1. What is the projected Compound Annual Growth Rate (CAGR) of the Smartphone Emulators?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smartphone Emulators

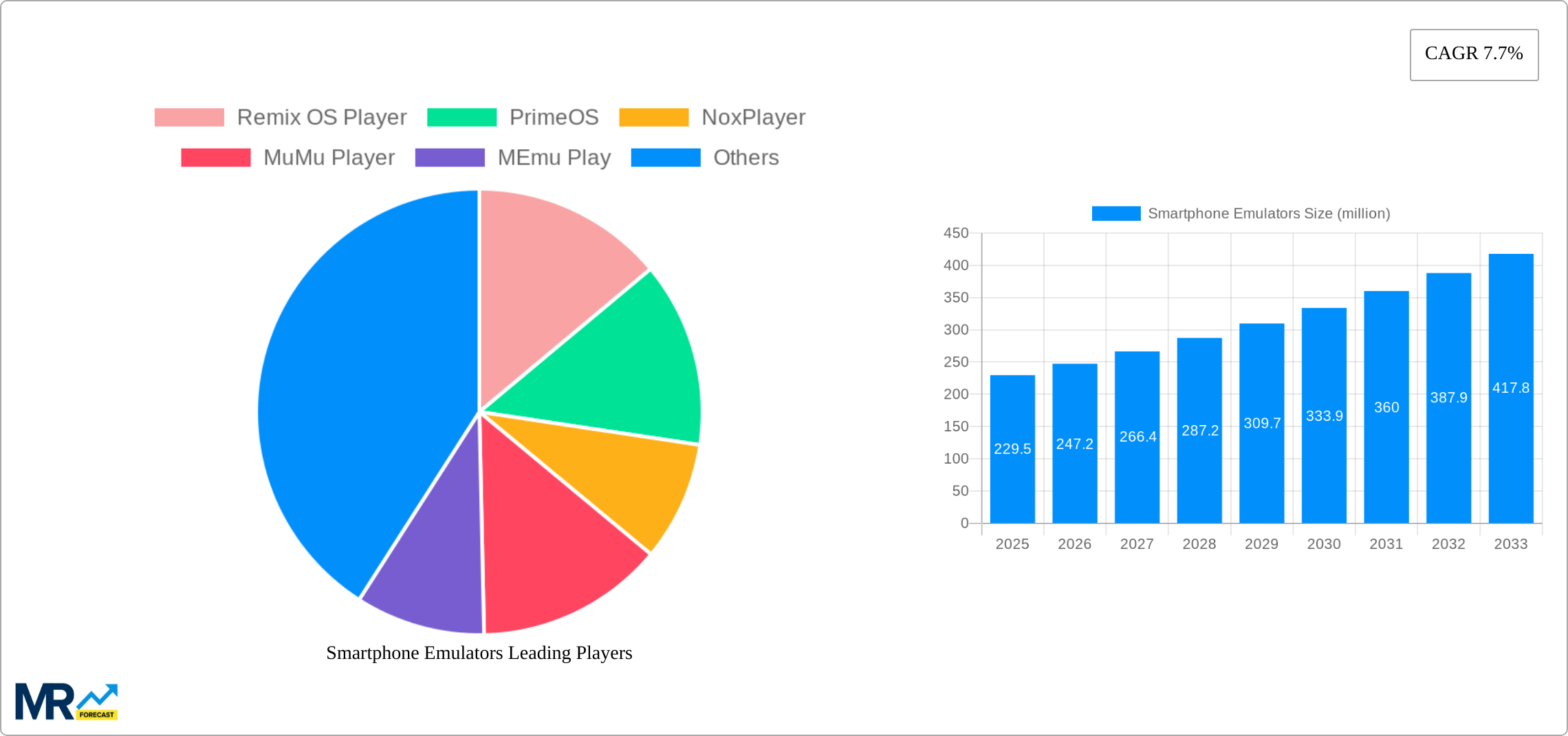

Smartphone EmulatorsSmartphone Emulators by Type (iOS Emulator, Android Emulator), by Application (Windows, Mac), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global smartphone emulator market, valued at $384.6 million in 2025, is poised for significant growth driven by the increasing demand for cross-platform mobile app development and testing. The rising popularity of mobile gaming, coupled with the need for efficient and cost-effective testing solutions, fuels this expansion. Key market drivers include the proliferation of mobile devices, the complexity of modern applications requiring robust testing environments, and the growing adoption of cloud-based testing platforms that integrate with emulators. The market is segmented by emulator type (iOS and Android) and operating system compatibility (Windows and Mac), with Android emulators currently dominating due to the larger Android device market share. Competitive forces are strong, with numerous players offering diverse features and pricing models. While established players like BlueStacks and NoxPlayer hold significant market share, newer entrants with innovative features and specialized functionalities continue to emerge, creating a dynamic and competitive landscape. Future growth will likely be influenced by technological advancements in emulator performance, particularly in areas like graphics rendering and network simulation, as well as increasing integration with DevOps and CI/CD pipelines. The geographic distribution shows strong growth potential across both developed and emerging markets, driven by factors such as rising smartphone penetration and increasing investment in mobile technology infrastructure.

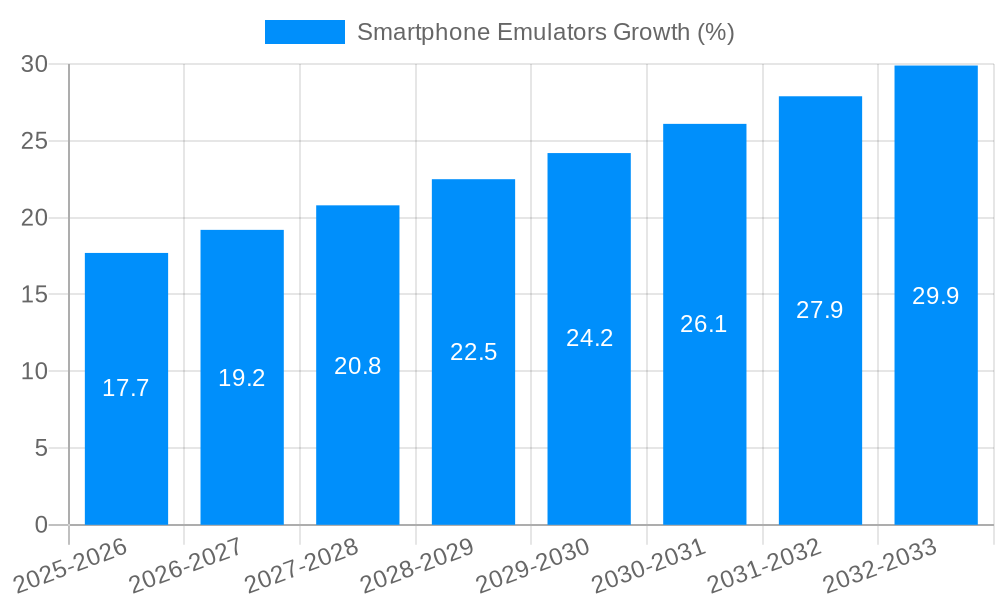

The market's Compound Annual Growth Rate (CAGR) is expected to remain robust through 2033, though a precise figure requires more information than provided. Based on similar technology markets exhibiting strong growth, a conservative estimate would place the CAGR in the range of 15-20%. This sustained growth reflects the continuous evolution of mobile technology and the ongoing need for sophisticated emulation solutions. However, potential restraints include the ongoing improvements in real device testing capabilities, which could lessen the reliance on emulators. Additionally, complexities in replicating real-world conditions perfectly, including network latency and hardware variations, pose ongoing challenges. Nevertheless, the overall trend points towards a steadily expanding market fueled by innovation and demand. Strategic partnerships and acquisitions within the market are expected to drive further consolidation and innovation. Furthermore, the market is likely to witness more specialized emulators tailored to specific industries or applications like gaming and automotive.

The global smartphone emulator market is experiencing robust growth, projected to reach multi-million unit shipments by 2033. Driven by increasing demand for cross-platform application development and testing, the market witnessed significant expansion during the historical period (2019-2024). The estimated market size in 2025 is substantial, with further significant expansion forecast for the period 2025-2033. This growth is fueled by several factors, including the rising popularity of mobile gaming, the increasing complexity of mobile applications, and the need for developers to test their applications across a wide range of devices and operating systems without physically owning them. The market is characterized by a diverse range of emulators catering to different needs and platforms. Android emulators currently dominate the market share, but iOS emulators are also experiencing steady growth, albeit from a smaller base. The accessibility of emulators across various operating systems like Windows and macOS further fuels market expansion, as developers can seamlessly integrate them into their existing workflows. The competitive landscape is vibrant, with both established players and emerging companies vying for market share through continuous innovation and feature enhancements. The market also shows potential for significant growth in developing economies where mobile usage is rapidly expanding. The study period (2019-2033) reveals a consistent upward trend, highlighting the enduring demand and strategic importance of smartphone emulators within the broader software development ecosystem. Furthermore, the evolution of emulator technology towards better performance and improved accuracy in replicating real-world scenarios is contributing to market growth. Finally, the increasing adoption of DevOps practices also fuels demand for effective and reliable testing tools like emulators, further solidifying the market's positive growth trajectory.

Several key factors are propelling the growth of the smartphone emulator market. The rising popularity of mobile gaming is a major driver, as developers need robust testing environments to ensure their games function flawlessly across diverse devices. The increasing complexity of mobile applications, incorporating features such as augmented reality (AR) and artificial intelligence (AI), necessitates sophisticated emulators capable of handling these advanced functionalities. Cross-platform compatibility is crucial in today's mobile landscape, and emulators provide developers with a cost-effective way to test applications across different Android and iOS versions, screen sizes, and hardware configurations, without the need to acquire a large inventory of physical devices. The expanding mobile application development industry itself is a significant growth catalyst. As more businesses and individuals develop mobile apps, the demand for effective testing and debugging tools, like emulators, rises proportionally. The convenience and cost-effectiveness of emulators are also key factors. Emulators eliminate the need for extensive physical device testing, saving companies considerable resources and time. Furthermore, the continuous advancements in emulator technology, such as improved performance, enhanced graphics capabilities, and integration with popular development tools, contribute to increased adoption rates. Finally, the increasing demand for continuous integration/continuous deployment (CI/CD) pipelines in the software development lifecycle necessitates reliable emulation solutions that integrate seamlessly into these workflows.

Despite its rapid growth, the smartphone emulator market faces several challenges. One significant hurdle is accurately replicating real-world scenarios. While emulators strive to mimic actual smartphone hardware and software, discrepancies can exist, leading to potential bugs or performance issues not detected during emulation but only surfacing on physical devices. This necessitates careful testing on real devices alongside emulation. Maintaining compatibility across various Android and iOS versions presents another challenge. As new versions of operating systems are released frequently, emulators must adapt quickly to ensure compatibility, which demands continuous updates and maintenance. Resource consumption is a concern; powerful emulators can demand significant system resources, particularly memory and processing power, limiting their accessibility for users with less powerful machines. Licensing costs can also be a barrier for some developers, especially smaller independent developers or startups. Finally, security is paramount, and developers must be wary of potential security risks associated with using third-party emulators. Ensuring the emulators used are from trustworthy sources and employ robust security measures is crucial to preventing data breaches or malware infections.

The Android Emulator segment is projected to dominate the market owing to the significantly larger market share of Android devices globally. The prevalence of Android in emerging economies further amplifies this dominance.

Android Emulator Market Dominance: This segment is expected to capture a substantial majority of the market share during the forecast period (2025-2033), due to the widespread use of Android devices and its open-source nature. The relative ease of developing and deploying Android applications also contributes to this dominance.

Windows Application Segment Strength: The Windows application segment will also demonstrate robust growth, driven by the vast user base of Windows operating systems worldwide and its established position as a dominant platform for software development. Many developers prefer using Windows machines for their development workflows. This provides a substantial market for Android and iOS emulators designed for the Windows platform.

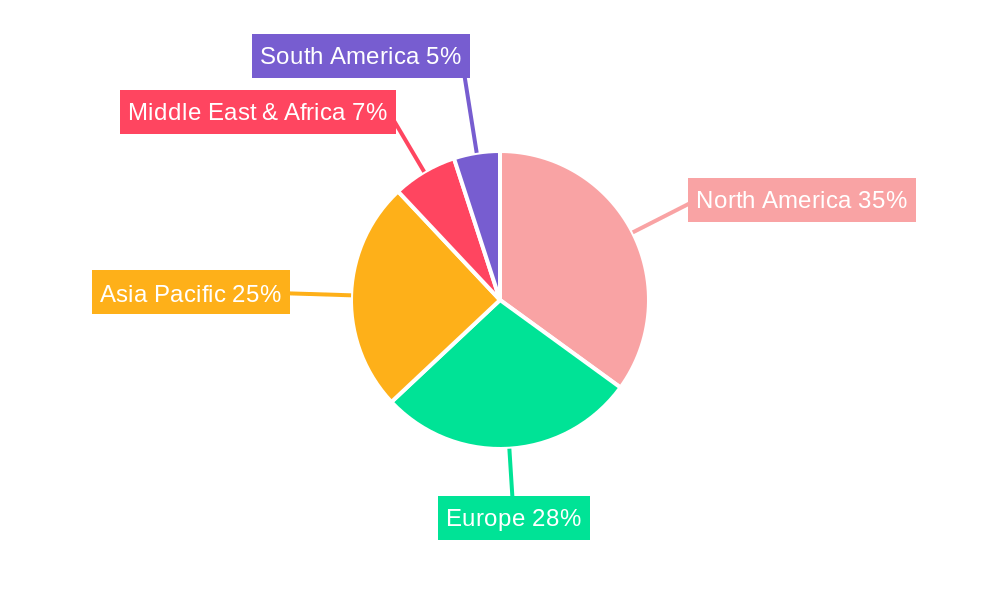

Geographical Distribution: North America and Europe are expected to be major contributors to market growth, given the high concentration of software development companies and the adoption of advanced technologies in these regions. However, rapidly developing economies in Asia-Pacific (especially India and China) are also poised for significant growth due to increasing mobile penetration and the burgeoning mobile application development sectors.

Market Segmentation Detail: The market can be further segmented by the type of emulator (e.g., full system emulation vs. virtual devices), pricing models (e.g., free vs. subscription-based), and specific features offered (e.g., GPS simulation, network conditions simulation). These sub-segments will offer further opportunities for market players to specialize and cater to diverse user needs.

The detailed breakdown of market share by region and segment will be provided in the full report, offering in-depth insights into the specific dynamics of each. The combination of Android's dominant market position and Windows' prevalence as a development platform points to these as the core segments driving market growth.

The convergence of multiple technological trends is accelerating the growth of the smartphone emulator market. The increasing adoption of DevOps practices necessitates efficient and reliable testing environments. Emulators fit perfectly into CI/CD pipelines, enabling seamless automated testing across a range of device configurations. Furthermore, the rise of 5G and other advanced network technologies drives demand for emulators capable of simulating diverse network conditions, aiding developers in optimizing application performance under various network scenarios. Finally, the evolution of emulators to incorporate more realistic simulations of hardware and software features, ensuring more accurate testing and improved overall application quality, is crucial to sustaining market growth.

(Further specific dates and details of other significant developments would be included in a full report.)

This report provides a detailed analysis of the smartphone emulator market, covering market trends, driving forces, challenges, key players, and significant developments. The information provided helps understand the current state of the market and anticipate future growth trajectories. The report’s insights will be invaluable for stakeholders involved in the development, deployment, and use of smartphone emulators, enabling informed strategic decision-making and market positioning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Remix OS Player, PrimeOS, NoxPlayer, MuMu Player, MEmu Play, LDPlayer, Ko Player, Genymotion, GameLoop, BlueStacks, Bliss OS, AndY, Android Studio Emulator, Tencent, .

The market segments include Type, Application.

The market size is estimated to be USD 384.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Smartphone Emulators," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smartphone Emulators, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.