1. What is the projected Compound Annual Growth Rate (CAGR) of the Securities Companys?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Securities Companys

Securities CompanysSecurities Companys by Type (Securities Underwriters, Securities Brokers, Securities Dealers, Compound Brokerage), by Application (Securities Brokerage, Securities Investment Consulting, Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect Services, Consignment Sales of Financial Products, Margin Financing and Securities Lending and Refinancing, Repurchase, IPO Sponsorship, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

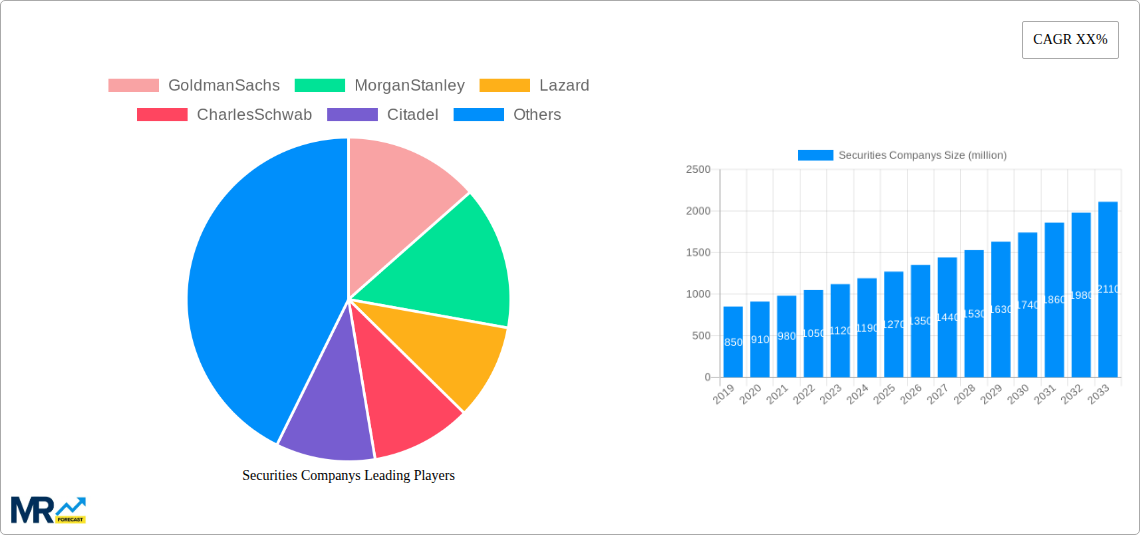

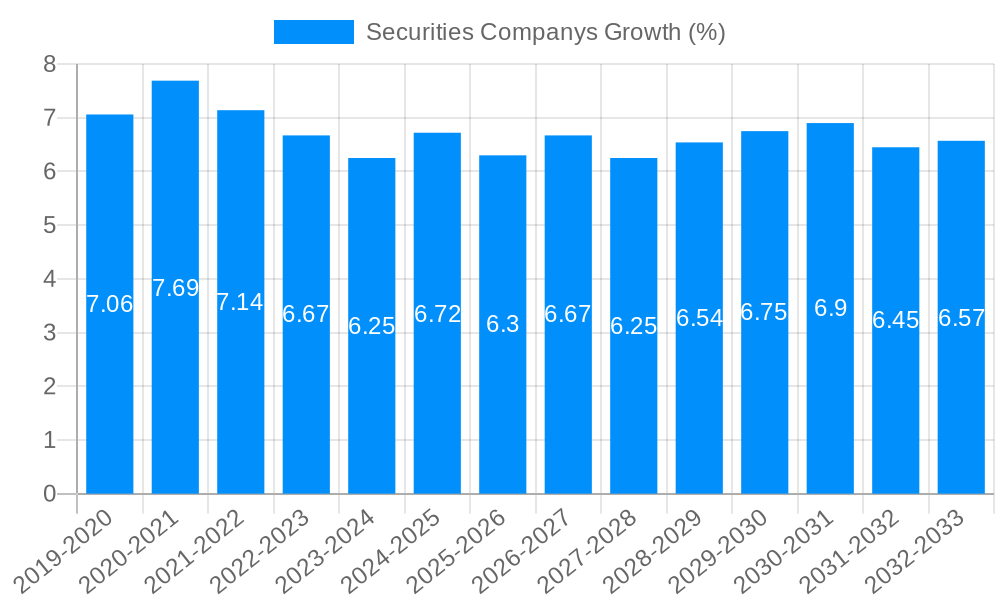

The global securities company market is poised for significant expansion, driven by increasing investor participation, a growing demand for sophisticated financial products, and the evolving regulatory landscape. With an estimated market size of approximately $1.2 trillion and a projected Compound Annual Growth Rate (CAGR) of around 8.5% from 2019 to 2033, this sector represents a robust opportunity for both established players and emerging entities. Key growth drivers include the burgeoning wealth management sector, the increasing adoption of digital platforms for trading and advisory services, and the cross-border expansion facilitated by initiatives like the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect. These factors are collectively propelling the market forward, fostering innovation and enhancing accessibility for a wider range of investors.

The competitive landscape is characterized by a mix of global giants and specialized regional firms, all vying for market share across various segments. The application segments, such as securities brokerage, investment consulting, and margin financing, are experiencing dynamic shifts, with a growing emphasis on technology-driven solutions and personalized client services. While market expansion is strong, potential restraints include heightened regulatory scrutiny, geopolitical uncertainties, and the inherent volatility of financial markets. However, the industry's ability to adapt to these challenges, coupled with continuous innovation in product offerings and service delivery, suggests a resilient and upward trajectory. Major companies are investing heavily in digital transformation and expanding their global footprint to capitalize on these opportunities and maintain their competitive edge.

The global securities industry is navigating a dynamic landscape characterized by technological disruption, evolving regulatory frameworks, and shifting investor preferences. Our comprehensive report, spanning the Study Period of 2019-2033, with a Base Year of 2025 and a Forecast Period from 2025-2033, delves deep into these transformative trends. During the Historical Period of 2019-2024, we observed a significant acceleration in digital adoption, with firms like Goldman Sachs and Morgan Stanley investing heavily in AI-driven trading platforms and personalized wealth management solutions. The rise of fintech disruptors also compelled traditional players to innovate, leading to increased competition and a greater focus on customer experience. The report highlights the increasing fragmentation of services, with specialized firms like Lazard and Greenhill excelling in advisory roles, while Charles Schwab continues to solidify its position in retail brokerage. The emergence of alternative asset classes and the growing importance of ESG (Environmental, Social, and Governance) considerations are also shaping investment strategies and product offerings across the sector. China's securities market, represented by giants like CITIC Securities Company Limited and China International Capital Corporation Limited, is exhibiting robust growth driven by domestic capital market reforms and increasing international integration through initiatives like the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect. The report anticipates a continued trend towards consolidation in some segments, particularly among smaller players, as they struggle to keep pace with technological advancements and regulatory compliance costs. Conversely, specialized advisory firms with strong niche expertise are likely to maintain their competitive edge. The adoption of distributed ledger technology (DLT) for trade settlement and clearing is also projected to gain traction, promising greater efficiency and reduced operational risks.

Several potent forces are driving the growth and evolution of the securities industry. The persistent low-interest-rate environment experienced for much of the Historical Period (2019-2024) encouraged investors to seek higher yields through equity markets and alternative investments, thereby boosting trading volumes and the demand for brokerage services. Furthermore, the increasing global wealth accumulation, particularly in emerging economies, translates directly into a larger pool of potential investors and assets under management. Technological advancements, including artificial intelligence (AI), machine learning, and big data analytics, are revolutionizing trading strategies, risk management, and customer engagement. Firms are leveraging these tools to offer more sophisticated, personalized, and efficient services. The ongoing digitalization of financial services continues to lower barriers to entry for new investors, democratizing access to capital markets and expanding the customer base for securities firms. Government initiatives aimed at fostering capital market development, such as the aforementioned Stock Connect programs in China, are creating significant opportunities for both domestic and international securities companies. The growing emphasis on sustainable investing and ESG principles is also creating new product development avenues and attracting a new cohort of socially conscious investors, forcing companies to adapt their offerings and disclosure practices. The increasing complexity of financial instruments and the need for expert guidance in navigating them also fuel demand for specialized investment consulting and underwriting services.

Despite the optimistic outlook, the securities industry faces significant hurdles. Heightened regulatory scrutiny and compliance burdens remain a constant challenge. Stricter capital requirements, anti-money laundering (AML) regulations, and data privacy laws demand substantial investment in compliance infrastructure and expertise, potentially squeezing profit margins. Geopolitical uncertainties and macroeconomic volatility can lead to sharp market downturns, impacting trading volumes, asset valuations, and investor confidence. Cybersecurity threats pose a continuous and evolving risk, requiring substantial expenditure on robust security measures to protect sensitive client data and operational integrity. The intense competition from both traditional players and agile fintech startups drives down fees and necessitates continuous innovation, putting pressure on profitability, especially for firms that are slow to adapt. The ongoing digital transformation requires significant capital investment in technology, which can be a barrier for smaller firms. Furthermore, talent acquisition and retention are becoming increasingly challenging, as the industry competes for skilled professionals in areas like data science, AI, and cybersecurity. The risk of technological obsolescence is also a concern, requiring constant updates and upgrades to maintain a competitive edge. Finally, potential shifts in investor sentiment away from riskier assets due to prolonged economic downturns or increased global instability could dampen demand for many securities-related services.

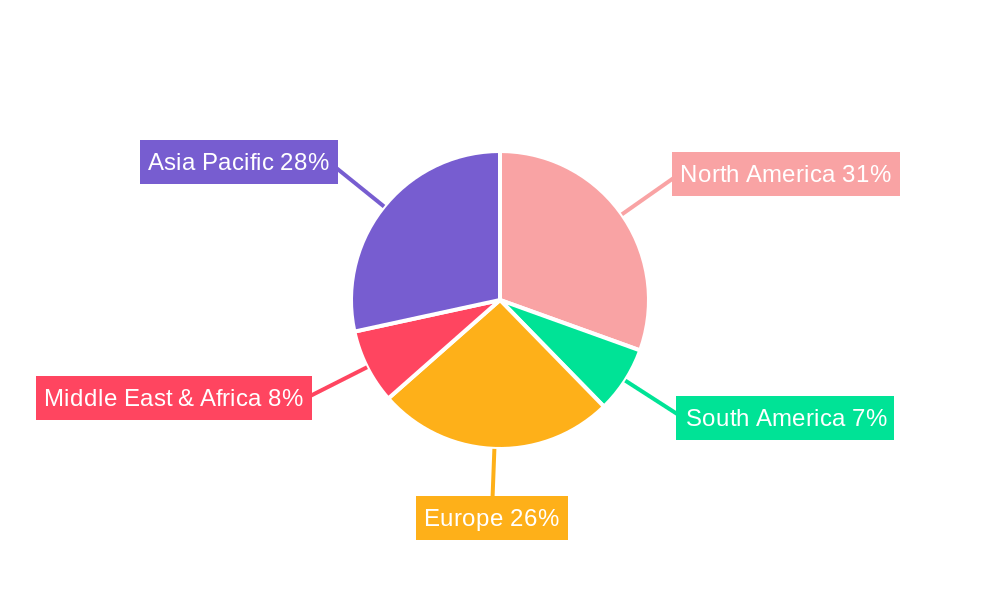

The securities industry's dominance is projected to be a multifaceted phenomenon, with distinct regions and segments poised for significant growth.

Key Regions/Countries:

China: The Chinese securities market is a formidable and rapidly expanding force. Driven by ongoing capital market reforms, increasing domestic savings, and government support, China is expected to continue its ascent. The presence of major players like CITIC Securities Company Limited, China International Capital Corporation Limited, and Huatai Securities underscores the depth and breadth of this market. Initiatives like the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect Services have not only facilitated cross-border investment but have also significantly boosted trading volumes and created new revenue streams for securities firms operating in or connected to China. The increasing sophistication of Chinese investors and the growing appetite for a wider range of financial products, including IPOs and structured products, further solidify China's dominance. The sheer scale of its population and the ongoing urbanization process continue to fuel demand for financial services.

United States: The United States remains a cornerstone of the global securities market, driven by established financial institutions like Goldman Sachs, Morgan Stanley, and Charles Schwab. Its deep and liquid capital markets, robust regulatory framework, and a mature investor base provide a stable yet innovative environment. The U.S. market is characterized by its leadership in technological adoption, with firms investing heavily in AI for trading and client services. The presence of major asset managers and the continuous flow of innovation in financial products ensure its continued significance.

Emerging Markets (Southeast Asia, India): While not yet at the scale of China or the U.S., emerging markets are exhibiting rapid growth. As economies develop and disposable incomes rise, there is a burgeoning demand for investment products and services. Countries in Southeast Asia and India are seeing increased participation from both retail and institutional investors, presenting significant opportunities for securities firms to establish a presence and capture market share.

Key Segments:

Securities Brokerage: This fundamental segment, encompassing firms like Charles Schwab and East Money Information, is expected to remain a bedrock of the industry. The increasing number of retail investors, facilitated by user-friendly online platforms and mobile applications, will continue to drive brokerage volumes. The evolution of brokerage services to include value-added research, advisory, and portfolio management tools will be crucial for sustained growth.

Securities Investment Consulting: As financial markets become more complex, the demand for expert advice is set to rise. Firms like Lazard, Greenhill, and EVERCORE, specializing in advisory services, will find increasing opportunities. This segment is crucial for guiding investors through intricate investment strategies, risk assessment, and wealth management. The growth in sophisticated investment products and the need for specialized knowledge will propel this segment forward.

IPO Sponsorship and Underwriting: The dynamism of economies, particularly in China and other emerging markets, leads to a constant stream of new companies seeking to go public. China International Capital Corporation Limited, CITIC Securities Company Limited, and Huatai Securities are prime examples of firms that will benefit from robust IPO activity. This segment requires deep market knowledge, strong relationships with issuers, and efficient distribution networks.

Margin Financing and Securities Lending and Refinancing: These complex financial instruments are essential for sophisticated traders and institutional investors seeking to leverage their positions or gain short-term access to securities. As market volatility increases, the demand for these services, offered by major players like Citadel (though a hedge fund, its market-making and trading activities involve these mechanisms), is likely to grow. These services are critical for market liquidity and price discovery.

The interplay between these regions and segments will define the future landscape of the securities industry, with a strong emphasis on technology-driven services, cross-border integration, and specialized expertise.

The securities industry's growth is being catalyzed by several key factors. The ongoing digitalization of financial services is making investing more accessible and convenient, attracting a wider demographic of investors. Advances in artificial intelligence and machine learning are enabling more sophisticated trading strategies, personalized financial advice, and efficient risk management, thereby enhancing both operational efficiency and client satisfaction. The increasing global wealth accumulation, particularly in emerging economies, translates into a larger pool of capital seeking investment opportunities. Government initiatives aimed at developing capital markets and promoting financial inclusion are creating new avenues for growth. Furthermore, the growing investor interest in sustainable and ESG-focused investments is driving the development of new products and services, tapping into a rapidly expanding market segment.

Our comprehensive report offers an in-depth analysis of the Securities Companys sector, providing granular insights into market dynamics, growth drivers, and future trajectories. The report covers a detailed segmentation of the market by type of service (e.g., Securities Underwriters, Securities Brokers, Securities Dealers, Compound Brokerage) and by application (e.g., Securities Brokerage, Securities Investment Consulting, Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect Services, Consignment Sales of Financial Products, Margin Financing and Securities Lending and Refinancing, Repurchase, IPO Sponsorship, Others). We present a robust forecast for the Forecast Period of 2025-2033, built upon a thorough examination of the Historical Period from 2019-2024 and a detailed understanding of the Base Year of 2025. The report is essential for stakeholders seeking to understand the competitive landscape, identify emerging opportunities, and navigate the challenges within this vital industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GoldmanSachs, MorganStanley, Lazard, CharlesSchwab, Citadel, CITIC Securities Company Limited, China Renaissance Holdings Limited, East Money Information, Zhongtai Securities, China Industrial Securities, China International Capital Corporation Limited, China Securities, Huatai Securities, Greenhill, EVERCORE.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Securities Companys," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Securities Companys, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.