1. What is the projected Compound Annual Growth Rate (CAGR) of the Short Video Platform Account Transaction?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Short Video Platform Account Transaction

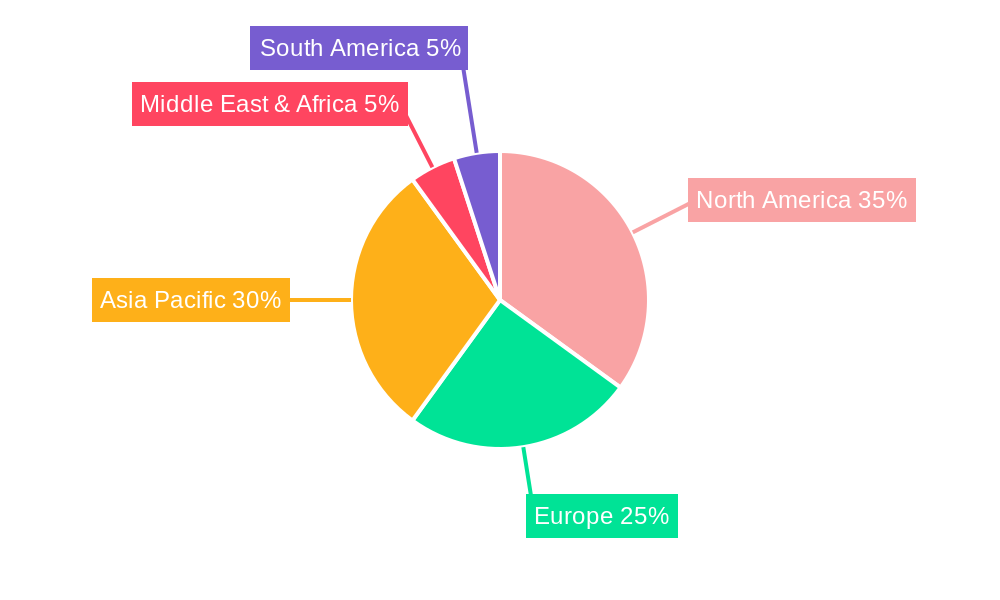

Short Video Platform Account TransactionShort Video Platform Account Transaction by Application (Publicity, Sales, Education, Entertainment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

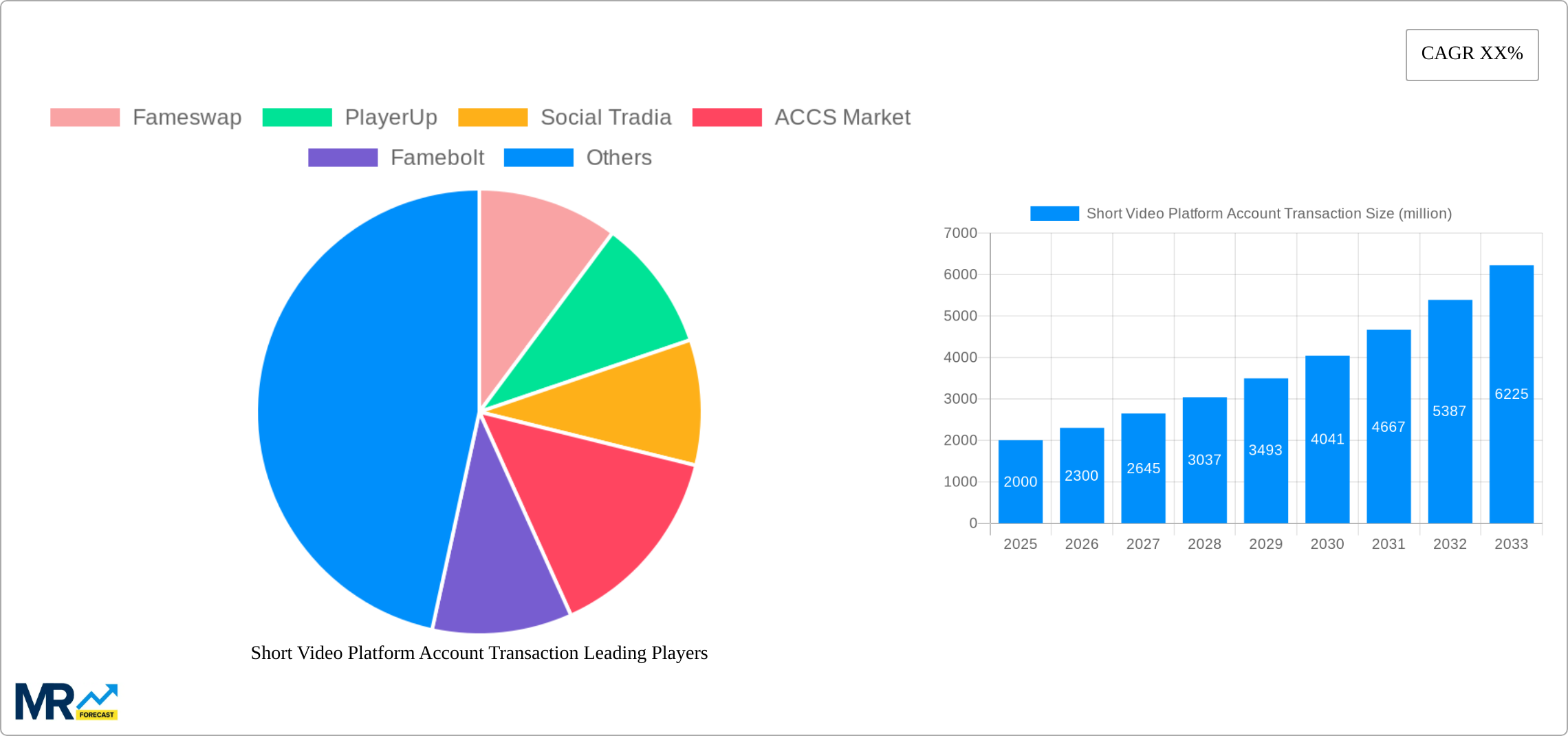

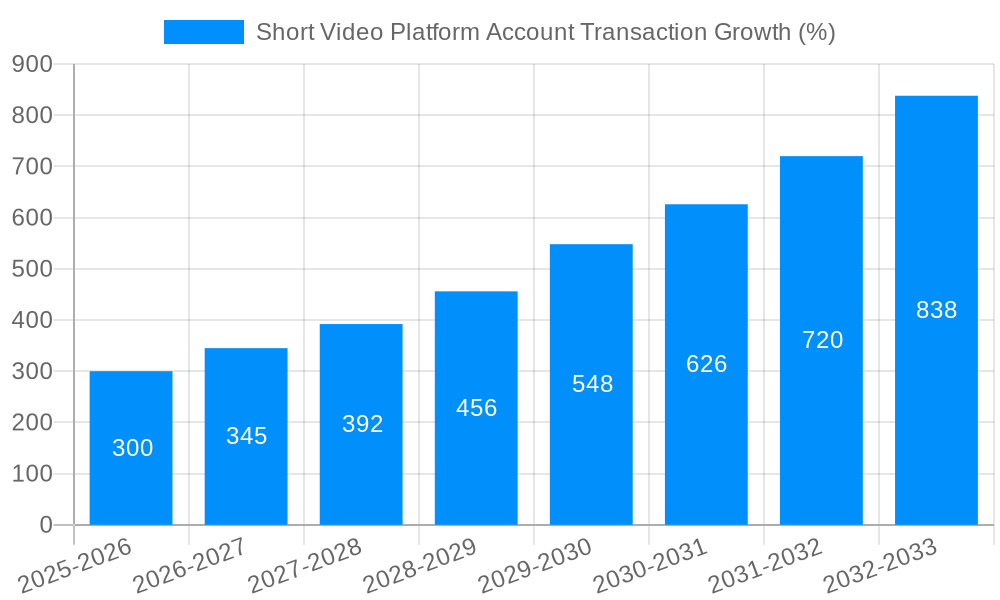

The global short video platform account transaction market is experiencing robust growth, driven by the increasing popularity of short-form video content and the expanding user base of platforms like TikTok, Instagram Reels, and YouTube Shorts. The market's value in 2025 is estimated at $5 billion, projected to reach $10 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 15%. This growth is fueled by several key drivers, including the rise of influencer marketing, the increasing monetization opportunities for content creators, and the growing demand for virtual gifting and in-app purchases within these platforms. Furthermore, the integration of e-commerce functionalities within short-video platforms is significantly boosting transactions, allowing users to directly purchase products featured in videos. The market is segmented by application, with significant contributions from publicity, sales, education, and entertainment sectors. Key players such as Fameswap, PlayerUp, and Social Tradia are actively competing to capture market share, innovating with new transaction methods and technologies. Geographic distribution reveals strong growth across North America and Asia-Pacific, driven by high internet penetration and smartphone adoption. However, regulatory hurdles and concerns regarding fraud and account security present challenges that need to be addressed to ensure sustainable growth.

The competitive landscape is characterized by a mix of established players and emerging startups. While larger companies benefit from brand recognition and extensive user bases, smaller players are leveraging innovative features and niche markets to carve out their own share. The future of the market hinges on several factors, including the evolution of short-form video trends, advancements in transaction security, and the continuous adaptation of platforms to meet evolving user demands. The ongoing development of virtual economies within short video platforms further enhances growth potential, creating new opportunities for revenue generation and user engagement. Regional differences in internet infrastructure and regulatory frameworks will also influence market growth trajectories, with regions demonstrating robust digital adoption likely leading the charge.

The short video platform account transaction market experienced explosive growth between 2019 and 2024, fueled by the rising popularity of short-form video content and the increasing monetization opportunities within these platforms. The market, valued at $XX million in 2024, is projected to reach $XXX million by 2033, showcasing a Compound Annual Growth Rate (CAGR) of XX%. This substantial expansion is driven by several factors, including the escalating demand for verified accounts, influencer marketing's continued prominence, and the burgeoning need for targeted advertising on these platforms. The historical period (2019-2024) witnessed a steady climb, with significant acceleration in the latter years due to the pandemic-induced surge in online engagement. The base year, 2025, serves as a crucial point for understanding the market's trajectory into the forecast period (2025-2033). Key market insights reveal a shift towards more sophisticated transaction methods, a greater emphasis on account verification and security, and the emergence of specialized platforms facilitating these transactions. This report analyzes the market’s evolution, highlighting the roles played by various platforms and their impact across different application segments. The estimated year, 2025, presents a snapshot of the market at a point of significant growth, setting the stage for the projections extending to 2033. The increasing sophistication of account management tools and the growing concerns over account security are key trends impacting the market's future development.

Several key factors are driving the exponential growth of the short video platform account transaction market. The ever-increasing popularity of short-form video content across platforms like TikTok, Instagram Reels, and YouTube Shorts is a major catalyst. Businesses are increasingly recognizing the potential of these platforms for targeted advertising and brand building, leading to a surge in demand for accounts with substantial follower counts. The rise of influencer marketing further fuels this trend, with brands seeking to collaborate with established influencers to reach wider audiences. The accessibility and ease of use of short video platforms have broadened the appeal, attracting both individual creators and businesses of all sizes. Moreover, the technological advancements making it easier to manage multiple accounts and enhance their visibility are contributing significantly. The consistent evolution of platform algorithms and the introduction of new features designed to improve user engagement have also played a vital role in this growth trajectory. Finally, the integration of e-commerce functionalities within short video platforms offers new avenues for monetization, driving further demand for accounts that can leverage these opportunities effectively.

Despite the significant growth potential, the short video platform account transaction market faces several challenges. Account security and fraud are major concerns, with the risk of fraudulent transactions and account hijacking posing substantial threats. The lack of consistent regulation and standardization across different platforms creates complexities for buyers and sellers alike. Price volatility, driven by fluctuations in supply and demand, presents challenges in establishing stable market pricing. The potential for copyright infringement and intellectual property issues also needs careful consideration. Moreover, the constant evolution of platform algorithms and policies can create uncertainties for those involved in account transactions. Furthermore, managing the reputational risks associated with purchasing accounts with dubious histories remains a critical concern for buyers. These challenges highlight the need for greater transparency, robust security measures, and effective regulatory frameworks to ensure the long-term sustainability and ethical development of this rapidly expanding market.

The Entertainment segment is poised to dominate the short video platform account transaction market. This segment’s dominance is driven by several factors:

Geographic Dominance: While several regions show significant growth, markets with high internet penetration and significant social media usage will likely see greater dominance. Regions like North America and Asia (particularly China and India) are predicted to lead the market due to their large user base, high smartphone adoption rates, and the proliferation of short-video platforms. These markets also benefit from increased disposable incomes, which boosts spending on digital advertising and influencer marketing.

The short video platform account transaction market is experiencing robust growth fueled by several interconnected factors. The burgeoning influencer marketing industry, the increasing demand for targeted advertising on these platforms, and technological advancements that streamline account management are all significant catalysts. The rising sophistication of account verification and security measures adds to the market's appeal, attracting both buyers and sellers who prioritize safety and legitimacy. Furthermore, the integration of e-commerce features within these platforms creates new monetization avenues, further driving demand for accounts with substantial reach and engagement.

This report provides an in-depth analysis of the short video platform account transaction market, offering valuable insights into its growth drivers, challenges, and future prospects. By examining market trends, key players, and regulatory landscapes, this comprehensive resource enables informed decision-making for businesses, investors, and stakeholders within this dynamic industry. The data presented provides a solid foundation for understanding the current state and future trajectory of the short video platform account transaction market, highlighting both opportunities and potential pitfalls.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fameswap, PlayerUp, Social Tradia, ACCS Market, Famebolt, Yuntuomg, Fakajie, Aoyu Website, Feiquewang, Lemaihao, Tianjin Sutong Qiancheng, .

The market segments include Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Short Video Platform Account Transaction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Short Video Platform Account Transaction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.