle is the accurate assessment and pricing of risk. Predicting the likelihood and severity of injuries or accidents in various sports can be complex due to factors like individual skill levels, environmental conditions, and equipment quality. This necessitates sophisticated risk assessment models and potentially leads to higher premiums in high-risk categories. Another challenge is the increasing incidence of fraudulent claims, which can significantly impact the profitability of insurers. Effective fraud detection mechanisms are crucial for mitigating this risk. Moreover, the market's competitive landscape requires insurers to constantly innovate and offer competitive pricing and coverage options to attract and retain customers. Fluctuations in economic conditions can also impact consumer demand for insurance products, especially in discretionary spending categories. The evolving regulatory environment in different regions requires insurers to adapt to changing compliance requirements and maintain adherence to legal standards. Finally, effectively communicating the value proposition of insurance to potential customers and overcoming the perception of insurance as an unnecessary expense remains a challenge.

The North American and European markets are expected to dominate the sport and leisure insurance sector throughout the forecast period, primarily due to high per capita income levels and a mature insurance industry. However, rapidly developing economies in Asia-Pacific are showing significant growth potential, fueled by rising participation in sports and increased disposable income.

In summary: While the professional sports segment leads in revenue generation, the growth potential within amateur and school sports insurance is significant and should not be overlooked. The geographic spread of dominance is likely to shift towards more developing economies in the future, although mature markets will likely remain strong throughout the projected period. The expansion of digital insurance platforms and increased government support for school and community sports further contributes to the overall growth of the sector.

Several factors are accelerating the growth of the sport and leisure insurance industry. Rising disposable incomes globally are empowering more individuals to invest in protecting themselves against potential risks associated with sports and leisure activities. Increased participation in both professional and amateur sports events and activities creates a large pool of potential customers. The rising awareness of potential liability and the need for risk management is pushing more individuals and organizations towards securing insurance coverage. Technological advancements such as digital distribution channels and improved risk assessment tools are creating greater efficiency and enhancing customer experience within the sector.

This report offers a detailed analysis of the sport and leisure insurance market, examining market size, trends, drivers, challenges, and future projections. It provides valuable insights into key market segments (professional, amateur, and school sports), leading players, and emerging industry developments. The report is designed to be a comprehensive resource for investors, insurers, sports organizations, and anyone interested in understanding this rapidly expanding sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz, MetLife, Aviva, GEICO, Esurance, Nationwide, SADLER & Company, Pardus Holdings Limited, Baozhunniu, Sport Covers, Huize, FinanceSN, China Life Insurance, China Ping An Life Insurance, China Pacific Life Insurance, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Sport and Leisure Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sport and Leisure Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.