1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Debris Cleanup Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Space Debris Cleanup Services

Space Debris Cleanup ServicesSpace Debris Cleanup Services by Type (Active Debris Removal (ADR), Passive Debris Removal (PDR)), by Application (Large Orbital Debris, Small Orbital Debris), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

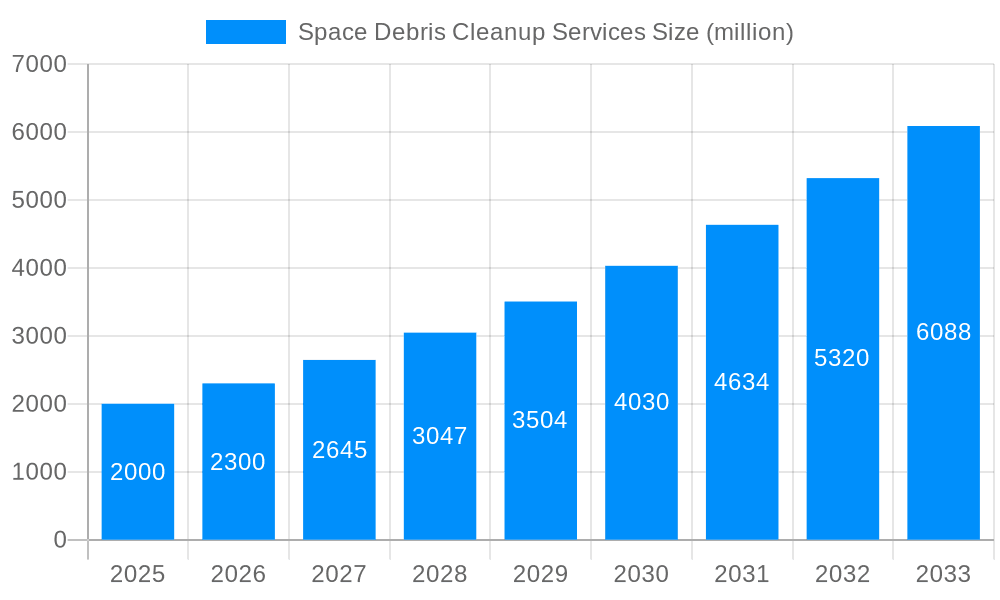

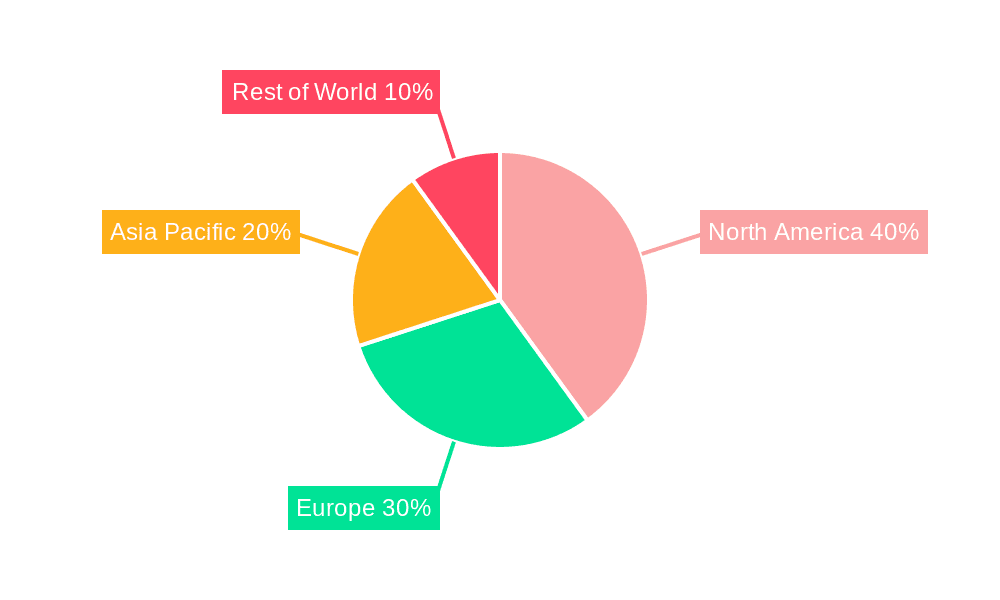

The space debris cleanup services market is poised for significant growth, driven by increasing space-based activities and the escalating risks associated with orbital debris. The market, currently valued at approximately $2 billion in 2025, is projected to experience a robust Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an estimated $8 billion by 2033. This expansion is fueled by several key factors. Firstly, the growing number of operational satellites and space launches contributes to a rapid accumulation of space debris, necessitating proactive removal solutions. Secondly, the increasing awareness of the potential for catastrophic collisions and the long-term sustainability of space activities is pushing governments and private companies to invest heavily in debris mitigation technologies. Finally, advancements in robotics, autonomous navigation, and space-based technologies are enabling the development of more efficient and cost-effective debris removal techniques. Active debris removal (ADR) is currently the more prominent segment, accounting for a larger market share than passive debris removal (PDR), although both segments are anticipated to witness substantial growth throughout the forecast period. The market is geographically diversified, with North America and Europe currently holding the largest market shares, but significant growth potential is observed in the Asia-Pacific region as space exploration activities expand in these countries.

The segments within the space debris cleanup market reflect distinct approaches to addressing the problem. Active debris removal (ADR) involves actively capturing and removing debris from orbit, while passive debris removal (PDR) focuses on technologies that passively reduce the risk of collisions, such as drag sails. Large orbital debris presents a greater challenge due to size and mass, hence commands a higher market share than small orbital debris removal initially, though the latter segment is expected to witness accelerated growth in the coming years due to the sheer volume of smaller debris particles. Competitive landscape is currently shaping up with several companies developing innovative technologies, indicating a dynamic and evolving market. Regulatory frameworks and international collaborations will play a significant role in shaping the market’s future trajectory. The market's growth is therefore not solely dependent on technological advancements, but also on policy developments and the increasing recognition of the long-term environmental and economic consequences of unchecked space debris accumulation.

The space debris cleanup services market is experiencing a period of significant growth, driven by increasing awareness of the risks posed by orbital debris and advancements in removal technologies. The study period from 2019 to 2033 reveals a dynamic shift, with the historical period (2019-2024) laying the groundwork for exponential expansion. Our estimations for 2025 peg the market value in the hundreds of millions of dollars, projecting a substantial increase throughout the forecast period (2025-2033). This growth isn't solely reliant on technological breakthroughs; it's also fueled by evolving regulatory frameworks and a growing consensus among spacefaring nations on the urgency of addressing this critical issue. The base year of 2025 serves as a pivotal point, marking a transition from nascent technology adoption to a more mature market with a wider range of services and players. Several factors contribute to this upward trajectory: increased satellite launches leading to more debris, the rising cost of mitigating collisions, and the escalating potential for damage to operational satellites and space infrastructure. The market is witnessing a diversification of approaches, with active debris removal (ADR) gaining traction alongside passive debris removal (PDR) strategies. The types of debris targeted also vary, with both large and small orbital debris demanding tailored solutions, pushing innovation in the sector. The market is expected to see increasing consolidation as larger players acquire smaller firms specializing in particular technologies or segments, leading to further market expansion. Finally, government initiatives and funding play a vital role, encouraging private sector investment and driving technological advancements in this critical field. This complex interplay of factors ensures a dynamic and promising future for the space debris cleanup services market.

The burgeoning space debris cleanup services market is propelled by a confluence of factors. Firstly, the escalating number of operational satellites and the resulting increase in space debris pose a significant threat to the continued viability of space-based assets. Collisions, even with small debris fragments, can cause catastrophic damage, jeopardizing multi-million dollar missions and creating a cascading effect of further debris generation (the Kessler Syndrome). This risk directly impacts the profitability of space-based industries, driving demand for effective cleanup solutions. Secondly, international regulations and guidelines are increasingly emphasizing the responsibility of spacefaring nations and private companies to mitigate the risks associated with orbital debris. This regulatory pressure creates a market incentive for companies offering debris removal services. Thirdly, technological advancements in robotics, autonomous navigation, and space-based manipulation systems are making active debris removal (ADR) increasingly feasible and cost-effective. This evolution is attracting further investment and stimulating competition within the sector. Lastly, the growing commercialization of space, with an ever-increasing number of private companies launching satellites, fuels the need for robust and reliable debris removal services to ensure the long-term sustainability of this burgeoning industry.

Despite the growing market, significant challenges hinder the widespread adoption of space debris cleanup services. The immense cost of developing and deploying advanced technologies for debris removal remains a primary barrier. The distances involved, the unpredictable nature of space debris orbits, and the need for highly specialized equipment contribute to the high capital investment required. Technological hurdles also persist. Precisely capturing and safely disposing of various sizes and types of debris, particularly smaller fragments, poses significant technological challenges. Developing robust and reliable systems that can operate autonomously in the harsh space environment is an ongoing process. Furthermore, the lack of a universally agreed-upon regulatory framework for liability and responsibility in space debris removal creates uncertainty and complicates commercial endeavors. International cooperation is essential to define clear rules and guidelines that incentivize participation and facilitate efficient operations. The sheer volume of existing space debris, spanning decades of space activity, constitutes a formidable challenge, making a comprehensive cleanup a long-term, phased undertaking. Finally, the difficulty of proving return on investment, particularly for passive debris removal approaches that may not yield immediate tangible returns, is a factor that limits widespread implementation.

The Active Debris Removal (ADR) segment is poised to dominate the market in the coming years. This is because ADR directly addresses the most immediate and critical threat: the large, actively trackable pieces of debris that pose the highest risk of collision with operational satellites. While Passive Debris Removal (PDR) techniques offer a longer-term solution for the vast amount of smaller debris, ADR offers more immediate impact and thus higher market demand.

Active Debris Removal (ADR) Dominance: The focus on ADR is driven by the immediate need to remove high-risk debris. Advancements in robotic technologies, spacecraft maneuvering capabilities, and capture mechanisms are contributing to the increased feasibility and market appeal of ADR. The ability to target and remove specific pieces of debris significantly reduces collision risks for valuable assets in orbit.

Geographic Distribution: While the market is expected to show growth globally, North America and Europe are anticipated to take the lead due to their established space industries, extensive research and development capabilities, and the presence of major players in the space debris removal sector. These regions possess the necessary technological infrastructure and regulatory frameworks to support the growth of ADR services.

Market Segmentation by Size of Debris: While both large and small orbital debris require attention, the market for large orbital debris removal will likely see quicker growth initially because the risk associated with these larger pieces is significantly higher, making the ROI more apparent to investors and government agencies. Removing these larger threats helps mitigate the cascading effects of Kessler Syndrome, making it a priority. Small orbital debris removal will eventually become a crucial element, but the technological challenges and costs associated with removing a vastly larger number of smaller pieces mean this segment will likely experience slower but steady growth following the dominance of large debris removal.

The combined influence of technological advancements, regulatory incentives, and the critical nature of the problem significantly strengthens the position of ADR services in this field. This segment is expected to account for a substantial portion of the overall market revenue throughout the forecast period.

Several key factors will drive the growth of the space debris cleanup services industry. Firstly, increased government funding and policy support, creating a favorable regulatory landscape, will directly spur investment and innovation in this sector. Secondly, continued technological advancements in areas like robotic manipulation, autonomous navigation, and debris tracking will lead to more efficient and cost-effective removal techniques. Finally, the rising number of satellite launches and growing commercial space activities will lead to increased awareness of the debris problem and a greater demand for preventative and remedial measures. This creates a positive feedback loop, driving further investment and innovation.

This report provides a comprehensive overview of the space debris cleanup services market, offering detailed insights into market trends, driving forces, challenges, and key players. It offers a granular analysis of the market segmentation, highlighting the key segments dominating the market and offering detailed forecasts for the forecast period (2025-2033). The report is an invaluable resource for stakeholders in the space industry, including companies, investors, and policymakers, providing actionable intelligence to navigate the complexities of this dynamic and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

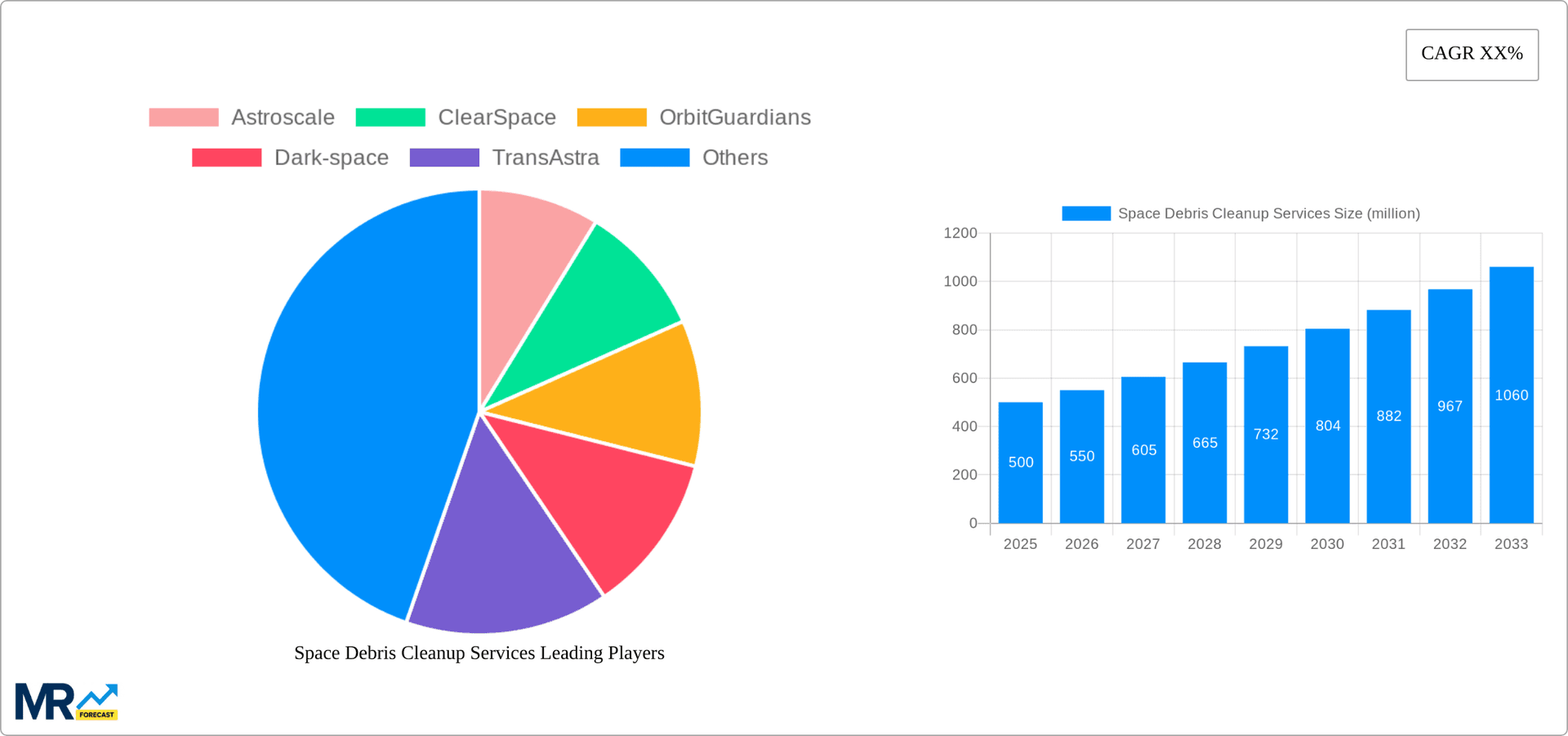

Key companies in the market include Astroscale, ClearSpace, OrbitGuardians, Dark-space, TransAstra, D-Orbit, Electro-Optic, Turion Space, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Space Debris Cleanup Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Space Debris Cleanup Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.