1. What is the projected Compound Annual Growth Rate (CAGR) of the Snow Blower Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Snow Blower Rental

Snow Blower RentalSnow Blower Rental by Type (Semi-Automatic Snow Blower, Full-Automatic Snow Blower), by Application (Commercial, Military, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

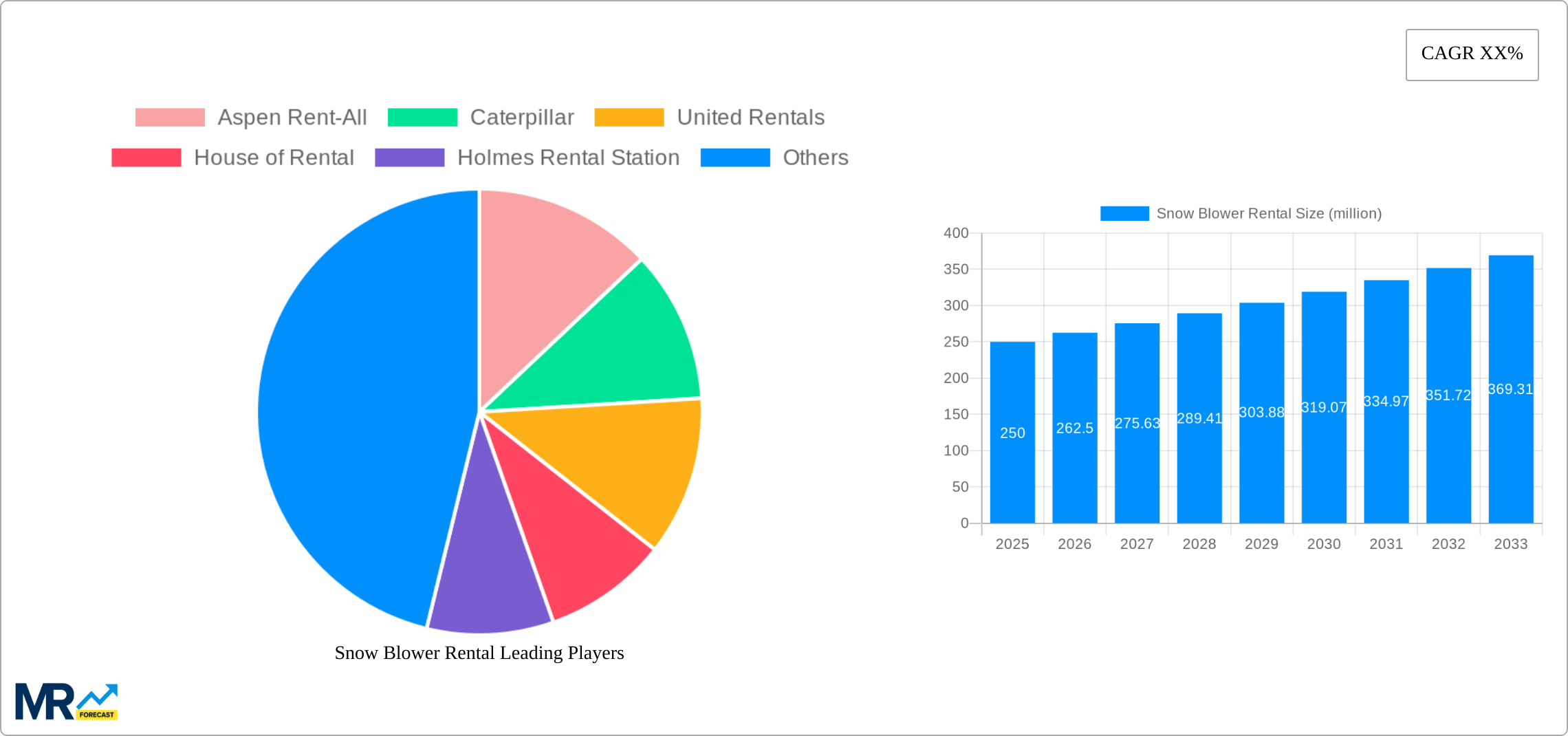

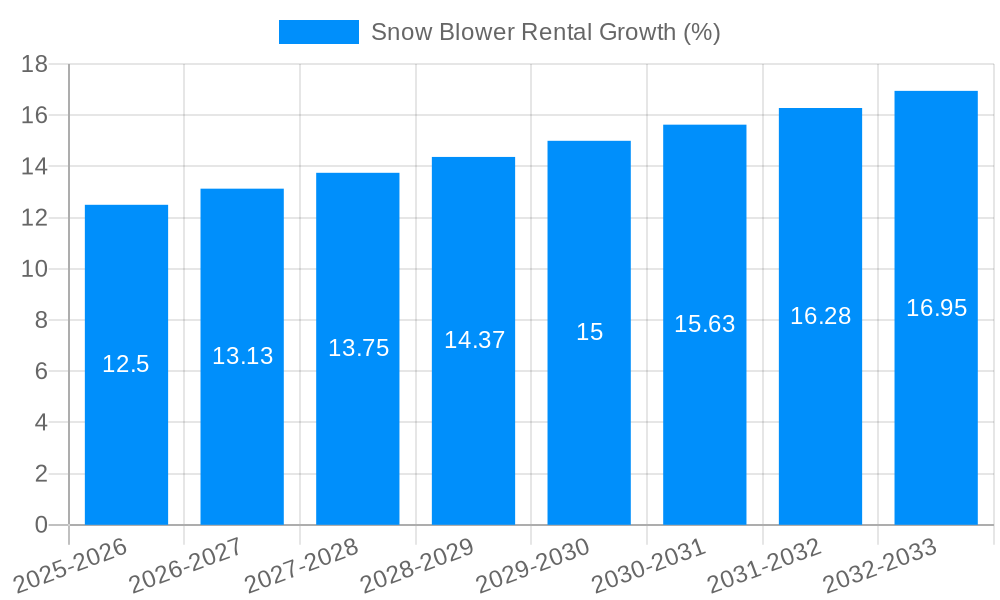

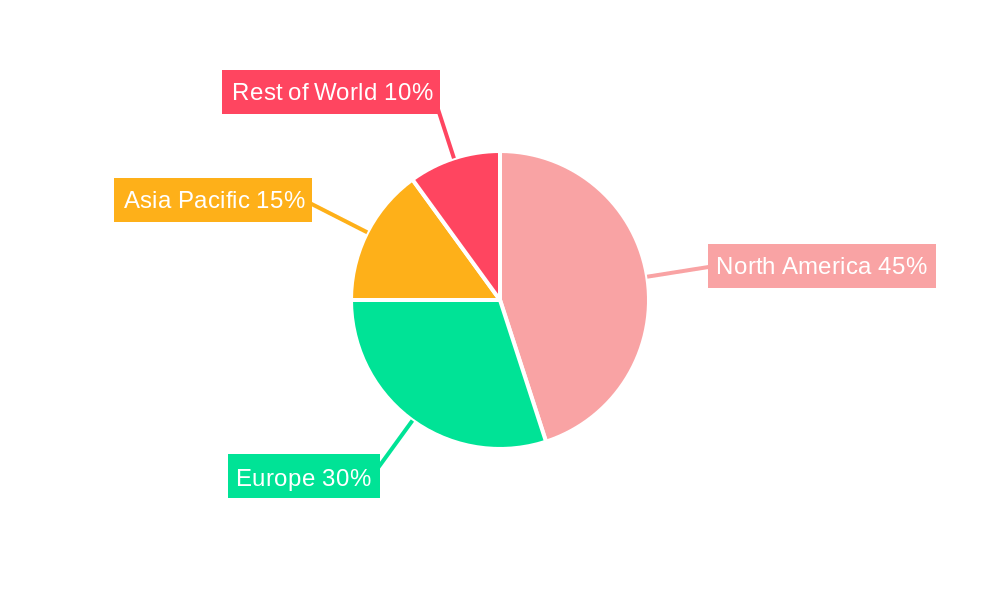

The snow blower rental market, while niche, exhibits promising growth potential driven by increasing incidences of heavy snowfall in various regions and the rising preference for rental services over outright purchase. The market is segmented by snow blower type (semi-automatic and fully automatic) and application (commercial, military, and others). Commercial applications, including landscaping companies and property management firms, constitute a significant portion of the market due to the high volume of snow removal required and the cost-effectiveness of renting equipment. Military applications, while potentially smaller in volume, are likely characterized by high-value contracts. The "others" segment encompasses residential rentals and smaller businesses. Considering the listed rental companies, primarily concentrated in North America, the market appears geographically concentrated, particularly in regions prone to significant snowfall. We can reasonably infer that North America holds a dominant market share, possibly exceeding 60%, followed by Europe and Asia-Pacific with considerably smaller shares. The forecast period (2025-2033) suggests a positive CAGR; while the specific value is not provided, a conservative estimate considering market trends and the seasonal nature of the business would place it between 3% and 5%. Growth will likely be influenced by factors such as climate change, which could lead to more unpredictable and heavier snowfall in some areas, and economic conditions, impacting consumer and business spending on snow removal. Restraints include the relatively short operational period for snow blowers, leading to less frequent rental demand, and potential competition from snow removal services.

The competitive landscape shows a fragmented market with numerous regional rental companies. Larger players like Caterpillar and United Rentals likely hold significant market share, leveraging established rental networks and broader equipment offerings. However, numerous smaller, localized rental businesses cater to specific geographical needs. Future market expansion hinges on factors such as technological advancements in snow blower design (e.g., improved efficiency and ease of use), expansion of rental services into underserved markets, and effective marketing strategies targeting both commercial and residential clients. Strategic alliances and acquisitions could significantly consolidate the market in the coming years. Overall, the snow blower rental market presents a compelling investment opportunity, although its seasonal nature and regional concentration require careful consideration.

The snow blower rental market, valued at approximately X million units in 2025, is projected to witness significant growth during the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a steady increase in demand, driven primarily by factors like unpredictable weather patterns leading to increased snowfall in several regions and the rising preference for rental services over outright purchases due to cost-effectiveness and convenience. This trend is further amplified by the increasing commercial and military applications of snow blowers, especially in areas with heavy snowfall. The market's growth is also influenced by the evolving technology in snow blower designs, with advancements in automation and efficiency leading to greater rental demand. The introduction of semi-automatic and fully automatic models caters to a broader range of users, from homeowners tackling moderate snowfall to large-scale commercial operations needing high-capacity snow removal. Competition among rental providers is keen, with established players like United Rentals and newer entrants vying for market share through strategic pricing, equipment upgrades, and enhanced customer service. However, the market’s growth trajectory is not without its challenges. Fluctuations in snowfall, economic downturns, and the availability of alternative snow removal solutions all present potential obstacles to continued expansion. The report delves deeper into these trends, offering granular insights into specific market segments and geographical regions, forecasting future growth, and identifying potential opportunities for stakeholders. The analysis considers the impact of various factors, including technological advancements, regulatory changes, and shifts in consumer behavior to present a comprehensive understanding of the market dynamics.

Several key factors are driving the growth of the snow blower rental market. The unpredictable nature of winter weather, marked by increasingly frequent and intense snowstorms in many parts of the world, is a significant contributor. Homeowners and businesses alike are increasingly reliant on efficient snow removal solutions, and renting provides a cost-effective alternative to purchasing expensive equipment, particularly for infrequent use. The rise of e-commerce and online rental platforms has also simplified the rental process, making it more convenient and accessible. This digital transformation has significantly broadened the market reach. Moreover, the increasing adoption of semi-automatic and fully automatic snow blowers has enhanced user experience and productivity, leading to higher demand. These machines are easier to operate and offer greater efficiency compared to older models, further driving the rental market. Lastly, the commercial and military sectors represent expanding markets for snow blower rental services, particularly in areas with significant snowfall and limited labor resources. Large-scale operations such as airports, parking lots, and military bases are increasingly outsourcing their snow removal needs, driving up demand for reliable and high-capacity rental equipment.

Despite its promising growth prospects, the snow blower rental market faces several challenges. The most significant is the inherent dependence on weather conditions. Years with below-average snowfall can severely impact rental revenue, while unpredictable snowfall patterns make accurate demand forecasting difficult. Furthermore, the market is vulnerable to economic downturns. During periods of economic recession, consumers are more likely to postpone non-essential expenditures like snow blower rentals, resulting in decreased demand. Competition within the rental sector is also fierce, putting pressure on prices and profit margins. Rental companies need to constantly invest in new equipment, maintenance, and marketing to stay competitive. Finally, the availability of alternative snow removal methods, such as hiring manual labor or using smaller, less powerful equipment, poses a competitive challenge, particularly for smaller-scale applications. These challenges necessitate strategic planning and innovative approaches from rental providers to mitigate risks and ensure sustainable growth.

The Commercial segment is poised to dominate the snow blower rental market over the forecast period. Several factors contribute to this projection.

Geographical Dominance: North America, specifically the United States and Canada, is expected to continue its dominance in the snow blower rental market due to significant snowfall and a well-established rental infrastructure. Europe is also anticipated to experience substantial growth due to increasing snowfall in many regions and the adoption of rental services by both commercial entities and individual homeowners.

The snow blower rental industry is fueled by several catalysts. The increasing frequency and intensity of winter storms drive the need for efficient snow removal, boosting rental demand. Technological advancements, particularly in automatic snow blowers, improve efficiency and user experience, making rentals more attractive. The rise of online platforms simplifies the rental process, enhancing accessibility and convenience. Finally, the cost-effectiveness of renting versus buying, especially for infrequent use, makes it a financially sound choice for many.

This report provides a comprehensive overview of the snow blower rental market, analyzing historical trends, current market dynamics, and future projections. It offers detailed insights into market segmentation, key players, driving forces, challenges, and regional variations, providing valuable information for businesses and investors operating within the sector or planning to enter this dynamic market. The report leverages extensive data analysis and forecasting models to provide accurate and actionable insights.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Aspen Rent-All, Caterpillar, United Rentals, House of Rental, Holmes Rental Station, Handy Rents, All Choice Rentals, Reddy Rents, Eastpoint Equipment Rentals, Power Equipment Rental, Buttrey Rental, Taylor Rental, Alaska Pacific Rental, Gamma Equipment Rental, Cedar Street Sales & Rental, Grand Rental Station, Big Tool Box, Total Equipment Rentals, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Snow Blower Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Snow Blower Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.