1. What is the projected Compound Annual Growth Rate (CAGR) of the Skid Steer Loader Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Skid Steer Loader Rental

Skid Steer Loader RentalSkid Steer Loader Rental by Type (/> Skid Steer Wheeled, Skid Steer Tracked), by Application (/> Construction, Agriculture & Forestry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

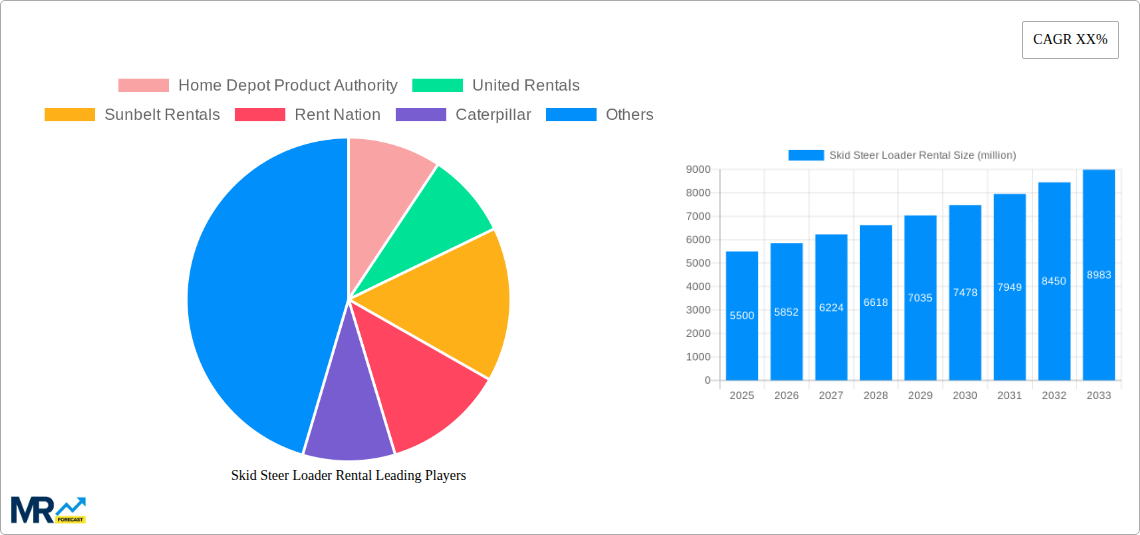

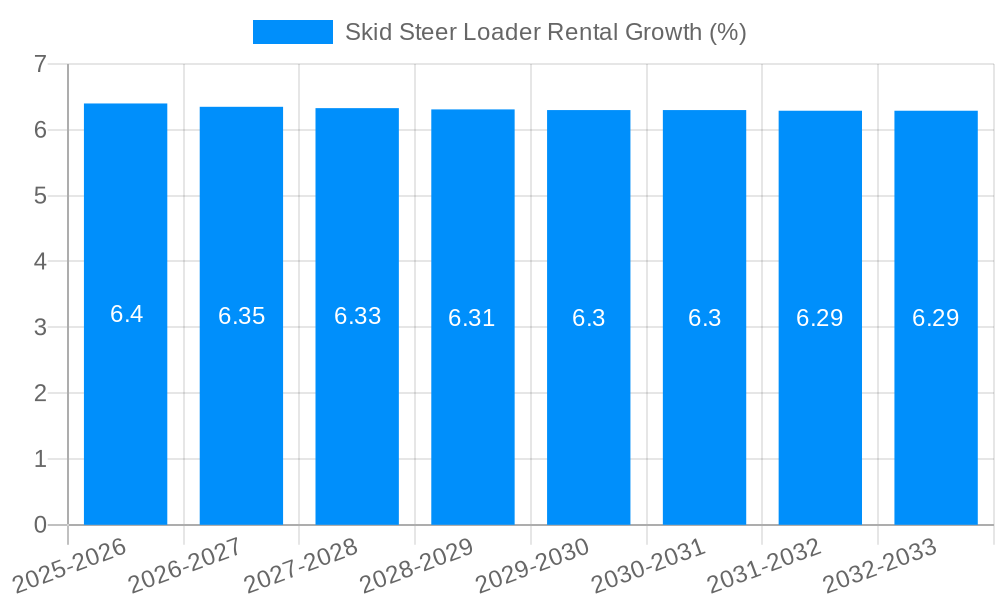

The global Skid Steer Loader Rental market is poised for robust expansion, driven by escalating demand across the construction, agriculture, and forestry sectors. With an estimated market size of approximately $5,500 million in 2025, this segment is projected to experience a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. Key growth enablers include the burgeoning infrastructure development projects worldwide, increasing agricultural mechanization, and the expanding need for versatile, compact equipment in diverse applications. The inherent flexibility and efficiency offered by skid steer loaders in tight spaces and varied terrains make them indispensable tools for a wide array of rental needs, from earthmoving and material handling to land clearing and landscaping. Furthermore, the rental model provides businesses with cost-effectiveness and access to the latest technology without significant capital outlay, further fueling market penetration.

The market's trajectory will be shaped by several emerging trends and a few restraining factors. Advanced telematics and GPS tracking are becoming standard features, enhancing operational efficiency and asset management for rental companies. The growing preference for eco-friendly and fuel-efficient models, including electric skid steer loaders, is also gaining traction, aligning with global sustainability initiatives. However, the market faces certain restraints, such as the high initial cost of ownership for rental fleet operators and potential economic downturns that could impact construction and agricultural spending. Nonetheless, the persistent need for adaptable and cost-effective machinery in critical industries, coupled with continuous innovation in equipment design and rental service models, ensures a positive outlook for the Skid Steer Loader Rental market. The significant presence of major players like Caterpillar, Bobcat, and prominent rental companies such as United Rentals and Sunbelt Rentals underscores the competitive landscape and the established demand for these versatile machines.

This report offers an in-depth analysis of the global Skid Steer Loader Rental market, meticulously examining its trajectory from the historical period of 2019-2024, with a base year of 2025 and a forecast extending to 2033. The study leverages extensive data and expert insights to provide a comprehensive understanding of market dynamics, driving forces, challenges, and future growth opportunities, with an estimated market value reaching into the millions of units.

The Skid Steer Loader Rental market is experiencing a dynamic evolution, driven by a confluence of factors that are reshaping its landscape. XXX, a pivotal trend observed throughout the study period, highlights the increasing demand for versatile and compact equipment across a spectrum of industries. The rental model's inherent flexibility, allowing users to access specialized machinery on an as-needed basis, has become particularly attractive to small to medium-sized enterprises and project-based operations. This has fueled a steady upward trend in rental durations and a growing preference for newer, technologically advanced models. The market has witnessed a significant shift towards tracked skid steers in recent years, particularly in applications requiring enhanced traction and stability on challenging terrain, such as rough construction sites and agricultural lands. Conversely, wheeled skid steers continue to dominate in applications demanding greater maneuverability and speed on paved surfaces.

Furthermore, the increasing emphasis on operational efficiency and cost reduction by businesses is a significant market influencer. Renting skid steer loaders eliminates the substantial upfront capital expenditure associated with purchasing, maintenance, and storage, making it a more financially prudent option for many. This has led to a broader adoption of rental services beyond traditional construction and agriculture, expanding into landscaping, event management, and even some industrial applications. The integration of telematics and GPS tracking in rental fleets is another noteworthy trend, providing rental companies with enhanced fleet management capabilities, improved asset utilization, and increased security. For end-users, this translates to greater transparency in machine usage and availability. The market is also seeing a rise in specialized attachments and accessories being offered as part of rental packages, further enhancing the utility and adaptability of skid steer loaders for a wider array of tasks. The competitive landscape is characterized by a mix of large national rental companies and smaller, regional players, each vying for market share through diverse fleet offerings, competitive pricing, and differentiated service models. This competitive pressure is a constant driver for innovation and service improvement across the industry.

Several potent forces are collectively propelling the growth of the Skid Steer Loader Rental market. The most significant driver is the robust and sustained activity within the construction industry. As urbanization continues and infrastructure development projects, both public and private, gain momentum globally, the demand for compact and efficient earthmoving equipment like skid steer loaders escalates. Rental services are the preferred choice for many construction companies, especially those involved in residential building, smaller commercial projects, and renovation work, due to the project-specific nature of their equipment needs.

Beyond construction, the agriculture and forestry sectors are also contributing significantly to market expansion. The need for versatile machinery for tasks such as land clearing, material handling, planting, and harvesting in these industries is substantial. Skid steer loaders, with their array of attachments, offer a cost-effective and adaptable solution for farmers and foresters, especially during peak seasons or for specific project-based requirements. Moreover, the increasing adoption of rental models across various industries, including landscaping, event management, and even some manufacturing and warehousing operations, is a crucial growth catalyst. Businesses are increasingly recognizing the financial and operational benefits of renting rather than owning, such as avoiding depreciation costs, ensuring access to well-maintained equipment, and having the flexibility to scale operations up or down as needed. The continuous innovation in skid steer loader technology, leading to more powerful, fuel-efficient, and user-friendly machines, also drives demand for rentals as businesses seek to leverage these advancements without the burden of ownership.

Despite the positive growth trajectory, the Skid Steer Loader Rental market is not without its challenges and restraints. One of the primary concerns is the volatility of the construction and agriculture industries. Downturns in these sectors, often influenced by economic conditions, interest rate fluctuations, or regulatory changes, can directly impact the demand for skid steer loader rentals. Projects may be delayed or cancelled, leading to reduced equipment utilization for rental companies. Another significant restraint is the intense competition within the rental market. The presence of numerous players, from large national corporations to smaller independent providers, creates price pressures and necessitates continuous investment in fleet modernization and customer service to maintain a competitive edge. This can impact profit margins for rental businesses.

Furthermore, high initial investment costs for acquiring new equipment can be a barrier for rental companies looking to expand or update their fleets, especially in periods of economic uncertainty. The rapid pace of technological advancement also poses a challenge, as rental companies must constantly evaluate and invest in newer models to meet customer expectations, which can lead to obsolescence of older assets. Logistical complexities and maintenance costs associated with managing a diverse fleet of skid steer loaders, including transportation, repairs, and spare parts inventory, also represent ongoing operational challenges. Finally, seasonal demand fluctuations can lead to periods of underutilization and revenue loss, requiring careful fleet management and strategic planning to mitigate these effects.

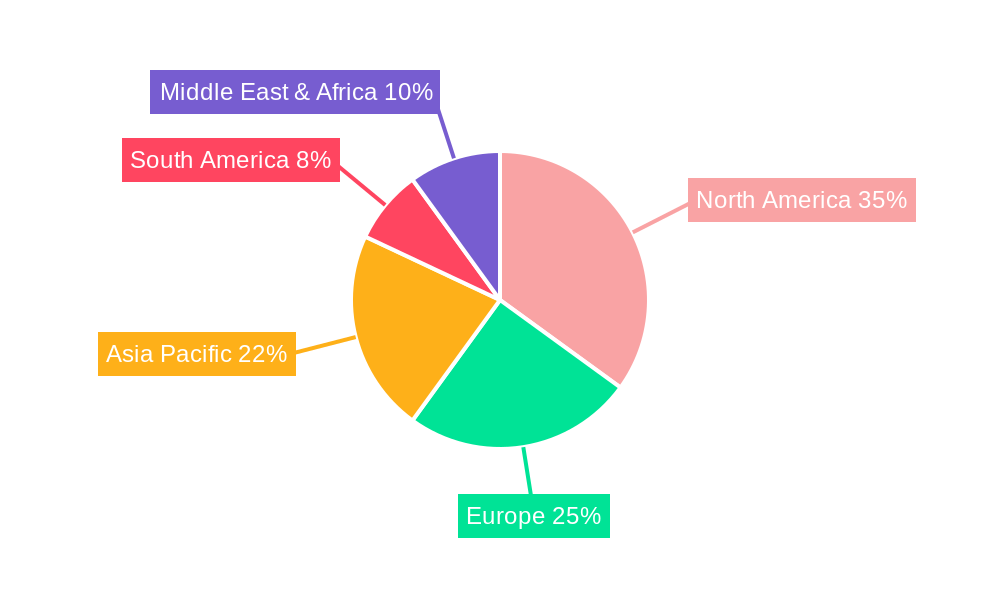

Several regions and specific segments are poised to dominate the Skid Steer Loader Rental market, driven by a combination of economic development, industry-specific demands, and infrastructure investment.

North America (United States and Canada): This region is expected to remain a dominant force in the Skid Steer Loader Rental market.

Europe (Germany, United Kingdom, France): Europe presents a substantial and growing market for skid steer loader rentals.

Asia Pacific (China, India, Australia): This region is projected to experience the fastest growth in the Skid Steer Loader Rental market.

Dominant Segment Across All Regions: Skid Steer Wheeled

The Skid Steer Loader Rental industry is experiencing several strong growth catalysts. The increasing trend of outsourcing non-core activities by businesses, including equipment procurement, is a major driver. Furthermore, urbanization and infrastructure development globally necessitate the use of compact and efficient machinery, which skid steer loaders fulfill. The rising popularity of flexible rental models over outright ownership, driven by cost-effectiveness and operational agility, is significantly boosting demand. The technological advancements in skid steer loaders, leading to enhanced performance and fuel efficiency, also encourage their adoption through rentals. Finally, government initiatives promoting infrastructure development across various countries provide a continuous stream of projects requiring such equipment.

This report provides a truly comprehensive overview of the Skid Steer Loader Rental market. It delves deep into market segmentation, analyzing the nuances of different skid steer types (wheeled vs. tracked) and their application across key industries like construction, agriculture, and forestry. The report meticulously charts the historical trends from 2019-2024 and forecasts future growth up to 2033, with a firm base year of 2025. It dissects the driving forces behind market expansion, identifies critical challenges and restraints, and highlights the regions and segments poised for dominance. Furthermore, it offers insights into growth catalysts and provides a detailed list of leading players, alongside significant industry developments, ensuring readers have a holistic and actionable understanding of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Home Depot Product Authority, United Rentals, Sunbelt Rentals, Rent Nation, Caterpillar, Rent1, BobcatCCE, Bridgeport Equipment, MacAllister Rentals, Arts Rental, Diamond Rental, Ohio Cat Rental Store, Bobcat of the Rockies, Reddy Rents, Stan Houston Equipment, KC Bobcat, Michigan CAT, Star Equipment, Kennards Hire, Next Level Rental, Durante Rentals.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Skid Steer Loader Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Skid Steer Loader Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.