1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Grid IT Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smart Grid IT Systems

Smart Grid IT SystemsSmart Grid IT Systems by Type (Distributed Energy Resource Management System (DERMS), Demand Response Management System (DRMS), Geographic Information System (GIS), Customer Information System (CIS)), by Application (Residential Sector, Commercial Sector, Industrial Sector), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

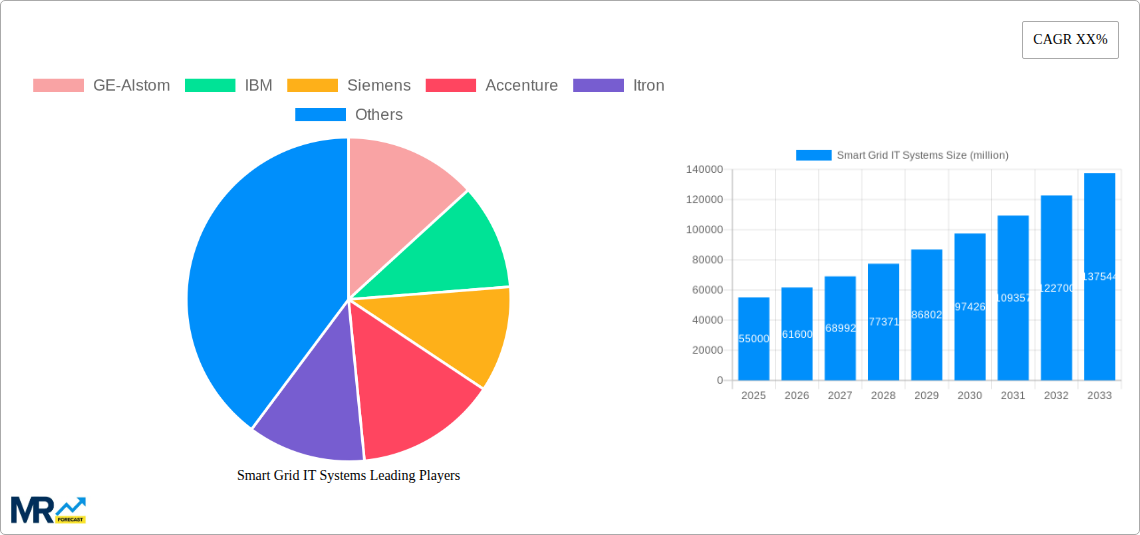

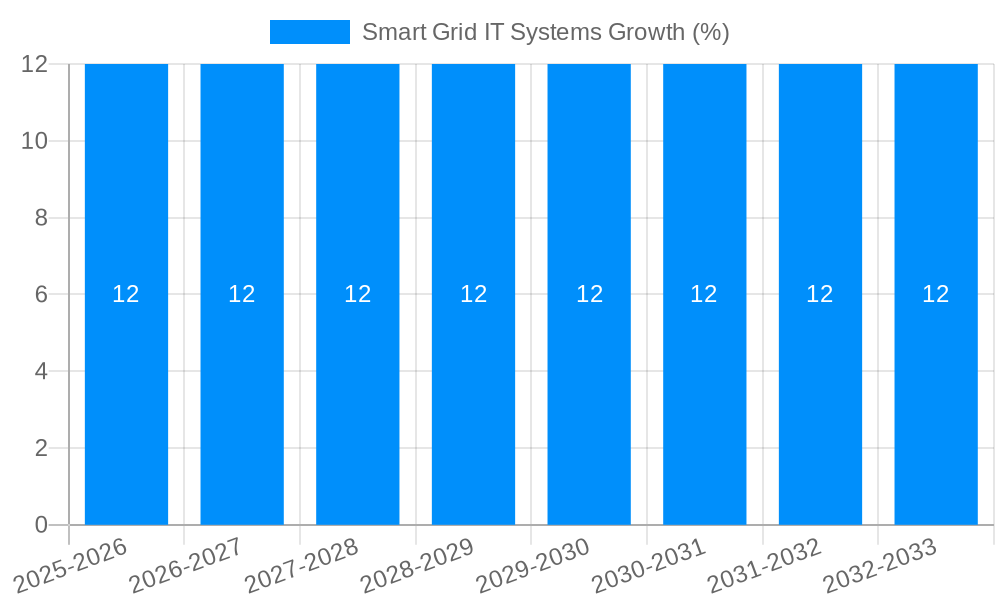

The global Smart Grid IT Systems market is poised for substantial expansion, projected to reach an estimated USD 55 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% anticipated through 2033. This growth is primarily fueled by the increasing adoption of Distributed Energy Resources (DERs) such as solar and wind power, necessitating sophisticated management systems to ensure grid stability and efficiency. The rising demand for energy security, coupled with stringent government regulations promoting smart grid infrastructure development, further underpins market expansion. Furthermore, the escalating need to integrate renewable energy sources and enhance grid resilience against cyber threats and natural disasters is driving significant investments in advanced IT solutions for smart grids. The market is experiencing a pronounced trend towards cloud-based DERMS and DRMS, offering enhanced scalability, data analytics capabilities, and cost-effectiveness for utilities and grid operators.

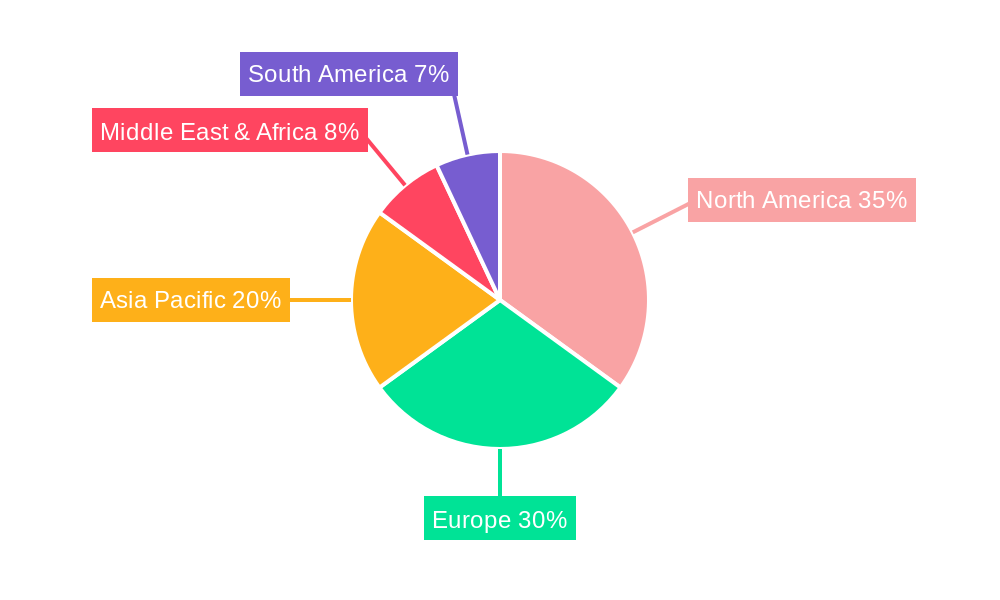

The market's trajectory is characterized by several key drivers, including the modernization of aging power infrastructure, the imperative to reduce transmission and distribution losses, and the growing consumer demand for reliable and sustainable energy. The increasing prevalence of electric vehicles and the associated charging infrastructure also contribute to the growing complexity of grid management, necessitating smart grid IT systems. While the market exhibits strong growth potential, certain restraints exist. These include the high initial investment costs associated with deploying smart grid technologies, concerns regarding data security and privacy, and the need for skilled personnel to manage and operate these sophisticated systems. The segmentation of the market highlights the prominence of DERMS and DRMS as critical components, while the Residential and Commercial sectors are emerging as significant application areas, driven by smart home technologies and energy efficiency initiatives. Geographically, North America and Europe are leading the adoption, owing to well-established utility infrastructure and proactive regulatory frameworks, with Asia Pacific demonstrating significant growth potential.

Here's a unique report description on Smart Grid IT Systems, incorporating your specified elements:

This comprehensive report offers an in-depth analysis of the global Smart Grid IT Systems market, meticulously examining its trajectory from the Historical Period (2019-2024) through the Base Year (2025) and into the expansive Forecast Period (2025-2033). The Study Period of 2019-2033 provides a robust foundation for understanding historical trends and projecting future market dynamics. We present a granular breakdown of market performance, with a projected market size of approximately $35,500 million in the Estimated Year (2025), poised for significant expansion. The report delves into the intricate interplay of technologies, key market players, and the strategic imperatives driving the adoption and evolution of smart grid IT solutions across various utility sectors.

XXX is witnessing a transformative shift within the Smart Grid IT Systems sector, driven by the imperative for greater grid efficiency, reliability, and sustainability. A pivotal trend is the escalating integration of advanced analytics and artificial intelligence (AI) into core grid operations. This move from reactive to predictive management is enabling utilities to anticipate and mitigate potential failures, optimize energy distribution, and respond dynamically to fluctuating demand. The market is seeing a substantial increase in investments within Distributed Energy Resource Management Systems (DERMS) and Demand Response Management Systems (DRMS), reflecting the growing decentralization of energy generation and the need for sophisticated control mechanisms. These systems are crucial for managing intermittent renewable sources like solar and wind, ensuring grid stability, and maximizing their integration. The adoption of cloud-based solutions and Software-as-a-Service (SaaS) models is also accelerating, offering utilities greater scalability, flexibility, and cost-effectiveness in deploying and managing their IT infrastructure. This shift away from traditional on-premise solutions is particularly evident in the Commercial Sector and Industrial Sector applications, where agility and rapid deployment are paramount. Furthermore, the increasing emphasis on cybersecurity is shaping the development of robust, resilient IT architectures, with significant market valuation attached to solutions that can protect critical infrastructure from evolving threats. The interoperability of different smart grid components and systems remains a key focus, with vendors striving to develop standardized platforms that facilitate seamless data exchange and system integration, a crucial element for the overall success of smart grid initiatives. The market is also experiencing a surge in demand for Geographic Information Systems (GIS) that are more deeply integrated with operational technologies, allowing for better asset management, outage prediction, and situational awareness. Customer-centric solutions, including enhanced Customer Information Systems (CIS), are gaining traction as utilities aim to empower consumers with greater control over their energy consumption and facilitate participation in demand-side management programs. The ongoing digital transformation within the energy sector underscores the critical role of these IT systems in achieving the ambitious goals of modernizing the grid for a sustainable and resilient future.

The global Smart Grid IT Systems market is experiencing robust growth, propelled by a confluence of powerful drivers aimed at modernizing aging energy infrastructure and embracing a more sustainable future. A primary catalyst is the escalating demand for enhanced grid reliability and resilience in the face of an increasingly complex energy landscape, characterized by extreme weather events and the growing integration of variable renewable energy sources. Utilities are investing heavily in IT solutions that enable real-time monitoring, predictive maintenance, and rapid fault detection to minimize outages and ensure uninterrupted power supply. The accelerating transition towards renewable energy generation, including distributed solar and wind power, necessitates sophisticated management systems like DERMS to balance supply and demand and maintain grid stability. This shift is also driving the adoption of DRMS, empowering utilities to actively manage consumption patterns and reduce peak load stress. Government regulations and incentives worldwide are playing a crucial role, mandating grid modernization efforts and offering financial support for the deployment of smart grid technologies. Furthermore, the growing awareness and demand from consumers for more control over their energy usage, coupled with the desire for cost savings and participation in demand-response programs, is spurring the development and adoption of customer-facing smart grid IT solutions. The increasing focus on operational efficiency and cost reduction within utility operations is also a significant driver, as advanced IT systems offer opportunities for automation, streamlined processes, and optimized resource allocation, ultimately leading to significant savings in the long run. The ongoing digital transformation across industries is also influencing the energy sector, with utilities seeking to leverage the benefits of big data analytics, AI, and cloud computing to enhance decision-making and operational performance.

Despite the compelling advantages and robust growth trajectory of Smart Grid IT Systems, several significant challenges and restraints temper the market's expansion. A paramount concern is the substantial upfront investment required for the deployment and integration of sophisticated IT infrastructure, which can be a considerable barrier, especially for smaller utilities or those in developing economies. The sheer complexity of modernizing legacy grid systems and integrating new IT solutions with existing operational technology (OT) presents significant technical hurdles, demanding specialized expertise and careful planning. Cybersecurity threats remain a pervasive challenge, as smart grids, with their interconnected nature, become attractive targets for malicious actors seeking to disrupt critical infrastructure. Ensuring the robust security of vast amounts of sensitive data and operational systems is a continuous and evolving battle. Interoperability issues between different vendor solutions and legacy systems can also hinder seamless integration and data exchange, leading to fragmented systems and operational inefficiencies. The lack of standardized protocols across the industry complicates system integration and can lead to vendor lock-in, increasing long-term costs. Furthermore, workforce skills gaps present another restraint, as utilities often struggle to find or train personnel with the necessary expertise in advanced IT, data analytics, and cybersecurity required to manage and operate these complex systems effectively. Regulatory landscapes, while often supportive, can also be fragmented and slow to adapt to the rapid pace of technological innovation, creating uncertainty and delays in deployment. Finally, public perception and adoption challenges, including concerns about data privacy and the perceived complexity of smart meters and demand response programs, can slow down the widespread acceptance and utilization of smart grid technologies by end-users, particularly in the Residential Sector.

The global Smart Grid IT Systems market is experiencing a dynamic regional and segmental evolution, with North America emerging as a frontrunner and the Distributed Energy Resource Management System (DERMS) segment poised for substantial dominance throughout the Forecast Period (2025-2033).

Dominating Segment: Distributed Energy Resource Management System (DERMS)

The Distributed Energy Resource Management System (DERMS) segment is set to experience the most substantial growth and market share within the Smart Grid IT Systems landscape. The increasing decentralization of energy generation, with the proliferation of rooftop solar, battery storage, electric vehicles (EVs), and other distributed energy resources (DERs), necessitates sophisticated management capabilities. DERMS are crucial for:

The growing complexity of the energy grid, driven by the energy transition, directly translates to an escalating need for advanced DERMS. Utilities are recognizing that effective management of these distributed assets is no longer optional but a critical requirement for maintaining a modern, resilient, and sustainable power system. The market for DERMS is projected to be valued at approximately $8,200 million in the Estimated Year (2025) and is expected to witness a Compound Annual Growth Rate (CAGR) exceeding 15% during the Forecast Period (2025-2033).

The Smart Grid IT Systems industry is experiencing accelerated growth driven by several key catalysts. The global push for decarbonization and the increasing adoption of renewable energy sources necessitate sophisticated IT systems for seamless integration and grid stability. Government mandates and supportive policies promoting grid modernization and energy efficiency are significantly boosting market expansion. Furthermore, the rising demand for enhanced grid reliability and resilience in the face of climate change and aging infrastructure is compelling utilities to invest in advanced IT solutions. The increasing digitization of the energy sector, coupled with advancements in AI and big data analytics, is unlocking new opportunities for operational optimization and predictive maintenance, fueling further growth.

This report provides an all-encompassing view of the Smart Grid IT Systems market, meticulously dissecting its every facet. Beyond market size and forecasts, it delves into the underlying technological trends, analyzing the impact of AI, cloud computing, and IoT on grid operations. It examines the strategic responses of leading companies and highlights emerging players. The report also assesses the critical role of segments like DERMS and DRMS in driving the energy transition, alongside the challenges and opportunities presented by different application sectors. With a detailed breakdown of regional dynamics and key growth catalysts, this report equips stakeholders with the insights needed to navigate the complex and rapidly evolving smart grid IT landscape, ultimately contributing to a more sustainable and reliable energy future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GE-Alstom, IBM, Siemens, Accenture, Itron, Capgemini, Schneider, Dell EMC, Oracle Corp, SAP SE, SAS Institute, Teradata, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Smart Grid IT Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smart Grid IT Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.