1. What is the projected Compound Annual Growth Rate (CAGR) of the Senior Living Communities?

The projected CAGR is approximately 5.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Senior Living Communities

Senior Living CommunitiesSenior Living Communities by Application (/> Below 65 Years Old, 65 to 75 Years Old, 76 to 85 Years Old, Above 85 Years Old), by Type (/> Assisted Living Services, Independent Living Services, Memory Care Services), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

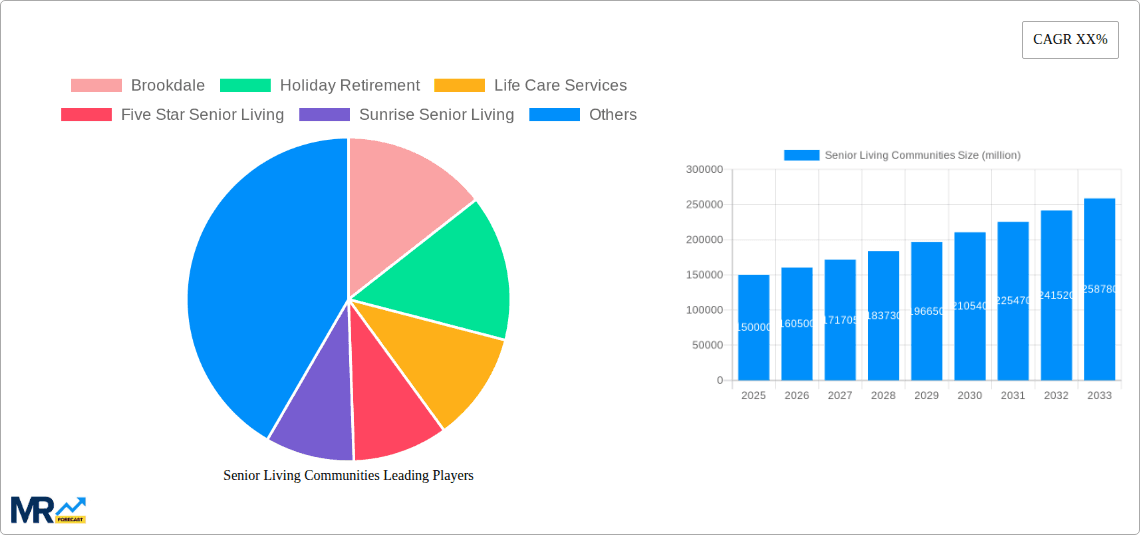

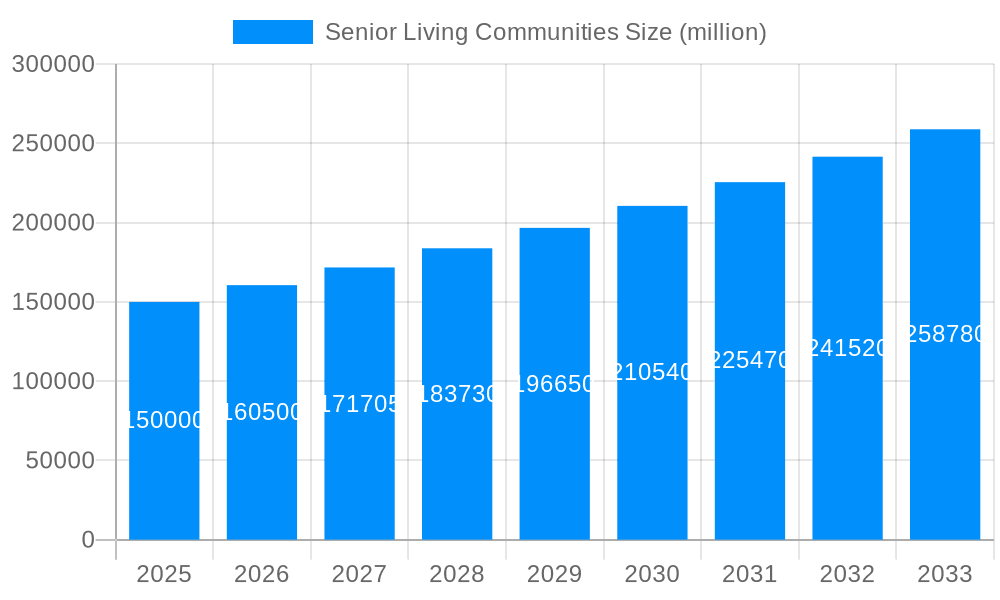

The senior living community market is experiencing robust growth, driven by an aging global population and increasing demand for specialized care services. The market, estimated at $150 billion in 2025, is projected to expand significantly over the next decade, fueled by a compound annual growth rate (CAGR) of 7%. This growth is being propelled by several key factors, including rising disposable incomes among the elderly, increased awareness of assisted living options, and technological advancements enhancing the quality of care. Furthermore, the increasing prevalence of chronic diseases and conditions requiring ongoing medical attention among the elderly significantly contributes to market expansion. The industry is also seeing a rise in specialized senior living facilities catering to specific needs, such as memory care units for Alzheimer's and dementia patients, and facilities offering rehabilitation services. Competition is fierce, with established players like Brookdale, Holiday Retirement, and Sunrise Senior Living vying for market share alongside newer entrants.

Despite the positive growth trajectory, the senior living market faces several challenges. Rising operating costs, including staffing shortages and increasing regulatory compliance requirements, present significant hurdles. The industry also needs to address concerns regarding affordability and accessibility, ensuring that quality senior living options are available to a wider demographic. The sector is also under pressure to continuously innovate and improve its offerings, providing residents with advanced technology, personalized care, and engaging social environments. Future growth will be determined by the industry's ability to adapt to evolving demographic trends, address affordability concerns, and consistently improve the quality of care provided, establishing trust and confidence among potential residents and their families.

The senior living community market, valued at several hundred million units in 2024, is experiencing a period of significant transformation. Driven by an aging global population and evolving preferences among seniors, the industry is witnessing a surge in demand for diverse and specialized care options. The historical period (2019-2024) saw steady growth, albeit with variations influenced by macroeconomic factors like the COVID-19 pandemic. The estimated market size in 2025 signifies a substantial increase, projecting continued expansion throughout the forecast period (2025-2033). Key trends include a rising preference for independent living options offering social engagement and supportive services, a growing demand for memory care facilities to cater to the increasing number of individuals with Alzheimer's and dementia, and a notable increase in the adoption of technology to enhance resident care and safety. Furthermore, the industry is witnessing a shift towards personalized care models, focusing on individualized needs and preferences rather than a one-size-fits-all approach. This trend is fueled by the increasing awareness of the importance of holistic well-being and quality of life among older adults. The consolidation of smaller providers into larger organizations is also a notable trend, driven by the economies of scale and the need for improved operational efficiency. This consolidation is leading to a more standardized and efficient delivery of services across different senior living communities. Finally, sustainable and environmentally conscious practices are gaining traction, with many operators focusing on eco-friendly building designs and operational improvements to minimize their environmental footprint. These trends, coupled with increasing investments in infrastructure and innovative care models, indicate a dynamic and promising future for the senior living community sector.

Several factors are driving the substantial growth projected for the senior living communities market. Firstly, the global population is aging rapidly, leading to a significant increase in the number of older adults requiring specialized care and housing. This demographic shift, particularly pronounced in developed nations, forms the bedrock of market expansion. Secondly, an increasing awareness of the benefits of specialized senior care is encouraging more families to explore these options. Modern senior living communities offer a superior quality of life compared to traditional at-home care, including social opportunities, health monitoring, and readily available assistance. Thirdly, technological advancements are playing a crucial role. From telehealth services and remote monitoring to smart home technology for enhanced safety and independence, these technologies are enhancing the overall quality of care and attracting residents and investors alike. Lastly, improved infrastructure and investment in the sector have led to the construction of modern, high-quality facilities offering a wider variety of services and amenities to meet evolving needs. This investment reflects a growing recognition of the sector's potential for profit and positive social impact. The combination of these factors points to sustained and significant growth in the coming years.

Despite the promising outlook, the senior living communities industry faces several challenges. One major obstacle is the rising cost of healthcare and elder care. This affordability issue often limits access for a considerable portion of the population, particularly those without extensive financial resources. Furthermore, the sector faces staffing shortages. Attracting and retaining qualified healthcare professionals, especially nurses and caregivers, is a persistent problem, often impacting the quality of care and leading to increased operating costs. Regulatory hurdles and compliance requirements also pose a considerable challenge, demanding substantial investments in time and resources to maintain adherence. The industry is also increasingly subject to scrutiny regarding transparency and accountability in financial practices and care quality. Finally, the inherent risk of outbreaks of infectious diseases, as highlighted by the COVID-19 pandemic, highlights the vulnerability of large-scale senior living facilities and the need for robust infection control protocols. Overcoming these challenges is critical to ensuring the sustainable and ethical growth of this vital sector.

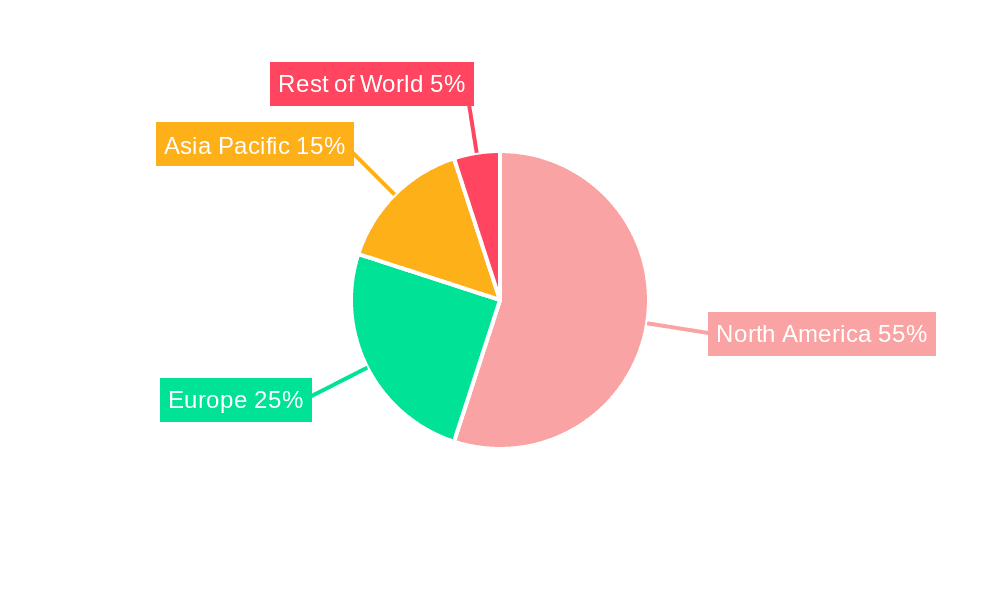

The senior living communities market shows significant growth potential across various regions and segments. However, some areas demonstrate a more pronounced upward trajectory.

North America (United States and Canada): These countries possess a high proportion of the aging population, robust healthcare infrastructure, and a relatively strong economy, creating high demand. The market is highly developed, with established players and a wide range of services. However, the increasing costs of care and potential staffing shortages are challenges.

Europe (Western and Northern Europe): Similar to North America, these regions have aging populations and established healthcare systems, though often with different regulatory frameworks and cultural nuances. Demand is high, particularly for specialized care options like memory care and assisted living.

Asia-Pacific (Japan, China, South Korea): This region is experiencing rapid demographic changes with a rapidly growing elderly population. While the market is still developing, the increasing affluence and changing cultural attitudes towards senior care present significant opportunities for growth.

Segments: The Memory Care segment shows particularly strong growth potential due to the rising prevalence of Alzheimer's and dementia. The Assisted Living segment also holds considerable weight, offering a balance between independence and supportive care. Furthermore, the demand for Independent Living communities is expanding, reflecting the desire among seniors for social engagement and convenient amenities. The provision of Specialized Care for specific conditions, such as Parkinson's disease or stroke rehabilitation, is also gaining traction. Many operators are incorporating Technology-enabled Care services to enhance resident monitoring and care delivery, leading to a premium segment.

The dominance of specific regions and segments will depend on the interplay of demographic trends, economic factors, healthcare infrastructure, and evolving cultural attitudes toward senior care. The US, due to its substantial elderly population and developed healthcare systems, currently holds a significant share of the market, however Asia-Pacific will likely show substantial growth within the forecast period.

Several factors are accelerating growth within the senior living community sector. Technological advancements, like telehealth and remote monitoring systems, are enhancing the efficiency and quality of care, attracting both residents and investors. The increasing preference for community-based living, offering a balance of independence and support, fuels demand for various housing options. Furthermore, government initiatives and supportive policies encouraging senior care development and access significantly contribute to market expansion.

This report offers a comprehensive analysis of the senior living communities market, providing valuable insights into market trends, driving forces, challenges, key players, and future growth projections. The detailed analysis spans the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering a clear understanding of the market's evolution and future potential. The report is an essential resource for industry stakeholders, investors, and anyone seeking a comprehensive understanding of the senior living sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.8%.

Key companies in the market include Brookdale, Holiday Retirement, Life Care Services, Five Star Senior Living, Sunrise Senior Living, The Clare, Belmont Village, Gardant Management Solutions, Artis Senior Living, Senior Lifestyle, Erickson Living, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Senior Living Communities," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Senior Living Communities, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.