1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Debris Removal Services?

The projected CAGR is approximately 31%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Space Debris Removal Services

Space Debris Removal ServicesSpace Debris Removal Services by Application (Large Orbital Debris, Small Orbital Debris), by Type (Active Debris Removal (ADR), Passive Debris Removal (PDR)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

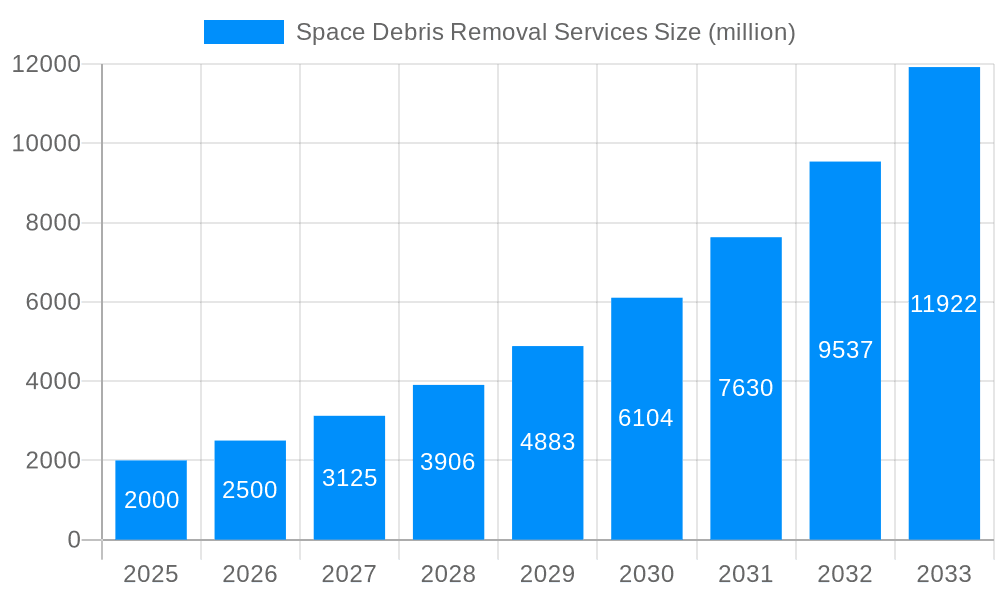

The space debris removal services market is experiencing robust growth, driven by increasing awareness of the risks posed by orbital debris to operational satellites and future space missions. The market, currently estimated at $2 billion in 2025, is projected to expand significantly over the next decade, with a Compound Annual Growth Rate (CAGR) of approximately 25% through 2033. This rapid expansion reflects the escalating need for effective debris mitigation strategies as the number of operational satellites and space debris continues to rise. Key drivers include stringent regulatory frameworks emerging to address the space debris problem, increasing private sector investment in space exploration and commercialization, and advancements in technologies like active and passive debris removal techniques. The market is segmented by application (large and small orbital debris) and type of removal service (active and passive). Active debris removal (ADR), involving direct capture and disposal of objects, holds a larger market share currently due to its effectiveness in removing larger pieces of debris. However, passive debris removal (PDR) techniques, such as deploying sails to de-orbit defunct satellites, are gaining traction due to their cost-effectiveness for smaller debris items.

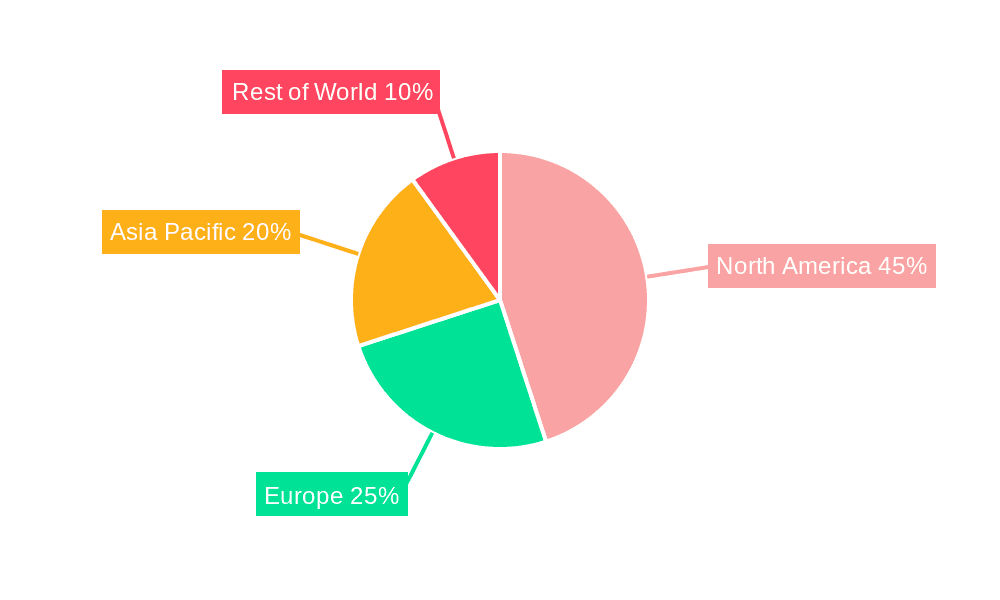

North America currently dominates the market, owing to significant investments in space technology and the presence of major players in the field. However, the Asia-Pacific region is expected to exhibit considerable growth in the coming years driven by the increasing space activities in nations like China, India, and Japan. The European Union and other regions are also witnessing increased activity, spurred by government initiatives and collaborative projects focused on debris mitigation. Significant restraints to market growth include the high cost of developing and deploying debris removal technologies, the technical challenges associated with capturing and disposing of debris, and the need for international collaboration and standardization. Addressing these restraints through public-private partnerships and international agreements will be critical in unlocking the full potential of the space debris removal services market and ensuring the long-term sustainability of space operations.

The space debris removal services market is experiencing a period of significant growth, driven by increasing awareness of the threat posed by orbital debris to operational satellites and future space missions. The study period from 2019 to 2033 reveals a trajectory of escalating demand for debris removal solutions. While the historical period (2019-2024) saw initial market development and technological advancements, the base year of 2025 marks a pivotal point, with the market estimated to be valued at several hundred million USD. This is projected to expand exponentially during the forecast period (2025-2033). Several factors contribute to this growth, including the rising number of satellite launches, increased regulatory pressure to mitigate the debris problem, and the maturation of technologies capable of effectively removing debris from orbit. The market is segmented by application (large and small orbital debris) and type of removal service (active and passive debris removal). While active debris removal (ADR) currently holds a larger market share due to its ability to target and capture specific pieces of debris, passive debris removal (PDR) is gaining traction as a more cost-effective solution for addressing the immense volume of smaller debris. The competitive landscape is dynamic, with several innovative companies emerging, each offering unique technological approaches to the challenge. The market is witnessing significant investment and collaboration, demonstrating a collective global effort to address this critical space sustainability issue. This report provides a comprehensive analysis of these trends, highlighting key market drivers, challenges, and opportunities within this burgeoning industry expected to reach billions of USD by 2033.

Several powerful forces are driving the expansion of the space debris removal services market. Firstly, the sheer volume of space debris is growing exponentially, posing a significant threat to operational satellites and future space exploration endeavors. Collisions with even small pieces of debris can cause catastrophic damage, leading to mission failures and financial losses running into millions of dollars. Secondly, international space agencies and governments are increasingly recognizing the urgency of addressing this issue and are enacting regulations that incentivize the development and implementation of debris removal technologies. These regulatory pressures are creating a robust market demand for companies capable of providing effective removal services. Thirdly, technological advancements are making debris removal increasingly feasible and cost-effective. Advances in robotics, autonomous navigation, and space-based capture mechanisms are enabling the development of sophisticated removal systems that can target and safely de-orbit debris. Furthermore, the growing commercialization of space and the expansion of mega-constellations are further intensifying the need for debris mitigation strategies, driving investments in this sector and fueling market expansion. Finally, the increasing awareness among stakeholders about the long-term sustainability of space activities underscores the necessity of proactive debris removal.

Despite the considerable market potential, several challenges and restraints hinder the growth of the space debris removal services sector. The high cost of space missions, including the development, launch, and operation of debris removal systems, remains a significant barrier to entry and widespread adoption. The technical complexities involved in capturing and de-orbiting debris, especially large and non-cooperative objects, pose significant engineering challenges. Uncertainty surrounding liability and insurance for debris removal operations creates legal and financial risks. Moreover, the international coordination required to effectively manage space debris presents a bureaucratic challenge. This includes establishing common standards, regulations, and collaborative frameworks among different space-faring nations. The vast distances involved in space operations and the unpredictable nature of orbital debris create logistical hurdles, impacting mission timelines and budgets. Finally, the long lead times required for the development and testing of new technologies, coupled with the need for rigorous safety protocols, can slow down the pace of market expansion.

The Active Debris Removal (ADR) segment is poised to dominate the market due to its ability to directly target and remove larger, more hazardous pieces of debris that pose the greatest threat to operational satellites. While Passive Debris Removal (PDR) offers a potentially more cost-effective approach for clearing smaller debris, the immediate need to mitigate the threat from larger objects gives ADR a significant competitive edge.

Active Debris Removal (ADR) Market Dominance: The market’s initial focus on ADR reflects a strategic prioritization of immediate risk mitigation. Large orbital debris presents a clear and present danger, necessitating the precision and control offered by ADR technologies. Significant investments are flowing into the development of advanced robotic arms, nets, and harpoons designed for targeted capture and de-orbiting. The higher cost per operation is justifiable given the high-risk nature of large orbital debris and its potential for causing catastrophic damage.

Regional Leadership: While the market is still developing, countries with advanced space programs and a commitment to space sustainability are likely to take an early lead. This includes nations like the United States, Europe (particularly through the ESA), Japan, and China, as they possess the technological capabilities and funding to invest in and deploy ADR systems. Furthermore, regions with strong aerospace industries and supporting infrastructure will see increased activity.

Technological Advancements: Further market growth is dependent upon ongoing technological improvements. Specifically, the need to reduce the cost of ADR operations while improving efficiency and reliability is vital. Advancements in artificial intelligence, autonomous navigation, and space-based robotics will be key factors in determining future market share.

The projection for the next decade shows substantial growth for ADR, driven by increased regulatory pressures, rising awareness of space sustainability, and technological maturity. The high initial investment cost associated with ADR systems will be offset by the long-term benefits of a safer and more sustainable space environment. This justifies a clear focus on this segment as the market leader in the foreseeable future.

Several factors are accelerating growth in this industry. Government regulations aimed at mitigating orbital debris are creating a stronger demand for removal services. Increased private sector investment is driving technological innovation and bringing more companies into the market. Finally, heightened public awareness of the space debris problem is fostering a supportive environment for this vital industry.

This report provides a detailed analysis of the space debris removal services market, offering valuable insights into market trends, growth drivers, challenges, and key players. It provides a robust forecast for market growth through 2033, segmented by application and removal type, along with a regional overview, identifying key areas for market expansion. This comprehensive analysis makes it an indispensable resource for businesses, investors, and policymakers involved in or interested in the space debris removal sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 31%.

Key companies in the market include Astroscale, ClearSpace, OrbitGuardians, Dark-space, TransAstra, D-Orbit, Electro-Optic, Turion Space, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Space Debris Removal Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Space Debris Removal Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.