1. What is the projected Compound Annual Growth Rate (CAGR) of the Software in the Loop?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Software in the Loop

Software in the LoopSoftware in the Loop by Type (/> Open Loop HIL, Closed Loop HIL), by Application (/> Automotive, Aerospace, Power Electronics, Research & Education, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

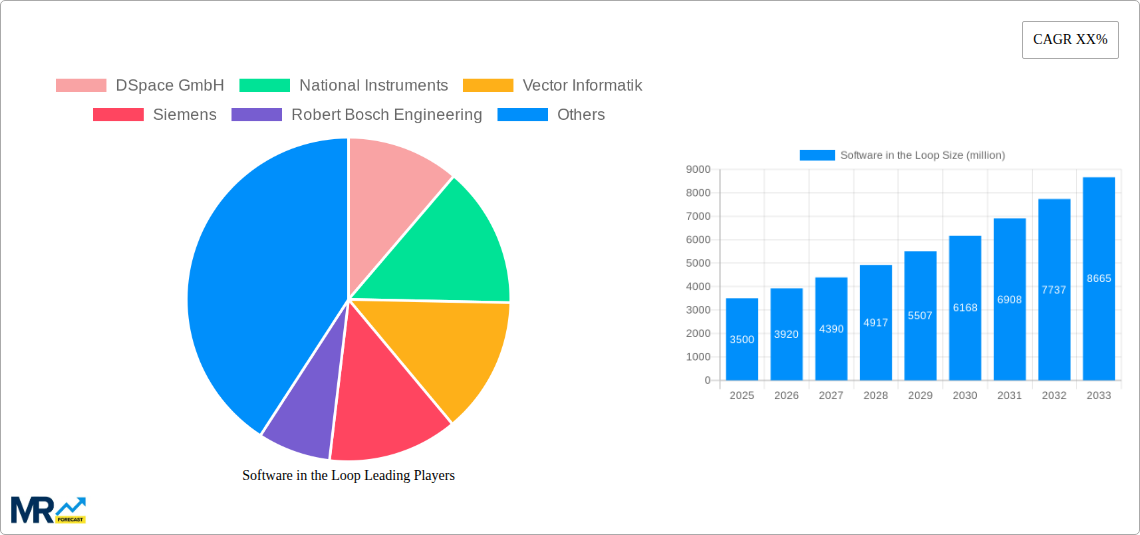

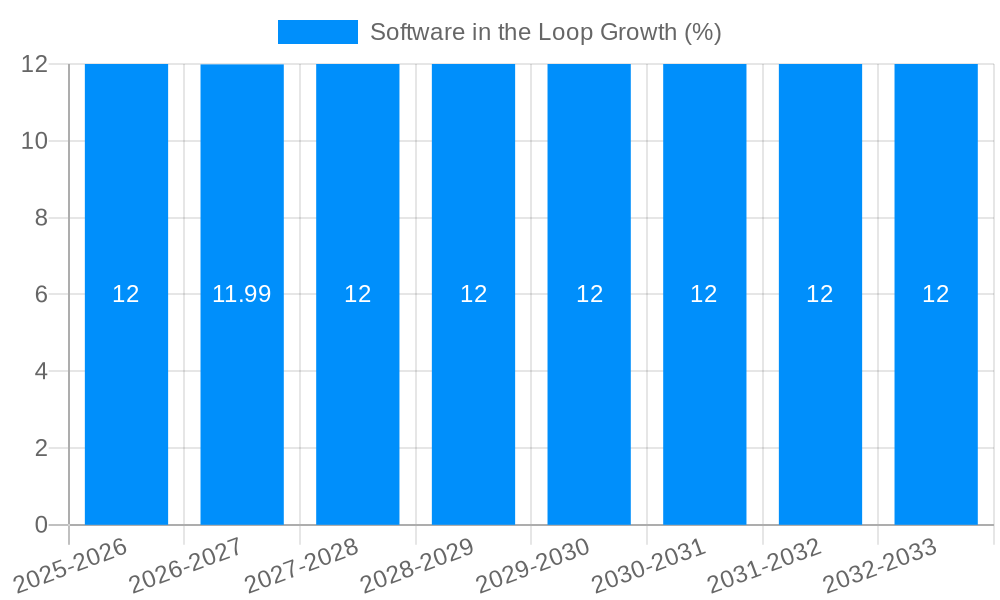

The global Hardware-in-the-Loop (HIL) market is poised for significant expansion, driven by the escalating complexity of automotive, aerospace, and power electronics systems, demanding rigorous testing and validation. The market is projected to reach an estimated USD 3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 12%, expanding through 2033. This growth is primarily fueled by the increasing adoption of autonomous driving technologies, advanced driver-assistance systems (ADAS), and the electrification of vehicles, all of which necessitate sophisticated simulation and testing environments. Furthermore, stringent safety regulations across these industries are compelling manufacturers to invest heavily in HIL systems for early defect detection and to ensure product reliability and performance. The trend towards open-loop HIL systems is expected to continue, offering cost-effectiveness for certain applications, while closed-loop HIL systems will see increased demand for more comprehensive and accurate real-time testing, particularly in mission-critical applications.

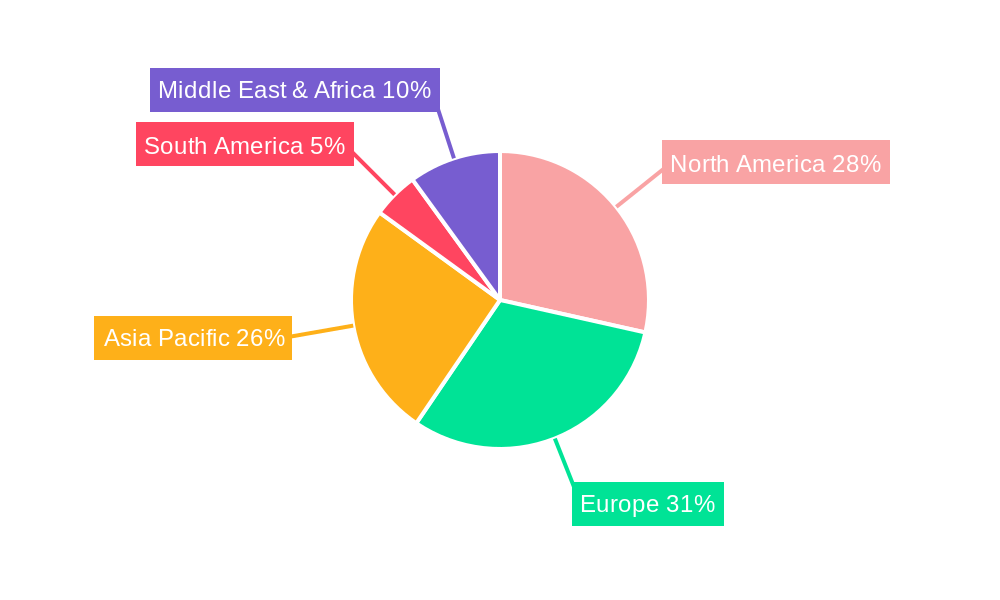

Geographically, Asia Pacific, led by China and India, is anticipated to emerge as a pivotal growth region, owing to the rapid expansion of its automotive and electronics manufacturing sectors. North America and Europe will continue to be dominant markets, driven by established players in the automotive and aerospace industries, and a strong focus on R&D. Restraints in the market may include the high initial investment cost of advanced HIL systems and the need for specialized technical expertise. However, the long-term benefits of reduced development cycles, improved product quality, and enhanced safety are expected to outweigh these challenges. Key players such as dSPACE GmbH, National Instruments, and Vector Informatik are actively innovating, introducing more powerful and versatile HIL solutions to meet the evolving demands of their clientele, further propelling market growth.

Here is a unique report description for Software in the Loop (SiL), incorporating your specified elements:

This report presents a comprehensive analysis of the global Software in the Loop (SiL) market, meticulously examining its trajectory from the historical period of 2019-2024, with a projected outlook extending through 2033. The base year for our detailed market valuation is 2025, with an estimated market size also set for 2025, followed by a robust forecast period from 2025-2033. We delve into the intricate workings of SiL technologies, understanding its crucial role in modern product development, particularly within complex and safety-critical industries. The market is segmented by Type, including Open Loop HIL and Closed Loop HIL, and by Application, encompassing Automotive, Aerospace, Power Electronics, Research & Education, and Other sectors. Industry developments and key trends are analyzed to provide stakeholders with actionable intelligence. The market value is presented in millions of units.

The Software in the Loop (SiL) market is currently experiencing an unprecedented surge, driven by the escalating demand for sophisticated virtual testing environments across a multitude of industries. The historical period of 2019-2024 has witnessed a steady adoption of SiL, laying the groundwork for exponential growth anticipated in the forecast period of 2025-2033. A key insight is the increasing complexity of embedded systems, especially in the automotive sector, where advanced driver-assistance systems (ADAS) and autonomous driving technologies necessitate rigorous and early-stage validation. This has led to a significant shift from traditional hardware-centric testing to software-based simulation, where SiL plays a pivotal role. The market is observing a pronounced trend towards greater integration of SiL with other simulation methodologies, such as Model-in-the-Loop (MiL) and Hardware-in-the-Loop (HiL), creating a comprehensive virtual validation ecosystem. The estimated market size for 2025 underscores this upward momentum, with projections indicating a compound annual growth rate (CAGR) that will redefine the landscape of engineering simulation.

Furthermore, the increasing emphasis on cost reduction and accelerated time-to-market is compelling organizations to adopt SiL solutions. By enabling the testing of software components in a virtual environment before physical hardware is available, SiL significantly mitigates development risks and reduces the need for expensive physical prototypes. The evolving regulatory landscape, particularly in industries like aerospace and automotive, also mandates stringent testing protocols, which SiL effectively addresses by providing repeatable and traceable testing scenarios. The research and education sector is also contributing to this trend, as universities and research institutions increasingly utilize SiL platforms for training future engineers and for conducting cutting-edge research. The market is also witnessing advancements in the sophistication of SiL tools, incorporating more realistic environmental models, sensor simulations, and fault injection capabilities, thereby enhancing the fidelity and scope of virtual testing. This continuous innovation is a defining characteristic of the SiL market, ensuring its relevance and growth in the years to come. The adoption of cloud-based SiL platforms is also on the rise, offering greater accessibility, scalability, and collaborative capabilities for development teams distributed globally. This trend is expected to further democratize SiL adoption and accelerate innovation.

The Software in the Loop (SiL) market is being propelled by a confluence of powerful drivers that are fundamentally reshaping product development and validation processes. Foremost among these is the relentless pursuit of innovation and the introduction of increasingly complex embedded software functionalities. In sectors like automotive, the rapid advancement of ADAS, autonomous driving features, and electric vehicle powertrains necessitates extensive software validation that goes beyond the capabilities of traditional testing methods. SiL provides an indispensable platform for testing these intricate software algorithms in a safe, controlled, and repeatable virtual environment, allowing for early detection and correction of bugs before they manifest in costly hardware failures or recalls. The economic imperative to reduce development costs and accelerate time-to-market is another significant propellant. By enabling engineers to test software against simulated models of hardware and the surrounding environment early in the development cycle, SiL significantly reduces the reliance on expensive physical prototypes and the associated testing infrastructure. This virtual testing approach not only slashes costs but also dramatically shortens the overall development timeline, giving companies a competitive edge.

Moreover, the growing stringency of regulatory compliance and safety standards across industries such as automotive and aerospace acts as a powerful catalyst for SiL adoption. These regulations often demand exhaustive testing under a wide range of scenarios, including extreme conditions and potential failure modes, which are best replicated and validated within a SiL framework. The increasing interconnectedness of systems and the rise of the Internet of Things (IoT) are also contributing to the demand for SiL. As more devices and components become software-controlled and interconnected, the potential for software-related failures increases, making robust software validation through SiL a critical necessity. The desire for greater design flexibility and the ability to explore numerous design iterations without the constraints of physical hardware further fuels the adoption of SiL. Engineers can experiment with different software architectures and control strategies in the virtual realm, optimizing performance and functionality before committing to hardware implementation.

Despite the burgeoning growth of the Software in the Loop (SiL) market, several challenges and restraints continue to shape its trajectory and adoption rates. A primary concern for organizations is the initial investment required for sophisticated SiL tools and the necessary expertise to operate them effectively. The high cost of licensing advanced simulation software, coupled with the need for skilled engineers capable of developing, configuring, and maintaining these virtual testing environments, can be a significant barrier, especially for small and medium-sized enterprises (SMEs). The accuracy and fidelity of SiL simulations are directly dependent on the quality and completeness of the underlying models. If these models are not representative of the real-world hardware or environment, the simulation results may be misleading, leading to flawed conclusions and potential issues in the final product. Achieving a high degree of model fidelity often requires substantial effort in model development, calibration, and validation, which can be time-consuming and resource-intensive.

Furthermore, the integration of SiL into existing development workflows can present a challenge. Many organizations have established engineering processes and tools that may not be readily compatible with SiL environments, necessitating significant changes and potential disruptions. The lack of standardization across different SiL platforms and tools can also hinder interoperability and collaboration between different teams or organizations. This can lead to vendor lock-in and increased costs for users who need to work with multiple systems. The perceived complexity of SiL systems can also be a deterrent for some engineers who are accustomed to more traditional testing methodologies. Adequate training and user-friendly interfaces are crucial to overcome this inertia and foster broader adoption. Finally, the rapid evolution of SiL technology means that organizations need to constantly update their tools and knowledge base to remain competitive, which can be a continuous operational challenge.

The Software in the Loop (SiL) market is poised for substantial growth, with specific regions and market segments expected to lead this expansion.

Key Region: North America is anticipated to be a dominant force in the SiL market during the forecast period of 2025-2033. This leadership is attributed to several factors:

Dominant Segment: Within the SiL market, the Automotive segment, particularly Closed Loop HIL, is expected to dominate significantly throughout the study period (2019-2033), with its influence projected to be most pronounced in the base and estimated year of 2025 and beyond into the forecast period.

The Software in the Loop (SiL) industry is fueled by several key growth catalysts. The exponential increase in the complexity of embedded software within modern vehicles, particularly with the advent of autonomous driving and advanced driver-assistance systems (ADAS), necessitates highly advanced and robust validation methods. SiL provides the ideal virtual environment for testing these intricate software functionalities. Furthermore, the global drive towards cost reduction and accelerated product development cycles is pushing manufacturers to adopt virtual testing solutions that minimize reliance on expensive physical prototypes. SiL enables early detection of software defects, thereby significantly reducing development risks and time-to-market. The ever-tightening regulatory landscape in critical sectors like automotive and aerospace also mandates comprehensive testing protocols, which SiL effectively addresses by offering repeatable and traceable validation scenarios.

This report offers a granular examination of the Software in the Loop (SiL) market, providing a holistic view for stakeholders. Our analysis spans from the historical performance (2019-2024) to detailed future projections (2025-2033), anchored by a thorough assessment in the base year of 2025. We dissect the market by key segments including Open Loop HIL and Closed Loop HIL, alongside critical application areas such as Automotive, Aerospace, Power Electronics, and Research & Education. The report meticulously details industry developments, identifying key trends, market drivers, and the challenges that shape the SiL landscape. This comprehensive approach ensures that readers gain a profound understanding of the market dynamics, enabling informed strategic decisions and identifying emerging opportunities within this rapidly evolving sector. The market valuation is presented in millions of units.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DSpace GmbH, National Instruments, Vector Informatik, Siemens, Robert Bosch Engineering, MicroNova AG, Opal-RT Technologies, LHP Engineering Solutions, Ipg Automotive GmbH, Typhoon HIL, Speedgoat GmbH, Eontronix, Wineman Technology, Modeling Tech, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Software in the Loop," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Software in the Loop, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.